Good morning!

It's so difficult to get moving again after a Bank Holiday, isn't it? The extra day off just seems to make me relax to a point where I grind to a halt completely! After an enjoyable brunch with investor friends on Sunday, I ended up binge-watching my favourite comedies (Big Bang Theory & Goldbergs) all day yesterday. Not a productive use of time, but it did help me unwind a bit!

Not forgetting of course New Top Gear, with Chris Evans & Matt LeBlanc. I think they pulled it off, perhaps not surprising given that Evans is an experienced TV host, and a massive petrolhead. Although his inability to modulate his voice from its single setting of hysterical shouting, can become wearing. LeBlanc was the opposite end of the spectrum, being a bit soporific and wooden. But it's very early days, so give him time! I suppose as a fallback position, he could always slip into character and become Joey again! So there is life after Clarkson.

Looking at Brexit, I've heard from several businesspeople that the vote is stalling certain projects. In particular IPOs. The CEO of Porta Communications (LON:PTCM) noted in a recent video that his firms have 11 IPOs in the pipeline, all of which have been put on ice until the Brexit vote is done & dusted.

So this could be quite a nice opportunity to pick up some bargain shares, for companies which may be experiencing low activity now, but should catch up after the vote. The key thing is that business is simply being deferred, not cancelled.

As regards IPOs, the City seems to have finally woken up to the fact that investors want good quality companies to be floated, not more junk. Certainly the handful of IPOs that I've looked at so far this year have looked quite interesting companies, although pricey.

I prefer to wait for them to warn on profits, and investor sentiment get crushed, which happens in a lot of cases. You can then pick up the occasional bargain - e.g. Boohoo.Com (LON:BOO) has been fantastic for me in the last year and a bit. To my mind, it's all about spotting great companies, then just waiting for Mr Market to present me with a buying opportunity at the right price.

The latest potential fallen angel is, I think possibly, Hostelworld (LON:HSW) . So I bought an opening-sized position in that last week, but certainly won't be going in heavily, as growth potential looks rather limited, unlike BOO.

I note that the betting odds have moved slightly away from the Remain side, but it's still heavily in the lead. Personally, I've placed a fairly large bet on a Leave outcome from the poll. This is partly to hedge my portfolio (as a leave vote would undoubtedly cause major disruption and uncertainty, in the short term anyway), and partly also because I very much want the UK to exit the EU - it's all about sovereignty for me, not economics. Let's not get into the politics of it here though.

Whatever the polls say, my view is that Out voters are very highly motivated, hence more likely to turn up and actually vote on the day. On the other hand, there could be a silent majority, who turn up on the day to protect their perceived personal interests (of staying in the EU).

There's also a suggestion that many people who are polled in opinion surveys are not even registered to vote. So I wouldn't be surprised if there's a big upset on the day - we've seen in recent years how inaccurate polling has become, it makes you wonder why they even bother?

Renold (LON:RNO)

Share price: 41p (up 1.2% today)

No. shares: 223.1m

Market cap: £91.5m

(At the time of writing, I hold a long position in this share)

Results y/e 31 Mar 2016 - I bought some of these after the profit warning in Feb 2016, as it passed my tests of it being financially stable, and facing problems which looked fixable. Plus of course the valuation had become attractive. So far so good, as the shares are up about 30% since then.

I'll quickly re-read my notes from Feb 2016, to refresh my memory, which can be found here.

Unusually, the company announced here in Apr 2016 that the year had not been quite so bad after all, and results would be ahead of revised expectations. It's not often you see that! Clearly management are conservative, obviously a good thing.

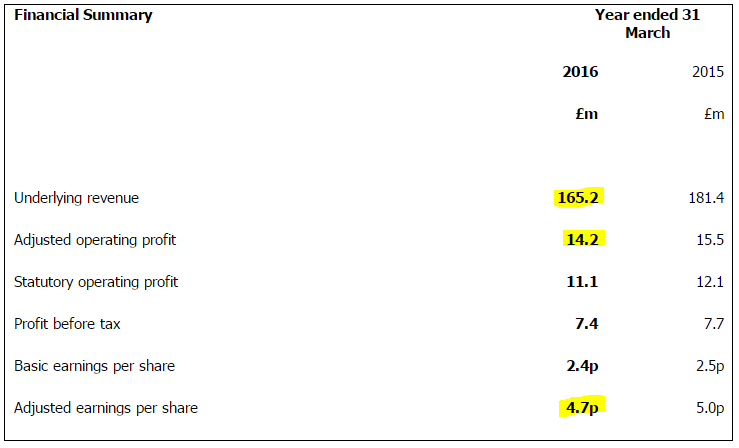

As the company has previously said, it's successfully cut costs to defend margins. Therefore the significant drop in turnover has had remarkably little impact on the bottom line. I'm impressed.

