Good morning!

Spread bets

I was discussing how to manage the risk of excessive gearing in spread betting accounts last night with some friends on Twitter. This is a subject dear to my heart, as I made terrible mistakes with gearing in 2007-8, with disastrous consequences. So I very much learned my lessons the hard way, which is why I like to warn other people about the dangers of gearing, and indeed manage my own gearing very carefully now.

My talk at Mello Peterborough a little while ago on this subject was well received, and as part of that talk, I created a simple spreadsheet which is very useful in monitoring & controlling the gearing used in spread bet accounts. A friend commented last night that he uses my spreadsheet, and finds it very useful in managing his own spread bet account, so this has prompted me to provide the link again here, in case anyone else would also like to use my spreadsheet. Just save the file yourself under a new name & delete the example data, then put in your own data. If anyone needs any help using it, just let me know.

NB. I am certainly NOT encouraging the use of spread betting - it's very dangerous if the gearing is abused, and the vast majority of punters with spread bet accounts lose most or all of their money. So best to avoid, unless you really know what you're doing. However, with sensible control of the gearing (or don't use any - it's not obligatory!), there's no reason why spread bets cannot be used within a portfolio of small caps, as a tax-free wrapper.

Tern (LON:TERN)

Share price: 13.7p (down 11% today)

No. shares: 45.4m

Market cap: £6.2m

Interim results to 30 Jun 2015 - normally I wouldn't report on something this small, but I noted that the shares in this company recently tripled, from 5p to about 15p, and I've previously done some research on it, so it's worth commenting on.

The company is basically a tiny cash shell, which has invested very small amounts in technology companies. There has been only £707k invested, and it held a further £336k in cash (but mostly offset by £280k of debt), so really tiny stuff. Net assets are £863k, so at £6.2m this is already trading at a large premium to net assets.

So the question to ask is, have their investments really multipled in value about 9-fold, or is it all just hype? We are after all in a market where there seems to be a lot of speculative money sloshing about in micro caps, along with pump & dump type operators on bulletin boards.

The main investment that Tern mention in today's results is called Cryptosoft Ltd - and it certainly ticks all the boxes for a good ramp - it's tech, it's cloud, it's internet of things, I can already hear the bulletin board pumpers saying "this could be huge!"

The trouble is, when I go to Companies House to check the accounts of Cryptosoft Ltd, its last set of accounts (made up to 11 Sep 2014) say that the company is dormant, with net assets of £1,000. Although the share capital is referred to as "not paid", so surely the accounts should actually show a debtor of £1,000 and net assets of nil?

It's definitely the right Cryptosoft too, as the registered office address filed at Companies House ties in with Cryptosoft's impressive-looking website.

Whilst it is possible that a dormant company might have been developed into something of value in less than a year (when did Cryptosoft start trading, given that it was dormant at 11 Sep 2014?), it seems to me that the value being attributed to this start-up investment appears to be wildly ambitious.

The language used in the RNS of 15 Jul 2015 from Tern, called "Product Launch" gives the impression of an established and successful business. Perhaps an existing business was reversed into Cryptosoft? Or perhaps there is an effort being made to represent Cryptosoft as being far more advanced than it actually is? I'm not sure, but based on what I've seen so far, this looks like a share that is being ramped well ahead of reality, so is best avoided in my view.

You have to be so careful with micro caps - people see a share price shooting up, so they rush in to buy without checking out what the company actually is or does, and often they end up over-paying many times what the company is actually worth (usually nothing to very little).

Quindell (LON:QPP)

Share price: 124.75p (Shares currently suspended - being lifted tomorrow morning)

No. shares: 445.0m (excluding Options)

Market cap: £555.1m

2014 results - the announcement has been split into two RNSs, and issued at 11:40 this morning, which has upset my schedule a bit.

I need more time to go through all the numbers properly, as there's a lot of detail, but the key points which have jumped out at me so far from an initial partial read are;

Management hoping to return 100p per share in cash to shareholders (tax-free)

Massive restatement of 2013 and 2014 historic figures - which completely vindicates my consistently bearish stance on this share from Dec 2012 onwards (I warned readers here that the figures looked dodgy in no less than 25 reports! So a note for the future - when I shout about red flags, I'm usually right in the end!)

