Good morning!

I'm starting early today, to catch up on the backlog from yesterday.

There's only one trading update (and no results statements at all) in my universe of stocks this morning, a rather pleasing update from BOTB, so let's start with that.

Best of the Best (LON:BOTB)

Share price: 212.5p

No. shares: 10.1m

Market cap: £21.5m

(at the time of writing, I hold a long position in this share)

Trading update - covering H1, the 6 months to 31 Oct 2016. This sounds encouraging;

Best of the Best plc, which runs competitions to win luxury cars online and at retail locations, is pleased to announce that trading for the six months ended 31 October 2016 has been strong with profits before tax generated ahead of management expectations.

Revenues have been in line with management expectations and the proportion of online sales continues to increase.

Operating margins have improved and marketing investment in customer acquisition during the period was slightly lower than originally anticipated.

Ahead of expectations is always good, although it's an important distinction to note that this seems to have been achieved by containing costs, rather than top line out-performance.

Broker expectations have increased this morning. FinnCap has increased its EPS estimate for the current year from 9.1p to 11.3p. With the share price currently at 212.5p (before the market opens - I expect it will rise maybe 10% today, at a guess?) that makes the PER 18.8 times.

Next year's FinnCap forecast has gone up from 10.7p to 12.4p, giving an FY18 PER of 17.1 times. Although FinnCap does indicate that they've been conservative, giving scope for upgrades.

My opinion - this is a long term holding of mine. The reason I bought the shares, is because I see this as a unique business. It's built up a strong reputation from operating at airports for about 15 years. However, business is increasingly moving online. Therefore the PER could shoot up at some point, if the market recognises that there could be much more impressive growth in future from internet sales really taking off.

Imagine what sales could rise to, if a larger gambling company were to acquire BOTB, and put some serious marketing spend behind it? I sometimes wonder if management are being too cautious - they've created something special, but arguably haven't exploited its full potential yet.

Anyway, the advantage of a cautious approach is that it's profitable, very cash generative, and has paid out some smashing divis in recent years.

The game is great fun to play, and I buy tickets nearly every week online.

This share is horribly illiquid, so can be very tricky to trade. So building (or disposing of) a position requires patience, and lots of little trades over a period of time.

Gattaca (LON:GATC)

Share price: 293p

No. shares: 30.9m

Market cap: £90.5m

(at the time of writing, I hold a long position in this share)

Results year-ended 31 July 2016 - this share has been a poor performer this year, slipping backwards from c.500p to under 300p now. Does it represent value at this level? I think it probably does.

Gattaca is the new name for MatchTech and Networkers - brands which are still used, but under the new corporate name. Equity Development ran an excellent webinar yesterday, which I participated in. Management said they had "completely repositioned" the group as a specialist in engineering & technology staffing. About three quarters of revenues come from providing contractors, typically on about a one year contract. The business is also expanding internationally, and they see this rising from about 30% of revenues, to c.50%, over time.

Cost synergies of about £3m have been achieved from combining MatchTech and Networkers, although this has mainly been reinvested in growth.

Profitability - was roughly flat against prior year, on an underlying basis.

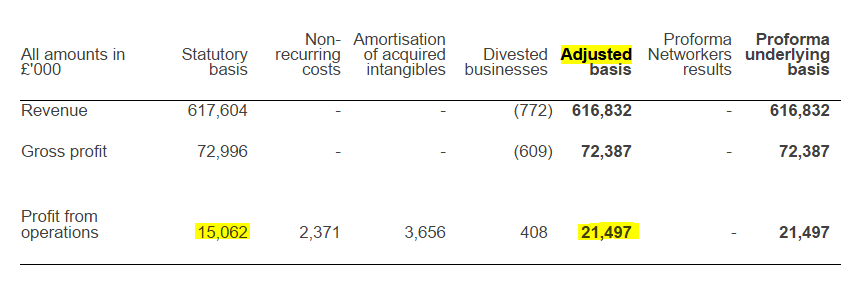

People often say that staffing companies are low margin, but that's because most revenue is "pass through" - i.e. the contractors' salaries. Therefore reported underlying turnover of £616.9m sounds a lot, but Net Fee Income is much lower at £72.4m underlying. This latter figure is what I personally see as the real revenues, excluding pass through salaries.

