Good morning! WYG (LON:WYG) is a new company to me, it's a £65m market cap (at 108.5p per share) group, which as is so often the case, I am finding it incredibly difficult to work out what they actually do. The "what we do" section of their website doesn't throw a lot of light, saying:

Here at WYG we provide a diverse range of services to clients across numerous sectors worldwide, offering creative and effective solutions to their projects.

Well that's as clear as mud then. The "about us" section of their website throws no further light, so I have resorted to guessing what they do from the pictures. So it looks like some sort of design & building consultancy? Today's RNS describes themselves vaguely as:

the global management and technical consultancy to the built and natural environment

So first rant of the day is to question why it is that so many Listed companies seem unable to give a clear & simple explanation as to what they actually do?! The fashion for dressing up simple activities into a confusing array of management-speak gobbledegook just puts me off even wanting to look at their figures, as I cannot fathom, quickly & easily, what their activites are.

Anyway, their trading update for the six months to 30 Sep 2013 sounds pretty good - in particular this section which augurs well for the UK economy as a whole:

In the UK, we have secured additional business across our core sectors of Defence and Urban Development including several projects related to the MoD's Base Optimisation programme and the Group is winning increased levels of planning and enabling work associated with the widely reported increase in activity in the construction and house building sector.

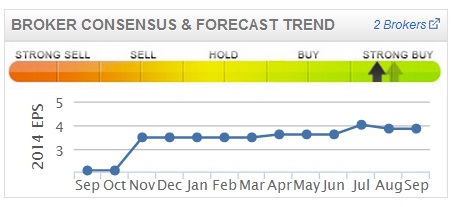

The conclusion is that current year profit expectations (which were raised in June) are now being raised again.

So to quantify that, current broker consensus is for 3.87p this year (ending 31 Mar 2014) and 5.67p next year. Therefore, one would imagine this year might be looking perhaps at nearer 5p per share, and say 6-7p next year if the improvements continue?

So to quantify that, current broker consensus is for 3.87p this year (ending 31 Mar 2014) and 5.67p next year. Therefore, one would imagine this year might be looking perhaps at nearer 5p per share, and say 6-7p next year if the improvements continue?

So at 108.5p the shares don't look particularly cheap, even once you factor in improved trading.

I make that 21.7 times this year's earnings, and 15.5 to 18.0 times next year's. Personally I'm not prepared to pay up-front for the next 18 months growth, so this one's not for me. The trouble with consultancy businesses, is that once the economy is recovering, then employers come under pressure from staff for increased salaries & bonuses. Good people then leave if their (perfectly reasonable) demands are not met, as competitors poach them.

I think this will particularly be the case over the next few years, as so many employees have accepted unprecedented downward pressure on their salaries (in order to preserve their jobs), and a cost of living squeeze. So companies where employee costs represent a high percentage of costs could well be vulnerable to wage inflation in the coming years, putting the squeeze on profit margins.

WYG's Balance Sheet appears to have plenty of cash on it, but when you dig a bit deeper, it's actually quite flimsy overall, with only £200k in net tangible assets overall. So I would disregard the cash, it's probably come from up-front payments from customers.

There have not been any dividends paid for years either, so overall I don't like it, whilst accepting that there could be some upside if they continue to benefit from a cyclical recovery. Too much of that is already priced-in for my liking though - as you can see from the two year chart below, it has already more than doubled in the last year, and doesn't look cheap any more.

Alumasc (LON:ALU) publishes its results today, for the year ended 30 Jun 2013. It's a share that has been covered here several times this year, most recently on 12 July, when I guesstimated that EPS would likely drop out between 10-11p for the year. That was correct, as they have today reported 10.7p adjusted EPS, which has been achieved on a strongly improved operating profit margin (up from 5.9% in the previous year to 9.5%).

The adjustments all look reasonable, being £0.3m brand amortisation, £0.7m restructuring costs, and £0.6m impairment. Those are not underlying trading costs, so it's fine to adjust them out in my opinion. Although as an article in MoneyWeek outlines, adjusted figures are arguably being widely abused now by many companies - stripping out more & more costs, to inflate benchmark profit figures. E.g., if a group is reporting exceptional restructuring costs every year, over many years, then surely that becomes normal? It's a grey area, so I like to look at the reasonableness of each company on a case by case basis.

