Good morning!

This morning's report comes to you from an alley on a side street in Corfu old town!

I'm flying back to the UK on Weds. So there will be a normal report today & tomorrow, but Weds will be late I'm afraid, as I don't get back home until about 3pm. I'll still do a report, but it will be late afternoon/early evening on Weds. Sorry about that.

My experiences of fund management

EDIT: Clarification - Fundamental Asset Management

I seem to have accidentally caused some confusion, for which I apologise. Fundamental Asset Management has asked me to clarify that the only part of their business I was involved in was a minor portfolio service called the Small Cap Value Portfolio.

So the SCVP had nothing to do with FAM's core business of IHT portfolio management, which is of course continuing completely as normal! (and is an excellent, well-run, strongly performing service).

One reader apparently misunderstood, and thought that FAM was shutting down, which obviously it isn't! This has caused a few red faces, for which I profusely apologise.

Over the last 3 years, I helped to run a portfolio management service, called the Small Cap Value Portfolio, through an excellent FCA-regulated firm called Fundamental Asset Management (who are specialists in IHT planning portfolios). Working with FAM has been terrific - they're really genuine, decent people, and have a wealth of experience in AIM stocks.

I've not mentioned it here before, as it could have been seen as a conflict of interest (i.e. being seen to drum up new clients by mentioning it here), so Stockopedia asked me not to refer to it here in the past. I did however declare all positions held, within my usual disclosures here, as if I held them personally (which I did in nearly all stocks anyway).

However, seeing as we're winding down the very small SCVP service (due to failing to reach critical mass to make it cost-effective), I thought it would be worth a mention, to pass on some snippets on what I've learned from 3 year's work, helping to (as part of a regulated team) manage other peoples' money.

NB. This has no effect on FAM's main activities, as noted above.

Firstly, it's incredibly stressful! If you lose your own money on a share that goes wrong, it's annoying, but you learn the lessons (if there are any - sometimes it's things you could never have foreseen), and move on. When it's someone else's money, the emotions are far more painful, I found. You feel that you've let the clients down, and take it much more to heart. Especially where clients are also friends.

This can then induce fear of taking action. You spot share opportunities, but think - I'd better not take the plunge, until I've researched it to death, and am 100% certain I'm right. Of course, by then, the opportunity may have passed, as with bargains you often have to act quickly.I found that you become particularly indecisive after a series of losses - it saps your confidence, and makes you question your own ability.

At the opposite end of the spectrum, even Neil Woodford said something similar, when early in his career he had a 2-year+ period of poor performance - I think it was in the tech boom period from 1998-2001, where he refused to participate in the madness. He sounded quite emotional about it when giving a talk on his career, and I think he came close to giving up back then.

Going back to the bottom end of the spectrum, the mandate for my portfolio service was on value - so low PER, high yielding shares, with decent balance sheets. Unfortunately, I just seemed to mainly pick stocks which then slipped up - so the market was telling us something by applying a very low PER - it was anticipating problems ahead.

Therefore, these days I'm much less attracted to low PER stocks - even if they don't slip up, they seem to stay cheap forever. It has been a much better strategy in recent years to go for the best quality businesses, and paying up with a higher PER (say 15 or more). Part of that has been a re-rating of growth stocks, which of course could easily reverse once the market loses its fizz. So value may come back into fashion, but it's not been a good area to hunt in, in the last few years, I've found.

I tend to look for businesses with good growth potential now, and if I can buy them on a low PER due to some market panic (e.g. the Brexit referendum), then so much the better.

One area where we did very well, was concentrating on your best stock ideas. When I researched Boohoo.Com (LON:BOO) after its profit warning in Jan 2015, it seemed very clear to me that this was an excellent buying opportunity. So, even though it was a very tough thing to do at the time (as the company had badly disappointed, and was half its IPO price), we loaded up with BOO, making it our largest position in the portfolio at about 24p. It's now more than triple that price. So I firmly believe that concentrating into your highest conviction shares is a good thing - providing you get it right more often than wrong.

