Good morning everyone,

Paul is off today, so I'll be adding various updates below.

It's a quiet day for results but there are quite a few trading updates and smaller announcements, I'll see how many I can get through!

Churchill China (LON:CHH)

Share price: 945p (+11%)No. shares: 11m

Market cap: £104m

This is a very old family business which has crossed my radar once before - last summer, when I thought the valuation multiple was a bit too hot to buy into.

The shares are up by 30% since then and today's full-year trading update explains why:

Trading in the final quarter of the year has been ahead of earlier expectations. Performance in export markets has remained strong reflecting continued progress with new products and more favourable exchange rates. The Board now expects that operating performance will be ahead of current market estimates and well ahead of 2015. Additionally, cash and deposit balances are also expected to exceed current market estimates.

2016 was a brutal year for exchange rate risk. Some people (e.g. myself) were caught on the wrong side of the investment outcome, and found ourselves too heavily invested in importers. Exporters had a much better time.

That's not to take anything away from a company like Churchill, however, which is a very good business in its own right - cash rich, prudently managed, reasonable returns on capital, and a respected name in the industry.

It's the sort of stock you might have in a "buy-and-forget" portfolio, though I'd probably still be a little bit fussier on entry price than to buy into it here. It might be suitable for those running more diversified portfolios.

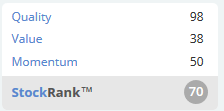

The StockRank sums it up: super-high quality, rather expensive.

Costain (LON:COST)

No. shares: 104m

Market cap: £385m

and:

Appointment to £500m Major Projects Framework

Encouraging noises from Costain:

Since the announcement of its interim results on 24 August 2016, the Group has continued to perform well and expects to deliver full-year results in line with the Board's expectations...

As a result, the Group's order book at the year-end was maintained at the record level of £3.9 billion (31 December 2015: £3.9 billion). The Group has increased its revenues secured for 2017 to over £1.2 billion (as at 31 December 2015: over £1.1 billion secured for 2016). In addition, Costain has a preferred bidder position at over £500 million (31 December 2015: £500 million).

In other words: things are basically flat.

Civil engineering makes me nervous as an investor - a very lumpy and cyclical industry! And while Costain is certainly a giant in the industry, with a fantastic history, it does have a track record of occasionally needing to raise fresh capital from investors (most recently, raising £75 million in 2014).

Profitability is quite good at the moment, though. It might be worth a second look if you have a positive view or a special insight into infrastructure spending.

Science in Sport (LON:SIS)

No. shares: 43m

Market cap: £33m

A positive announcement from this growing nutrition company:

Sales increased 30% to £12.24 million in the 12 months to 31

December 2016 compared with the same period the previous year (2015:

£9.45 million)...

The Board remains confident of continued strong growth in 2017 and

beyond.

Of course, there is a catch: the company has been unprofitable for the past five/six years, and needed to raise more money from investors in 2015.

It has a strong gross margin of almost 60% but sales volumes so far just haven't been enough to bring it through to profitability.

This isn't helped by the fact that costs keep rising: administrative expenses were up significantly in 2015, rose again in H1 2016 (by 24%), and this trend looks set to continue. Breakeven in 2017 would be a great result, but I wouldn't count on it. Profitability might still be a few years away, and is still not guaranteed.

I like the brand though, and I think there should be an asymmetric payoff if it does reach critical mass.

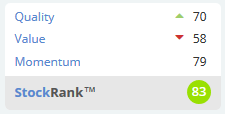

The StockRank is not that bad for a company with no profits:

Zytronic (LON:ZYT)

Share price: 400p (-1.2%)

No. shares: 15.4m

Market cap: £62m

Notice of AGM and Proposed Capital Reduction

By request, I'll try to explain this announcement:

At the forthcoming AGM, in addition to normal business, a resolution will be proposed relating to a reduction in the Company's capital ("Capital Reduction") in order to increase the Company's distributable reserves, however there is no immediate plan to return capital to shareholders. If approved by shareholders and by the court, the Company intends to implement the Capital Reduction through a bonus issue of newly created Capital Reduction Shares, and to subsequently cancel the newly created Capital Reduction Shares. This proposed Capital Reduction will not change the number of ordinary shares in issue.

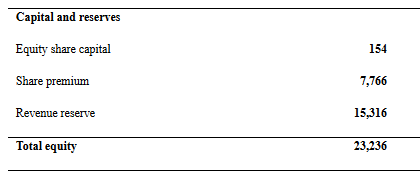

This is Zytronic's latest share capital (in thousands of pounds):

Apologies if this is very basic info for some readers, but here we go!

- The equity share capital is the nominal value of Zytronic shares. Since it has 15.4 million shares outstanding, and they are nominally worth 1p each, the nominal value of shares is £154k.

- When the company sells shares for more than their nominal value (e.g. when share options are exercised at more than 1p), the difference goes into share premium.

- Revenue reserve, in this case, is another name for retained earnings.

Retained earnings can be distributed, share premium and share capital cannot.

My guess is that Zytronic simply wants to tidy up the balance sheet by resetting the Share premium account to zero.

When shares are sold for a lower price than their nominal value, the difference is deducted from share premium.

So to reduce share premium, the company gives away free bonus shares with a nominal value equal to £7.8 million.

