Good morning!

Vislink (LON:VLK)

Share price: 48.6p

No. shares: 122.6m

Market Cap: £59.6m

(at the time of writing I hold a long position in this share)

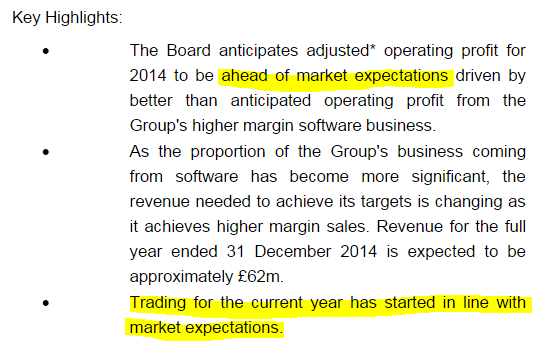

Trading update - good news for shareholders here, as the company reports trading for 2014 ahead of expectations;

The recently acquired "Pebble Beach" software company appears to be driving overall out-performance.

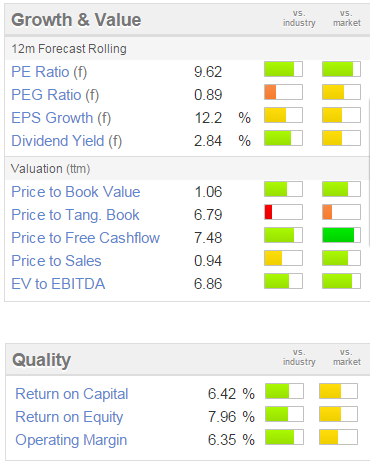

Valuation - Vislink has a high StockRank, of 91, and the PER (based on broker forecasts) looks modest:

My opinion - this is encouraging news today, and more will be revealed with results due on 24 Mar 2015.

Cambridge Cognition Holdings (LON:COG)

(at the time of writing I hold a long position in this share)

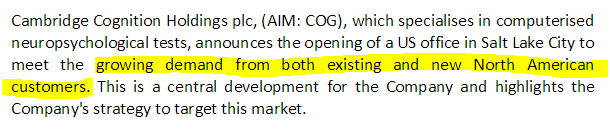

USA office opening - the company today says it is opening an office in the USA, and refers to increasing demand, which sounds promising - see highlighted bit below;

On the other hand though, another office means more overheads & higher cash burn, initially at least.

Coalfield Resources (LON:CRES)

Placing & Open Offer - this is an interesting one. The company owns 25% of a property group, called Harworth Estates, which owns 27,000 acres of development land. A deal has been done to acquire the remaining 75% of Harworth, and change the name of the listed company from Coalfield Resources, to Harworth Group plc.

A Placing has been done at 7.25p per share, and the NAV of the enlarged group will be 9.0p per share.

Anpario (LON:ANP)

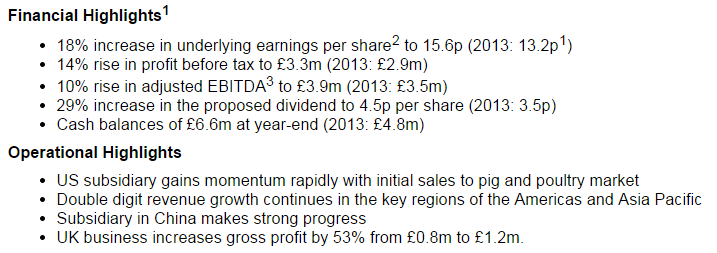

Final results for calendar 2014 look good, here are the highlights from today's announcement;

I note that turnover was only up 2.4%, to it looks as if the profit improvement has come mainly from improved margins, since gross profit was up 7.9%.

The reported EPS figure of 15.6p appears to be well ahead of broker forecast of 13.5p, which seems to have pleased the market, with the shares up 5.5% to 300p this morning.

Balance sheet - is excellent, no problems here at all! The company has surplus cash, reporting cash of £6.6m, and no debt.

My opinion - this looks a nice company. With hindsight, there was a good oppportunity to buy these shares last summer/autumn, but with the price now back up to 300p, being a PER of just under 20, they now look fully priced once again, so it doesn't interest me at this valuation.

Outlook - the Directorspeak today sounds positive;

4imprint (LON:FOUR)

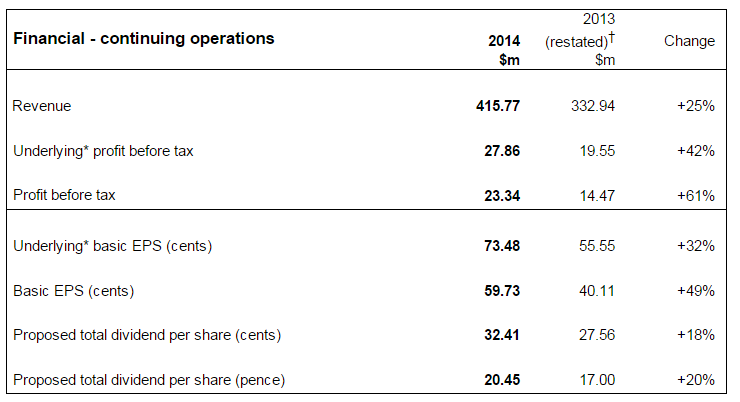

Final results for the 52 weeks ended 27 Dec 2014 are out, and they look great (as always, with this company).

This is one of my favourite companies, and it was a big oversight on my part not to buy any shares in it. It never looked good value, so I didn't buy any. In the meantime, the company's performance has gone from strength to strength, so the lesson learned is that I should have just paid up, when it first came to my attention at c.250p per share. Look what has happened in the last two years.

As the highlights table from today's results show, this company is delivering a barnstorming performance;

I'm hoping to do an audio interview with the CEO at some point in the future, as I've not spoken to the company before, so it would be really interesting to ask them about the secrets of their success. I really enjoy interviewing successful investors on my audioboom channel, and am looking to do some more CEO interviews too, later this year. But only for companies that I like.

Hydrogen (LON:HYDG)

Results are out today, along with news that both the CEO and FD are stepping down. Looks like they've been sacked. The Chairman is taking over. All rather disconcerting.

The outlook sounds wobbly too - due to exposure to the oil & gas sector.

The shares have hit a fresh 12m low today.

Right, gotta dash, another lunch in the City beckons.

Regards, Paul.

(as mentioned above, Paul has long positions in VLK and COG, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.