So a strong rise in underlying profit is good. The outlook statement is non-specific, but sounds moderately positive. So broker consensus of 12p EPS for the current year looks sensible. Hence at 127p today (up 8p on the day so far) the PER still looks reasonable, at 10.6.

What about net debt then? There has been a good reduction, with reported net debt being £7.7m against £13.2m a year earlier. That's now coming down to a level where it's not a worry any more. Bank facilities are a total of £25m, and expire in June 2016, so that looks fine.

Dividends have been strongly increased, with a total payout of 4.5p against 2.0p in the prior year. That's one of the biggest percentage increases in the dividend I've seen for a while, and gives a meaningful yield of 3.5%. Plus it's a pretty dramatic statement of management confidence, to increase the dividend that much. It gives considerable comfort that trading is not likely to deteriorate any time soon, and probably is likely to continue improving, especially as the economy now seems to be in recovery mode.

Overall, I'm not terribly happy with their Balance Sheet, and hence would only consider making a small investment here. Net tangible assets are only £3.0m, which is not really enough.

It looks to me as if the pension deficit could be a bigger problem that investors realise. It is shown on the Balance Sheet under IAS19 accounting rules as having shrunk to a deficit of £10.1m at 30 Jun 2013. However, the deficit recovery payments are very large, at £2m p.a., and set to increase. This alarms me, and I think has made these shares uninvestable for me. This section from today's results narrative in particular is interesting, but made me recoil:

The group's defined benefit pension funds are currently undergoing their formal triennial valuation, with a valuation date of 31 March 2013. This valuation uses a more prudent methodology than the accounting valuation described above with, for example, future liabilities to pay pensions are discounted using adjusted long dated gilt yields, as opposed to the (higher and more favourable) AA corporate bond yields used under IAS19.

As gilt yields have fallen significantly overall in the three years to 31 March 2013, despite subsequent improvement and changes in actuarial assumptions such as mortality rates, it is likely that the group's actuarial pension deficit will have increased from the £11.5 million at 31 March 2010. The company has until 30 June 2014 to agree the new valuation and associated deficit reduction plan with the Pension Trustees.

The new valuation, when agreed, will be the basis for calculating future deficit reduction contributions paid by the company in cash each year, which currently amount to £2.0 million per annum as part of a six year recovery plan. In view of the above, it is possible that company contributionsmay need to increase in 2014/15.

So overall then, I think the potential size of the pension problems has ruled this out. Certainly the pension deficit may well shrink again in future, but it's likely to be a big drag on cashflow for the next few years. I think that justifies adding a few points onto the PER, which probably takes it up to a valuation overall that's about right, i.e. not cheap.

It amazes me how many investors are just ignoring issues like debt, and pension deficits, but more fool them - such issues greatly heighten risk, and can have a nasty impact when something goes wrong. If you don't factor them into how you value a company, then you're valuing it wrong, which makes it less likely that you will make a profit on the shares.

Any micro cap share that goes up 5-fold in a very short space of time, is usually an over-hyped pile of junk, in my experience. So I always approach such moves in very small companies with deep scepticism, and hence thought I'd take a look at results from @UK (LON:ATUK) this morning, to see if there is any substance for the recent rise from 6p to 34p in its share price, giving them a market cap of £25m currently.

Based on the results announced today, for the six months to 30 Jun 2013, I see no reason to change my view. Turnover rose 26%, but only to £1.4m, and it's still loss-making, at £0.3m for the six months, only slightly improved from the prior year H1 loss of £0.4m.

Directors supported it with loans, as the Balance Sheet is weak, at negative £0.4m net tangible assets, therefore an equity fund-raising looks very likely, indeed they would be crazy not to raise fresh equity, having seen the share price explode to the upside. But that could then reduce & cap the share price, as fresh backers are unlikely to want to pay such a high premium to put new money in.

So the whole thing really hinges on expectations for their future performance. They do say that they generated £250k in cashflow in the 36 days after the year-end, but it's not clear whether that is due to one-offs?

All in all, I have no way of knowing whether their business model is poised for huge success, as they seem to be saying in the narrative, or not. But personally I value businesses on the historic figures, and a cautious assessment of the future, and on that basis I would struggle to pay more than a few pence for this share. So it's not for me, I've been burned far too many times in the past on blue sky stuff, only a very small percentage of which actually deliver on the hype. Good luck to holders though.

