Good morning. Looks like it will be a short report again today, not because I overslept or had IT problems, but just because there are few relevant announcements this morning. Although that does give me time to take a more in-depth look into companies reporting, rather than the usual cursory glance.

McBride (LON:MCB) prove that profits warnings do not always come in threes, with an in line trading update this morning. As you can see from the 12-month chart below, there was a mild profits warning on 21 Mar 2013, and as is often the case, that has damaged sentiment ever since, leading to McBride shares significantly under-performing the Small Caps Index (the beige comparative line on the chart).

It's really striking just how much the Small Cap Index has risen in the last year, and how little correction there has been recently. This has really been a roaring bull market for small caps in the last year, so if our portfolios are not strongly up (30-40%) in the past year, then we've actually under-performed!

It looks to me as if, based on this morning's statement, McBride shares should now start to narrow some of that gap, if you accept that the starting valuation was correct.

So far so good. Looking at valuation, based on future earnings, which is my main preferred way of at least initially valuing companies, providing the earnings are sustainable, broker forecasts for McBride for the year ended 30 Jun 2013 average around 7.8p to 8.8p, and this rises to around 11p for the following year (which has just started).

So at 117p that puts the shares on a historic PER in the range 13 to 15.

The forecast PER for 2013/14 drops to 10.6, which looks good value if you think 11p forecast EPS is achievable.

The valuation is supported by a very good dividend yield, with 5.3p expected to be paid out for 2012/13, yielding an attractive 4.5%. Bear in mind that dividends should contain inflation protection too, as they are likely to rise over time, which in many ways makes decent yielding equities highly attractive relative to other assets, especially things like Gilts, where the yield is not only very low, but usually fixed too, so will be eroded by inflation.

On the downside, McBride has a lot of debt, most recently reported at £77.8m, or just under 43p per share, which is pretty material to the valuation. It's a capital-intensive business, being a manufacturer (of household & personal care products), so you could argue that a certain amount of debt is acceptable to finance the £169.9m fixed assets.

Also, there is a big depreciation charge, so when you add that back and look at EBITDA, it really does generate a lot of cash - the most recent full year showed operating cashflow before changes in working capital of a remarkable £52.3m.

That said, the trend is for heavy capex every year, so EBITDA really is not a valid measure for any business where there is an ongoing capex requirement as e.g. machinery wears out & is replaced with newer, more efficient versions, factories are opened & closed, etc.

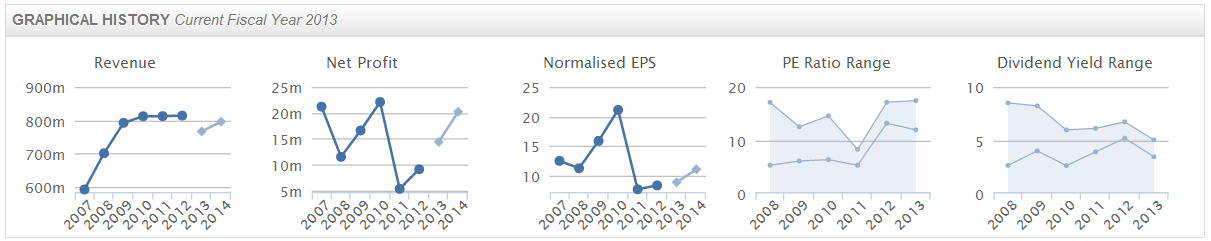

The historic trend graphs on the Stockopedia report for McBride are always revealing, as they give you a quick snapshot of so many factors, see below:

What do these tell me? Well firstly that it looks to be a mature business, since turnover has been fairly flat around £800m p.a. for the last five years - which means it probably won't command a high PER multiple going forwards.

I can also see that the profit margin is fairly slim, indicating not a great deal of pricing power, which is to be expected for a company supplying supermarkets, again that steers me towards a lower valuation rating.

EPS seems to have stabilised around 10p, although bear in mind the lighter blue section are forecasts, hence may not turn out to be correct! (although the 2013 ones have just been confirmed today, so that's fine, we just don't know how 2014 will pan out).

The last 2 graphs show us that historically McBride has had a lower PER, with the base level being around 7 from 2008 to 2011. Also it's been possible to buy on a higher dividend yield too, that has trended downwards in the last five years.

This all suggests to me that McBride has been better value in the past, but given that the economic situation is probably now better than it has been for some time, although risks still exist, you could argue that markets (being forward-looking) are now starting to price in some recovery in European economies & therefore earnings. Who knows?

Overall, I suspect that McBride shares might have some reasonable upside on them from 117p, but not enough to get me excited.

Oh, forgot to mention, McBride also has a pension deficit, shown as £22.6m on the last reported balance sheet, but a triennial valuation is due imminently, so that is subject to change.

I also note that on 9 May 2013 the company said that net debt is expected to rise to £90m by 30 Jun 2013, due to currency movements & a temporary increase in working capital, so overall I'm thinking this one is maybe just a little too problematic to get involved in?

Next I'll have a look at Churchill China (LON:CHH), which has issued a positive H1 trading statement, that also says they are confident of meeting full year expectations. Let's have a look at the top section of the Stockopedia page:

The first bit I always look at is the Market Cap & Enterprise Value (which I've put a ring around, to highlight it above). It amazes me how many people tell you chapter & verse about shares they like, but don't tell you the only bit that really matters - namely what price they are!

