Good afternoon,

I haven't made the final decision about which stocks to cover, so please shout in the comments if you'd like me to mention something. Thanks!

Graham

Conviviality (LON:CVR)

Share price: 260p (unch.)

No. shares: 172.5m

Market cap: £449m

Half-Year Results for 26 weeks ended 30 October 2016

I have written very cautiously about these shares before, and I'd remain very cautious here, after today's results.

The group swings into pre-tax profitability of £7.4 million (up from a loss in H1 last year).

Ne debt is 1.2% below "pro forma net debt" (that will have been a tricky calculation, following on from a series of acquisitions), and is now £138 million.

And how about this covenant situation:

Leverage is comfortably below the Adjusted EBITDA bank covenant of 2.50x at 2.19x

At 87% of the maximum, it's comfortably below? Really?

Still paying dividends:

Interim dividend up 100% to 4.2 pence (H1 FY16: interim dividend 2.1 pence), which is currently expected to represent approximately one third of the anticipated full year dividend.

That 4.2p dividend is worth £7 million in total, so it's the entire pre-tax profit figure.

It's a big statement of confidence to suggest that c. £21 million in dividends could be paid out in total this year.

Interest costs added up to £2.7 million in the period. This might not seem much against the market cap or the near-£800 million in revenues.

My opinion: I don't think there is anything comfortable about the leverage here for what remains a low-margin business.

In that context, I don't understand how the dividend policy makes sense - it needs more breathing space for its covenants, in my view.

Management are heavily incentivised to grow EBITDA (contributing to a max 100% salary bonus for the CEO) and to grow EPS on a 3-year timeframe via the LTIP.

The shareholder base has obviously signed off on these policies, so in aggregate it must be content, but it looks to me as if management are incentivised to shoot for the moon - with all the attendant risk which that involves.

For these reasons, I view the low PE ratio and the dividend yield as value traps.

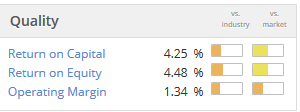

This Stockopedia table helps to illustrate some weak quality statistics:

Sopheon (LON:SPE)

Share price: 380p (+13%)

No. shares: 7.4m

Market cap: £28m

Posting this in response to reader request. Great news here:

"...a strong performance in the second half of 2016, driven by a large number of license orders in the final quarter, including substantial activity with major enterprise customers. In addition to the effect of the stronger sales performance, the profitability of the business was further enhanced by cost efficiencies over the course of the year, and to a lesser extent by foreign exchange gains linked to the sharp fall in Sterling.

As a consequence, the Board expects that reported revenues for the year ended 31 December 2016 will be in line with current market expectations. The Board also expects that, even when excluding the impact of the positive foreign exchange effects, EBITDA will be ahead, and pre-tax profits significantly ahead, of current market expectations."

So to be absolutely clear, the good news today is due to margins and not sales.

I haven't actually looked at this company before (it's great to engage with other investors, because you can get exposed to a lot more interesting ideas!)

Anyway, I see that these shares have "multi-bagged" over the past year, rising from 60p.

It's a software business, specialising in "Enterprise Innovation Management". Checking their website, I get the following summary:

"Sopheon integrated Enterprise Innovation Performance solutions support everything you need for the entire innovation, new product development (NPD), and innovation governance lifecycle."

And on the Introductory page for investors:

Sopheon (LSE:SPE) is an international provider of software and services for product life cycle management. Our Accolade® solution supports strategic roadmapping, idea development, product portfolio management and the creation, commercialization and replacement of products.

So that's reasonably clear, although without trying some of their software for yourself, or talking to staff, the company will inevitably feel like a black box as an investment.

When investing in software, a basic test is the strength of cash flow - does the company generate real earnings, or is it capitalising too many of its expenses?

Doing a quick test, I see that SPE capitalised £900k of development costs in H1, and amortised £1 million of intangibles (so that £1 million can be added back to net income, to arrive at operating cash flow). That looks like a fair match, and H1 in the previous year was also a fair match.

Checking the final results for 2015, I see a similar positive pattern in terms of the match-up between development costs capitalised and intangibles amortised.

So on an initial glance, I'd have good confidence in the earnings here.

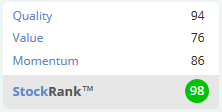

It has a huge StockRank of 98, and looks worthy of further investigation.

Waterman (LON:WTM)

Share price: 82.5p (unch.)

