Good morning!

Next (LON:NXT)

Share price: 5070p (up 1.8% today)

No. shares: 150.1m

Market cap: £7,610.1m

(at the time of writing, I hold a long position in this share)

Q1 trading update - It's clearly not a small cap, I know. The Q1 update this morning seemed a bit soft, but what's interesting is that the share price quickly rebounded from an initial drop. I'll stick my neck out here, and suggest that we might have reached a low after big recent falls. Mind you, I thought that at 5600p too! Market timing is not really my thing.

I've waited a long time to be able to buy Next shares at a reasonable price.

Today's update says that the retail stores are suffering, with sales down 4.7%. However, Next Directory is doing well, with sales up 4.2%. That seems odd, and lends credence to the claims that some of the fall in High Street sales could be weather-related.

I remain of the view that it's just a very competitive market, with lots of online competition, giving people less of a reason to visit the High Street. I don't believe that there is any issue with overall consumer demand - spending habits are just shifting. More money seems to being spent on leisure - e.g. J D Wetherspoon (LON:JDW) reports LFL sales up 3.8% today.

With clothing so cheap now, you do reach a point where the wardrobe is just full to bursting point. Apparently women today have something like 4 times as many clothes as they did a few decades ago.

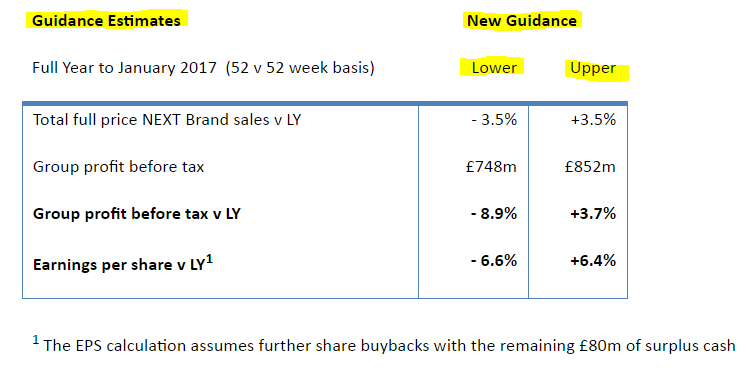

As always, the update from Next is a model of clarity, check this out:

I have highlighted the word "guidance". So to all the companies who tell me, "We can't give guidance to the market" - my reply is, "Yes you can, and you should".

The upper & lower range, which is tweaked as the year progresses, is a wonderful way to manage investor expectations. Everyone should do this.

My opinion - this is a great quality business, making excellent margins. It's vastly better than say Marks and Spencer (LON:MKS) in almost every respect. Yet the price is now very reasonable, a fwd PER of c.11-12. That's a real bargain in my view. As always though, please DYOR.

BHS - Part 2

This is such an interesting, and topical subject, that I felt compelled to do more research on it last night.

In yesterday's report, I commented on my review of the published accounts for BHS back to 2006, saying correctly that it had paid no dividends at all over that period. A reader correctly pointed out that it had paid divis earlier.

So I decided to review all the published accounts for BHS Limited going back to 1999, up to the most recent, to 2014.

My notes are below. Sorry the formatting isn't great. I should have tabulated it, but didn't have time:

This is what BHS Ltd (the main operating co) paid in dividends:

1999-2001 - No divis paid.

y/e 30 Mar 2002

£124m divis paid. Profit before tax this year of £94.9m, so eating into reserves a bit to pay some of the divi.

2003

£70m divis paid, on £101.8m profit. So divis covered by profits made in the year.

2004

£220m in divis paid, which considerably exceeded profit of £101.9m

Balance sheet now looking stretched, but note that the main creditors are now other group companies - group companies are now owed £212m by BHS Ltd. So Green was effectively borrowing money from himself, to pay himself a big divi! Why?

2005

No divis paid. Profits for the year are retained, and group creditor on balance sheet reduces considerably.

2006

Business is now starting to struggle, with a big fall in profits, from £87.5m last year, to £31.0m this year.

No divis paid again.

Pension deficit shown on Bal Sheet for first time, at only £48.8m.

So note that the big dividends paid to date have not come at the expense of funding the pension scheme.

2007

£38.5m profit.

No dividends paid, again.

Bal sheet now looking more healthy, with £184.9m net assets.

Pension deficit has fallen to only £22.5m

2008

Profit of £21.5m

No divis paid again.

Balance sheet strengthened again. NAV now £226.2m

Pension deficit - n/a. Pension scheme now in SURPLUS of £2.2m

2009

Extended 74 week period.

Loss before tax of £65.6m

No divis paid.

Pension scheme goes back into deficit, of £99.3m

Balance sheet now looking stretched - NAV has fallen from £207m to £30m, due to trading losses & big fall in pension scheme.

