Good afternoon,

Apologies for the slow service today.

I thought it worked well yesterday, taking suggestions about which stocks to cover.

So if you have any suggestions, please let me know.

I provisionally intend to cover:

- Carpetright (LON:CPR)

- Joules (LON:JOUL)

- Quarto Inc (LON:QRT)

- Alumasc (LON:ALU)

- SCS (LON:SCS)

Thanks

Graham

Carpetright (LON:CPR)

Share price: 185.5p (+6.6%)

No. shares: 67.9m

Market cap: £126m

I covered Carpetright recently, in the SCVR of Dec 13th.

That was the interim results, when the company reported:

We have made an encouraging start to the second half with a return to like-for-like sales growth in both businesses. As we enter the important January trading period, we remain comfortable with the range of market expectations.

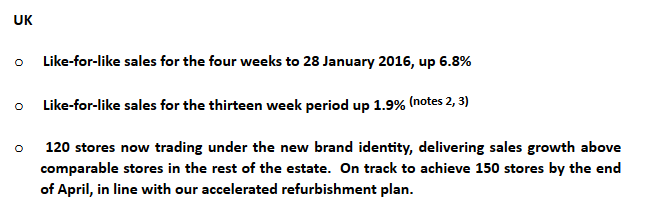

It has certainly delivered on that today, confirming as follows:

Other bullet points:

- Number of UK stores reduces slightly to 427.

- Rest of Europe like-for-like, constant FX sales (the best measurement) are up 5.4% (in reported currency, up 22.4%).

- The CEO comments and lets us know that the store refurbishment plan is on track. Excellent news.

I haven't got much to add to what I said last time - namely, that I think there is a good chance that management can execute their investment plan, at considerable cost but with the opportunity of creating attractive medium-term benefits.

More than three quarters of CPR's operating cash flow in H1 was spent on the refurbishment plan. We can't expect much free cash flow here for now. But if it helps to restore strong performance, it will certainly have been worth it.

Joules (LON:JOUL)

Share price: 216.5p (-2%)

No. shares: 87.5m

Market cap: £189m

Following the pre-close trading update in December, I warmed to this share, thinking that it could grow into its (then, 195p) share price.

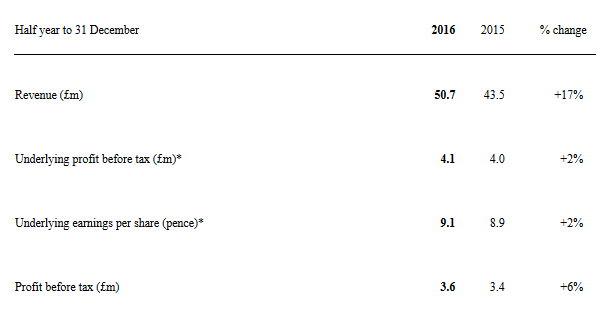

The company is making that argument easier now:

When I ran the numbers on last year's financials, I thought that a fair estimate of the full-year result was about £7.1 million in PBT.

Those results were riddled with "non-underlying" costs, and today's report again insists on making some adjustments.

They are fairly simple, though: just £0.3 million in IPO expenses and £0.3 million in share-based payments.

I feel strongly that share-based payments must be included in underlying results (just as if they were a part of ordinary salaries).

The IPO is a legitimate non-recurring event, however. So I think a fair adjusted result here is £7.2 million in PBT.

Not bad for a half-year result. And the maiden dividend is a strong signal.

My opinion: There are good reasons for confidence: active customer numbers are up by 30%, Christmas period sales are up 23% year-on-year, and retail e-commerce sales are up 30% too (now a quarter of all sales, including wholesale).

Even the gross margin improved by 1ppt, to 55.5%.

My only concern is that capex seems rather high for this period, at £7.2 million, which the company attributes to a variety of factors including new store openings (11 new UK stores were opened). Perhaps that's reasonable, but I'd want to keep an eye on it.

Overall, whereas before I said that the share price was overcooked, it looks increasingly reasonable to me now.

Quarto Inc (LON:QRT)

Share price: 295p (-7%)

No. shares: 19.7m

Market cap: £58m

The market is less than impressed with this trading update (a profit warning). To put things in context, the shares are still up by more than 30% since Jan 2016 - at this stage, it's just a bump in the road.

What happened:

With a continued decline in performance in Books and Gifts Direct (BGD), the Board has reaffirmed that BGD is not a core business and negotiations with a potential acquiring group are ongoing. Heads of Terms have been signed and the deal is anticipated to close in the coming weeks. The proposed total consideration of A$5.75m comprises A$1.0m of cash consideration payable on completion, with a further A$4.75m in interest-bearing loan notes which are repayable out of cash generated by the business, but with a long-stop date of 10 years. Assuming the transaction completes and the loan notes are repaid in full, this will result in a total writedown of approximately $11.0m.

Quarto is still not a company I feel fluent in, so I decided to check their website to better understand the company structure. This helps, sort of:

(I tried pasting a picture in here, but it didn't work - follow this link to see where BGD fits into the company structure.)

Books & Gifts Direct is Australia and New Zealand's largest direct seller of books and gifts. We sell our products from lunchrooms and reception desks in more than 55,000 workplaces around Australia and New Zealand - workplaces that include schools, child care centers, office buildings and community centers.

A quirky type of bookseller, then. Perhaps it makes sense to get rid of it and focus on the core publishing business,

It sounds like a horrible deal, though, based on the information given: just A$1 million in cash, with the rest of the money to be paid out of BGD earnings. It sounds a lot like just giving away any future earnings in excess of A$5.75 million or further than 10 years out. I wonder how such a deal can make sense? Maybe if the alternative was a costly bankruptcy or restructuring process? I'm not sure.