Underlying operating profit was £21.4m, so actually quite a good profit margin if you compare it with NFI. The prior year comparison number is £21.2m.

In terms of EPS, I think the company has caused some confusion by only highlighting basic EPS, of 31.0p (diluted). Someone asked about this in the webinar yesterday, wondering if the share price fell because the company failed to highlight adjusted EPS, which was 44.3p. That makes quite a big difference to valuation of course - the PER is 9.5 using basic EPS, but drops to only 6.6 if you use the adjusted EPS - a big difference.

Here are the reconciling items to get from statutory, to adjusted profit. I'm happy with these adjustments, so to my mind this stock looks dirt cheap, on a PER of only 6.6 .

Of course, a PER is only cheap if earnings are sustainable. What the stock market is probably doing, is discounting a fall in future profitability. I think this is due to heightened worries about a possible recession in 2017 - not an unreasonable position, since I think the economic outlook is very uncertain at the moment.

Outlook - there are various outlook comments scattered throughout the results narrative. I've collated them below;

Since entering the new financial year we have a seen a slowdown in trading in the UK with Group NFI in 2017 Q1 forecast to be down 3% on 2016 Q1 (Contract down 2%; Permanent down 7%)

We are continuing to Invest in our overseas operations which continue to enjoy growth and which will to some extent mitigate the uncertainty around UK economy in the medium term

Full year effects of Networkers acquisition to come through in FY17, with first concrete sales synergies now being realised

...However, the outcome of the vote continues to make the economic outlook uncertain, yet it is still too early to say what its near-term impact will be for Gattaca. Whilst the amount of business we conduct in Europe is not significant, the same cannot be said for many of our clients and any uncertainty can have a knock-on effect in the investment decisions our clients make.

In the longer term, our strength within the Engineering and Technology sectors transcends international boundaries, and as the trend towards globalisation continues, we are in a good position to respond to any EU exit settlement eventually reached.

The medium term outlook for Gattaca is positive, despite some weakening in demand in the UK. The Board will continue to assess UK trading over the coming months as clearly there is uncertainty over how the EU referendum result will affect UK investment. We are, however, well placed to increase our market share in the UK, while pursing strong international growth through our regional hubs.

The overall tone of the webinar was completely different to the above, I thought. Talking about the business, management sounded far more upbeat than the RNS indicates. So some mixed messages, which probably explains why some shareholders exited yesterday, pushing down the share price.

Obviously the slowdown in Q1, and cautious comments about Brexit, haven't helped sentiment. In the webinar though, management sounded enthusiastic about the potential for improving UK business due to Heathrow expansion, Hinkley Point, and other big infrastructure projects - which will need large numbers of engineers, from the design stage onwards.

Divdends - brokers seemed to be assuming a cut in divis, but the full year divi has actually been increased by 5% to 23p, with management saying this reflects their confidence in the future. Again, that doesn't really tally with the cautious outlook comments above. So I'm confused!

The dividend yield is excellent, at 7.8%. Therefore if you think that's sustainable, this could be an attractive time to buy. The divi cover is quite healthy too, at almost 2 times (using adjusted EPS).

Interestingly, management said on the webinar that they didn't cut the divis in the last recession.

Balance sheet - one of the better ones I've seen, amongst small cap staffing companies.

NAV is £81.6m, then I always delete intangibles, making NTAV £33.2m.

The current ratio is very healthy at 1.84, so a strong working capital position - basically a massive debtor book, partly funded by bank debt.

Note that net debt of £25.0m is down £8.6m on a year earlier, and that Gattaca has tons of headroom within its total £105m of bank facilities - recently extended to Oct 2020.

