goalGood morning! Apologies for the technical gremlins yesterday, which coincided with me needing to travel back from London to Hove, but I completed the report when I got home.

Tungsten (LON:TUNG)

Share price: 347p

No. shares: 100m pre-Placing (c.103.5m post-Placing)

Market Cap: £347m pre-Placing (c. £359m post-Placing)

There was an interesting announcement just after the market closed last night from this innovative company which is aiming to revolutionise e-invoicing and integrate it with receivables financing. A small Placing of £12m is being undertaken through an accelerated book build (which will be completed by 9am today) organised by Cannacord. So in other words, Institutions & professional investors can ring Cannacord and bid for the new shares, and the deal is done at the price where demand meets supply.

I'll stick my neck out here, and guess that there is likely to be strong demand for these shares. It wouldn't surprise me if the deal is done at or near to the current share price. This company has a real buzz around it, although it's currently loss-making. It's one of my favourite more speculative shares, as the market opportunity they have is of potentially spectacular size & recurring in nature, if they can pull it off. It's a speculative share though, so as usual essential to do your own research.

The purpose of the fundraising is partly to finance a small acquisition of a company called DocuSphere (costing £4m), with the other £8m effectively being for increased losses due to large contracts being won with new clients, requiring integration into the Tungsten e-invoicing network.

What gives me considerable confidence is that five Board members are participating in the Placing, for a total of 569,825 shares plus £750k, which at an estimate of 340p per share equals £2.7m! That is some vote of confidence, where the Board stump up 22.5% of a £12m Placing, not something you see very often, if at all!

UPDATE at 07:57: I understand that the deal has been done, and that the price is 340p, so virtually no discount at all, as I suspected. This is bullish for the shares in my view.

Note that TUNG are presenting at a Proactive Investors event tonight, so there could be some feedback from attendees tomorrow.

UPDATE at 14:59: The company has now formally announced the Placing has been completed at 340p.

API (LON:API)

Share price: 62p

No. shares: 76.75m

Market Cap: £47.6m

Profit warning - bad news today from this specialist foils & packaging materials group, I'm afraid, with the company warning;

Overall, the elimination of last year's losses in Holographics is proving insufficient to compensate for the significant profit shortfall at Foils Americas. As a consequence, Group expectations are being downgraded, with both first half and full year results behind those reported last year.

Checking the archive here, I last reported on 15 Jul 2014, when the company issued a reasonable-sounding trading update. Although as I noted at the time, the company can be seen as damaged goods - it went through a lengthy sale process at the behest of large shareholders who want out. There was no interest in the company from anyone, so that tells you something! (i.e. that it's not a very good business).

Does it represent value now perhaps? Results for the year ended 31 Mar 2014 showed turnover of £114.7m, and an operating profit of £6.7m, which has flat-lined for about three years. It does look reasonably good value, at a market cap of £47.6m, although as a mature business, it's difficult to see what happens next? Particularly as major shareholders are known to want an exit, yet there were no trade buyers when it was put up for sale. The pension deficit, whilst not huge, nor requiring big overpayments, is probably a block to a takeover bid.

For these reasons I'd want to see these shares stonkingly cheap before becoming interested. A dividend yield of say 6%+ would be the sort of level where I'd probably find it irresistable. The divi is forecast at 2.15p this year, so that's a yield of just under 3.5% at the moment, which isn't attractive enough.

So with a rather poor trading statement today, I shall continue to steer clear of this share for the time being.

Goals Soccer Centres (LON:GOAL)

Share price: 219p

No. shares: 58.5m

Market Cap: £128.0m

This company operates 44 five-a-side soccer centres in the UK, and one in Los Angeles.

Interim results - for the six months to 30 Jun 2014 are published today, and look reasonably good to me. Growth is rather pedestrian though, with turnover up 3% to £17.1m for the six months, but note the very high profit margin with EBITDA of £7.0m (up 5%), and underlying profit before tax up 9% to £4.4m. I'm happy with their definition of underlying - it's just excluding some genuinely exceptional costs (mainly being exit costs from an interest rate swap).

Balance Sheet restructuring - things are now on a much firmer footing, with an £11m Placing in Mar 2014, combined with a new 5-year bank facility of £42.5m (on competitive margins). Therefore I'm now comfortable with the Balance Sheet of this company for the first time, after several years of things looking stretched. Note that the new bank facilities will "reduce the Group's interest expense by in excess of £1m p.a. on a pro forma basis, and provide flexibility to accelerate the controlled roll-out of new centres".

