Good morning!

KBC Advanced Technologies (LON:KBC)

This is a consultancy and software group, that specialises in optimising efficiency and hence profits at oil refineries. It's a share I've followed, and sometimes owned, for almost all my investing career, since the mid to late 1990s, when it was recommended to me by the widow of a former employee, who said that it was an up & coming company, staffed by extremely clever people. It also looked attractive as an investment, paying a nice dividend yield, but seemed to serve up repeated disappointments every couple of years, with something always going wrong.

The last year has been a lot more encouraging, with more positive trading updates, and in this roaring bull market for smaller caps that we've had in the last couple of years, KBC shares have also risen strongly. Today's trading update is for the full year of calendar 2013, and sounds positive, with the key bit saying;

Following a strong first half, good operational and financial progress was maintained in the second half. Investment in key growth markets continued with new hires and contract awards in the FSU, Middle East, China and SE Asia. As a consequence, the Board anticipates that results for the year to 31 December 2013 will be slightly ahead of management's expectations.

Broker consensus is for 7.3p EPS for 2013, and 7.8p for 2014, so if they are "slightly ahead" (and assuming that management's expectations are the same as broker consensus forecast), then I guess they are probably talking about c.7.5p EPS. Therefore at the current share price of 116p, these shares look fully priced, on a PER of 15.5.

For a business with a rather erratic track record, and no obvious signs of strong & sustainable growth, I would probably only be interested if the price was a PER of about 10. So it's not for me. Also, the dividend yield is poor, at about 1.4% forecast.

There was an issue here about excessive tax charges too, if I recall correctly, because their profits are generated in a high tax jurisdiction, and their losses cannot be offset, something like that anyway. Action was being taken to deal with this, so it would be worth following up on that. If the tax charge is going to drop, then that could benefit EPS in the future, and bring down the PER to a level where it might be worth looking at it in more detail perhaps. But it doesn't interest me at this price.

MyCelx Technologies (LON:MYX)

This is a clean water technology company, which has developed a very interesting product that has a novel method of filtering the polluted water that is produced when drilling for oil. It's certainly an attractive-sounding growth story, with recurring revenues from replaceable filters, that should continue building with each installation of a MyCelx filtering machine.

Today's trading update is very good, with the key paragraph saying;

We are also pleased to be able to confirm that we expect to exceed guidance for 2013, with recent contract wins and our strong pipeline underpinning the Board's confidence for delivering further growth in 2014.

So looking at the figures, obviously the most important one is the price! So at today's 500p mid price (up 6.7% on the day), and with 13.258m shares in issue (per RNS dated 10 Dec 2013), the market cap is currently £66.3m. That's a very high valuation based on the historic figures, but of course growth companies are not valued on historic figures, but instead are valued on expectations of future profits. That makes them inherently higher risk, as expectations can suddenly change, and by a lot. However it also means that if you spot a credible growth company early, there can be multibagger potential.

Broker consensus for 2013 is $21.8m turnover and only a whisker over breakeven at $0.19m profit (note that they report in US dollars). This is seen as rising to $32.5m turnover and $1.6m profit in 2014. That's still not much for a £66m market cap company, so I don't know how much immediate upside there could be on the current price?

Another website has higher broker forecasts, £0.69m (reported in sterling) for 2013, or 3.03p EPS, and 12.27 EPS for 2014. So that equates to a 2013 PER of 165, and a 2014 PER of 40.7. So you would need to really have done your research, and be convinced the company is going to strongly out-perform, to pay the current price. The shares are not very liquid either. It will be interesting to see how things pan out in the long term here, but for me the price is probably a bit too high for the time being. I'd rather wait to see a bit more profit under their belt, and be able to better assess the future prospects, even if that means paying a bit more in future.

Billington Holdings (LON:BILN)

Structural steel company Billington has been on my watch list for a while now, as there was an upbeat trading statement a while ago. Trouble is, it's ridiculously illiquid, with a bid/offer spread that is so wide, you cannot really deal in the shares.

They've put out another good statement today, saying;

The Group's performance continued to improve in the second half of the 2013 financial year and, as a result, Billington will report results ahead of current market expectations.

5p EPS is forecast for 2013, so maybe we're talking 6p+? The shares don't look cheap at today's 130p, having been marked up 22p in a pre-emptive strike by the Market Makers. The Bid is 122p, Offer is 137p, so the market is effectively closed. No point in it being Listed, if there are no trades and a spread of 15p - the vicious circle of illiquidity.

I would only be prepared to pay less than half the current price for something so illiquid, so am taking it off my watch list.

Newmark Security (LON:NWT)

This company looks potentially interesting. It's a very small, niche security company, making products to safeguard the security of people and property. Historically it has been profitable, but the main problem seems to be errative performance, presumably due to lumpy order intake, and one-off nature of orders.