I like the way Stockopedia present the Market Cap & Enterprise Value together, as that immediately tells you both what the company is worth, and what net debt or cash it has. Enterprise Value is just Market Cap plus net debt ("net debt" being defined as interest-bearing borrowings, netted off against cash).

In this case Churchill China has a market cap of £36.8m (which is the previous night's closing share price of 336p multiplied by 10.95m shares in issue).

However you can see that the Enterprise Value is lower, at £29.8m, so that tells me that the company has net cash of the difference between the two numbers, of £7m. Personally I always prefer investing in companies with net cash rather than net debt, as it greatly reduces risk for investors - a company with net cash cannot normally go bust for as long as it continues to hold net cash. Companies only go bust if they run out of cash, or borrowing facilities are withdrawn.

We should bear in mind that all balance sheet numbers are only a snapshot on one particular day, and most companies window-dress their balance sheets for the year-end - i.e. they chase customers to pay just before the year end date, and might delay some payments to their own creditors to flatter the year-end cash figure. So care is needed. The P&L interest charge for the year is a quick way to reasonableness check the year end stated net debt/cash, and you'll often find a mismatch - i.e. the interest charge often suggests a higher average net debt figure than is disclosed at the year end. Companies often set their year end date to coincide with a seasonal high point in cash as well. So EV figures should always be treated with care, as these factors can distort valuations based on EV.

It would make more sense if companies had to disclose in the notes to their accounts not only the year end net debt figure, but also the average net debt throughout the year. I very much like it when companies voluntarily disclose that information in their Annual Reports, as Home Retail Group, and French Connection have both done in the past (two examples off the top of my head).

Looking at the "Growth & Value" indicators in the StockReport above, the forecast PER of 15.9 looks fully priced to me, even allowing for the fact that Churchill China has net cash. The dividend yield of 4.36% looks attractive - regulars know that I place a lot of emphasis on good dividend yields, as they provide some support to the share price (if dividend is well covered) in the event of poor trading, and of course companies with net cash can continue paying dividends even in a bad year.

Also one doesn't mind waiting a couple of years for a share to re-rate, if one is being paid a healthy dividend along the way.

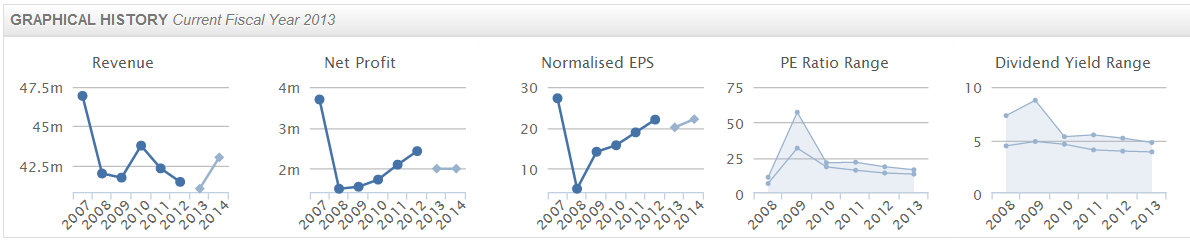

Looking at the graphical history for Churchill, this is also a mine of information:

What can we glean from this? Firstly that it appears to be a mature business again, with turnover pretty flat at about £42m for the past 5 years, and forecast to remain flat. Similar story with profits, a gently rising trend from a bit below, to a bit above £2m p.a.

EPS has been steadily rising, but again not at a huge growth rate, in the last four years.

The dividend yield has remained remarkably steady at around 5% in recent years, so that does seem to underpin the share price. Same with the PER, just drifting down slightly, but that graph is somewhat distorted by the spike in 2009.

My conclusion from this is that, based on what I can see historically & current trading, it's probably priced about right. I would only become interested in the shares therefore if some new information became available which suggested that there might be some growth potential here.

At the moment it just looks like a steady, mature business. However, growth might come from a broader economic recovery, so it might be a good idea to look back and see how cyclical their sector is - did profits shoot up in the past when the economy was growing, prior to the 2008 financial crisis?

Or, growth might come from new product launches, acquisitions, etc. Companies with net cash have scope to do acquisitions more than indebted companies, but do management have a track record of making sensible acquisitions? In my view many acquisitions are disastrous ways to destroy shareholder value - just look at how often vast amounts of goodwill have to be written off from balance sheets of acquisitive companies! Management ego often drives acquisition strategies, rather than commercial logic, and the stock market graveyard is littered with the corpses of highly acquisitive companies that overpaid, took on too much debt, and then went bust.

Overall then, I'm rambling round to concluding that Churchill China doesn't really meet my broad criteria for GARP (growth at reasonable price), but it looks more like a steady, mature business, that's probably priced about right.

There's an interesting-sounding AGM statement from @UK (LON:ATUK) issued today. It's a very small software company that has bumped along with turnover of about £2m p.a. for years, yet their statement today says that they believe they have an opportunity to grow internationally to "turnover of over £50m ..." within the next 3-5 years. Sounds pretty bold! They don't say anything about profits, so I've no idea if they intend making any money, or just continued losses? I know nothing about this company, so can't really comment any further, but just want to flag it to readers as looking potentially interesting. The shares are up strongly today, so someone likes the story.

That's it for today, and this week. Let me know what you think about me covering fewer companies, but in more detail, as tried out today - useful, or too long-winded?

Have a super weekend, and enjoy the sunshine!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FCCN, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.