Good morning! A lot of my small caps seem to be coming alive again, which is encouraging, as the last year has been generally poor for small caps, with most shares drifting down, even if results have been alright. This is quite surprising, as I had expected most investors to sit on their hands until the General Election was decided. Although personally I think it makes so little difference that UK politics can almost be disregarded - a Labour Govt would just spend & borrow a bit more than the Tories, but it's fiddling around the edges of policy really, rather than dramatic differences. Therefore the GE has certainly not stopped me buying shares I like.

Talking of shares I like;

Avesco (LON:AVS)

Share price: 130.5p

No. shares: 19.1m

Market Cap: £24.9m

(at the time of writing I hold a long position in this share)

Trading update - this sounds encouraging;

My opinion - there has been increasing evidence of the turnaround strategy working, and today's announcement is the strongest yet. This share also has a terrific dividend yield of over 5%, and the balance sheet has considerable hidden value - apparently the freehold property is worth considerably more than book value, I am told.

I've been adding to my position here in recent months, although it's an illiquid small (or even micro) cap, so I've found it best to only buy on red days, and then ask my broker to approach the market makers and try to buy stock for say a penny or two above the bid price. When that is successful, it negates the impact of what would otherwise be a horrible spread. This morning for example, the price is 127 bid, 134p offer, so that's a 5.5% difference - nasty, as that's creating an instant loss.

My target on this? I reckon 150-200p is what this stock could be worth, if the positive newsflow continues. Note that management have been big buyers of stock recently too - a good sign if it's spontaneous, but not a good sign when it's done for PR reasons after some bad news.

Chartists might like the breakout to a new high this morning, on today's positive trading update;

Flybe (LON:FLYB)

(at the time of writing I hold a long position in this share)

New Cardiff routes - I suspected that a catalyst for a recovery in the share price here would be news of the surplus planes being disposed of, or otherwise occupied. So today's announcement that two surplus planes are to be used for new routes from Cardiff, is encouraging. Better to have the planes out there doing something, rather than costing a lot of money to be parked up idle.

As I Tweeted yesterday, I've been averaging down my position in FLYB, because the shares seemed to find solid support at around 58p - repeated efforts to go down further were thwarted by buyers. An Institution called Pelham Capital seems to have been buying, although as usual with those ghastly TR-1 forms, it's difficult to work out what has actually happened. They seem to have gone above 5%, but that doesn't seem to tie in with the quantity of shares held in various forms. I'm not quite sure what an "equity swap" is, either. Must be some form of derivative which is equivalent to holding the shares.

As you can see from the chart, we now seem to be over the worst, perhaps - providing there is no more bad news of course.

William Sinclair Holdings (LON:SNCL)

Profit warning - oh no, not again?! This company has been a serial disappointer, and in my last review of the company on 20 May 2014, I concluded that the shares looked too high risk, and the company too accident-prone. Good thing too, as the shares have halved in value since then.

The CEO has been sacked, and a new interim CEO is in place, and working on a "transformation plan" which will be announced by end April . Although the latest catalogue of woes sounds alarming;

A turnaround specialist has been appointed as a Non-Exec too. I note that the recent cases he worked on, Dawson Holdings, and Office2Office, ended with the companies being sold. So perhaps that might be the outcome here?

The last balance sheet for William Sinclair was OK in terms of working capital, but it has quite high long term debt, and a nasty pension deficit too. So overall, looks a bit wobbly.

My opinion - it all hinges on the bank remaining supportive, which for me makes this a no-go area. I wish the company well in its restructuring, but the shares look too high risk to me until the situation becomes clearer. I would take a punt on it, if the company had plenty of net cash in the bank, but it doesn't.

