Good afternoon.

It's been a rather difficult morning here, we had a medical emergency, so I've been looking after the patient, and had to go into hospital with her, after the Doctor called an ambulance, due to some worrying signs.

Unfortunately, the impact of 50 years smoking is now making itself known. What an absolute scourge on humanity tobacco is - I've never bought shares in any tobacco company, nor will I ever do so.

So somewhat belatedly, here is today's report. Sorry for the delay.

Redde (LON:REDD)

Share price: 177p (up 8.4% today)

No. shares: 302.2m

Market cap: £534.9m

(at the time of writing, I hold a short position in this share)

News release - the company issued a statement last week, on Fri afternoon, in response to the Govt's Autumn Statement, which included action to be taken to rein in the compensation culture, in particular in relation to (often false) whiplash claims after car accidents.

Shares in REDD fell in sympathy with other companies involved in personal injury claims. Although reading through REDD's statement on Friday, it seems that very little of their business is likely to be affected by the changes. Therefore it's looking increasingly likely that the sharp fall in share price last week might have been unjustified.

This last sentence from REDD's announcement in particular, suggests that the group appears to have little exposure to problems in this area;

Redde further notes that the activities of the Group which would be covered by legislation of the sort proposed by the Chancellor contribute less than 2.5% of the Group’s revenue.

This set me thinking that 2.5% of group revenues isn't much, but what if it's a lot more profitable than the other group activities? So for this reason, I downloaded the accounts for every group company within REDD, from Companies House (which is now free) and had a quick look, to get a better feel for where the group's main activities and profits come from.

In this case, the main activity seems to be replacement vehicles for accident victims, which has always been the case with this company, from when it was HelpHire, although for some reason I thought it had broadened out much more into other areas, such as whiplash. That doesn't seem to be the case particularly, so it looks like I made a mistake by opening a short position on this share late last week. It's not a big deal - you try out lots of ideas, and see what works. Some will, some won't.

That said, I note that Aviva, the insurance giant, and also REDD's 3rd largest shareholder, reduced from over 14% to over 13% last week. So I'm intrigued as to why they were selling? Maybe the memo about REDD not being impacted much by the Govt's stance hasn't yet been read at Aviva HQ?

So on balance, I decided that it was probably a mistake to be short of this share, so I covered half my position this morning, but will let the balance run, and see what happens. I'm not really supposed to write about my short positions here, but seeing as new information emerged on Friday, then I think it's important to mention it here today.

French Connection (LON:FCCN)

Share price: 38.5p (up 27% today)

No. shares: 96.2m

Market cap: £37.0m

(at the time of writing, I hold a long position in this share)

Trading update - covering the 16 weeks to 21 Nov 2015, so it's H2 to date (the year end is 31 Jan 2016). Trading updates from this wholesale/retail/licensing group tend to be completely erratic, apart from the twice a year results statement.

As I mentioned in my report here of 21 Sep 2015, which was quite a detailed review of the interim results, there was a clue that things were improving in the outlook section, in that trading in Aug & early Sep was quite good. This is significant, because if a new season's range (which tends to go into shops in mid to late July) sells well initially (i.e. in August), then that tends to augur well for the rest of the season - i.e. good sales, and just as importantly good margins, tend to happen.

Retail sales & margins - I was pleased, but not particularly surprised, to hear FCCN say it is trading well today. The sales uplift is very modest, only +0.2% LFL (i.e. stripping out the impact of store openings & closures). However, the challenge for FCCN is selling more of its high-priced goods at full price, instead of in the sales. On this score they're doing better, with +6.0% LFL sales performance on full priced stock, and hence a corresponding drop in discounted stock sales. This better sales mix (i.e. more being sold at full price) has delivered an uplift in gross margin of 150bps. To quantify that, in H2 of last year, retail sales were £53.4m, so applying a 150bps rise to that figure, gives a benefit to this year H2 profit of £801k, if all other things are equal.