Nevertheless, their results today look pretty good - these are only interims, for the six months to 31 Oct 2013 - turnover is up 8% to £8.8m, and profit before exceptionals was £893k. Pretty good going for six months, and bearing in mind the market cap of this thing is only just under £8m, after today's 10% rise to 1.75p per share.

The downside is that they capitalised development spending, and there is a £826k exceptional impairment also announced today, taking it back down to almost breakeven. However, the outlook sounds strong;

The Board is delighted to announce recently that, in view of the results for the first half of the year and a healthy order book, full year revenues are expected to be substantially ahead of expectations.

Their Balance Sheet is adequate, so it looks worthy of doing some more research anyway, for micro cap specialists. I don't have time to look at it in any more detail, but would be interested if any readers follow it up to hear what you think.

Trifast (LON:TRI)

More good news from Trifast, which seems to be on a roll at the moment. They report strong trading, effective cash collection, and modest gearing. There are no figures given, so it's just a general update covering 1 Oct 2013 to date.

More good news from Trifast, which seems to be on a roll at the moment. They report strong trading, effective cash collection, and modest gearing. There are no figures given, so it's just a general update covering 1 Oct 2013 to date.

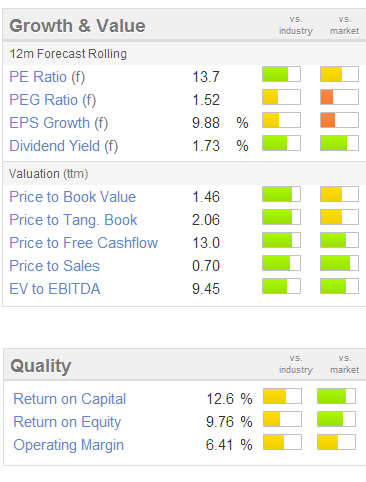

Their shares are up 2.5% to 82p todayand the Stockopedia graphics show a valuation that probably looks about right, based on consenus forecasts, as you can see on the right here.

Looking back on my previous comments on Trifast, their Balance Sheet has impressed me before - which although an unfashionable thing to focus on these days, is a key component of limiting investing risk - companies with strong Balance Sheets don't go bust basically.

Today's statement from Trifast also mentions that they are seeking out acquisitions. I'd want to know what experience management have of making acquisitions, as I was thinking some more about Silverdell, and the fundamental problem that caused them to go bust was probably that they had an ambitious, but inexperienced CEO, who made bad acquisitions on an inadequate capital base.

From what I recall of the Trifast Chairman, he seemed pretty battle-hardened, so I suspect he might be a much safer pair of hands on that front. However, no harm in double-checking.

Forbidden Technologies (LON:FBT)

This micro cap has looked very expensive for some time now. At 33p per share the market cap is almost £45m, yet it's delivered negligible turnover & always traded at a loss. 2012 turnover was £0.87m, and they have today reported 33% organic growth for 2013. Is that enough to justify this valuation? Doesn't look like it to me.

It has already done a fundraising, and today's trading update says it looks forward to further growth in 2014. It needs to deliver much more convincing growth to get me interested at anything like this price.

Blinkx (LON:BLNX)

All hell's broken loose with this video hosting/advertising company today, with their shares currently down 44% to 98p. Apparently there has been some sort of allegations or criticism of their method of charging advertisers. So no doubt a response will be published by the company fairly shortly, and kittens are probably being had in offices all over the City.

I looked at their website once, but it seemed to me like a greatly inferior copy of YouTube, so after that I didn't consider buying any shares in it.

However, it is perhaps a wake-up call that in this technology age, we really need to be sure about how a company actually makes money, as it might not be sustainable. That's a general point, not specific to Blinkx. However, I can think of quite a few other companies where people are not really sure where the profits actually come from, and the companies themselves seem to obscure that by using overly waffly language - a warning sign in my view. Every good investment should be crystal clear in how they make profit, and that it is sustainable.

On a more general level, I've been putting my cash pile to work in the last few days, picking up bargains where nervous nellies have been selling up good companies on recent market wobbles, so thank you to them for handing me some bargains!

I'm still keeping a bit of cash back, in case the current emerging market wobbles spread into another banking crisis. Although I can't help thinking that this time, everyone knows what to do - so if Banks get into trouble, they have to be refinanced and/or nationalised straight away. The politicians and civil servants know that they have to act fast, and decisively, to stop contagion spreading. That's very different to 2008, when nobody had any idea what to do, but learned the hard way.

Same with China - at some point their system will blow up, because the entire economy is stuffed full of bad debts that are never crystallised. But in a command economy when the Banks are owned by the State, it could just be kept rolling forever possibly? They just print more money, and end up with hyper-inflation in the end. That could take decades though, who knows? So personally I'm not losing any sleep over it.

Back from 8am tomorrow, although it will be a short & fast report tomorrow because I have to dash off early for a company meeting.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.