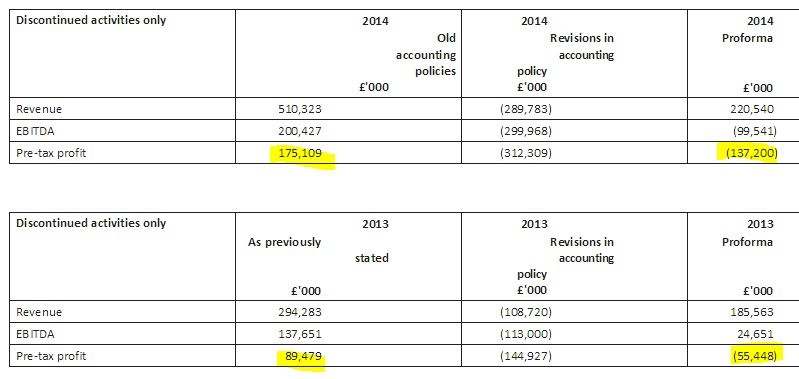

So the amazingly low PER, and the amazing growth, etc? It was all nonsense, as I thought. The company has today published details of staggeringly material revisions of the 2013 & 2014 figures. The table below explains it better than I can;

As you can see, this relates to discontinued operations only, but that was the bulk of the group, and the other bits & pieces not included are also loss-making, I believe.

So Quindell wasn't profitable at all! It was actually making heavy losses, particularly on the industrial deafness stuff. Some might argue that the accounting has swung from one extreme to the other - i.e. ridiculously optimistic & misleading under Rob Terry's stewardship, to ultra conservative now.

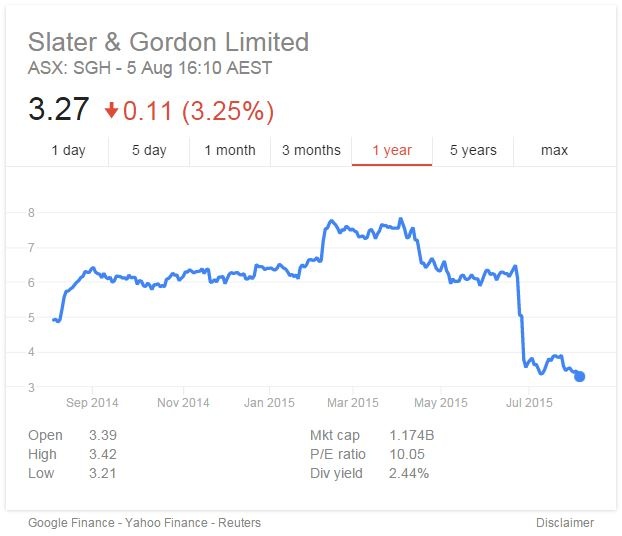

Others might say that none of this matters any more - because the division in question has been sold to Australian legal firm Slater & Gordon, but look what it's done to their share price:

There's no doubt that Quindell's operations had some value, but the huge price paid by S&G, considering Quindell was on the verge of going bust, and that S&G seemed to be the only buyer in town, is inexplicable. The only conclusion I can come to, is that S&G management are not very commercially astute, given that they probably could have bought Quindell's PSD for a fraction of what they actually paid.

Anyway, that doesn't matter to Quindell shareholders, as the money is in the bank, and they hopefully will get their 100p cash return - although there is a risk that legal action against the company by former shareholders could derail that, so it's not in the bag yet.

What a fascinating situation this has been - with investors being amazingly polarised, and a really tangled web of dodgy dealings having been uncovered by Tom Winnifrith in particular, who love him or loath him, did some amazingly detailed investigative work on this company.

From my point of view, there are numerous red flags to watch out for in future, which seemed obvious to me at Quindell - in particular;

- Too many costs being capitalised into intangibles

- Ballooning debtors & work-in-progress - nearly always a can of worms

- Far too many acquisitions, being done too rapidly

- Repeated fundraisings, and little to no dividends

- Amazingly low PER on exponential growth forecasts

- Suddenly switching the focus into new business areas

- Management with a poor track record - the amazing thing with Quindell is that it was almost a carbon copy of Rob Terry's disastrous reign at Innovation (LON:TIG)

- A business model that is too complex to explain - which means it's actually being obscured deliberately because there's something wrong

- Financial engineering of any kind - where you're left scratching your head as to why deals have been done in a particular way

- Rampy-sounding narrative to the results statements, e.g underlining or bolding growth figures & comments

- Gobbledegook management-speak in announcements, all designed to sound impressive, but with very little meaning

- Repeated clarification statements, or unscheduled trading updates when the share price is falling

- Sending solicitor warning letters to outspoken bears/bloggers/journalists, but then failing to take further action when they refuse to back down (this point courtesy of Ben Turney)

The list just goes on & on, these are the things which immediately spring to mind - I might add to this in future. But these are the things to look out for, and it's remarkable how often you see this type of thing crop up at dodgy companies. The shares can remain levitated for a long time, years even, but eventually the whole deception will come crashing down to earth.

As a general point, ultimately it all comes down to management. Are they straightforward and honest, in which case you won't normally get any of the above red flags. OR is there underlying culture of dishonesty in a business? In which case you will probably start to find several of the above red flags (they don't usually appear in isolation). Needless to say, investing in dishonest people usually doesn't end well. I think you can tell how honest management are from their RNSs, but meeting them is useful as well - but only if you're a good judge of character.

