Good morning!

UK Investor Show

What an enjoyable day Saturday was! I cycled from Islington down to Westminster for the show, on a Boris Bike, but unfortunately arrived late, and I missed the talks from Mark Slater & Nigel Wray.

However, the next session, from our own Ed, was just brilliant (and I'm not just saying that because he's my boss here!). Ed focused on investor psychology, and used some clever software to make it interactive. So he asked us a series of trick questions, we had a few seconds to respond on our smartphones, then he revealed how stupid we all were!! I got nearly every question wrong. Oh dear!

The key point was that Ed was highlighting how the quick, impulsive section of our brain (the old monkey brain which we share with animals) leads to us making terrible investing mistakes. Whereas the more we engage our higher level, slower, but more rational brain, then the better our performance should be.

Fascinating stuff. Also apparently it has been proven that women make better investors than men. I can quite believe that actually, as the female investors that I know seem much more level-headed than most male investors. We males are far too prone to make impulsive & reckless decisions - I could write a book about that for my own mistakes, and one day I will!

Isn't it strange therefore that it's nearly always the men who manage portfolios, despite being the wrong gender to do it well!? (Sweeping generalisation of the day no.1!)

I was delighted to meet literally dozens of my readers from here at the investor show. It was continuous all day actually, so in the end (well at lunchtime) I bowed to the inevitable and allowed my readers to start buying me pints of lager, and crisps at the Westminster Arms.

Peter quipped that he's going to wear safety goggles next time he buys me a pint & crisps, as I pebble-dashed him with small particles of salt & vinegar crisps, due to being unable to stop talking for long enough to swallow them!

I had to peel off back to the investor show at 2pm, in time to give a 20 minute talk to the audience in the Analyst Room. My stock picks from last year (WTM, something else, and AVS were up 17%, 17%, and 67%). So buoyed by this good luck, I decided to offer up some stock ideas for further research again, which were;

Avesco (LON:AVS) & Waterman (LON:WTM) again, joined by Restaurant (LON:RTN) (at 273p post profit-warning).

(please note that I hold long positions in all 3 of these companies)

I just started on my "worth a look" list, but only got as far as Flowtech Fluidpower (LON:FLO) (I do not hold any position in FLO) before the next speakers started hovering next to me, giving me that "stop talking and go away" fixed smile. It's easy to miss that smile though, as I discovered once at a Mello event, when Leon Boros resorted to making a throat-cutting gesture (complete with grimace) to force me off stage when I'd run 20 minutes over time & ruined the event's remaining scheduling.

I managed to grab Neil Catto, the CFO of Boohoo.Com (LON:BOO) (I hold a long position in this share) and have a quick chat with him. Everyone I met seemed to like him, finding him very straightforward & down to earth. I think BOO shares are fully valued for now, but it's very much a long term winner in my view. So trying to time the market by going in & out is a risky business.

I stressed to him that the Call Option over PrettyLittleThing.com is now the burning issue that needs to be resolved, to eliminate the conflict of interest between family and listed company interests. He took that point on board.

There was a strange twist to the day - I meandered over to Tom's old restaurant in Clerkenwell for the after-show party, now owned by the affable Darren & Martha. Whilst outside talking to Nigel Somerville, a drunk/druggie wandered down the road and deliberately walked straight into poor Nigel, sending him flying. He then started trying to smash up the restaurant, hurling objects (such as an A-board) at the shop front.

Next thing I know, Lucian Mears is outside, grappling the chap to the ground, explaining calmly to him why trying to smash up a restaurant really isn't a good idea. The police were called, and I helped Lucian restrain the chap until they arrived.

I did wonder if one of Tom's many enemies might have arranged this fracas by paying the chap to make mischief? All I can say is that the quality of the attacker matches the quality of the shares which Tom highlights.

ShareSoc Brighton

Oh dear, this is not going well. Only 7 people have signed up so far, when ShareSoc needs 20 for the event to go ahead.

The event is a week today, 10 May 2016. Booking details are here.

There are now 2 speakers, Avation (LON:AVAP) (I hold a long position in this share) and Fishing Republic (LON:FISH) (I hold no position in this share) - the latter in particular is potentially interesting, if they could get their inventories under control. So it will be very interesting to hear from management on that key point.

As this is the first Brighton event, if it's cancelled from lack of investor interest, then there won't be any future ones. So I'm desperate to see this first event get off the ground, as we can then build it into a regular thing. The ones I organised in 2014 were very enjoyable, and quite well-attended. However, it's so difficult to arrange them when people only seem to book in at the last minute, if at all.

So please do support this event by booking now, if you can, otherwise we'll lose it altogether.

