Good morning. Yes I'm late, so it must be Thursday! To compound that, tinternet has gone down here in Hove, so my iPhone is currently doing a remarkable job at supporting 17 tabs on Google Chrome - which is great, but it's a shame they forgot to make it competent at actually making phone calls too, that seems to have been overlooked by Apple...

Right, let's get stuck into today's announcements. There's a trading update from Norcros (LON:NXR). It starts out sounding like a profit warning, but gradually improves. By the end I have heaved a sigh of relief, with the last sentence crucially saying, "The Board remains confident of the full year outcome". In a bear market the shares would have been marked down at least 10% just in case, but today the price is unchanged from where it has been in recent days:

Normally I would consider selling if a trading statement says that trading is expected to be more heavily H2 biased than usual, which this does. However, the valuation is sufficiently low that in my opinion it already factors in lacklustre current year trading. Plus, with the UK economy now recovering, one would expect their trading to begin showing signs of recovery in H2 (NB. it's a March year-end).

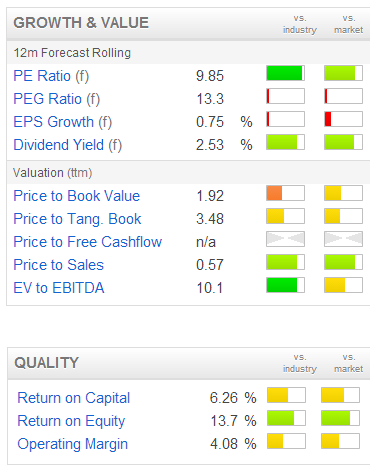

As you can see from the Stockopedia growth & value table to the right, the forward PER is attractive here (you won't find many cyclical companies on a PER under 10 these days), and the dividend yield is useful at about 2.5%.

Today's statement also indicates that net debt is anticipated to be around £29.5m at the half year end of 30 Sep, which is down slightly from their last reported figure of £31m. It's not a problem level of debt, but personally I wouldn't want to see it go any higher.

Also bear in mind there is a big pension fund here, with a deficit, although the deficit is fairly modest as a percentage of the total fund assets, and in common with other schemes, the deficit should have shrunk recently as Bond yields have risen. Why? Because the impact of a higher discount rate on calculating the present value of scheme liabilities tends to be a positive factor which is greater than the negative factor of reduced asset values from bonds sinking in value, although it varies from one fund to another. The trend is certainly towards pension deficits shrinking at the moment anyway, and that's likely to continue.

So overall, at the current valuation, I'm happy to sit tight in NXR. As always DYOR!

I hear that the ShareSoc technology company seminar last night in London was a great success. Sorry I didn't make it, but didn't get home until 5:30pm from a meeting that over-ran, and by then it was too late to hike into London. So instead I put the time to good use doing another training run along the seafront, and lumbered along for 1hr 15m, managing 12km this time, which was much improved (although still not exactly Daley Thompson!).

Thanks again for all the generous donations to Scope on my fundraising page, much appreciated! The big day is this Sunday, so I'll only be nagging you one more time about this, tomorrow! We've already reached £757 including Gift Aid, so I wonder if we can break into 4-figures?!

Prelims from Inland Homes (LON:INL) for the year ended 30 Jun 2013 look pretty good at a P&L level, with turnover up massively as a percentage to £31.1m, and a bumper operating profit of £5.1m. EPS has dropped out at 1.98p, but you can't really value small property developers on a PER basis, I prefer the build-out value method (i.e. calculating what NAV would rise to once they've developed all the existing holdings, then discounting it back to present value).

Or simpler, just look at NAV now & decide what (if any) premium you're prepared to pay. Reported NAV is 28.7p per share, and there is another few pence of off Bal Sheet asset value, from memory about 5p? So that takes the underlying NAV up to about 34p, so not really terribly exciting compared with the current share price of 39.5p. I was buying these shares last year at a deep discount to NAV, so can't bring myself to pay a premium now.

These shares also deserve a management discount, as they're not as clever as they think they are, in my opinion, and they draw too much in remuneration. So I won't be revisiting this one.

Alternative Networks (LON:AN.) might be worth a look - their shares are up 5% today to 352p on the back of a positive-sounding trading statement. The valuation table looks fairly interesting - a fwd PER of 13.9 is not especially cheap, but it has net cash too, so adjust for that and it would be lower. Also the dividend yield is pretty good at 4.1%.

Other than than, not a lot else going on today. I have to dash for a train into London now - am seeing another company, Scisys, so will report back if anything interesting crops up there.

I've also been looking again at Albemarle & Bond Holdings (LON:ABM), and am coming round to the view that the situation there is probably not terminal. It's still very high risk, but given that the last reported Balance Sheet showed liquid assets (the stock and pledge book) was greater than the total bank debt, then I can't see any reason why the Bank would be likely to pull out altogether. From their point of view, it would probably make sense to give ABM some time to raise fresh equity funding.

From an investor point of view, the risk is not in a discounted Rights Issue, since although you would lose money on your existing shares, you should make it back on the new shares when you subscribe for them. The risk is that the company does a Placing, which excludes existing private investors.

So my suggestion to the company is that they should get an announcement out, saying that if a fund-raising is required, they will do it via a Rights Issue, thus giving all existing shareholders a chance to subscribe for new shares. It's more expensive doing it this way (Placings are quicker & cheaper), but it looks to me as if they have time to sort this out, if the Bank remains supportive.

So a very high risk situation, but potentially interesting now the shares are down at 24.6p. Any views? Comments in the comments please!

Gotta dash, see you from 8am tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in NXR, and a token number of shares in INL.

A Small Caps Fund to which Paul provides research services, also has a long position in NXR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.