In summary then, this means that the retail operation has slightly improved its performance, although let's not be under any illusions, the retail division is a complete disaster area, and is still heavily loss-making, so the priority above all else, is to exit from the loss-making shop leases.

Wholesale & licensing - these divisions are the decent, profitable part of the business, which would be worth (in my opinion) perhaps £100-200m as a standalone company.

All other areas of the business are also trading in line with expectations.

That sounds fine.

Cash position - as mentioned today, this time of year is the cyclical low point for cash, as the shops have been stocked up ready for the crucial Xmas sales bonanza;

Group cash, during a cyclical low period of the year, was £6.1m (2014: £7.6m).

Note that cash has only fallen by £1.5m in the last year, and that the company still has a healthy, positive cash balance, at the low point of the year. That should rise to about £20-22m net cash by the year end, 31 Jan 2016, a seasonal high for cash.

Therefore the company is still in a very strong financial position, despite being loss-making, and I am reassured that it is still very much a viable entity.

Brand licensing - this is the jewel in the crown. People often say that the slogan T-shirts at FCUK are old hat, and they are. I cringe every time I see the latest twist on this incredibly tired concept, on their website. However, in other areas, the company has been very successful at licensing its brand - e.g. spectacle frames, perfume, and others. There is even a French Connection range of sofas at DFS, mentioned today;

As part of the continued development of the licensing business for the Group we have ongoing discussions in a number of product categories and significantly have recently extended our very successful furniture licence with DFS for a further period of 5 years.

I feel that the £37m market cap, after today's big rise, still woefully undervalues the brand value, which is aspirational - if it wasn't, then other companies wouldn't pay FCCN millions of pounds for the right to put this name & logo on their products, and consumers wouldn't buy the products. But they do.

Closure of retail sites - this is the key to the company overall becoming profitable again. It will take several years to dispose of the loss-making shop leases, but progress is being made. I am particularly pleased with the deal announced today on the closure of its loss-making Regent Street store, with a large cash receipt having been negotiated. What a cracking deal. The Oxford Street flagship store is the big one - I reckon that must be a huge loss-maker, as the rent is sky-high. Watch out for news of that being disposed of, as I think that could be material to the overall company performance.

We continue to look for opportunities to rationalise our store portfolio and now expect to close a further 7 non-contributing stores during the second half of the year. Further, due to the redevelopment of the building, we will vacate our Regent Street, London store at the end of March 2016, at which time we will receive a compensation payment of £2.4million, while also removing the ongoing trading losses of the store.

Trading overall - we get the all-important in line with expectations comment in today's Directorspeak part of the update;

"I am pleased to report that the performance of the Group has improved considerably compared to the first half of the year, particularly in the UK/Europe retail stores and while we still have the all-important Christmas period to come, we expect the results for the full year to be in line with market expectations."

Stockopedia is showing a broker consensus of -4.7p EPS for this year, which translates to a post-tax figure of -£4.5m, and it looks (from last year's prelims) as if the reported pre-tax and post-tax profits are about the same. So there's still some way to go, before the company gets to breakeven, let alone profits. Note however that H1 was a £7.9m operating loss, so if they do -£4.5m for the full year, then that implies a reasonable H2, profitable by about £3.4m if I've done my sums right. There is an H2 seasonal weighting, which punters often forget, so buying after poor interim results can be a good strategy with this share, as people think the company is trading far worse than it actually is.

As those problem loss-making shops gradually disappear though, the company should move into profits, but this could take several years.

My opinion - this share is gradually working out, as I hoped it would. The company has had false dawns in the past though. The key to eventual success is the gradual closure of the loss-making shops, and that seems to be progressing nicely. It will be a few more years though until all the problems are dealt with, but by that stage there should be a very decently profitable, and much more valuable wholesale/licensing business.

If the newsflow remains reasonably positive, then I see considerably more upside potential for this share. As I mentioned in my last report though, it's a special situation, which won't appeal to many investors, as you have to work through the figures differently to just a vanilla retailer.

