Good morning. It's eerily quiet for announcements today, but there are a couple of interesting things that have caught my eye.

Laura Ashley Holdings (LON:ALY)

Share price: 27.25p

No. shares: 727.8m

Market Cap: £200.1m

Interim results - for the 26 weeks to 26 Jul 2014 have been published this morning. I'm impressed with them, and have picked up a little stock this morning, on the basis of a fairly cursory glance at the figures, which I'll research in more detail over the weekend.

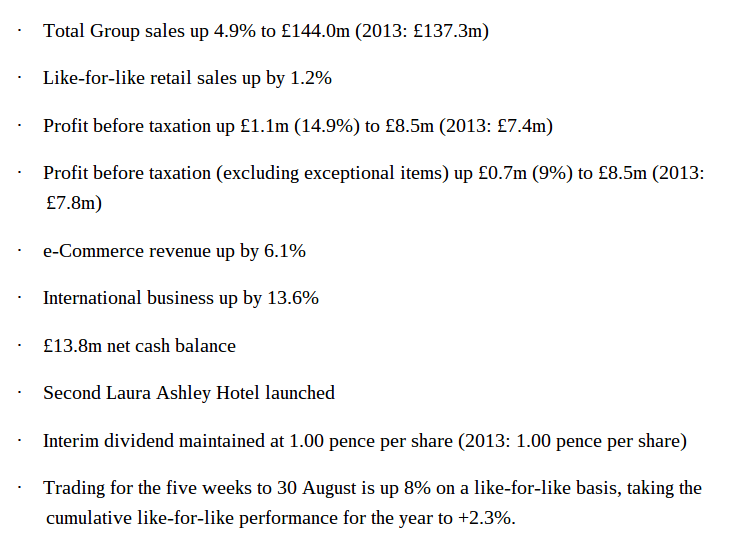

Here are the headline points from today's interims, which all look pretty good to me;

From looking at the results today and the prior year comparatives, it seems to be a slightly H2-weighted trading year, which I would expect from a fashion & homewares business (because the run up to Christmas is very strong for retail sales in this sector, and people tend to economise for a few months after Christmas, thus skewing profitability towards calendar H2).

Ah, I've just realised this isn't a calendar year end, it's a 25 January year end, but the point above still stands, as end Jan year ends are optimal for most fashion retailers, because it gets the busy January Sales period in the bag, and cash balances are usually at a cyclical peak in January. Cash then usually ebbs away through the Spring, and reaches a seasonal low just before Easter after payment of the March rents. Then cash builds up over the summer, and reaches another low in the autumn as Xmas stock is paid for, then spikes up hugely over Xmas & new year due to peak sales & de-stocking.

Profit before tax up nearly 15% is a good result for H1.

However, I am particularly impressed with the +8% current trading in the last five weeks - that's important because it indicates that the new autumn ranges have been well received - hence the company is probably on course to put in a good performance in the whole of H2. Weather may have helped them somewhat, but +8% recent sales tells me that the new season (autumn/winter) ranges are good - something I've confirmed from looking at their website - the furnishings in particular look a highly credible competitor to John Lewis, in my view.

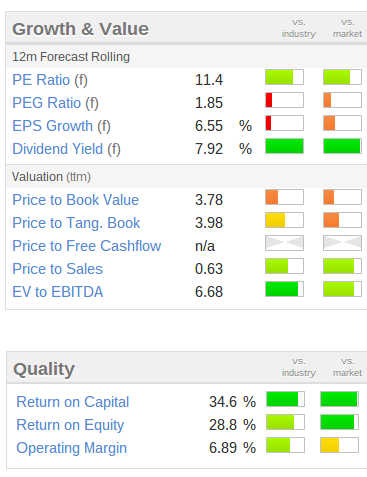

Valuation - Broker forecast consensus is for a slight increase to 2.1p EPS for this year, but that's now looking too cautious in my opinion. If the company has a good H2, then I would say somewhere in the 2.3 to 2.5p EPS range looks more realistic perhaps? If I'm correct about that, then the shares at 27.25p seem good value, that's a current year PER of between 10.9 to 11.8, which looks good value to me - for a company that seems to be entering a period of stronger performance, and has a strong brand & international franchising operations, which provide a good platform for growth. Internet sales are also growing, thus further broadening their geographic reach.