2010

Loss before tax of £7.2m

Pension deficit rose to £118.1m.

NAV now only £2.5m

NB. See note 6 - management charges from Arcadia Group start - looks v high at £56.8m

2011

Unusual accounts - warrants a closer look.

Dividend INCOME for BHS Ltd of £56m, boosts profits. Where did this come from?

Going concern note - continued support of group holding company is confirmed.

Pre-exceptional operating loss of £43.7m

Large exceptional charge of £88.3m - being mainly a provision against onerous leases on stores which are now loss-making.

Pension deficit has reduced to £79.1m

Note £51.8m management charge from Arcadia Group (note 7)

Net assets just positive, at £330k

2012

Loss before tax of £71.4m, plus exceptional charge of £44.m - giving total loss of £116m

Balance sheet now negative, at -£80.3m net assets

Pension scheme deficit is £73.1m

Arcadia mgt charge £50.9m

Note that BHS Ltd now owes other group companies £147m (within creditors, see note 15)

2013

Loss for the year of £69.6m

Balance sheet now very weak - NAV is negative at -£178.2m

Pension deficit risen to £109.3m

Arcadia group mgt charge - seems odd that it is identical to last year's charge, at £50.901m

(this may be a typo, as it is changed to £42.36m in the following year's accounts, prior year comparative)

Group companies creditor has risen further to £176.2m

2014

£85.1m loss, which includes more provisions of £21.7m

Bal sheet now a car crash, at -£256.3m NAV.

Arcadia group mgt charge of £42.1m

Pension deficit is £101.1m

Group companies creditor is now £184.2m

Key findings from the above:

Dividends paid by BHS Ltd to its parent company totalled £414m, and were paid from 2002-2004 only - a time when the company was strongly profitable. These dividends look fine in the context of the profits being reported at the time.

No dividends were paid out by BHS Ltd after 2004.

The company was profitable, and capable of paying the above dividends, and still had £86.6m in positive NAV after paying out the £414m divis, because at the time it was making a profit of c.£100m p.a.

Pension deficit - was modest pre-financial crisis, so there is no evidence to suggest that the divis paid out by Green in any way affected the pension fund. To suggest so is simply hindsight.

Figures being bandied about of £ 500-600m pension deficit do not correspond with the actual figures in BHS's accounts. The scheme even briefly went into surplus in 2008. This is likely to be because the deficit has worsened considerably due to QE, ultra-low interest rates, and better mortality. None of these could have been anticipated when the big divis were paid from 2002-2004. Also, I expect that the actuarial deficit would be considerably larger than the accounting deficit, as that is usually the case.

The management charges levied by Arcadia Group from 2010 look high. What were they for, and are the figures justified by actual services provided? We don't know. This needs investigating.

BHS Ltd only survived due to financial support from its parent company - which was a large creditor. So Green would have incurred a loss of perhaps £200m+ on disposing of BHS, from having to write off this debt owed by BHS to group companies. In addition to a reported £200m loss on writing off his purchase price. So it looks to me as if he might have broken even overall, if we ignore the Arcadia Group mgt charges. If those management charges were inflated, then there might be a question mark over that.

Taveta Investments Ltd

BHS Limited was 100% owned by an intermediate holding company, called BHS Group Ltd. That in turn was owned by Taveta Investments Ltd, which was the UK topco for Green's main retail operations, including Top Shop/TopMan, Wallis, Miss Selfridge, Evans, and others (the Arcadia Group companies), as well as BHS.

The Arcadia group companies were/are highly profitable, and therefore Taveta group accounts show big dividends paid out, mainly funded by cashflows from Arcadia. The press have conflated divis from BHS Ltd, with divis from Taveta, which of course is nonsense! The big divis paid out by Taveta had zero impact on the BHS, and its pension fund, since BHS was a subsidiary of Taveta.

I've also confirmed my research with someone familiar with the situation.

So what concerns me, is that Green is being wrongly accused of stripping cash out of BHS through divis, when in fact no divis were paid out by BHS Ltd after 2004. The divis that were paid out were reasonable in the context of profits, and perfectly legal.

The pension fund deficit only became a major issue after 2008, due to Govt policy on interest rates. Green's big divis from BHS Ltd pre-date this by 4+ years.

Overall then, I'm very concerned that the reporting in the press has been highly misleading on this issue. Now it may be the case that there are other skeletons in the closet - there often are with companies that go bust. However, based on its published accounts, it is factually wrong to claim that Green stripped cash out of BHS through dividends in a reckless manner. He didn't.

