Good morning!

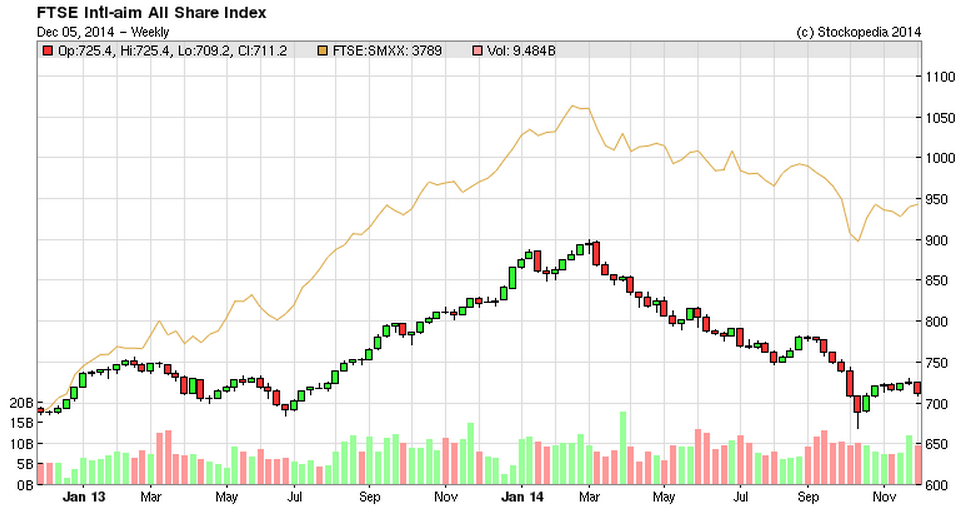

It's tough still out there in smallcapsville. Certainly for AIM the party is over, with the FTSE Intl-aim All Share Index (FTSE:AXX) having given up all of the 2013 bull run, and now 21% down from its peak in Mar 2014. Although fully listed small caps have fared somewhat better (the beige comparison line on the chart below). You can sometimes feel confidence melting away with small caps, and it feels like that again at the moment.

Chinese stocks

I've warned readers about these shares many times, so hopefully prevented some losses for you. It looks very much as if we're fast approaching the inevitable end game of these small Chinese stocks de-listing from AIM and disappearing without trace.

I see Naibu Global International Co (LON:NBU) is now down to only 8.5p, over worries that it won't be able to find another NOMAD following Daniel Stewart losing its NOMAD licence. Of course if the company was genuine, then insiders would be buying the shares in droves at this price. But it isn't, so they aren't!

As Was Shakoor said in a recent audiocast with me, whenever he's come across a company where he's had to seriously question if the numbers are real, they NEVER are real! He couldn't remember a single case which ended well, where the figures had looked too good to be true, or were otherwise seriously questionable. That's worth keeping at the front of your mind, and it's certainly helped me side-step a lot of the worst shares this year.

You also have to remember that AIM is the Wild West of the investment world. There are a lot of companies on AIM which are just plain bad - with dishonest management, and false accounts. Audits mean nothing, and regulation is totally ineffective. So very much a case of caveat emptor. It's also a great pity because there are perhaps 300-400 decent companies on AIM which are being tainted by association with all the grotty stuff. Action is long overdue, and personally I would like to see root and branch reform, driven by Government to sort things out, before the reputation of the London market goes completely down the drain.

There are plenty of good companies to choose from, so why do people even go near the dodgy stuff? I read on a bulletin board this week that a chap had lost most of his savings with a big bet on Quindell (LON:QPP). So he accepted that the markets were probably not for him. However, he had decided to have a final roll of the dice, sell his QPP shares, and put the whole lot into Peertv (LON:PTV) a £1.4m micro cap, permanently loss-making. You just despair sometimes.

Outsourcery (LON:OUT)

This company has looked a basket case, but today announces a contract win with a FTSE 100 company, which is expected to generate around £31k per month for 3 years.

So maybe there is some hope after all? It's not clear what costs are associated with this contract, so will it be profitable or not I wonder? Still, some good news. No doubt there will be more good news announcements, in the lead up to the next Placing!

Waterman (LON:WTM)

Share price: 56.5p

No. shares: 30.8m

Market Cap: £17.4m

This is a small consultancy in the civil engineering area. My attention is drawn by a reader in the comments below to a trading update from the company today.

The company lists a number of impressive-sounding projects which it is working on, and says that the company believes it is on track to triple adjusted profit to £3.3m by June 2016.

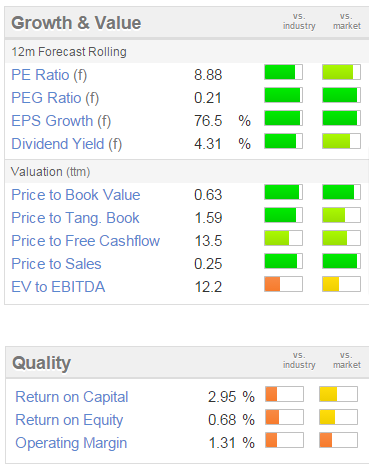

That's only an aspiration, and it has been said before. Although consulting my notes here from 28 Feb 2014, I liked the progress the company had been making, but didn't like that the share price had risen to 74p. It's usefully lower now. The Stockopedia valuation graphics show some attractive levels of green too;

Although note that the quality scores are all low.

The attractiveness (or not) of these shares therefore hinges on the company's ability to increase profits in line with their stated aim to do so.

The company also says it should benefit from the Govt's £15bn roads programme.

Note there's a nice forecast divi too.

Overall, I think it looks potentially interesting, although as always with something this small, lack of liquidity in the shares is likely to be a problem, especially if something goes wrong, where you can be left high & dry. I reckon there could be maybe 20-50% upside on this share though, if things go well, and there's always the possibility of a takeover bid too.

There's nothing else of interest today, a quiet day for news.

So I shall wish you a pleasant weekend, and see you back here on Monday morning! My jetlag has almost gone now, so I should be back on a more reliable timetable again next week, so apologies again for things being a bit erratic this week.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.