The £1.1m P&L finance charge is consistent with the reported net debt too.

Note that forex gains boosted profit by £1.0m.

Overall then, I don't have any balance sheet concerns - this is a well-financed company that could weather an economic downturn.

Tax rate - is high, due to overseas operations, and not being able to reclaim some overseas tax. This is a pity, but of course is accounted for within EPS (which is post-tax profits).

My opinion - it's not often you find a sustainable dividend yield that is higher than the PER, but that is the case here. It has a strong balance sheet too.

Therefore I very much like the value characteristics of this share. The trouble is, the market isn't interested in value shares at the moment, it's all about growth. Having said that, I think the valuation here is so compelling, that I'm very likely to increase my existing long position here at some point - probably after the US elections are out of the way, so it's going back onto my buying list.

Intangible assets

A reader sent me a message recently, complaining about my policy of writing off intangible assets. He pointed out that a lot of physical fixed assets don't have much resale value either, so why don't I write off those too?

My thinking is along these lines. Most intangible assets are usually connected with acquisitions - goodwill in one form or another. The trouble with this is that many acquisitions destroy shareholder value, and often the goodwill ends up being written off at a later date. So I take a cautious view of goodwill, and prefer to write it off straight away.

Also, many businesses develop goodwill internally, which never appears on the balance sheet at all. Therefore, acquisitive companies need to have all their goodwill written off, in order to make their accounts comparable with other companies which have grown entirely organically.

Development spending is another problematic area. One can argue that companies are obliged by accounting standards to capitalise development spending. In practice that's not true though - plenty of companies write off everything, and don't have any problems with the auditors.

I've seen so many companies boost their profits by aggressively capitalising development spend, that it can make the accounts so far from commercial reality that they become ridiculous. Examples include YouGov (LON:YOU) - which dramatically over-states its profitability using this method. Also I've long been sceptical of the accounts of Lombard Risk Management (LON:LRM) - due to it capitalising a large chunk of its costs.

This is the method of choice for fraudsters too - Globo used to create fake profit by, amongst other things like falsifying revenues, shoving a lot of costs onto the balance sheet into intangibles.

Investors generally are far too uncritical of company accounts I think. Many market participants don't look at the balance sheet at all, and never question any adjustments to earnings, let alone the underlying accounting policies. This is dangerous, and leaves you wide open to being scammed from inflated profits & hence share prices.

So my approach is to be conservative, and write off the intangibles. That gives me a much clearer picture of a company's underlying financial strength or weakness.

You don't have to agree with me though. That's why I usually give both figures for NAV (including intangible assets) and NTAV (having written off intangibles).

Hilton Food (LON:HFG)

Share price: 596.5p

No. shares: 73.6m

Market cap: £439.0m

Trading update - this is a meat-packing business, which operates internationally. I've not looked at it for 3 years, so please forgive me if this section is brief, and not particularly insightful.

More detail is given, but the key paragraph says it's trading in line with expectations;

In overall terms, the Group continues to trade in line with the Board's expectations.

We have experienced local turnover growth in most of our markets and, as anticipated, we have also continued to benefit from the strength of the various currencies in which the Group trades in relation to sterling.

Balance sheet - I've had a quick look at the last set of accounts. Food producers often seem to gear up, but this company last reported a net cash position. Although it's unusual to see £56.2m in cash, simultaneously with bank borrowings of £34.6m. That seems inefficient, in terms of interest costs.

Overall its balance sheet looks fine to me.