Taking the adjusted EPS figure of 4.7p, and dividing it into the share price of 41p, gives a PER of 8.7 - looks good value at first glance, for a business with a decent operating profit margin. The adjusted EPS figure of 4.7p looks to be ahead of broker consensus, which is shown as 4.51p on Stockopedia.

As there is a large difference between adjusted, and statutory EPS, I'll make a point of checking that I'm happy with the adjustments. The company provides a table, showing all the adjustments. They're a bit dubious in my view. There are some restructuring costs, but this can potentially hide a multitude of sins. Although I've not seen anything here to suggest anything untoward.

The other key adjustments are to strip out £2.7m of pension-fund related costs.

So just to be clear, the adjusted profit figures ignore the pension fund related costs, which are material. Therefore if we value the business on that basis, then it's essential we adjust the PER right down to a low figure. The danger is that investors use adjusted EPS, and then ignore the pension deficit altogether. You would then be significantly over-valuing the shares.

Directorspeak - the CEO sounds cautiously optimistic, which I will take seriously because the company has a track record of being realistic, or even too cautious, in its recent shareholder communications:

Looking ahead, we are hopeful that market headwinds will moderate around the end of the first half of the new financial year [PS: i.e. Sep 2016]. All three phases of STEP 2020 are now in progress. We are confident that the steps we are taking to improve our business will generate significant shareholder value, particularly when market conditions improve.

Also, this sentence jumped out at me, as sounding very encouraging:

...The business will continue to identify and deliver on the wealth of internal efficiencies and growth initiatives available to us...

The outlook section concludes:

Our ability to draw on our self-help initiatives gives confidence that we remain well placed to deliver sustainable gains in shareholder value. As a result of the recent improvements in operating margins, supported by our long term re-financing of the business to 2020, we retain the resources and operating flexibility to maintain our expanded capital investment programme and fund initiatives that will ultimately enable the business to grow when market conditions improve.

Dividends - there won't be a divi this year, due to heavy capex on modernising plants. Personally, I'm fine with that. The alternative, of receiving a divi, but the company soldiering on with old equipment (and consequently lower profit margins) clearly wouldn't make sense.

Debt - net debt was £23.5m at 31 Mar 2016. The group is well within its banking covenants. The main covenant, as is usual, is Net Debt : EBITDA, not to exceed 2.5 times. Measured at 31 Mar 2016, the actual figure was 1.1 times, so plenty of headroom there.

It's important to consider volatility of profits when thinking about bank covenants. In this case, I'm encouraged that the group has demonstrated it can preserve profitability even when there's a sharp downturn in revenue. This adds to my feeling that the bank debt here, whilst undesirable, is not a problem.

Pension deficit - this is a big issue, and definitely needs to be considered when valuing the company - i.e. the PER should be low, to adjust for this issue.

The group seems to be actively managing & de-risking pension liabilities, which is good.

Acquisitions - the group says it's not currently pursuing any acquisitions. However, its strategy is to be opportunistic when potential acquisitions crop up. It seems to have struck an excellent value deal with a smallish bolt-on acquisition (of Aventics Tooth Chain). So more such deals may happen, and the bank facility has a £20m accordion facility for this purpose.

Again, a good strategy. I've not met them yet, but am very impressed with the clear, and sensible strategy of this management team.

Balance sheet - the middle section of the balance sheet (i.e. working capital) looks fine. The current ratio is very healthy, at 1.95. So the group is not under any working capital strain at all.

However, it's important to note that it has very heavy long term liabilities, of £124.1m, which is mostly the pension deficit (£82.9m but this can be partially reduced by deferred tax asset of £17.0m, netting out at £65.9m).

The other big item in long term liabilities is £35.6m in gross bank debt.

As regards investors, this introduces risk, but it looks manageable to me. The other key point is that the pension funds are effectively sucking in money that could otherwise have been paid out in divis. So there are no divis showing on the StockReport (which covers 2010-2016). Brokers are forecasting a small dividend starting this year.

If you want to go further back, you can find "Dividend Summary" under the "Accounts" tab on the company's StockReport here. This shows that the last time Renold paid a divi was 2005! This is one of the problems with weak balance sheets.