ShareSoc vs Marcus Stuttard (head of AIM)

I'm delighted to see ShareSoc going public in its campaign to improve the standard of companies on AIM. An article was published recently in the Times, with Stuttard defending AIM.

This is ShareSoc's response, in a letter it has sent to the Times, in reply:

Dear Sir,

Thank you for publishing the article entitled “We’re no dodgy casino…” on 2nd May, containing comments I made at the AGM of the London Stock Exchange Group, on behalf of ShareSoc, and the response of Marcus Stuttard, head of AIM.

Mr Stuttard comments: “[People] wouldn’t invest if they felt there was any kind of problem…”. He is right. Many won’t invest in AIM companies, due to AIM’s reputation as a casino, thus depriving legitimate businesses of much needed capital via this route.

ShareSoc can cite a litany of frauds and abuses perpetrated on investors in the AIM market – many within the last year alone. Some of these were Chinese companies, which the AIM market sought to attract, and some home grown.

Without transparent and effective prosecution of the perpetrators of these frauds there is no deterrent – and that is why we continue to see them occurring time and again.

The LSE seems well satisfied with the listing and transaction fees it generates from its operation of the AIM market but does not seem to want the inconvenience of having to properly fulfil its role as regulator of that market. We therefore now call upon the FCA to step in and conduct a thorough review of the operation and regulation of the AIM market.

Yours faithfully,

Mark Bentley

Director, UK Individual Shareholders Society

Bravo to ShareSoc for taking up this issue.

My view is that the LSE's stewardship of AIM has been appalling. It's worse than a casino actually. It's a free-for-all, with no effective regulation, which has therefore become a magnet for fraudsters all over the world.

For this reason, I personally won't touch any overseas AIM-listed companies, apart from SKIL Ports & Logistics (LON:SPL) which is a rare exception to my self-imposed rule.

What a state of affairs, where many private investors need to rely on bloggers like me to expose the dodgy companies, because there is no effective regulation. If I can correctly identify the frauds (e.g. Quindell, Globo, etc), several years ahead of them imploding, why can't anyone at the LSE?

Also, the perpetrators of frauds are seemingly free to carry on with their lives! What punishment will the Chinese fraudsters face, after they successful used AIM as a vehicle to rip off British investors? Where is Costis from Globo? Why is Rob Terry free to continue with his next attempt at financial engineering (Quob Park)? The problem is that the bad guys get away with it, with impunity.

All of this is of grave concern. The trouble is, it's given AIM a terrible reputation, and many investors now steer clear of AIM stocks. That is such a pity, as AIM contains several hundred good companies too.

Time for a change I think. Stuttard should be sacked, and someone with a stronger moral anchor brought in to straighten out AIM. This is a good example of bad capitalism - people at LSE putting profit before ethics. They know the facts as well as we do, but turn a blind eye because LSE generates income from each company listed on AIM. It's not good enough.

BHS

There's a lot of comment about Sir Philip Green's involvement in BHS, which he owned from 2000-2015. I've had a look at the accounts for BHS Ltd going back to 2006, and I can't see any dividends being paid at all. The company was profitable until 2008, when it started losing money. Personally I'm amazed thst BHS lasted as long as it did - a redundant format that probably would have gone bust a lot earlier if Mr Green had not been involved and breathed fresh life into it.

Also, the pension deficit that he is being blamed for, was actually in surplus in 2008. The deficit which has since arisen was caused by Govt policy - ultra-low interest rates, and of course increasing life expectancy.

It seems to me that many people have pre-judged Green, and are not interested in the facts. They want him to be guilty of something bad, and are blurring the BHS issue with other issues such as his vulgar, conspicuous consumption, and his abrasive personality. The politics of envy are always so close to the surface in the UK, sadly. Would I prefer it if he spent his money on helping the poor, rather than ridiculous yachts & parties? Of course, but that's none of my business. In a capitalist system, he can spend his money on whatever he likes - and other people will judge accordingly.

Also, note that Green's companies pay full UK Corporation Tax. He could very easily have set them up using an offshore, private equity style structure, to avoid Corporation Tax altogether, but he didn't. He deserves considerable credit for this. He has however dodged UK income tax, by registering the company in his wife's name, and parked her offshore in the tax haven of Monaco.

Did Green cynically starve BHS of funding? Not that I can see from the accounts. He seems to have actually spent 15 years trying very hard to make it work - expanding product ranges, revamping the stores, etc. That's not at all how asset strippers usually behave, is it? So why do people think he asset-stripped it?