My conclusion on 21 Sep here proved to be very right! I hope some of you picked up some stock then at 25.75p:

"So far, 2015 has been poor, but not so poor that the company is under any threat of going bust. Therefore to my mind, it's something where I'm more inclined to buy more, on the crushingly negative market sentiment, rather than sell because it's had a bad H1. This is especially true, as the current trading figures are much better than in H1."

Bear in mind also that the founder, and 42% shareholder, is no spring chicken, so at some point no doubt he will be seeking an exit on the most lucrative terms possible. So providing he treats other shareholders fairly, then this could give us an eventual value catalyst.

Accsys Technologies (LON:AXS)

Share price: 68.5p

No. shares: 89.8m

Market cap: £61.5m

(at the time of writing, I hold a long position in this share)

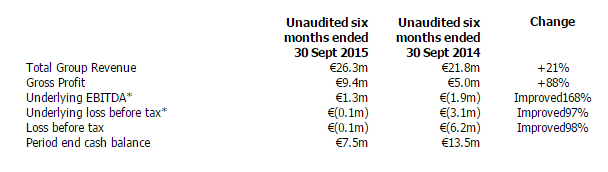

Interim results - just a quick comment on results from this one. I quite like this share, as it has blue sky elements, but the existing business (selling a special type of treated wood, with superior qualities) was said to be approaching breakeven. The figures today confirm to me that things seem on track. The other thing I like about this company, is that it seems to have enough cash in the kitty to move things forward, and partnership deals with big companies to do the heavy lifting in terms of capex. So potentially things look quite nicely lined up.

The highlights look encouraging to me;

There seems to be a production capacity constraint at the moment, but with more capacity coming on stream in 2017. So for those prepared to be patient, who knows, things could develop here perhaps? I think this stock could have good potential, if production is indeed moved up to significantly larger amounts, and profits follow.

Solid State (LON:SOLI)

Share price: 612p (up 2.9% today)

No. shares: 8.4m

Market cap: £51.4m

Interim results to 30 Sep 2015 - what an interesting situation this has been! The shares sold off massively on a profit warning at the end of Oct 2015, due to delays on a large contract with the MoJ.

However, the narrative with the interim results announced last week sounds a lot more upbeat, and that has triggered a very big rebound in the share price.

So who says that catching falling knives is a bad thing to do? Some of the best investments you can make are often after an overdone sell-off for a fundamentally sound business. With hindsight, this would have made a lovely purchase after the profit warning a few weeks ago.

I think the key thing with falling knives, is to recognise that every situation is unique. So there's no simple formula for deciding which ones to avoid, and which ones to buy up. We just have to weigh up each situation individually, and try to identify which companies are fundamentally sound, but have sold off due to temporary, fixable issues - those are the ones to buy after profit warnings (once they've stopped falling in price, anyway). The ones to avoid, and situations where something has gone fundamentally wrong with the business model, and is not likely to improve any time soon.

How about this for a recovery though? In my view, it didn't get sufficiently cheap on the fall, and there's no way I would entertain it now, after such a big rebound. So one that slipped through the net, but never mind.

It would be interesting to do some statistical analysis of profit warnings, and work out the optimum type of companies, type of profit warnings, and timing of when to buy, which might give good overall results? Or to identify which shares would make good shorts, immediately after a profit warning - as of course, shares very often continue falling after a profit warning.

Contract manufacturers, with lumpy orders, like SOLI, are just not attractive investment propositions to me.

Right, I'd better dash, as there's a Xmas party I have to go to now - which will take my mind off a difficult & stressful day being a cross between Florence Nightingale and a dog sitter!

See you tomorrow.

Regards, Paul.

(of the companies mentioned today, I have long positions in FCCN and AXS, and a short position in REDD which I am thinking about closing possibly. A fund management company with which I am associated may also hold positions in companies mentioned.

NB. These reports are my personal opinions only, which are subject to change without notice. These reports are never financial advice, or recommendations. The emphasis for this particular website, is on readers doing your own research).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.