Good morning. Apologies for the technical gremlins this morning, hence am running a bit late. So here's a quick rattle through the announcements & market events which have caught my eye in the small cap space today.

There has not as yet been an update from Silverdell (LON:SID) on what has happened there, after yesterday morning's suspension of the shares. It's too early to pass judgment on the situation or the Directors, because we do not yet know the full facts. I'm amazed at some of the comments on bulletin boards & elsewhere - how can people be so emphatic when they don't have the full facts?

Although what I do know, from a reliable source close to the company, is that a further announcement will be issued shortly, probably some time today. It appears that there has been some sort of disastrous sequence of events concerning a Winding-Up Petition for a fairly trivial amount of money, which appears to have triggered much bigger problems with the Bank and/or the Court in some way, and has resulted in a subsidiary of Silverdell, Kitson's being put into Administration.

We don't know what will happen next, but it sounds to me as if there's some chance that the situation could be salvageable. We'll have to wait & see what their next announcement says.

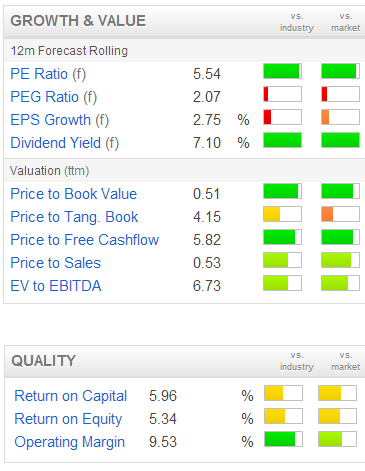

Next I've been looking at results from Begbies Traynor (LON:BEG) for the year ended 30 April 2013. They seem to have come in slightly below broker consensus, but not enough to make much difference. Revenue fell from £57.7m last year to £51.1m, so that's an 11.4% drop, and the third consecutive year of declining turnover and profits.

Adjusted EPS came in at 5.3p (vs 6.0p last year), slightly below forecast of 5.45p.

As the business has shrunk, due to continued subdued conditions in the insolvency sector, each year there have been significant exceptional costs, mainly associated with redundancies & office closures. When these costs happen every year, you have to question at what point do they stop being exceptional?

On the positive side, the 1.6p final dividend has been maintained, which gives 2.2p for the full year (same as last year), yielding a thumping 7.2% at the current 30.75p mid price. In my experience, dividend yields over 6% are usually fairly wobbly - i.e. there is an elevated danger that the dividend might be cut, or passed altogether.

I'm very much in two minds about the dividend at Begbies. On the one hand the business generated ample cashflow to finance the divided in 2012/13, but on the other hand it still has high levels of net debt, although net debt has reduced significantly in the last year, and is now £17.2m.

The insolvency practitioner sector is unusual, in that very high levels of debtors are normal, because the costs of each case accumulate, and the fees are then paid in a lump sum from asset realisations near the end of the Administration or Liquidation process which Begbies manage.

So a conventional view of net debt is not so relevant here. Instead it can be seen as revolving credit, which is a normal and unavoidable part of the business model. As long as you account for the interest cost, then arguably you can ignore the revolving debt. This is particularly the case because insolvency practitioners effectively work for the banks, so don't usually have any trouble securing the revolving finance they need.

Begbies facilities look secure, with maturity dates ranging from 2017 to 2021, which these days is actually quite long - most companies struggle to get financing for more than 3 years at a time from the Banks - a factor that has certainly held back economic recovery - how can businesses invest long term if they can only borrow short term?

Cost cutting means that Begbies has managed to increase it's EBITA margin to 16% in the most recent half year, so even on reduced turnover they should continue to churn out decent profits and cashflows, hence the dividend is probably fairly secure.

The group cost base has been reduced from £52m in 2011 to £44m in 2013, and a further £2m reduction is expected this year, so they are certainly operationally geared to deliver bumper profits if & when the insolvency sector becomes busier. We just don't know when that will be.

I reckon Begbies shares are a pretty good each way bet, for a long term portfolio, where you collect in hefty dividends which look reasonably likely to be maintained, and at some point could see good upside on the share price too when insolvencies increase - which they must do at some point, when the Banks balance sheets are strong enough to take the hit from zombie companies currently just meeting interest payments only.

The Eurozone crisis seems to come in wave after interminable wave, and the tide seems to be coming in again. What an utter disaster this misguided single currency project has been, and how much more untold misery will the people of Southern Europe tolerate, in order to continue providing Germany with an artificially cheap currency to maintain its export machine?

There's really only one viable solution in my view, and that is for the Eurozone to split into two, with the Germans & their close neighbours forming a new currency of their own, which will then appreciate against the existing Euro. Only then will the imbalances begin to correct.

The lesson from the 1930s was that you cannot solve a recession by constantly trying to balance the Govt spending deficit. You have to accept a degree of Govt deficits in bad years in order to pull an economy out of recession, otherwise you end up in a deflationary spiral, which is exactly what's happening now in Southern Europe all over again.

I read today that wages have fallen 21% in Greece in the last 3 years, which therefore reduces tax receipts, which means the Govt has to cut again & again, triggering further reductions in demand, and further reductions in tax revenues, and so on in a vicious circle. Who knows where it will end, but countries like Greece, Spain & Portugal surely can't be far away from either popular uprisings, military coups, or embarking on a reckless war to unite the people (Spain invading Gibraltar perhaps?).

Who knows, more sticking plasters from the EU are likely, but at some point the plasters won't work any more. Sorry, I'm rambling a bit, let's get back to companies.

Profits warning of the day comes from Stadium (LON:SDM), a small electronics group, who say that for various reasons results for the full year will be significantly below market expectations. Broker consensus was for 6p this year (ending 31 Dec 2013), so significantly below suggests to me we're probably looking at 3-4p perhaps?

Stadium shares are down 22% to 30.5p at the time of writing, so that puts them on a fairly reasonable rating for the likely level of reduced profits this year. I am intrigued by them also saying that by Q4 and beyond they see profits restored to the level consistent with previous guidance. This suggests to me that this might, and I emphasise might (and always DYOR as usual!) be a buying opportunity? I don't have any spare funds at the moment, but it looks tempting at around the 30p level.

I've almost run out of time, but profits warning of the day should really go to Office2office (LON:OFF), whose shares are currently off 44% to 46.5p. Nasty. They put out a profits warning last night at 5:31 pm. Some people moan about that sort of timing, but personally I don't have a problem with it. The market's shut, so really it's no different to a 7 am announcement, other than that it can affect your sleep badly for one extra night.

I don't normally invest in office supplies companies, as there's no margin in what they do, and customers just shop around for the cheapest online supplier. They are also vulnerable to bad debts from companies going bust, and if you only make a wafer thin margin, one bad debt wipes out the profit from dozens of other accounts.

There's also a profits warning from ITM Power (LON:ITM), which is a blue sky thing, so not of interest to me. But it's a sharp reminder that when there are no profits or revenue to speak of, it's anybody's guess what the company is worth. Also, blue sky projects usually fail, and even when they do work, the process is usually many years longer and much more costly than expected, so shareholders usually get diluted away to nothing by the time they do hit the big-time. However, investors do love a good story, and still lap them up and over-pay for story stocks generally.

Right that's it for today. An old City friend is visiting me in Brighton, for our annual exceedingly boozy lunch. So nobody is likely to get any sense out of me for the rest of today.

See you from 8 a.m. tomorrow morning.

Regards, Paul.

(of the shares mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.