I'm not a fan of Green generally, but he's a smart retailer, and overall has probably done more good than harm for the UK retailing sector. If he's found guilty of any genuine wrongdoing with BHS, then fine, I'll stand corrected. So far though, I've not seen any evidence at all that he's guilty of anything. Just people who want him to be guilty. Also a lot of hindsight stuff - if a company pays out dividends when it's profitable, and has distributable reserves, then that's absolutely fine. If that business subsequently goes downhill, due to competitive pressures, then that's a completely separate issue.

The above is true of so many issues actually. It's pointless discussing politics with almost everyone, because they usually don't care about facts. They have pre-conceived ideas, and will twist or just ignore facts which disprove their existing view.

We're all guilty of this to a certain extent. It's particularly dangerous when this same human weakness crops up with shares. Have you noticed how we tend to give a company the benefit of the doubt, if we hold the shares? Then people often turn violently against a company once they have sold their shares. So in other words, people suppress any information they don't want to hear. Once they have detached from the share by selling it, they suddenly reverse their opinion and start slagging off the company they were defending to the hilt just days earlier! This is one of the reasons I rarely post any more on bulletin boards, as most people are mindless in their support for a share, simply because they want to talk up the share price, and are emotionally attached to it. So their views are worthless to me.

Also, I've found that if you become the public cheerleader for a particular stock (been there, done that!), then it's much harder to change your mind. You become locked into owning shares which you should probably be selling. These days, I have no trouble at all changing my mind, if the facts change. That approach has greatly improved my investment returns. It's a key skill for all investors to develop actually. Switching off the emotional part of the brain, and focussing solely on interpreting the facts & figures. Very much as Ed highlighted in his talk on Saturday.

EDIT: Incidentally, I was surprised to read in one sunday newspaper that there were "howls of laughter" at BHS head office, at the suggestion that Mike Ashley of Sports Direct is considering a bid for the whole of BHS (I hold a long position in SPD).

I suggest that staff at a company which has just gone bust are not really in a position to be howling with laughter at any potential rescue bid.

It will certainly be fascinating to see how the BHS situation develops.

Plastics Capital (LON:PLA)

Share price: 110p (up 6.8% today)

No. shares: 35.3m

Market cap: £38.8m

Trading update - an in line update for the year ended 31 Mar 2016:

Plastics Capital (AIM: PLA), the niche plastics products group, is pleased to announce that it expects trading for the full year ended 31 March 2016 to be in line with market expectations.

H2 was stronger than H1, and the outlook comments sound encouraging, particularly for the new products being developed:

Despite difficult macroeconomic conditions, which negatively affected certain parts of the business, new business wins have generally compensated for softer global markets. Moreover, during the last year, we have developed a pipeline of new products to be introduced during the next 12 months, which create the potential for strong organic growth over the next few years. We are also expanding capacity in industrial films, bearings and mandrels - all areas where we anticipate capacity constraints in the next 12-24 months. Finally, we continue to develop opportunities for acquisitive growth which remains an important part of our business strategy.

My opinion - this seems to be a small group which has plodded in the last 5 years or so, resulting in a lacklustre financial performance.

The dividend yield has been rising though, and is high now, at just below 5%. Mind you, I question the wisdom of paying out big divis, instead of the surely more sensible strategy or building up cash for further acquisitions?

It seems a bit pointless paying out big divis, but then effectively taking them back (through dilution) by doing Placings in order to fund further acquisitions.

I also have concerns about the extent of adjustments, non-recurring items, etc, in the accounts. I prefer to see clean figures with no adjustments. It's too easy to bury bad news in adjustments.

Having said all that, the update today is clearly positive, so maybe financial performance could start improving?

Stadium (LON:SDM)

Share price: 118p (up 0.4% today)

No. shares: 37.2m

Market cap: £43.9m

Trading update - this looks reassuring:

Trading in the first three months of the year has been in line with management expectations. Following a similar pattern as the previous year, we expect further revenue growth in the second half of the year and this is evident in our strong order book.

Normally I'm wary if a company says it expects stronger H2 trading. However, if this expectation is justified with evidence, of a strong order book, as in this case, then it's usually fine.

New facilities - the company is opening new facilities, including a design centre in Stockholm:

One of our strategic objectives, as outlined in the recently announced 2015 financial results, is to continue to develop the operating model to deliver the Group's customer focused, design-led technology proposition supported by strategically located design centres, manufacturing centres of excellence and regional fulfilment centres. Each of these developments will support further organic growth across the Group.

This worries me. The use of the word "centres" three times in the bit above, which I have bolded, could be replaced by the words: more overheads. Or more fixed costs rather. So if new orders fail to come through as hoped for, then this could become a case of operational gearing in reverse - i.e. lower profits, due to increased fixed costs.

