Good morning, and Happy New Year!

The FTSE100 Futures market looked healthy last night when I went to bed, so it was rather a surprise to see it heavily down this morning, pre-market opening. That means something bad has happened overseas, and sure enough it has - the Chinese market has lurched down heavily again overnight. So we enter 2016 with a 2% fall on the FTSE100 at the time of writing, mid-rnorning, not a great start!

Having pondered things over the long weekend, I feel that many investors have perhaps become complacent, particularly with highly rated growth stocks. Many growth companies had a superb year in 2015 - rises of 40%+ were quite common. However, the ratings are now, in many cases, very expensive. So if you look at things fresh today, would you buy that stock at the current rating? I wouldn't, in many cases, unless the company is absolutely trading its socks off, and likely to significantly beat market forecasts.

So I can't help feeling that it might be a good time to take some money off the table, in shares that have had a very strong run in 2015. It depends on your attitude towards short term losses though. Most investor/traders are terrified by the idea of say a 20-30% loss. Whereas what I have observed, is that investors who ride out such fluctuations, and hold the right stocks for the long term, win the really big prizes.

So as ever, "when to sell?" remains the most difficult question in investing. There's no simple answer unfortunately, each investment is unique. Personally I just try to weigh up risk:reward in each situation. If the price looks full, with limited upside, then I'll take some (or all) money off the table - you can always buy them back on any dips. However, if it's a high conviction, long-term investment, then I'll just hold permanently, and ride out the short term fluctuations.

Sometimes it works, sometimes it doesn't. My win:loss ratio in 2015 was 60:40, which gave a very good overall result. Although I can't help feeling that with more discipline, and fewer impulsive purchases, I could improve that ratio significantly. That's my aim for 2016 and beyond anyway.

It's fairly easy to create a successful strategy. Actually implementing it in a disciplined & consistent way is the difficult bit. Most of us break our own rules constantly, which is usually a drag on performance.

Audiocasts

I've been busy over the long weekend, with 2 new transcripts of my CEO interviews published (for people who prefer to read, rather than audio), on Zytronic here, and Brady here.

Also, just published is my recorded chat last night with renowned small caps investor David Stredder. He achieved +41% in 2015, on his Top 15 picks, as published by him at the start of the year (so verifiable) - a remarkable achievement, coming after many former years of brilliant investing. If you don't follow David, you really should (Twitter: @Carmensfella) - his track record is astonishingly good. His focus is on finding good management, above all else, combined with a promising business opportunity. So he extensively meets, and talks to management, which combined with his entrepreneurial flair, means he just has a nose for finding overlooked bargains, and then flagging them up to the wider investing community.

I'm hoping to record a lot more audiocasts this year, when time permits. There are 2 new CEO interviews planned for late next week. I only interview companies that I think are good, or at least interesting in some way, or to give a "right to reply" for companies where I've been highly critical in these reports. It's the same with investors - I only interview people who I know have made millions from the market in an ethical way, because I've seen them do it! That way yours & my time is not wasted with promoted rubbish.

Epwin (LON:EPWN)

Share price: 132.7p (up 0.9% today)

No. shares: 136.2m

Market cap: £180.7m

Acquisition & trading update - looking at the trading update first, it says;

The Board announces that despite challenging market conditions in the RMI markets in the second half of the year, the Company's profits for the year ended 31 December 2015 will be in line with market expectations.

Of course, "In line with market expectations" are the magic words. Although "challenging market conditions" makes me worry that performance could deteriorate in future perhaps?

I would prefer it if companies didn't use abbreviations in statements, as readers may not be familiar with the terminology, especially where we have to cover dozens of different sectors, and hundreds of companies. RMI stands for repair, maintenance, and improvement, but I had to Google it to find out what the i stood for.

Epwin floated in Jul 2014, and surprisingly perhaps, hasn't had a profit warning (yet). Its sister company, Entu (UK) (LON:ENTU) has of course bombed out, on the closure of its solar division, and more general worries about the company.

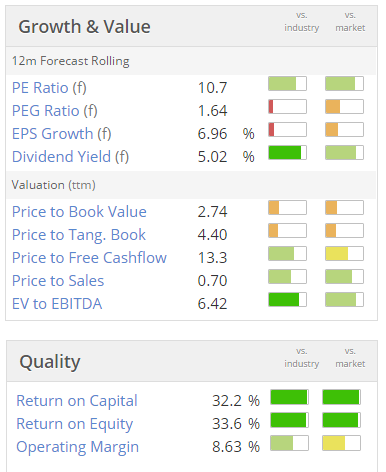

Valuation - given the sector, which should be relatively modestly valued, the figures here look about right to me;

Note the good dividend yield, but there is only a short track record of paying divis, as it's only been listed for 18 months. A big promised yield was (perhaps) used as a way to help get the IPOs away of DX (Group) (LON:DX.) and Entu (UK) (LON:ENTU) , and they have both since flopped, so caution is needed when placing emphasis on a high forecast dividend yield.

Acquisition - Epwin is buying a UK company called StormKing. On the face of it, this looks a sensible deal, priced at 6 times EBITDA, and said to be immediately earnings enhancing. The company makes moulded products for the housebuilding sector, clearly a good place to be right now, due to the pressing need for more affordable housing in the UK.

I like the reason for the sale - the founders are both retiring. That gives comfort that there is no other more worrying reason for the existing owners to cash out. In my view, many acquisitions destroy value for the acquirer - since it's the seller who knows the business best, and if they're prepared to sell, the chances are that the price is a better deal for the seller, rather than the acquirer - who may be chasing EPS growth targets, and over-paying, especially when using cheap debt.

Total initial consideration is £27.0m, of which £20.25m is in cash, the rest in shares. An earn-out of up to £8.0m is potentially payable in Mar 2017. Therefore, it's a fairly decent sized deal, in the context of Epwin's £180.7m market cap.

The cash element has been funded through extended bank facilities, so investors would need to check the balance sheet to ensure that the company is not becoming too highly geared.

The big problem with gearing, is that, especially in an ultra low interest rate environment, companies can drive their earnings growth very strongly using debt to buy up other companies. That's great in the short term, but when the next recession hits, it can leave some such companies in a real pickle - when profits collapse, and often the acquired companies turn out to not be as good as hoped, and the bank starts getting jittery when covenants are in danger of being breached.

The same cycle plays out over & over again, and it's amazing that so few businesses seem to plan ahead for such cyclicality. Optimism seems to trump all in periods of economic growth.

My opinion - I've had a look back to Epwin's last published accounts, and its balance sheet looks fine to me, and is ungeared. So overall I'm happy that funding this acquisition from debt looks fine. It looks a sensible deal, and will increase earnings, so that might well provide a catalyst for the shares to go higher.

The market tends to value shares mainly on a forward earnings multiple, and lots of investors just ignore debt, so there is an opportunity perhaps to make some profit from this?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.