Twitter is buzzing with news that the Russians have said their monitoring has detected the launch of 2 missiles in the Eastern Mediterranean, so looks like the strike on Syria may be starting? That's triggered a bit of a drop in the FTSE 100.

Personally I don't usually adjust my portfolio in reaction to global events, unless it's likely to have a major long-term impact on economic activity. Let's hope Syria does not, and that hopefully the terrible situation there is somehow resolved - although it seems to me that lobbing in a load of cruise missiles is not exactly going to make anything better, but anyway it's not appropriate to stray into politics here, this is just about shares.

BBC Breaking News has just said on Twitter that the Israelis have reported no signs of any missile launches in E.Med, so looks like earlier reports were a false alarm. It is a reminder though of the geopolitical risks out there, and that it doesn't take a lot to trigger profit-taking.

I've over-run the time for the 11 a.m. emailing, but will carry on writing until about noon, so if you're reading this before noon, then if you refresh the page later, there will be more results reviewed beyond this point.

Next I'll look at interim results to 30 Jun 2013 from Hydro International (LON:HYD). This company has always looked potentially interesting, but struggled to maintain growth. They make innovative products for the handling & treatment of water. However, orders have proved lumpy in the past, making the company vulnerable to profits warnings.

Looking back, I last mentioned it here on 19 Mar 2013, when the shares looked good value on 2012 full year results, but a poor outlook for 2013 (which they said would be "materially lower" than 2012 for both turnover and profits), has kept the shares grounded in the 90-110p range.

Revenue is a whisker down on last year's H1, at £15.1m, and adjusted operating profit is up slightly from £420k to £520k, so that's a low operating margin of only 3.5%. Adjusted EPS is only 1.91p for the six months.

They say that it was an H2 weighted year last year, and the same is expected this year. However, they reiterate the previous guidance that the ending of 3 large contracts with Thames Water will be "materially lower than 2012 levels". That then raises doubts about how 2014 will fare for them, so with such an uncertain outlook, it's really impossible to value this company sensibly. Here are some pictures from their website, to break up this text:

The Balance Sheet is OK, with £7m net tangible assets, including net cash of £2.9m, although Debtors look rather high to me, at £11.5m, which is a lot considering turnover was only £15.1m for the six months. Although debtors includes VAT, whereas turnover doesn't, but even so I would be more comfortable with a debtors figure nearer £6m, which would be about 60 debtor days by my rough calculations. So at nearly double that, they don't seem to have very good control over debtors, which increases risk - as when people are slow to pay, it means they might be disputing the invoice, and are not happy with the goods/services supplied.

The shares are down 10% today, to 98p, which values it at c. £14m. With such an uncertain outlook, I can't judge whether that's good value or not, as there is not a reliable profit figure to hang a valuation on. Therefore I would need considerably more margin of safety to want to take a risk on these, and am thinking that a share price of about half the current level would be where I'd start to get interested. So it's not for me.

Finally, I've had a quick look at the interims from dry cleaners Johnson Service (LON:JSG). This has been a turnaround story, which is clearly working now, and my previous concerns about excessive debt have been addressed with a disposal that has reduced net debt to a pro forma (since the disposal occurred after the period end) level of £25.6m. That looks just about acceptable, since it's less than twice last year's operating profit (which is very roughly the sort of figure I can live with for net debt).

Turnover from continuing operations (i.e. the disposal has been stripped out of these figures) was down 1% to £96.1m, and adjusted operating profit up 29.3% to £7.5m, so a decent result. It looks to me as if they might hit something like 4p EPS this year, although I note the broker consensus is 4.72p this year, and 5.17p next year. So at 49p these shares are on a PER of around 10, which is starting to look reasonable value, now that debt has come down to a more sensible level.

The forecast dividend yield is 2.43%, rising to 2.67% next year. So overall it looks quite good, and certainly better than in the past when it was carrying all that extra debt. But it doesn't jump out at me as something to get excited about.

Their pension deficit has come down nicely from £14m to £8m. Although the addtional contributions of £2m p.a. are pretty hefty. A new actuarial valuation is due in Sep 2013, so hopefully that might see reduced overpayments in future?

The outlook statement says they are in line with full year expectations. I could see some longer term upside on this, but there are probably better opportunities out there. Is a dry cleaning business ever going to command a premium valuation? Probably not.

Phew, that's it for today. Off to grab some lunch.

See you at the same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.