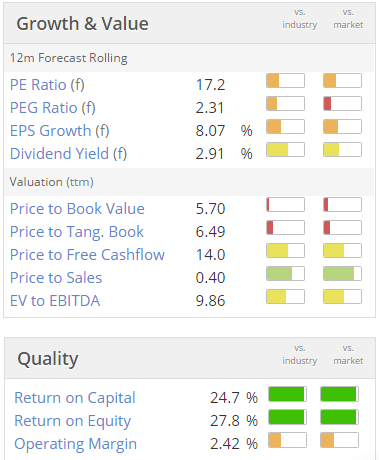

Valuation - this looks priced about right to me - note the very low operating profit margin, but the other quality scores are good - it seems to generate decent profits from not particularly large fixed assets;

The StockRank of 90 is high.

My opinion - I can't see anything to get excited about here, it doesn't float my boat at all.

Although management talk about further expansion, which could drive profits higher.

Dialight (LON:DIA)

Share price: 665p

No. shares: 32.5m

Market cap: £216.1m

Trading update - in line with expectations, and it sounds like they're benefiting from exchange rate movements;

The Group is targeting a modest constant currency revenue performance, with reported revenue to benefit from a positive FX impact.

The Group's trading performance for the full year remains in line with current market consensus.

My opinion - it's had a great recovery this year. Price looks toppy to me now at 670p/share. That's 33 times this year's forecast earnings, and over 20 times next year's. What happens if something else goes wrong? The company has been accident-prone in the past.

Risk:reward doesn't look good to me, at this level.

H & T (LON:HAT)

Share price: 290p

No. shares: 37.0m

Market cap: £107.3m

Trading update - a missed opportunity here. A friend told me I should buy some when they fell to 240p last month, but I dithered too long & missed it. Also, I don't really want to own shares in a pawnbroker.

A very good update came out yesterday, and the share price is now 290p;

H&T Group plc ("H&T" or "the Group"), is pleased to provide a trading update for the financial year ending on 31 December 2016.

The Board expects full year profit before tax to be above the top end of market expectations.

The principal reason for the strong performance is the higher sterling gold price since the EU referendum result. The increased gold price benefits the Group's Pawnbroking Scrap and Gold Purchasing segments.

The Group's development of its lending activities continues, at 31 October 2016 the pledge book had increased to £40.5m (30 June 2016: £39.0m) and the Personal Loans book to £8.2m (30 June 2016: £6.3m).

I'm told that the personal loans product has good growth potential.

I've just checked their website, and as I feared, the personal loan product is extortionate in cost, and therefore brazenly exploiting the poorest in society. I find that completely unacceptable, and hence wouldn't want to buy this share. Yuck!

Quarto Inc (LON:QRT)

Share price: 281p

No. shares: 20.4m

Market cap: £57.3m

Trading update - sounds alright, with the key bits saying;

On the basis of current levels of trading and order book visibility, the Group remains confident that it will meet management expectations for the full year and deliver both debt reduction and earnings growth.

Marcus E. Leaver, Chief Executive of The Quarto Group, commented:

"We have entered the last quarter confident that we will meet management expectations for the full year, reducing debt and delivering growth for a fourth successive year.

We are pleased with the integration of Harvard Common Press and becker&mayer into our publishing portfolio, both of which are performing to expectations and complement the organic growth we are seeing in the core business.

We have a solid model in place: the right people, high-quality and long-lasting product, efficient processes, a balanced portfolio of imprints and a scalable platform."

Overall - I'm warming to this share, but for my personal taste the debt is still too high. You don't have to agree with me on that though. Indeed, the Stockopedia computers are telling me I'm wrong, as this share has a very high StockRank of 98.

Servoca (LON:SVCA) - a small staffing group. It said yesterday that it's trading in line;

The Board is pleased to announce that it expects to report that its results for that period will be in line with market expectations.

This covers the year ended 30 Sep 2016. No outlook comments were given.

According to the 2.22p EPS forecast shown on Stockopedia, that equates to a PER of 10.2.

I'm struggling to understand why a smaller staffing company should be priced a good bit higher than bigger companies like Staffline (LON:STAF) and Gattaca (LON:GATC) (both of which I hold long positions in).

All done for today, and the week!

I'm off into the City now for lunch & meetings, but will see you back here on Monday.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.