2015 results - these slipped through the net - maybe I was having one of my rare duvet days when they were issued?

The P&L figures look good actually - adj. EPS rose from 7.8p in 2014, to 9.9p in 2015.

Balance sheet - not good. Taking off the intangibles, leaves NTAV of only about £0.5m. There's quite a bit of bank debt, and a pension deficit too. So it's probably too risky for me to consider buying any shares.

My opinion - things seem to be going quite well, but this type of business is very difficult to value. Orders can be lumpy. Products come & go, as technology moves forward at a seemingly ever faster pace.

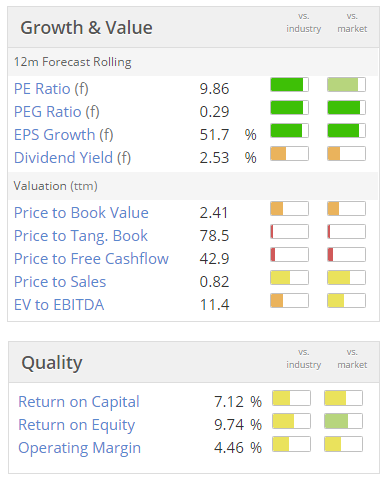

Based on the valuation graphics below, it looks good value on a PER basis. Although given the sector it operates in, and the rather weak balance sheet, I think this is probably priced about right. There could be some upside if the company meets or beats forecasts though. There's also the ever-present danger of a profit warning, if a gap opens up in the order book, at any time. Don't ignore that pension deficit either!

DP Poland (LON:DPP)

Share price: 27.2p (up 4.6% today)

No. shares: 130.2m

Market cap: £35.4m

AGM statement - considerable caution is needed when reading trading updates from this operator of Dominos Pizza stores in Poland. You can easily run away with the idea that this is a successful business being created, and that everything is going well.

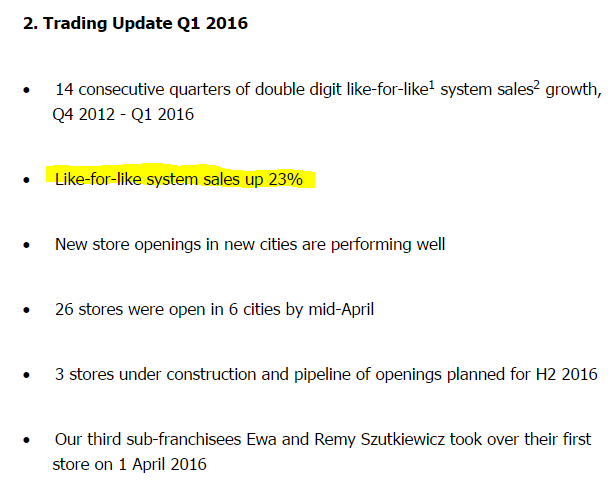

Look at these positive highlights today, for example:

LFL sales growth of +23% does indeed look very impressive.

However, if you look back at the financial results for 2015, they're terrible! This company is still miles away from becoming profitable. The central costs are far too high, and the individual stores hardly make any money to contribute towards those central costs.

My opinion - I cannot understand why investors have kept refinancing this company, when after nearly 6 years as a listed company, it's still nowhere near profitability.

The whole point of a retail roll-out, is that you only do it once the concept is proven. The reality is that Dominos pizzas are too expensive for Poles - I know that because I went to Poland and asked some Poles what they thought of Dominos! That's why the company doesn't make any profit.

Compare that with a much better retail roll-out, Crawshaw (LON:CRAW) (I hold a long position in this share) which hits the ground running, with each new branch making a profit of £140k p.a. soon after opening. That's a format which is worth rolling out. Loss-making, expensive pizza joints, in a country which is already very well-served by cheaper pizza joints, is not a good roll-out.

Admittedly, CRAW is eye-wateringly expensive at the moment, and has been for a while. But there's a good reason for that - you can easily forecast greatly improved future profitability by simply multiplying £140k profit per branch, by the several hundred new branches planned. Sure, there will be increased central costs too. So maybe reduce the £140k to £100k, to be on the safe side, but it's still a very interesting roll-out, where profits are likely to rise rapidly.

I don't see anything like the same potential at DPP. Yet the valuation of DPP is far more bonkers than the valuation of CRAW. CRAW is expensive because it's a classic, profitable roll-out. DPP is expensive because investors are hoping for the best. £35.4m market cap for DPP is complete nuts. It should be fraction of that, in my view. I'm sure it will be again, when the latest round of cash has run out, and it needs to come back for more.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.