In my view it's important to only use broker EPS forecasts as a starting point. Actual results often under or overshoot forecasts by a considerable amount, so I generally try to find companies which appear to be trading ahead of what the brokers are forecasting. Also in an economic recovery brokers are often too cautious with their forecasts, as their mindset tends to be dominated still by the downgrade cycle in the most recent economic downturn. Also they often forget about operational gearing! So if broker forecasts have been consistently too optimistic in recent years, they tend to play it safe going forwards. That provides an opportunity for us!

Balance Sheet - Looks fine to me. The company has net cash of £13.8m, and there is a zero interest charge on the P&L, suggesting that it held net cash throughout H1.

Pension Deficit - There is a reported £8.8m pension deficit on the Bal Sheet, but I've checked the last Annual Report, and the scheme is relatively small, and overpayments are under £1m p.a. So that is not something that worries me at all.

Dividends - this is very interesting. The company has been paying out effectively all its earnings in dividends in recent years, so at 2.0p p.a. the yield is a stonking 7.3%! Normally I would discount such a high yield, as anything over about 6% is usually too high to be maintained. However, in this case with a sound Bal Sheet holding net cash, and strong current performance, the divi could probably be maintained at this level. The interim divi has been held at 1.0p.

My opinion - From what I've seen so far, this share ticks a lot of my boxes! I'll do some more research on it over the weekend, and welcome reader comments below.

As you can see from the chart below, ALY shares have lagged the small caps sector, hence could possibly be in with a chance of a re-rating, given the low valuation, and strong current trading?

Low & Bonar (LON:LWB)

Share price: 68.7p

No. shares: 327.6m

Market Cap: £225.1m

Profit warning - this share is the biggest % faller of the day at the time of writing, down nearly 16%. The reason is a trading update published this morning. This company manufactures coated fabrics, for many different sectors, especially construction, flooring, etc.

It doesn't sound too bad, with a number of factors meaning that forecasts are being trimmed;

The Group's other businesses continue to perform well and are in line with the Board's expectations. However, recognising the lower demand in the civil engineering sector, the Board anticipates that profit before tax, amortisation and non-recurring items for this year will be in a range of £25.3m¹, last year's result, to £26.5m.

I wish more companies would follow this excellent example of publishing a specific profit range for the current year. In fact all companies should do this. I often ask companies to give an indication of where profit might be, and they nearly always splutter "we can't give forecasts!". Well why not? This company has (as indeed some others do). So if they can, all companies can! Instead we have to go through the charade of pretending that broker forecasts are completely independent, when you know full well that the analyst has probably been given a steer by the FD of the company that he's reporting on.

So top marks to Low & Bonar and their advisers Peel Hunt for clarity.

I'm struggling a bit to interpret the numbers, as it's a company I'm not familiar with. Over half of turnover comes from W.Europe, so the Eurozone countries economic malaise is clearly weighing on the company, as mentioned in the narrative today.

Valuation - Broker consensus for the current year was for £29.2m profit, so assuming that is comparable with the £25.3-26.5m range mentioned by the company today, then it looks like a rougly 11% shortfall on the full year figures. That may not sound too bad, but bear in mind the interims showed profits up, so it's quite a sharp pullback in H2 being forecast (it's a 30 Nov year end, so about 3/4 of the year has happened already).

So it looks as if EPS for this year might come down from forecast of 6.35p to about 5.7p. That would put the shares on a current year PER of about 12.1, which sounds about right.

Balance Sheet - this is the deal-breaker for me. Net debt of £103.4m at the last set of interims is too high for me to consider investing here.

Nothing else has caught my eye particularly today, so will sign off.

Have a good weekend & see you back here on Monday morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ALY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.