In a two-step process, the company then buys them back for nothing from shareholders and cancels them, creating an illusory "profit" of £7.8 million which can be added to retained earnings (and this amount is then distributable).

It's just a tidying-up exercise, but it gives the company more flexibility in the future.

You might ask why every company doesn't do it.

Firstly, there is hassle involved.

Secondly, they need to make a solvency statement. This is to prevent companies

from issuing shares at a particular price, borrowing money, distributing all of

the shareholders' original funds back to them, and then defaulting on their

creditors. Creditors must always be first in line.

Share price: 18p (+10%)

No. shares: 97m (plus up to 239m new shares)

Market cap: £17m (current share count)

and

I get plenty of things wrong but, so far, my bearish stance on fastjet isn't one of them!

An enormous quantity of shares is being issued to recapitalise this African airline once again (I've lost count of how many times it has been recapitalised at this stage).

For the time being, it has given up on leasing and operating its own aircraft, instead switching to "wet leases" - this means outsourcing to another company which provides the craft and the crew.

Since that's expensive, it is paying for its new wet lease arrangements by issuing c. 96 million shares to the lessor, who will also have the right to nominate two directors to the Board.

Separately to that, it has sold 143 million shares at 16.3p (a far cry from the 50p unadjusted issue price of the placing 6 months ago). The buyers were the same fund managers who have been backing it since it raised $75 million in an ill-fated 2015 placing.

Forgive my cynicism, but this to me is the perfect example of a company which would almost certainly not exist in the absence of the stock market, as there is no economic reason for it to exist.

Leeds (LON:LDSG)

Share price: 37.5p (-1%)No. shares: 27.5m

Market cap: £10m

Interim Results for the six months ended 30 November 2016

Muted results from this small fabric wholesaler which I am looking at for the first time:

The Group achieved sales in the period of £21,057,000 (2015: £18,489,000) and made a profit after tax of £848,000 (2015: £692,000). Earnings per share were 3.1 pence (2015: 2.5 pence).

The weakness of sterling in recent months has had a material impact

upon the Group's results. Sales growth of 13.9% over the first half of

the previous financial year comprises a fall of 2.7% in sales at

constant exchange rates, disguised by the translation effect of weaker

sterling, which increased reported sales by 16.6%.

Another beneficiary of exchange rate risk, then.

The benefits appear to be mostly presentational, however, since the company's "major transactional currency exposure" is EURUSD, not a GBP exchange rate (it buys from China and brings product to its trading subsidiary in Germany).

So the underlying result is not very encouraging, with a fall in sales at constant exchange rates and little or no "real" benefit from the new exchange rates.

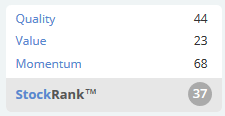

The StockRank is 91, thanks to cheap valuation and reasonable return on capital metrics.

My interest has been piqued; this could be worthy of further research.

That's about all I've got for today. Thanks for reading!

Best wishes

Graham

Bonus extra comments from Paul

Thanks Graham, a really interesting report. It is indeed remarkable that Fastjet (LON:FJET) is repeatedly propped up by major shareholders. It makes me wonder whether career risk for fund managers (if FJET were to go bust) might be a key motivation for injecting fresh funds, perhaps?

As regards Zytronic (LON:ZYT) - I understand the point about creating more distributable reserves, so that the company could pay out special divis in future. However, it looks as if the company already has plenty of retained profit. So there must be some other complicating factor.

I've just emailed the CEO to ask him to clarify, and will publish his reply here in due course.

A couple of quick comments from me, on other stocks not mentioned above;

IG Design (LON:IGR)

Share price: 256p (up 3.2% today)

No. shares: 62.6m

Market cap: £160.3m

Q3 trading update - covering the period to 31 Dec 2016 (as it has a 31 Mar 2016 year end).

Things are going well;

The Group is pleased to report that following the strong performance reported over the first six months ending 30 September 2016, trading has continued to be strong during the Christmas period.

Results remain in line with the upgraded expectations announced in November 2016, with all regions trading profitably. The Board remains confident in the full year outlook of the Group.

My opinion - I think this is a good company, well managed, and performing well. The current valuation seems about right to me. However, we're in a bull market, so the price could yet rise further. It's been strangely volatile of late, I don't know why.

Johnson Service (LON:JSG) - a positive trading update today from this textile hire business;

Results for the year from the Continuing Textile Rental business are expected to be slightly ahead of current market expectations. This reflects both organic growth, ahead of anticipated levels, and synergy benefits following recent acquisitions.

In addition, net debt to EBITDA (excluding rental stock depreciation) as at 31 December 2016 is expected to be less than 2.0x, a key area of focus for management.

In a separate announcement, its retail dry cleaning business has been sold off.

My opinion - taking into account debt, the valuation looks about right to me. Personally I'm not keen on textile hire businesses, as historically they have tended to get into big trouble in recessions.

IMImobile (LON:IMO) - a solid update today;

IMImobile, a cloud communications software and solutions provider, is pleased to report that current trading and outlook remains in line with management expectations.

There is also further detail about a large contract renewal, and a new reselling arrangement.

My opinion - I think this is a good, well-run company, and the valuation seems reasonable at 166p.

Cheerio!

Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.