Empresaria (LON:EMR)

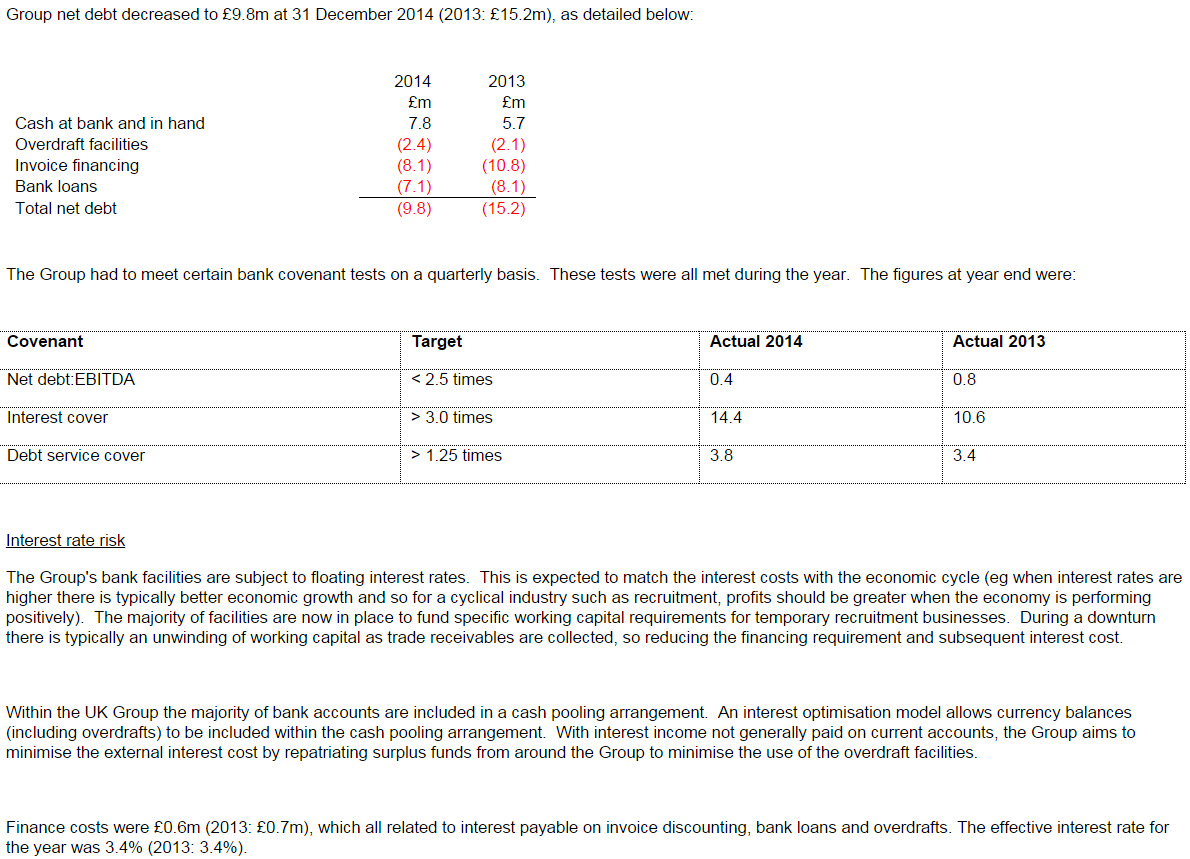

Results for calendar 2014 are out today. I'm going to circle back to these tonight, and properly ponder them. On a quick review this morning, the company appears to be doing well, and the balance sheet/debt situation seems to have improved. There's probably still a little too much debt for my liking.

As a general point, I suspect that year end cash balances are probably window-dressed at most companies. That's the danger of doing analysis of balance sheets - as it's only a snapshot on one particular day, and things can be managed to give a better impression on that day, compared with typical values throughout the year.

I applaud Empresaria's openness in publishing its banking covenants, where they seem to have plenty of headroom, which is reassuring. Also a helpful note about cashflows throughout the economic cycle is useful;

I have to dash now, as am cycling across London, from Islington to Victoria, for another investor lunch, followed by a company meeting. I'll respond to reader comments when I get home tonight. Have a good day!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in AVS & FLYB, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.