Good morning!

Impellam (LON:IPEL)

Share price: 639p

No. shares: 48.8m

Market Cap: £311.8m

(disclosure: at the time of writing I hold a long position in this share)

Preliminary results for the 53 weeks ended 2 Jan 2015.

On an initial review the figures look good to me. This is a staffing group, of considerable size - turnover reached £1.3bn. It's a turnaround situation, as there was one particular subsidiary, called Carlisle, which had some loss-making contracts in the past, that are being sorted out.

Valuation - adjusted EPS rose from 51.5p in the prior year to 68.1p in 2014 - not bad going, so that puts it on a PER of only 9.4, which strikes me as good value.

Balance sheet - I'm more flexible with people businesses, as there is no inventories line on the balance sheet. Therefore I lower my usual 1.2 lower limit for the current ratio to 1.0. Impellam passes that lower threshold with a score of 1.06, so an OK, but not strong working capital position.

The company has been on an acquisition spree, so the balance sheet is filling up with goodwill. This takes the net tangible assets position negative, to -£10.7m. So technically that breaks one of my key balance sheet tests. Given that the group has just posted a pre-tax profit of £31.6m then I can accept a less than perfect balance sheet, as the company is not under any financial strain in my view. Although it's something I'll keep an eye on.

Net debt - is reported at £14.8m, which looks fine, given the size & profitability of the business.

Dividends - total divis for the year are up a healthy 16.7%, at 14p. That's a yield of 2.2%, so not particularly impressive - there are much better yields available elsewhere in this sector.

Outlook - I can't seem to find one, but instead the company gives a list of its priorities for 2015. Although I've not read all the narrative, as it looks mainly waffle. Given that some acquisitions were made during 2014, then they should provide upside for the 2015 figures, where they will contribute a full year instead of a part year.

Broker consensus is currently for 75p EPS this year, so I would have thought a PER in the 10-12 range would be reasonable, which implies a share price of 750-900p, giving 17-41% upside on today's share price.

My opinion - so far so good. Although the shares have risen strongly in the last year, the valuation still appears undemanding, and whilst not the best balance sheet I've seen, I don't see that as a problem either. So I'm not inclined to even think about taking some profits until we reach my target of 750p (a PER of 10).

Hydro International (LON:HYD)

Share price: 111.7p (up 15% today)

No. shares: 14.4m

Market Cap: £16.1m

Final results for calendar 2014 look quite good. This is a positive surprise, as the shares are up 15% today. Looking back at my previous notes here, I last reviewed the company this time last year, in my report of 4 Mar 2014. The company reported an uncertain outlook at that time, so I concluded that the shares were probably best ignored until there was more evidence of the outlook improving.

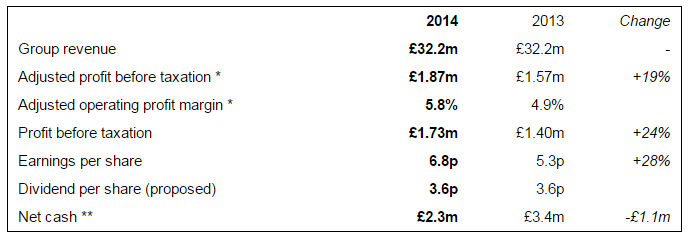

As you can see from the company's highlights table, reproduced below, 2014 turned out alright in the end, in fact these figures look quite good;

Outlook - Directorspeak from both the Chairman and CEO sounds positive;

Valuation - the PER works out at 16.4 times 2014 earnings - not a bargain. However, broker consensus is for growth to 9.0p EPS this year, which looks consistent with the outlook comments above, and a closing order book 33% higher than a year earlier. 9.0p EPS equates to a PER of 12.4, which is probably about right for the time being.

My opinion - this is a nice little company in my view, and the price looks about right. There is the issue of lumpy contracts, so there's always the risk it might warn on profits again. Overall I quite like it, and think the company looks worthy of more detailed research.

Johnson Service (LON:JSG)

Share price: 73.75p

No. shares: 300.0m

Market Cap: £221.3m

Preliminary results for calendar 2014 look to be as expected. I last reported on this company after its trading update on 6 Jan 2015, and there's not really a lot to add to that. I liked the shares at 63.8p, and they're up nearly 16% in just under two months.

Note that the company reports £28.5m net debt, equivalent to 9.5p per share.