Having said the above, Green is certainly not off the hook. His sale of the business to someone totally unsuitable, for £1, in the knowledge that the inevitable outcome would be it going bust, looks foolhardy. Not illegal of course. Although it reminds me of the deal that the last Labour Govt did to distance itself from Rover Group, which subsequently went bust when in private ownership. So a bit rich for politicians to criticise Green for doing the same thing.

In my eyes, BHS is a failed format, and long overdue for being put down. There will be more jobs created by more vibrant retailers taking over its many prime stores. Therefore this is capitalism in action - brutal though it is - assets being reallocated to more efficient operators, and yesterday's formats like BHS gradually disappearing. We should not mourn this, it's progress.

Another point in the press which has irritated me, is that they say the company (Taveta Investments Ltd) is owned by shadowy offshore companies. What's shadowy about it, when there is a note in Taveta's accounts, saying that the ultimate controlling party is Tina Green? It couldn't be more explicit as to who controls the group!

Taveta Investments Ltd is controlled (87.8% shareholder) by an offshore company called Taveta Ltd.

Incidentally, I didn't know that Green had sold 25% of TopShop. It was sold for £350m, to reduce debt. Thus TopShop was valued at £1.4bn. It's been a fabulously successful business, and that's where most of Green's wealth has come from. Not from BHS.

What I find most alarming about the BHS situation, is that the press are reporting it so inaccurately, and that nobody is challenging them (apart from me now). This is because many people want Green to be guilty of wrongdoing, so are twisting the facts to suit their predetermined narrative. That's very dangerous stuff.

I'm not a particular fan of Green, but the truth is clearly that he supported heavy losses at BHS, for several recent years, until it became obvious that it had no future in its current form.

Avingtrans (LON:AVG)

Share price: 186p (up 13.3% today)

No. shares: 27.7m

Market cap: £51.5m

(at the time of writing, I hold a long position in this share)

Proposed (major) disposal - this is a very interesting announcement. Mgt are basically selling the bulk of the group - its aerospace operations. After fees, and paying off all group debt, it will have net cash of £47m. Some of this is going to be paid out to shareholders (no figures are given on that).

So this means the remaining business is only valued at £4.5m. Yet it has apparently quite exciting growth potential in nuclear decommissioning.

My opinion - this strikes me as a good deal - achieving a full price for disposing of the aerospace division. It also highlights that management seem to be good deal makers. I reckon this share could be heading higher, once people crunch the numbers.

Many thanks to the reader here who nagged me into looking at the figures a couple of months ago. I'm sitting on a nice profit of 43% now, so I owe you lunch! So do get in touch, and we can arrange it, if you have easy access to London or Hove.

Avon Rubber (LON:AVON)

Share price: 815p (up 13.6% today)

No. shares: 31.0m

Market cap: £252.7m

Interim results, 6m to 31 Mar 2016 - it's good to see prompt reporting here - a sign that good financial controls are in place. The market clearly likes the figures, with the shares up 13.6% today.

Although I'm not keen on the presentation of the P&L, which draws unnecessary focus to EBITDA, and also contains significant adjustments.

Tax - note also that the EPS figure is heavily flattered by a favourable tax charge this year, so caution is needed when valuing the company on a multiple of EPS. I would always normalise the tax charge first, to lower EPS.

Outlook - this sounds upbeat, but doesn't say anything about performance versus market expectations, which is the key information that investors need:

The Board remains confident that the Group will continue to make progress as the year develops and maintain our record of strong cash generation.

Trading is normally second-half weighted in our Protection & Defence business and we believe this will again be the case this year. We continue to see a number of higher margin export opportunities and while, as always, the timing of order receipt remains unpredictable, the DOD order we received late in the first half affords us production flexibility to fulfil these as and when they are received.

In Dairy, despite weak market conditions, the acquisition of InterPuls and the encouraging gains in Milkrite market share provide us with significant opportunity at the point milk prices start to improve. This, together with the sales and distribution platforms we have established in China and Brazil to service these rapidly growing emerging markets, means we have a Dairy business with excellent short and longer term growth prospects.

Balance sheet - surprisingly weak actually. NAV is £47.9m, but once intangibles of £45.5m are removed, then NTAV is only £2.4m - not much for the size of business.

The culprits are some debt (a moderate amount, no particular worries with this), and an £18.7m pension deficit.

Overall then, the balance sheet seems OK, considering the level of profits.

My opinion - last time I looked at this company, it was really expensive. However, I hadn't spotted that the share price had fallen so much this year (see 2 year chart below).

Based on existing forecasts, the forward PER will now be about 14, which sounds about right.

The divi yield is low, at only about 1.4%.

The group has a very good track record of growing profits, but I worry that the big gas mask orders may eventually stop, giving a greater potential for a profit warning perhaps?

Overall, I'm not really up to speed on this company, so don't have a particular view either way really.

I have to dash, as am putting on my FD hat this afternoon for a local small business.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.