So normally I would reject Renold shares, as it fails my balance sheet testing (NTAV is negative, and there's a large pension deficit). However, rules are made to be broken, and in this case I think the business is so robust and cash generative, that I can live with the balance sheet weakness.

My opinion - this looks a very convincing turnaround to me. Management are clearly doing lots of things to improve profitability, and have coped well with a downturn in business. They seem to see the downturn as temporary, so if they're right we could see profits zoom up nicely when revenue starts to rise, and operational gearing really kicks in.

On the downside, it has a big problem on the balance sheet, from pension fund deficits. In all other respects, the balance sheet looks fine. Bank debt is under control and at a reasonable level.

Pension deficits are good in one respect, in that they won't usually threaten the existence of the group. Whereas excessive bank debt can do. So I see the pension deficit as a long-term drag on cashflow, and hence I'll adjust the value of the company down by about a third in this case. I would have been happy with a PER of about 13-14. So adjusting that down by a third, I arrive at a target PER of about 9. That's very close to the actual PER of 8.7, so I reckon this share is probably priced about right for where things are now.

However, the market looks forwards into the future. In this case therefore, it depends how you view the future. Overall, I'm moderately optimistic. The world tends to muddle through, and has got through numerous patches of economic upheaval in the past.

Management at Renold seem to be doing all the right things to improve profitability, so I see good upside thrown in for free here. That makes it an attractive share, so I'll continue to hold. Although with demand still somewhat wobbly, I think shareholders will have to be mentally prepared for maybe one more profit warning later this year, if demand does not recover.

Although broker forecasts look modest, and don't seem to factor in a recovery. Indeed, N+1 Singer say today that their forecasts assume no recovery in the current financial year (ending 3/2017). So the bar is set quite low, which I like - as it means better performance feeds through into a higher share price.

Overall then, it gets a cautious thumbs up from me, and I'm happy to continue holding this share - albeit a smallish sized position, to take into account the higher risk from the weak balance sheet.

Kainos (LON:KNOS)

Share price: 190.5p (down 3.3% today)

No. shares: 118.0m

Market cap: £224.8m

Results, y/e 31 Mar 2016 - a reader has flagged this company's results today, so thought I'd take a look. It's a software group, which floated on the main market in Jul 2015. As I've not looked at this company before, this section is just my initial impressions. It takes time to build up a view on a company, based on its track record. My main worry with new listings, is that quite often they're dressed up for sale - with figures being massaged to present the best possible view. Also, there can quite often be hidden problems, hence why existing shareholders look to cash in their chips (e.g. DX (Group) (LON:DX.) which springs to mind).

It's essential to read the Admission Document, which I don't have time to do now, so will read that later. Here are my initial impressions from today's results:

Bull points

- Revenue up 26% to £76.6m

- High profit margin - adj. PBT up 19% to £14.1m

- Clean accounts - profits and cashflow look real to me - I don't see any of the usual "funnies" in these accounts

- Strong balance sheet, with net cash of £15.0m

- No capitalising of R&D! Excellent stuff - this is the most prudent way to do things, and meets with my approval. £2.3m of R&D spend was expensed straight through the P&L.

- Strong contract wins & impressive-sounding clients.

- Opportunity to win NHS contracts.

- Dividend-paying - final divi of 4.2p proposed.

Bear points

- Only £1.7m of revenues are SaaS-based. So profit is vulnerable to one-off licence fees.

- Evolve division is seeking to transition to a SaaS-based model, so a "period of transition" - that is code for lower profits!

- UK Government digitisation projects sound highly significant. However, are these one-offs?

- Workday software is third party-owned. So could they change the fee structure to give Kainos less profit? Potential risk.

Valuation - adjusted diluted EPS is 10.5p. So at 190.5p the PER is 18.1. Given that the company has a strong balance sheet too, then that's not outrageously expensive. It does however require a continuation of profit growth.

My main question therefore is the most important question when looking at any company which you're valuing primarily on a PER basis: Are profits sustainable?

Summary & Outlook - this all sounds encouraging:

The directors believe that the Group is well placed to deliver growth in the coming years. The Group's Digital Services division has established a trusted reputation in central and regional government, and continues to benefit from the UK government's policy of wholesale digitisation of public services. For the first time, this policy extends into the NHS, where the Kainos Evolve solution is a market leader, so the Group is uniquely placed to reap the benefits of its strong credentials in both healthcare and central government sectors.

The WorkSmart division has established itself as one of the leading boutique implementation services providers in Europe, and is in a commanding position with Smart, the only automated testing product for Workday globally. The SaaS version of Evolve, the Evolve Integrated Care platform, has also achieved early success, winning a flagship deal in the US. A gradual increase in recurring revenue is expected in the coming years as customers transition to SaaS offerings.

