Good afternoon!

I've managed to find a quiet corner of Vienna Airport, so will have a quick whizz through the day's RNSs before boarding my flight back home later this afternoon.

Waterman (LON:WTM)

Share price: 90.5p (up 1.7% today)

No. shares: 30.8m

Market cap: £27.9m

(at the time of writing, I hold a long position in this share)

Trading update - a nice clear, in line update today, from this group of engineering consultants, saying;

The Board expects to report Interim Results consistent with market forecasts for the year as a whole, with increases in revenue, profit and operating margin percentage compared to the prior year comparable period.

Also, the cash position has improved;

Waterman has experienced a successful interim trading period and a continuing emphasis on working capital management has resulted in a significant improvement in the Group's net cash position, notwithstanding the increase in activity. The Group expects to report net funds at 31stDecember 2015 of £6.5m (£3.8m at 30th June 2015 and £3.6m at 31stDecember 2014).

Valuation - broker consensus is for 7.8p EPS this year (ending 30 Jun 2016), and 10.0p next year. Having done my research, my view is that these figures should be fairly readily achievable, due to turning around one loss-making division (it only needs to reach breakeven to considerably boost full year profits for the group). Also management seemed very upbeat about their pipeline for several years to come, when I interviewed them in Oct 2015 here.

My opinion - I reckon a share price of 120-150p looks achievable over the next couple of years, based on possibly out-achieving on the 10p EPS forecast for 2016/17, and using a PER of say 12-13.

Meanwhile the divi yield of 4.0% is pleasing, and note that the StockRank is 98, so a thumbs up from Stockopedia's algorithms too. It may not be the most exciting share out there, but in my view looks a reasonably decent place to park some money for a couple of years. One has to be mindful of the cyclical nature of what they do, so at some point business is likely to turn down, as it does periodically.

Note that Waterman shares peaked at around 200p before the GFC in 2008, and it looks as if the number of shares in issue then is similar to now - I've checked back to a "Voting Rights" RNS from late 2007, and the company had 29.1m shares in issue then, as opposed to 30.8m now - so in the same ballpark. I like companies that issue relatively few shares over the long term, as it's less dilution for long-term holders.

This supports my idea that a price of 120-150p is at least possible in this cycle, maybe more, who knows?

HSS Hire (LON:HSS)

Share price: 79.6p (up 0.7% today)

No. shares: 154.8m

Market cap: £123.2m

Trading update - this update relates to the year ended 26 Dec 2015, saying;

Trading in the final quarter was in line with the update announced on 25 November 2015.

For the year to 26 December 2015, the Board can confirm that Group revenue grew 10% on the prior year, compared to the guided range of 8 - 11%, and full year results are anticipated to be in line with management expectations.

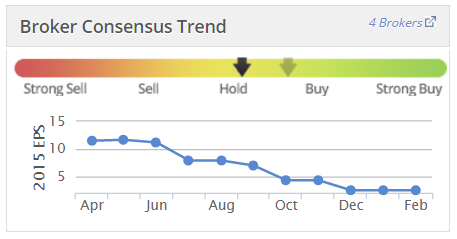

Although as you can see from the Stockopedia graphic below, market expectations (which we can usually assume are the same as management expectations) were managed down from 11.5p a year ago, to just 2.48p now.

It's been a fairly disastrous year for HSS, with the shares falling from c.200p a year ago, to a low point of 46p in Nov 2015, after serious bad news coming shamefully soon after the shares floated, in Feb 2015.

We're well up from those lows now though, so confidence seems to be returning, and today's update should further reassure - no more bad news at least.

My opinion - the balance sheet for HSS is a mess - far too much debt, and net tangible asset value is negative at -£20.5m - so people who ignore the balance sheet, and just focus on PER, are of course over-paying for the shares.

You have to be so careful buying shares that Private Equity have offloaded onto the market, as there's very often something wrong with the company, and they usually leave behind far too much debt.

To my mind, Speedy Hire (LON:SDY) and Lavendon (LON:LVD) offer much better value, and much stronger balance sheets, in the equipment hire space (both of which I personally hold, at the time of writing).

