Good morning!

It's quiet for company news today, so I'll look into T.Clarke in a bit more detail, as it's a company that interests me. But first, a few other snippets.

Armour (LON:AMR)

Share price: 3.5p (down 26% today)

No. shares: 97.1m

Market cap: £3.4m

Suspension - shares in this tiny cash shell will be suspended tomorrow morning, because it has fallen foul of the rule that cash shells must invest in something within 12 months;

Unfortunately, in accordance with Rule 15 of the AIM Rules for Companies ("AIM Rules"), the Company's shares will be suspended from trading on AIM from 7.30 a.m. on 5 August 2015 as the Company has not been able to complete an acquisition which constitutes a reverse takeover under the AIM Rules, or otherwise implement its investing policy within the twelve months permitted.

This reminds me of a meeting I had about 8 years ago with the CEO of an acquisitive AIM-listed group. Well, I say meeting, it was more that he was in the area, and dropped in for a coffee at my place, and we had a chat about various bits & pieces.

One issue that we discussed was some cash shell which was being suspended because it had failed to find anything to invest in. The CEO was incredulous at this, and he quipped, "Why didn't they just buy a local hair salon, or a newsagent, anything!" in order to remain Listed?

Clearly such a small acquisition would not constitute a reverse takeover, but it could be described as the first in a series of investments, and thereby perhaps keep the shares listed?

What is also surprising, is that there seems to be a stampede for the exit today, the last day of trading for AMR shares before suspension, despite the 12-month rule being widely known. So how come AMR shareholders didn't see this coming, and sell their shares before today's announcement?

The company confirms that it had £3.7m in cash at the interim period end. Seeing as that was 28 Feb 2015, I cannot see the relevance of quoting today what its cash position was over five months ago. Surely it would have been more relevant to tell shareholders & other interested parties what the cash position is today?!

So, if anyone has a small company that you want to list, this cash shell might fit the bill, as it looks like they might be fairly desperate to do a deal by now perhaps? Looking at the major shareholders, Hawk Investment Holdings has 47.4%, and seems to be linked to Bob Morton (the Chairman), so he would seem to be the person to run any ideas past for potential deals.

I suggest something to do with social media be reversed into it. That's what they did with Audioboom, and the subsequent hype triggered something like a 15-fold rise in share price (two thirds of which has since dissipated, as you would expect).

NWF (LON:NWF)

Share price: 158.6p (up 1% today)

No. shares: 48.4m

Market cap: £76.8m

Results y/e 31 May 2015 - it looks as if this company had an improved H2, as when I reported on its H1 figures, profit was down against last year. Yet today it reports underlying operating profit is up 1.2% to £8.6m. That is on turnover of £492.3m (down 8.4%). Note the very small profit margin (only 1.7%), so a low quality business.

EDIT - note that, whilst the business is indeed low margin, this is exaggerated by the presence of a fair bit of "pass through" revenues, e.g. in fuels where NWF takes a small turn on each litre of fuel that it distributes, but the full sales value passes through the P&L.

Headline basic EPS is up 6.5% to 13.2p, so that puts the shares on a PER of 12.0.

Net debt - has fallen significantly, down nearly 50% to £5.9m, and note that the company has heaps of headroom on its £65m banking facilities, and hints at acquisitions or expansion;

Renewed £65.0 million banking facilities provide significant headroom for investment in growth initiatives

Perhaps that could be a catalyst for the shares to rise in future, if a good acquisition is arranged? It would be good to see the company increasing its operating margin, by expanding into more lucrative activities.

Outlook - sounds fine;

Progress to date in the current financial year has been in line with the Board's expectations and the Board remains confident about the Group's future prospects.

Dividends - the pattern of payments over several years has been for a fixed 1p interim divi, and then a rising final divi - this time the final is 4.4p, giving 5.4p for the full year. That's a yield of 3.4% - worth having.

Pension deficit - watch out for this - whilst not a huge scheme, there's a wide gap between the scheme assets, and its liabilities, so this will be a bit of a drag on cashflow;

The gross liability of the Group's defined benefit pension scheme increased by £2.9 million to £20.2 million (31 May 2014: £17.3 million), primarily due to the decrease in the assumed discount rate from 4.4% to 3.7% in order to reflect the changes to the bond market yields at 31 May 2015. The value of pension scheme assets increased by 11.2% to £34.7 million (31 May 2014: £31.2 million). The value of the scheme liabilities increased by 13.0% to £54.9 million (31 May 2014: £48.6 million) primarily as a result of the assumed 0.7% decrease, to 3.7%, of the discount rate used to calculate the present value of the future obligations.

So a pre-tax pension deficit of £20.2m.

Balance sheet - overall it's OK, but not especially strong. However, it's worth checking to see what freehold property might be within fixed assets, as this type of business often has substantial (and valuable!) land assets in at cost on the balance sheet.

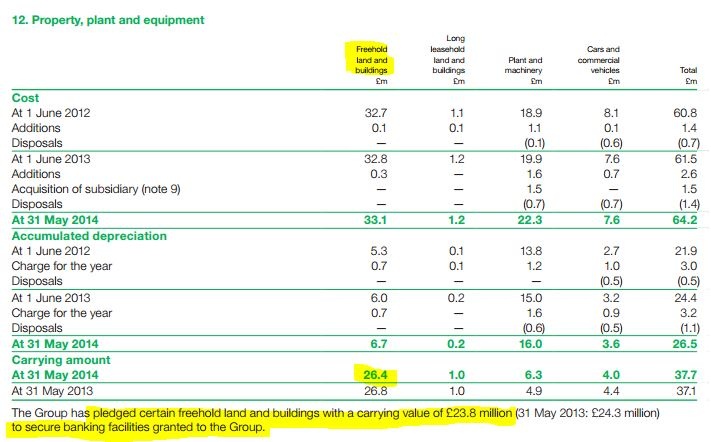

EDIT - I have since ascertained that the company's main operating site is in Wardle, near Crewe, and is c.50 acres of freehold land. Note 12 to the 2014 Annual Report shows freehold land & buildings in at depreciated cost, with NBV of £26.4m, so it would be interesting to know how historic cost compares with market value.