In summary, the Group sees continued stability and improvement in core markets and is encouraged by the emerging opportunities in the US and by the strengthening sales pipeline across all divisions. Going forward, it will remain focused on providing exceptional careers for staff and exceptional digital products and services for customers.

My opinion - I don't know enough about the company to make a judgement on whether its profits are sustainable. Being a recent IPO though, there has to be a big question mark over that. Its Prospectus from IPO in Jul 2015 is here. I've got to have a quick look at it now, curiosity has got the better of me!

A few quick points:

IPO price was 139p, so shares have done well - up 37% since then.

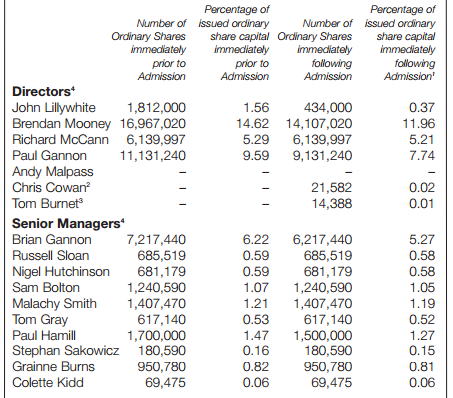

It's good to see that Directors & senior management generally held most of their shares in the IPO, and hold a decent overall total (so interests well aligned with outside shareholders):

Note that the IPO did not raise any fresh cash for the company. It was done as an exit & partial exit for existing major shareholders & some Directors:

Note that QUBIS is the University of Belfast. So probably less likelihood of them trying to stuff outside investors, compared with usual Private Equity sellers! This probably explains why the accounts are clean. I rather like University spin-outs - the people are usually honest.

The growth from 2013 to 2015 is remarkable, and entirely organic. If that's sustainable, then this could be a very interesting share.

The risks & uncertainties sections of prospectuses are always very important to scrutinise carefully. This section confirms my worries about the sustainability of profits:

Within the UK there are a finite number of Acute English NHS Trusts that will have a requirement for the adoption and implementation of an EDRM solution such as Evolve. Therefore, whilst the adoption of Evolve by Acute English NHS Trusts is an investment of a long-term nature, the ability of the Group to generate significant new revenue streams from this ‘platform’ will require the Group to identify and develop other related or complementary products and services that can be sold to users of Evolve during the life cycle of the product.

Any failure by the Group to identify and/or develop sufficient related or complementary products to Evolve could impact the ability of the Group to generate significant revenue streams in relation to Evolve in the future from the Acute English NHS Trusts that utilise it.

Kainos has been a Workday implementation partner since 2011 and through that partnership Kainos is able to provide implementation services to Workday’s clients. If Workday were to terminate its implementation partner agreement with Kainos, Kainos would be unable to deliver Workday Implementation Services, which could have a material adverse impact on the Group’s business. Termination of this agreement would restrict the software Kainos could build and the service that Kainos could provide its clients and thus could have a material adverse effect on the Group’s reputation, business, prospects, results of operation and financial condition.

Also, note the unusually heavy reliance on 10 key customers:

The business of the Group is dependent on certain key customers (the Group’s ten largest customers for the financial year ended 31 March 2015 accounted for approximately 62 per cent. of revenue) who may seek lower prices or may reduce their demand for the products or services of the Group. If the Group’s commercial relationship with any of its key customers terminates for any reason, or if one of its key customers significantly reduces its business with the Group and the Group is unable to enter into similar relationships with other customers on a timely basis, or at all, the Group’s business, its results of operations and/or its financial condition could be materially adversely affected.

My revised opinion (after reading prospectus) - this company's track record of organic growth in both turnover & profit is absolutely remarkable. So there must be something very good here - being a software business, that means some seriously smart people, who have developed (and/or reselling) excellent products.

However, I'm just worried that quite a lot of their business seems to be one-off projects, selling into the public sector. Once a customer has bought software though, they're "captive" - and there can be lots of opportunities to milk the customer for add-ons, fixes, customisation, etc. I've been on the receiving end of that before, and it's a very painful experience. So supplying mission-critical software can be very lucrative, even after the initial licence fee is received.

Overall though, I need more time to weigh up the various factors. Also, it would be good to find some third party evidence from buyers/users of their software, to see if the clients rate the company as highly as the company suggests!

This certainly seems like a company that's on a roll, and is worth researching in more detail I think.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.