Quarto Inc (LON:QRT)

Acquisition - of an American publisher. However, no financial details are given, not even the amount being paid to acquire it. I appreciate that there might be some commercial sensitivity, but surely the announcement could have at least given shareholders some idea of the size of deal, and its impact on the group's finances.

Incidentally, a broker emailed me about Quarto recently, wanting to discuss it with me. I replied to the email, but my replies bounced, despite several attempts, so if you would like to get in touch again using a different email address that I can reply to, then am more than happy to discuss.

Proactis Holdings (LON:PHD)

(at the time of writing, I hold a long position in this share)

Acquisition - another deal is announced by this acquisitive procurement software (and services) group. The £4.5m purchase price is being funded by cash, and a new £3m loan. The balance sheet is a bit stretched for my taste, so personally I would have been inclined to accept a bit of dilution in return for funding the deal with some new equity.

When interviewing mgt at Proactis, I was impressed with how grounded they seem, and that there was good logic behind each acquisition that had been made to date (today's is the 4th fairly recent acquisition). As they put it, "We haven't cocked things up yet!", which I think was a modest way of saying that they're aware of the risks inherent in building a group through multiple acquisitions.

If it's done with care, there's a lot to be said for building a suite of niche software products through bolting on small companies that, for one reason or another are up for sale (e.g. retirement of founders, disposal due to the closure of a VC fund, etc).

General comments on acquisitions

One lesson that (I hope) people learned from the debacle over critical blogger comments over acquisitions made by TRAK, is that you can't just look up the historic accounts for a private company at Companies House, and assume that the acquirer is relying entirely on those numbers, and nothing else.

In reality, detailed due diligence will have been done, adjustments made to historic accounts, and ultimately the acquirer will be calculating what value they can build from the combined businesses going forwards - which may, or may not be obvious from historic accounts.

Ultimately, as outside shareholders, we have no alternative but to trust management to make worthwhile, value creating acquisitions. After all, they know their sector far better than any of us do, so why would we presume to be able to criticise their decisions, based on a few minutes desktop due diligence by us?

To my mind, if in doubt, it's much better to pick up the phone and ask management why they've made a particular acquisition, rather than jump to conclusions based on the flimsiest of research.

Mind you, there are numerous examples of groups which have been created & rapidly grown through acquisition, and then come a cropper at some later point, once it becomes clear that the companies they bought were not what they seemed in some way, and/or when credit conditions tighten, and the heavy bank debt that usually accompanies acquisition sprees becomes a serious issue.

So generally, I like well thought-through acquisitions with a clear strategic fit. I dislike a frenzy of acquisitions by management who are empire builders. A good clue can be management's own shareholdings. If they are major shareholders, chances are that they won't do anything daft that dilutes their own holding. If however management are just hired hands with little to no personal shareholding, then watch out if they get carried away with multiple acquisitions - its usually only a matter of time before the wheels come off!

Porta Communications (LON:PTCM)

Share price: 7.2p (up 4.2% today)

No. shares: 277.3m

Market cap: £20.0m

(at the time of writing, I hold a long position in this share)

Trading update - I can't make head nor tail of this update. It's just a jumble of out-of-context figures, and random comments. There's no attempt to draw any conclusion, or let us know how the business is performing relative to expectations.

As a colleague quipped this morning, "For a PR company, they don't seem to be very good at communicating!" I agree.

In the past, Porta's updates have struck me as being highly misleading, painting a falsely positive picture by excluding costs which they deemed to fall outside their definition of EBITDA - e.g. the first 2 years' trading losses from start-up companies within the group.

On the positive side, management have been large, and repeat buyers of stock, spending over £1m in the last 18 months on open market purchases. That's too large a vote of confidence to ignore, and is the main reason why I'm still holding the shares.

The outlook statement (for what it's worth - which is very little!) today says;

Prospects for the current year look very exciting given the internal changes made and the quality of new senior recruits. New business levels and opportunities are extremely buoyant and we are looking at a number of potential acquisitions that will accelerate our growth plans if successful.

My opinion - I think they're building an interesting group of PR businesses here, so time will tell how it works out. Perhaps they could find someone within the group who is capable of writing clear trading updates in future?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.