The freehold is pledged as security for the bank loans, and helps explain why the bank are happy with such a large £65m facility.

My opinion - I can't see anything to get excited about here. Growth has been pedestrian in recent years, and the very low operating profit margin puts me off. I like businesses with pricing power, which do something unique, not businesses which work very hard shifting loads of stuff, but only end up with a tiny profit margin, like this one.

That said the Stockopedia computers love it, with a StockRank of 98, so who knows?!

T Clarke (LON:CTO)

Share price: 77p (down 1.8% today)

No. shares: 41.8m

Market cap: £32.2m

(at the time of writing, I hold a long position in this share)

Interim results to 30 Jun 2015 - this is a low margin electrical contractor, mostly for large & complex projects, such as fitting out office blocks. What is interesting about this share, is that the company has an established policy of maintaining staffing & skills during recessions, doing low margin work at or just above breakeven overall, so that it can then be in a position of strength to benefit from higher margin work in more buoyant economic times. That's the theory anyway.

Today's results are a bit disappointing in my view. Underlying operating profit rose from £1.1m to £1.4m, on turnover up 2% to £112m. So that's only a 1.3% margin, still very low - I had hoped to see a more convincing rise in profit margin in these numbers. Although, looking back to the last trading update on 8 May 2015, the company said;

Trading for the year to date is in line with the Board's expectations. The first quarter is typically our slowest quarter and we maintain that it will be the latter part of the year before we begin to see meaningful margin improvement in our most competitive markets.

So today's results are consistent with this update in May. Hopefully we should see some improvement in operating margin in H2.

Order book - this is up 16% against last year, at £320m, and the comments today suggest that improved margins are in the pipeline;

2015 will see the remainder of those contracts that were secured during the recession work their way through to completion. This provides confidence in the Group's results for future years which is supported by the pipeline of new contracts which we have secured over the past twelve months.

Demand for our services continues to be strong, and the strength of the order book reinforces the Board's belief that our reputation, experience and level of resources will drive opportunities for TClarke; we continue to see our clients taking advantage by "locking in" our directly employed skilled operatives and engineering teams at a far earlier stage of the procurement process. The signs of improvement in our London markets continue to be seen and we expect to see further opportunities for margin growth next year and beyond in our wider markets across all our UK locations.

Balance sheet - this is rather weak. Net tangible assets are negative, but not disastrously so, at -£3.9m.

Net debt - this seems under control, and is relatively modest given the size of the business;

Our net debt as at 30th June 2015 was £8.7m (30th June 2014: £4.3m) as the Group invested in its engineering resources to ensure the delivery of the enhanced order book. In total we had £13m facilities available which have been renewed and increased by a further £3m. The net debt position is expected to improve during the second half of the year as the larger schemes in London come on stream.

It's good to see the bank renewing & extending facilities, as this suggests they are increasingly comfortable. The company sailed rather too close to the wind for comfort in the autumn of 2014 (see chart below), when it looked financially distressed. I feel that the improving order book & prospect of higher margin work kicking in, is a favourable backdrop, so there shouldn't be any worries about the banking position.

Cashflow - was negative in H1, but this isn't a worry to me. I only fret about companies which have consistently negative cashflow over two years or more. In this case, the cash outflow seems to me consistent with the vagaries of contract work, and the company specifically says it expects the H1 negative cashflow to reverse in H2, which is a satisfactory explanation to my mind;

The first half of the year saw a significant cash outflow, due to a number of projects let during the recession at highly competitive margins now nearing completion together with investment in our overhead to enhance our capabilities as the order book continues to strengthen. We expect cash flow to improve during the second half of the year as final accounts are closed out, retention payments released and on site activities commence on the larger London schemes that we have recently secured.

My opinion - I'm a little disappointed with the H1 results, but the excitement (of improving margins) should kick in in H2. Therefore I'm prepared to hold for another six months, and see where the company has got to then.

Although I do feel that progress has been somewhat slower than I expected, given that the commercial building sector is fairly buoyant right now.

Zotefoams (LON:ZTF)

Interim results to 30 Jun 2015 - I've had a very quick skim of these results, and they're OK, unremarkable really - adjusted profit before tax is up 6% to £3.2m, although it looks like they've been really whacked by exchange rate movements, as in constant currency the same profit measure would have been up 19%. So a reminder that exchange rate movements are still causing havoc for some companies.

Outlook comments sound good, including this key bit;

We enter the second half of the year with a strong order book and high levels of activity in all business segments. Zotefoams continues to maintain a consistent strategy and approach while being mindful of economic uncertainty and the impact of foreign exchange in particular. We therefore remain confident in the long-term prospects for the business.

My opinion - I like this company, but with the forward PER now at 22 (at 297p per share), it looks very richly rated. So people holding the shares need to be very confident that the business can grow profits considerably to justify such a rating.

I don't think the balance of risk:reward is attractive at a PER of 22, although in fairness I've not researched in any great depth about the company's products or markets. There is some excitement here about new product ranges, I believe. The company has warned on profits before, so why pay top whack, when you could wake up one morning and find that you've been hit with a 30% loss on a disappointing trading update? That would be the time to buy, to my mind, not when the shares are riding high.

All done for today. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CTO, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions, and are never financial advice or recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.