We've not sold any BOO shares since. I wanted to take profits along the way, but our fund manager said no - he said you're onto a winner there, so just run the position. We did, and it's worked brilliantly - the BOO position has hoovered up all the other losses. Despite a period of lacklustre performance, now all client accounts (bar 1, who happened to open the account with unfortunate timing on purchase prices) are in profit. So we'll close the portfolio service on a high, and having beaten our benchmarks.

The key point in the last paragraph though, is to run the winners. Easier said than done, but in the future I am going to resist the urge to top-slice & take profits, and instead run my highest conviction positions for the long-term.

That said, if a lower conviction share in my portfolio zooms up, and looks expensive, then I would still sell some of those ones. It's the big, conviction buys that go right, which one needs to stick with, in my view.

Liquidity - as PIs, we moan about liquidity in smaller stocks. Well it's far worse for fund managers! As their funds under management grow, buying & selling become even more difficult. Plus, if they're trying to get out of a position, having to put out an RNS every time they cross a % threshold telegraphs their intentions to the whole market. So sensible PIs will often hang back, and wait for the price to fall further, and only buy a share once the selling fund manager has exited.

So I can see why many fund managers avoid small caps. Risk:reward for them is terrible - if something goes wrong in a small cap, they can't get out. Whereas the average PI can exit from a failing position, usually.

Although in times of serious market dislocation, then liquidity can disappear almost entirely. That was certainly the case in 2008. You can only sell things that are liquid, so you end up with a remaining portfolio of all your mistakes, which are too illiquid to sell.

Gearing - generally speaking, I think it's a mistake to use gearing with small, illiquid stocks. I've covered this ground many times before, so won't repeat it. Even though our portfolio service was based on using spread bet accounts (to make it flexible, cheap to run, and tax efficient), we applied strict rules on not using more than a smidge of gearing.

Moreover, unlike others who run services like this, we actually stuck to our rules, and hardly used any gearing at all. For this reason we were able to ride out a period of lacklustre performance, and come out the other side with a closing position of nearly all remaining clients being given back usefully more money than they originally invested. I am convinced that our disciplined management of gearing was key to this positive outcome.

Structure - there's a massive difference between open-ended (where clients can withdraw their funds), and closed-ended (e.g. an investment trust). Open-ended is just horrible - what tends to happen is that when things go badly, clients get cold feet, and some pull out. This crystallises their losses at often the worst possible time, so they lose out. Also, it forces the fund to start selling at the low point, which can worsen the price falls, getting into a vicious circle.

Therefore, I would only do something again in fund management within a closed-ended structure. This means clients can't withdraw money from the fund itself, but they can sell their shares in it. However, this structure is costly, and involved a lot of admin. It does however free up the fund manager to concentrate on taking a long-term view, and not having to devote time & energy into reassuring wobbly clients.

Overall - working in a fund management team for 3 years was an interesting, but rather stressful experience. It sapped a lot of my time & energy, for negligible returns. However, I am grateful for the opportunity (that sounds like The Apprentice!), and have learned a lot from it.

I was determined to see it through to a point where client accounts moved back into profit, as a matter of honour (and latterly for zero fees), and in all but one case that has happened, for clients who stuck with us until the end. So I feel that I've done the right thing. That's more important than money in terms of motivating me. I wish that more people in the city had the same ethical approach - there's a huge ethical deficit in the financial sector generally.

As for readers, if friends or family ask you to manage a portfolio for them, I have just one word of advice - don't!

It's too likely to cause unnecessary stress & strain on your personal relationship. Far better to outsource it to a good fund manager, with a decent, long-term track record.

For me, I'm taking a break from fund management for a little while, although there is another possibility bubbling away, which might develop into something, who knows?

Right, onto today's trading updates & results statements.

Cambria Automobiles (LON:CAMB)

Share price: 71p (up 6.0% today)

No. shares: 100.0m

Market cap: £71.0m

Pre-close trading update - this is for the year ended 31 Aug 2016, for this expanding car dealership group. It reads well to me, the key part saying;

The Board is pleased to report that trading in the second half of the financial year continued strongly following a good first half.

Trading in the first 11 months of the financial year was substantially ahead of the corresponding period in 2014/15 on both a total and like-for-like basis.

