Good morning!

Dart (LON:DTG)

Share price: 230p

No. shares: 146.4m

Market Cap: £336.7m

Legal judgment - Shares in Dart have dropped about 30p today to 230p. This is the Jet2.com airline, package holidays, and also owns a road haulage business. The reason for the fall is that the Supreme Court has ruled that Jet2.com cannot appeal against an unfavourable judgment which will result in the company having to pay higher levels of compensation to customers whose flights were delayed in certain circumstances.

The contentious issue concerned whether technical breakdowns should be regarded as "exatrordinary", or as part of the normal course of events, and therefore trigger compensation payments to customers or not.

Dart says that it will make a £17m provision to cover historic claims, and the future cost is expected to be between £3-5m p.a.. So that's distinctly unhelpful, and in the context of profit of about £36m last year, it's probably going to put a noticeable dent in future profitability. On the other hand, airlines are benefiting from the lower price of fuel at the moment (to the extent that they haven't hedged), and this legal risk was a known factor that has been grumbling away for some time.

My opinion - the market tends to take issues like this in its stride. Forecasts will be adjusted, the share price has already adjusted down, so the only risk now is whether claims volumes (and the cost of handing them) might exceed estimates. Personally I doubt there will be a huge issue here - how many people are going to bother going through all the hassle of claiming a relatively small amount of compensation for a flight that was delayed more than (say) a year ago? I wouldn't bother - would you?

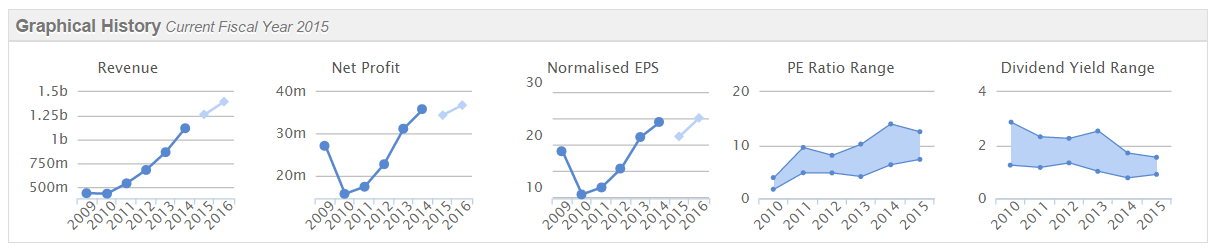

The company's track record in recent years has been good;

Ryanair Holdings (LON:RYA) - It's worth noting that Ryanair has put out a positive trading statement today, noting that unit costs fell 2% due to cheaper fuel (excluding fuel costs rose by 3%, so that's a big impact from cheaper fuel).

Note that they are locking in current oil prices by increasing hedging, time will tell if that was the right or wrong decision;

We have taken advantage of recent oil price weakness to extend our fuel hedges to 90% for FY16, at approx. $93 per barrel. In Euro terms this will result in a 2% reduction in unit fuel costs over the next 12 months. We will now look for opportunities to extend our fuel hedging programme into FY17 to lock in future cost savings. We have also extended our Capex programme to September 2017 at an average exchange rate of €/$1.35 which locks in substantially lower costs for the new aircraft deliveries.

Cloudbuy (LON:CBUY)

Share price: 41p

No. shares: 119.9m

Market Cap: £49.2m

Contract win - I rarely comment on contract win announcements, since they are usually PR puffery, to get the share price up, rather than actually triggering an upgrade in profit expectations. However, I am flagging this one, as it looks potentially interesting. Although as mentioned before, I don't understand this company's business model, and have no idea whether the shares are any good or not.

What caught my eye today was this bit;

Ronald Duncan, Chairman of cloudBuy plc, commented: "The Company previously had four potential routes to reach its short term target of £50 million revenue pa; this contract in Hong Kong, plus the SYNISE deal together can deliver USD$150 - $200 million revenue per annum alone.

We have managed to step up our contract size to this new level and we have a number of similar sized opportunities in the pipeline.

On the face of it, that sounds rather exciting. However, the company has only reported turnover of between £2-3m p.a. in each of the last 6 years. So I wonder whether the figures quoted above are gross revenue - i.e. the invoices processed by CloudBuy's clients, with only a small sliver of under 1% actually being retained by CloudBuy? That's a key point which could do with some clarification.

My opinion - I still have no idea what this company actually does, nor how its business model works. The updates always sound amazingly good, but the reported figures are poor - e.g. interims to 30 Jun 2014 showed no real turnover growth, at just £1.5m, and a greatly increased loss of £1.6m for the six months.

I'm waiting to see tangible proof, in reported accounts, that there is real substance to this business. Broker consensus is for £4.5m turnvoer this calendar year, with a loss of £1.5m, so that means the company has to double turnover from H1 to H2, and reach breakeven in H2.

Forecasts are for turnover rising to £7.2m in 2015, and a maiden profit of £0.89m. Note that the £7.2m turnover is a tiny fraction of the $150-200m revenue mentioned above, so something doesn't seem to stack up here. Perhaps the company could clarify what they mean by the revenue figures mentioned in the RNS today?

The notes to today's statement that the company has processed over $500bn of spend to date (yet reported turnover to date in its accounts has been tiny), suggests that one should approach this company's references to figures with a degree of caution!

Nothing else to report today.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.