Net debt of £36.6m may still look high, but it's solidly asset-backed - with land & buildings showing a net book value of £103.5m. Therefore it makes sense to have just over a third of that financed by bank borrowings. Also, bear in mind that for this type of business banks lend against EBITDA, as well as asset backing. So the annualised EBITDA of £14m looks alright against net debt of £36.6m, at 2.6 times.

Outlook - this all sounds solid to me;

The positive trading momentum in the business has continued into the second half of the year, underpinned by the implementation of the Group's Path to Success programme. With the rebalanced capital structure generating significant interest savings, a healthy pipeline of new centres and the opportunity to further improve sales and profits in the immature sites the Board is confident in meeting its financial expectations for the current financial year and delivering long term value to its shareholders.

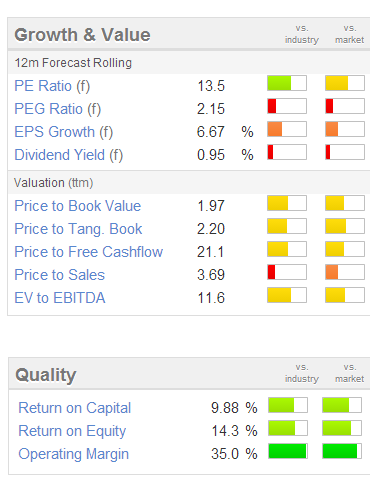

Valuation - the shares look priced about right to me, when you adjust for the net debt. The company scores well on Stockopedia's quality measures, has a very high StockRank of 94, and the valuation looks medium to perhaps a tad expensive on some measures;

Dividends - nothing to write home about, as the company has been conserving cash in recent years. So the forecast yield is only about 1%. Over time though, if you take a much longer term view, this company should churn out more divis as it matures, and growth slows.

My opinion - I like it. There are good barriers to entry for this type of business, and reading the narrative you get an overall feel that the company is developing well on many fronts, perhaps by trial & error! So they're improving their marketing, using Apps for players to book pitches & pay individually (so that an organiser doesn't end up with a bad debt for no-shows). Therefore in my view this share could potentially make a good candidate for a long term portfolio, now that they have fixed the balance sheet. Takeover deals could resurface, as it's the type of company that is difficult to replicate, so could command a premium price at some point possibly?

In retrospect, I was probably too cautious about the company's debt in the past, but being able to sleep at night is an important factor.

And finally, a couple of quickies from micro caps;

Belgravium Technologies (LON:BVM) - £6m market cap at 6.13p per share - interim results to 30 Jun 2014 look OK, with turnover up 12% to £4.6m. Profit is up ahead, at £215k (vs. £137k), but we're really talking very small numbers here. Not sure why it's stock market listed really? It's forecast to pay a 4% dividend this year, so that might just cover your bid/offer spread on the purchase? The commentary sounds pretty upbeat. An H2 weighted year is expected. The Bal Sheet doesn't look great - only £1.3m net tangible assets. TrakM8 recently looked at it as a potential acquisition, but talks ended almost as quickly as they were announced. This business hasn't really gone anywhere in the last 6 years, so it's a bit of a leap of faith to think it will become more successful now. I can't get excited about this one. The trouble is, you can find yourself unable to exit in a bear market with stocks this small, so they don't appeal to me unless there's a very good reason to buy & it's very cheap.

Petards (LON:PEG) - another micro cap, with mkt cap of just under £5m at 13.4p per share. Interim results look quite good - revenues up 101% to £7.2m, and an operating profit of £346k (vs. £299k loss). The order book looks strong, at £20m, with over a third due for delivery in H2. The company looks very similar to C21, supplying CCTV to transport sector. The Bal Sheet is OK-ish, with about £1m in net tangible assets. There is £1.5m in cash, but trade creditors look stretched to me, so I wouldn't rely on that cash being surplus. I've just noticed a £1.5m loan, so that offsets the cash to nil. The trouble with tiny companies like this, is that they rely on winning a few big contracts, then run into trouble when a gap in the order book opens up. So for that reason personally I'm steering clear, although it might do well if they can maintain current momentum? De-Listing is a high risk with such a tiny company too, as well as horrendous illiquidity & wide bid/offer spreads.

All done for today. See you again in the morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in TUNG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.