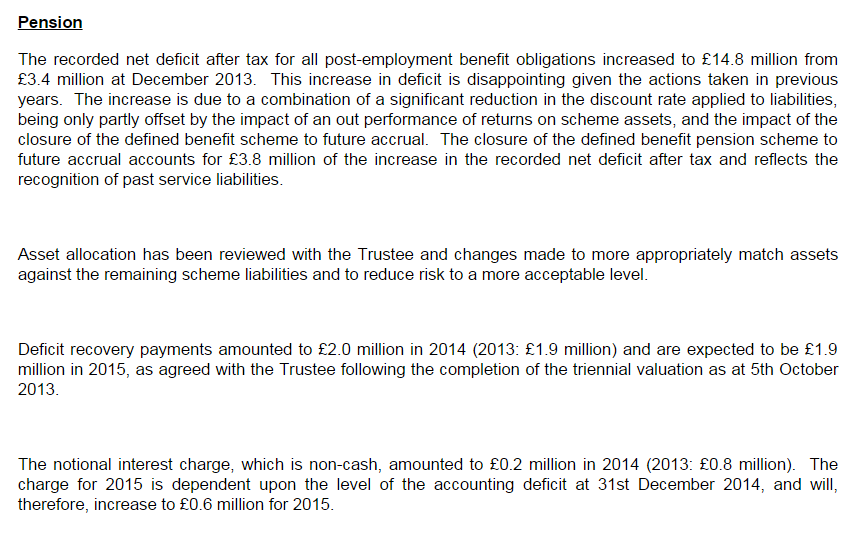

Pension deficit - I urge readers to keep a close eye on pension deficits, as they are generally rising at the moment, due to low bond yields. The deficit here has risen sharply, and the deficit recovery payment is a material sum, at £1.9m p.a.;

My opinion - I like the company, and its turnaround has been impressive over the last couple of years. At 73.75p perhaps the shares are up with events now, in valuation terms? (once you adjust the rating for the net debt, and the pension deficit recovery payments). I should have bought some in Jan 2015, but think risk/reward is probably now too late to buy at the current level.

ISG (LON:ISG)

This one's on my bargepole list, and reviewing their interim figures today, putting it there was definitely the right decision. Trading was bad in H1, and the balance sheet is awful (net tangible assets of minus £50m!). It's a very low margin contracting business, where some contracts have gone wrong.

UPDATE: I've only just noticed the second announcement today from ISG, namely a deeply discounted Placing at 170p. The share price was 239p yesterday, so that's a 29% discount in price to get the Placing away. The share price has already collapsed down to the Placing price, and is 170.5p at the time of writing.

This is a perfect demonstation of what I was talking about last week at the ShareSoc seminar - a low margin business, doing large, complex contracts, runs into problems (as inevitably this type of business always does, sooner or later), and then ends up in a crisis because it has an extremely weak balance sheet.

The only solution is to do a discounted fundraising, which destroys shareholder value. Also note that dividends have been suspended too for the time being, so that's a double whammy - again a company with a weak balance sheet should not have been paying divis in the first place, as that just further weakens its financial position.

As I pointed out in my report of 2 Feb 2015 this company looked a can of worms, and was best avoided (I put it on my bargepole list at 262p on 2 Feb 2015).

A company with a strong balance sheet can ride out a downturn in business. Whereas a company with a weak balance sheet ends up in this situation, where it is forced to raise fresh equity from a position of weakness, after a profit warning. They should have fixed the roof when the sun was shining, so this is down to poor management I'm afraid.

The number of shares in issue will rise from 39.2m to between 48.6 to 50.4m (since there is a flexible element within the Placing). The net proceeds after fees will be between £15-18m.

My opinion - as mentioned above, this was an accident waiting to happen, as I've mentioned in previous reports. Weak balance sheets are a menace, and it is reckless of management to run a company with an inadequate capital base, in my opinion.

I don't see this £15-18m fundraising as being enough. In my view the company needs to raise about £50m to fix its balance sheet, and even that would only bring its net tangible assets back up to zero!

It just isn't worth the risk, investing in companies with balance sheets this week, especially if they are low margin contracting businesses. Something always goes wrong eventually, as it has done here.

Filtronic (LON:FTC)

Profit warning - they've done it YET AGAIN!! Another profit warning. It's becoming increasingly clear that this company is a dead loss. I've been bearish on it for ages, although was starting to get tempted to bottom fish after the last profit warning which I covered here in my report of 2 Feb 2015. Thankfully common sense prevailed, and I decided it was too risky.

Today's warning has spelled the end for the CEO, who has resigned, and is replaced by the CFO. Also the company says it is exploring options to raise more funding - so probably a deeply discounted Placing is likely to be on the way here too?

They are cutting costs too, which looks sensible. As things stand, it just doesn't look like a viable business, so I think a root & branch restructuring is needed here.

It should have gone on the bargepole list a long time ago, but I've added it today.

Off into the City for lunch, so have to leave it there for today.

See you tomorrow!

Regards, Paul.

(as disclosed above, Paul has a long position in IPEL, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.