No. shares: 30.8m

Market cap: £25m

I last covered this engineering & environmental consultancy at its AGM, which included a slightly positive update to the end of October.

We are now updated for H1, which ran until the end of December.

This update is short, to-the-point and in line with expectations, so it's not much of a surprise to see that the shares haven't budged.

Waterman has experienced a positive interim trading period and the Board expects to report Interim Results consistent with market forecasts for the year as a whole, with revenue, profit and operating margin percentage generally in line with the prior year comparable period.

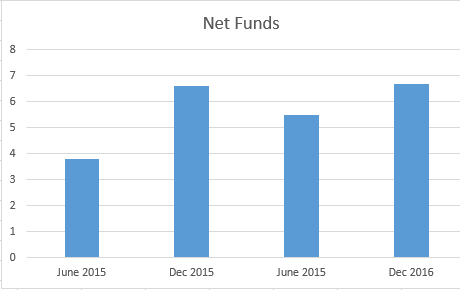

A continuing emphasis on working capital management has resulted in the Group expecting to report net funds at 31st December 2016 of £6.7m (£5.5m at 30th June 2016 and £6.6m at 31st December 2015).

Working capital management is not the most exciting of topics but it's crucial housekeeping for the majority of businesses.

Waterman's net funds position has evolved in the following way: £3.8 million (June 2015), £6.6 million (Dec 2015), £5.5 million (June 2016), £6.7 million (Dec 2016).

I'm glad that the company has emphasised this aspect of performance. It looks to me as if the movement in the net funds position has been about right, starting from that low in June 2015.

In the year from June 2015, WTM earned £2.7 million in net income and paid out £700k in dividends, so with perfect cash conversion and starting from £3.8 million, it would have reached £5.8 million in net funds by June 2016. It reached £5.5 million, which was close enough, and has gained an additional £1.2 million since then. That's slightly lower but within the ballpark of what might have been expected, given performance which the company has described as "generally in line with the prior year".

I see that the brokers left their forecasts unchanged here, as of last Friday. After today's update, there's no reason for anyone to change their mind on this.

Flybe (LON:FLYB)

Share price: 45p (-1.4%)

No. shares: 216.7m

Market cap: £98m

Flybe has a new CEO, formerly CEO at Cityjet from 2010-2015, who is upbeat on prospects:

"I have only just started work as CEO at Flybe. However, everything I have seen so far confirms my excitement at the opportunity we have to become the best regional airline in Europe. There is much to be done, but we have the firm foundations needed to develop the business. My first priority is to look to rebuild passenger unit revenue and to challenge all our costs. This will be assisted by Flybe becoming an even more customer-focussed business as we achieve greater control over our fleet size."

Today's statement reinforces the difficulty of the situation, telling us that "increased capacity and tough trading conditions resulted in lower load factors" in the most recent quarter.

Checking back to the H1 statement, the company said:

7.1% increase in passenger volumes to 4.8 million in H1 2016/17. The effect of adding new routes and rotations, together with a weak aviation market, meant that load factor fell by 4.3 ppts to 72.0%.

I tend to harp on about load factor, but it's the most basic requirement to have a successful airline. Short-haul airlines are even more sensitive, because of the need for ancillary revenue - and if the seat is empty, there is of course no ancillary revenue. The operationally leveraged business model, involving so many heavy up-front costs, can't afford this.

Today's statement informs us that load factor has fallen by another 1.7ppts, so that it was at 67% in Q3 (down from 69% in Q3 2016). By contrast, Ryanair Holdings (LON:RYA) achieved around 95% from October - December 2016.

Seat capacity at Flybe continued to grow, up by another 13%. It seems crazy to keep growing capacity when load factors are so low, but the statement insists that the growth in capacity has "started to slow". Four aircraft were added to the fleet, and another four are due, but six leases will be allowed to expire next year.

The balance sheet as of September shows net debt of £25 million (£142 million of cash offset by £167 million of borrowings), and net assets of £167 million which includes £247 million of aircraft assets.

My opinion: I don't consider this to be investable, or at the very least it's highly speculative, given the load factors and the likely difficulty of making a turnaround (though anything is possible, of course).

Perhaps the market cap at c. £100 million is a fair reflection of likely liquidation value, plus a premium for the chance that a turnaround could succeed? I doubt that, personally, but I'd love to be proven wrong.

That's all I've got for today, thanks for reading.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.