Good morning! Firstly, apologies again for being late - I cannot blame it on the sunshine, nor the moonlight, not even the boogie. So it can only be blamed on the good times. Luckily I put those good times to good use, and decided to massively upgrade my charity fundraising target for Sunday's Half Marathon, from five hundred quid to £3,000, and put my own money where my mouth is! We're over half way there, at £1,610 including Gift Aid, so today I beg readers to dig deep and cough up a bit more if you can, for Scope. Our collective wealth must run into not just millions, but hundreds of millions of pounds, so surely £3k is not an unrealistic target for me enduring a painful & unpleasant Sunday morning hobbling at an accelerated pace around London's leafy enclaves?

Anyway, let's crack on and have a look at the morning's trading results. It's a very quiet day, thankfully. Amazingly quiet actually, there's hardly anything of note. Maker of specialist foils and packaging materials, API (LON:API) has issued a trading update. The key bit seems to be this;

The Board's most recent guidance, provided at the time of the AGM on 11 July 2013, remains unchanged overall. Full year results are still expected to show progress over the previous year despite first half trading having been weaker than anticipated and very strong comparables at the interim stage last year.

So a bit vague, in that it doesn't refer to how they are trading relative to expectations (which is what matters!). There really needs to be a standardised required format for trading statements, so that companies are required to state (1) what market expectations are, and (2) how they expect to perform against them. Furthermore, companies should be required to give a likely range of profits - a single number is ridiculous, few companies can be that precise in forecasting, but every company should be able to give a range of likely outcomes for profits. Something for the regulators (although you sometimes wonder if they actually exist, as anything seems to go!) to ponder.

Here is their 2 year chart - you can clearly see the bid premium go into the price, and then come out again, bringing it back to exactly match the trend, the beige line is always the FTSE SMALL CAP INDEX XIT (FTSE:SMXX) benchmark that I tend to use.

Broker consensus is for 9.35p normalised EPS this year (ending 31 Mar 2014), so that puts the shares on a PER of just 7.7 times. That drops to just 6.8 times next year's forecasts. Which is very good value on the face of it. The forecast dividend yield is 2.8% (since a 2p payout is predicted for this year), but caution is needed with that, since the company has not paid dividends historically.

One reason the shares might be cheap is because there was a protracted trade sale attempted, at the instigation of major shareholders, which got nowhere. So that means there is a large overhang of shareholders who want to exit but can't. It also makes you wonder what potential buyers didn't like about the company when they looked over the books? If something is put up for sale, and nobody wants it, then that asset is badly tarnished, for a long time.

The cure for that is paying decent dividends. I'm a huge fan of dividends - it means you get an income whilst you wait for the shares to re-rate, and it also shows that management have got their priorities right, in skimming off some cashflow for the owners of the business.

Tricorn (LON:TCN) has issued a mild profit warning, the key sentence of their trading update today being;

Given prevailing conditions for the UK businesses and our investment in both the USA and China, PBT for the half year is expected to be slightly below management's expectations for the period.

It's a small engineering company, specialising in tube manipulation. I've only looked at it once here, on 3 Dec 2012 when I was struck by how cheap the shares looked, at 16.9p. Unfortunately, I didn't buy any at the time, as the market cap fell below my £10m minimum at the time (I'm prepared to go lower now that we're in a bull market, as the risk of de-Listings has reduced). The shares are more than double that now, at 38p, and look fully priced to me for the time being, so I won't be revisiting it.

People ask me if I'm compromising my standards on quality of companies, and valuation, and the answer is a firm no. If I can't find value, then I just sit in cash, and wait. The market will throw up opportunities, and indeed does so all the time - there are nearly always bargains to be found somewhere, but sometimes it's just a question of being patient. We don't have to be fully invested, and indeed the most successful investors I know are people who aren't scared of sitting on the sidelines in cash if they cannot find acceptable value in shares.

It doesn't matter that cash gives a negligible return - if it prevents you making a (say) 30% capital loss from investing in something over-priced, then holding cash has been a good investment!