Another note for concern is the stubborn net debt position at $62.2 million, or about £50 million. BGD performance and working capital movements are blamed - that's reasonable in principle, but investors will need to watch carefully to see that it reverses.

The company went on a small acquisition spree in 2016, when it might have paid down debt instead. It also announces today that it's planning to increase its dividend.

It has a highly diversified catalogue, so maybe it can afford to take on this financial risk.

My opinion: This needs more research on my part, but I can see that there have been some huge operating cash flow results over the past few years. (Navigate to the Stockopedia cash flow page to have a look.)

Free cash flow generation looks pretty good, too.

Overall, I don't feel like I've managed to make sense of this company just yet. The best I can say is that I'm open to the idea of it being a good investment at this price!

Alumasc (LON:ALU)

Share price: 175p (+0.3%)

No. shares: 36.1m

Market cap: £63m

This company is new to me. Thanks for bringing it to my attention in the comments.

It says it has a "strategic focus on premium building products, systems and solutions for niche markets"..

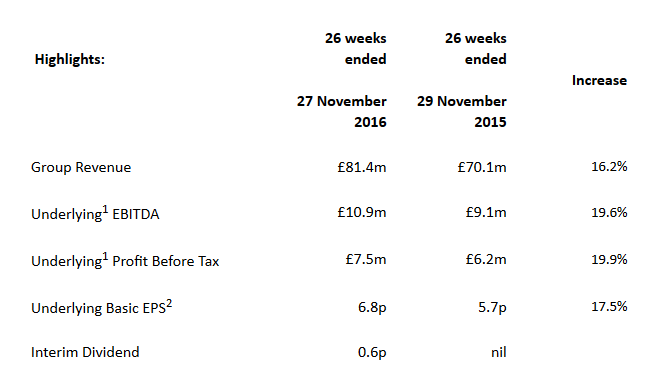

The results today look good:

In the "key points", I find it a little odd that there is mention of this being "the fifth consecutive first half year of earnings growth". I suppose it's a good thing at least!

One might think that revenue growth of 17% would have translated to a better profit result, but:

Lower group margins reflect increased imported materials costs and continued investment to support growth.

Benefits of pricing actions and operational gearing will see margins stronger in H2.

Order book: now at £27.6 million, which is said to be at "close to record levels".

Annual revenues have been around £90 million in recent years, however, so this is just a few months of the work which would be hoped for - visibility must not typically be very strong here.

Outlook: "the Board's expectations for full year performance remain unchanged."

Brokers are forecasting EBIT of about £9 million for the full year, putting this stock in the "value category" (in current market conditions) with a PE ratio of about 9x.

I'd be interested to find out quantitatively how much the FX effect has hurt the result, as it seems to have been the only negative.

This is particularly encouraging

Sales to domestic markets grew by 9% to £43.2 million. This compares with UK construction market growth of around 1% in the period, providing further evidence of the higher than industry average growth rates generated by Alumasc's specialist systems and solutions, with over two thirds of the group's business now focused on managing the scarce resources of water and energy in the built environment;

Pension: a triennial valuation has been completed (actuarial, not accounting methods).

On this basis of valuation, the pension deficit was calculated to be £33.0 million and is to be recovered over a period of ten years, with Alumasc making annual cash contributions of £3.2 million (previously £3.0 million), to include scheme running costs. This outcome is in line with the expectations set out in our 2016 Annual Report.

That's quite a large chunk of earnings due to the pension over 10 years. Though it's far from terminal. I'd be happy to treat this the same as I would a £33 million bond outstanding, repayable in installments.

My opinion: I'm quite impressed at first glance. There is good financial evidence of a competitive advantage - excellent return statistics (ROE, ROCE) and industry-beating growth.

Valuation rests on the strength of that advantage. It will take some time for the company to work through its pension deficit, but if there if there is an advantage then I could potentially see this turning out very well for shareholders in 3-5 years.

SCS (LON:SCS)

Share price: 170.5p (+0.3%)

No. shares: 40m

Market cap: £68m

A short update for the H1 period ending 28 January.

Trading has been in line with expectations:

The Group achieved like-for-like order intake growth of 2.7% for the 26 weeks ended 28 January 2017, a pleasing performance against particularly strong comparatives. Two year like-for-like order intake has grown 12.5%. Trading over the Christmas and January sales period was also in line with the Board's expectations.

As flagged by Paul previously, management appear less than entirely confident about beating last year's excellent results:

We remain mindful that the Group still faces the key Easter and May bank holiday trading periods and faces very strong comparatives during the remainder of the year. The Board believes the business remains in a strong position to maximise opportunities as they arise and to grow market share.

Last year saw operating profit jump to £11.0 million (from £2.8 million in FY 2015), and brokers are looking for a slightly improved result to £11.3 million this year.

So there's potential value to be had, including a huge dividend yield (about 9%).

My opinion: I'm reminded of the adage which says that (ideally) you shouldn't buy a stock, unless you'd be happy to be left holding it even if the stock market was shut down.

So personally, I wouldn't try to buy this with a view to selling it before the next consumer recession or hike in interest rates. I would only buy it if I wanted to own it indefinitely.

Gross margins look acceptable to me but what's killing the operating margin is the expenses line, which I understand to be related to the advertising spend. It needs to get a grip on expenses to deliver a comfortable margin.

That said, I can see the potential value here, and would probably continue to hold it if I owned it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.