In Quindell's case it wasn't a total deception by any means - there were some good bits within Quindell, but what a pity the megalomaniac in charge of it steamed the whole thing at full speed into the iceberg.

Anyway, I'll comment more on this company once I've finished reading & digesting all the news from it today.

UPDATE: I see the Financial Reporting Council (FRC) has put out a statement detailing its own findings. The FRC is the accountancy profession's review body, and has always struck me as being largely irrelevant in terms of overall reporting standards.

Anyway, it details today the various errors (if we can call them that!) in Quindell's accounts, and also notes that it is investigating two member firms. In my view, the auditor of Quindell should certainly be fined heavily, and the partner(s) in question struck off, as they signed off completely bogus accounts.

From one ineffective regulator, to another - AIM Regulation (yes, there is one, amazingly!) have put out a short statement saying they are supportive of the FRC and the FCA's ongoing investigation. That's nice.

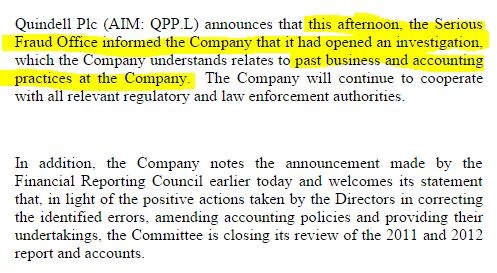

ANOTHER UPDATE: Just as I settled down to look at another company, and with smoke coming out of my ageing inkjet printer, yet another Quindell announcement has come out!

This one will throw in a few more cats to finish off whatever pigeons remain, because Quindell has confirmed that the Serious Fraud Office is now investigating too;

My opinion - I've added Quindell back onto my monitor, and will watch the fun and games from tomorrow morning with great general interest (but no financial interest personally).

It's sure to be a very high volume day. Many investors will just want to get out, at any price. Whilst others will be wondering where the bottom is, and if it's a buying opportunity for the 100p payout (I suggest risk-weighting that payout, as it seems to me that it's likely to be put on hold, or reduced maybe, now the SFO are involved, but who knows?).

Latchways (LON:LTC)

Share price: 755p (up 1.3% today)

No. shares: 11.2m

Market cap: £84.6m

Trading update - this safety equipment maker has a 31 Mar year end, so today's update covers the first four months of the current year ending 31 Mar 2016.

I've read the rather long-winded update twice, and my feeling is that it's trying to sound positive, but is very light on specifics. So let me summarise the key points;

Strategic expansion of sales team is "mission" for this year, to drive sales pipeline.

UK - "significant increase in our prospect bank" - confident in full year outcome, H2-weighted.

Europe - "order intake encouraging", but weak Euro means lower margins.

N.America - prospects in utilities & aviation markets are good.

Loss of main distributor in N.America for self-retracting lifeline product, but low margin work so no material impact on current year profits.

RofW - mixed trading.

Overall - "our view on the year is unchanged", H2 weighting for this year.

Outlook - "early indications are ... revenues significantly higher in due course"

My opinion - the above all sounds a bit jam tomorrow to me. There are no figures, or hard facts in this update, it's all about improved future prospects, etc.

Also, the H2 weighting for this year, and impact of the Euro on margins make me feel that there could be a risk of another profit warning later this year, possibly? Bear in mind that forecasts are currently for a considerable improvement on last year's results - and the above doesn't really sound to me as if we can be sure that the company is on track to deliver the forecast rise in EPS from 37.9p last time to 51.6p this year.

On the positive side, this company has a fantastic balance sheet, with net cash, and a remarkably strong current ratio of 7.6, and negligible long term creditors. The dividend yield of 5.4% is very appealing (if it is maintained at the current level), and the StockRank of 93 is very good.

Overall then, I'm on the fence on this one. If the company delivers forecasted figures for this year, and the sales drive generates sales growth in future years, then this could be a good entry point. If however the company struggles, and warns on profit later this year, then the shares could lurch lower.

Filtronic (LON:FTC)

Share price: 9.75p (up 30% today)

No. shares: 106.9m

Market cap: 10.4m

Update - there is some positive news on contract wins today, but the final sentence means this share is still uninvestable for me:

The Board continues to evaluate measures to strengthen the Company's balance sheet. Further details will be announced in due course.

Personally I can't see any reason to buy the shares now, and then possibly see a deeply discounted Placing happen, to dilute existing holders, or worse. Bear in mind the company flagged that it was seeking to raise fresh funding on 3 Mar 2015, so here we are five months later, and the company still needs money, so it doesn't look great.

I hope they succeed, but I'm yet to be convinced there is a viable business here.

All done for today, see you tomorrow - when the market will deliver its verdict on Quindell shares, as they unsuspend in the morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only, NOT recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.