There has been a sharp sell-off in the price of Pure Wafer (LON:PUR) in the last few days, and on further investigation it appears that a legal dispute in the USA is worrying investors. This apparently concerns the treatment of waste water from a factory that Pure Wafer has out there, which could threaten the plant with closure.

More clarity is needed here, and I think the company should put out a response, given that it is having a big impact on the share price. I'd be interested in readers views - could this be a buying opportunity perhaps? I'll hang back until the situation becomes a bit clearer.

People sometimes ask me why I don't do short-selling usually, and the answer is that I've found prices can detach from reality for such a long period, and by such a large extent, that you can be correct in your analysis, but still lose your shirt by shorting a share that won't stop going up! Ocado is a good example - a lousy business model that doesn't make any money, yet the price tag is now in the £billions.

Other practical considerations, are that it can be difficult to get a borrow on heavily shorted shares, and indeed the borrowing charge can be so high that you end up losing even if the share price just stays the same. You can also be forced to close the position if the stock lender recalls the stock, so that means you've actually handed control over when the position is closed to someone who is long of the stock! That massively damages risk/reward for the shorter.

It's really all about timing. If you can do the fundamentals well, and get your timing right, then maybe short selling is a good idea, but it's a much more specialised area than just buying value stocks & waiting for them to go up, which is my preferred strategy.

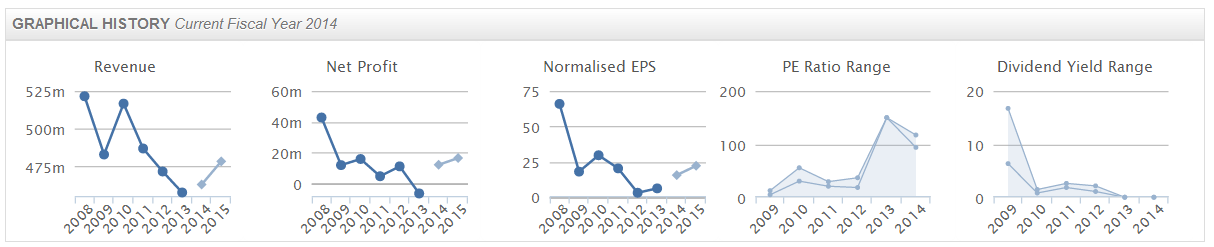

Why am I mentioning this? Well, it's because I am wondering if Carpetright (LON:CPR) might finally be in danger of coming down to a more sensible valuation? It's really a mid cap, but it should be a small cap, hence me mentioning it here. The company's track record is awful, just look at the Stockopedia graphical history below;

So over a period of poor performance over the last five years, the valuation has just got higher & higher! Bonkers. The key sentence in their trading update today sounds pretty grim:

Whilst the self help activities are continuing to deliver, as a result of a combination of a softer UK market and a further step down in the Netherlands, it is likely the Group's full year profit will be significantly below our previous expectations.

Therefore the dotted lines in the charts above (forecasts) will be coming down. I simply cannot understand why the market cap here is anywhere near where it is - around £423m at 620p per share. To my mind that is multiples of what the company is really worth, so I wouldn't be interested above 100p per share.

It will be interesting to see what happens eventually, but I suspect that when it finally breaks, it will collapse to a much lower price.

Interesting to see that Albemarle & Bond Holdings (LON:ABM) shares have rebounded strongly today, up 50% to 39p. I did have a little flutter on these in a small "punting account" that I manage, and have just sold at 39p for a terrific 60% gain in a couple of days. As my broker just quipped, a couple of those every week and you'll be laughing! If only it was that easy.

I had promised myself not to go after any more falling knives, as it's been a loss-making strategy in the past, but when I looked more closely at ABM's Bal Sheet, it became clear that they're probably not going bust. So the Bank are likely to be supportive, which gives them time to do an equity raise.

That's it for today & the week. Sorry for the leisurely timings today & yesterday, but I got there in the end!

Let's hope the same is true for Sunday's run, and thanks again to everyone who has chipped into the Scope fundraising - I'm very grateful, and it's a big moral support & motivator too.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.