The Board is confident of delivering results for the full year in line with the revised market expectations.

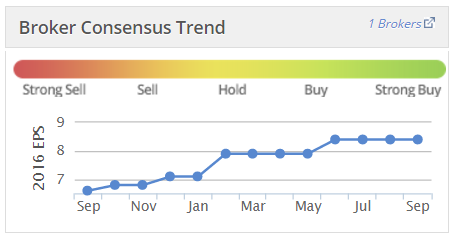

Looking at the Stockopedia graph for broker expectations over the last year, there have been a series of upgrades to forecasts. Although some of this is due to acquisition of new sites remember;

The comments on new car sales sounds more upbeat to me, than the recent comments from Vertu Motors (LON:VTU) - which mentioned a softening since Apr 2016 in new car sales.

Current trading - also sounds positive;

Heading into the important September trading period, the new car order book for the Group is building well and in line with our expectations. The Board expects the Group to deliver another strong trading performance in this crucial month.

Valuation - it looks really good value, and I would have bought some shares recently, had it not been for me already being overweight in this sector with Vertu Motors (LON:VTU).

I remain of the view that this is an excellent value sector, if you expect interest rates to remain low for a long time. Also, I'm not at all convinced by the argument that manufacturers will sell electric cars direct to customers in future. This may be the case for niche cars, such as Tesla (I am currently short of this share), but for mainstream cars I think most people want a proper dealership where they can test drive, compare models, etc. Also, it's so exciting going to a car dealership, and choosing a car. I would always want that experience, as it's so enjoyable.

Although with much less to go wrong on electric cars (far fewer moving parts), then maybe that might put strain, longer term, on aftersales revenue/profit for dealerships?I'm not too concerned about that, as my interest is purely to hold my VTU shares until they re-rate to a more sensible valuation, then I'll move on to the next thing.

CAMB looks excellent value, and is well worth a look, in my view. Although note the divis are low, as it's concentrating on growth.

Speedy Hire (LON:SDY)

(at the time of writing, I hold a long position in this share)

This is getting ridiculous! Toscafund has issued yet another statement today concerning its imminent EGM (9 Sep). Today's comments from Tosca can be summarised as: my Directors are better than yours, so there!

For me, the crucial factor is that Tosca wants to push Speedy to buy the basket case competitor HSS Hire, which is loaded with huge amounts of debt. That's a complete no-no for me. I don't want Speedy to take on HSS's debt whatever the benefits of combining the two companies.

So I feel that Tosca's resolutions deserve to fail.

Koovs (LON:KOOV)

Share price: 64p (up 7.6% today)

No. shares: 149.7m

Market cap: £95.8m

Trading update - this online retailer is trying to become the Asos for India. I remain very cautious about this company, because it is still a million miles away from demonstrating that it has a viable business model.

The model Koovs has adopted is to throw huge amounts of money at marketing, in order to drive customers to its website. Marketing spend is the major issue that fashion websites have - barriers to entry are minimal, but you then have to spend serious marketing bucks in order to drive traffic to your website.

So whilst Koovs can publish exciting-looking top line growth figures, as it has done again today, the actual amounts are still very small. It only achieved £5m sales (tax inclusive) in the 4 months to 31 Jul 2016. Sure that's up 115% year-on-year, but is still tiny. Moreover, we're not told what level of marketing spend, nor overall losses, were incurred to achieve this fairly trivial level of sales.

Heavily loss-making, cash-burning companies like this are always reluctant to publish the figures that matter - losses, cash burn, and remaining cash. Sure enough, I can't see any of those key figures mentioned today by Koovs. Instead, a lot of other KPIs are given, which are largely irrelevant as far as I'm concerned.

One KPI which alarms me is that the company now has 10,100 product lines! So they must have a large warehouse full of stock, yet is selling only a small amount of it. That doesn't sound like good business to me, at all.

If you look at how successful online retailers have grown, e.g. Boohoo.Com (LON:BOO), they specialised in key product categories first, e.g. dresses. Then once critical mass had been achieved in sales & profitability, then gradually expanded the product ranges into other categories. This is the sensible way to do it.

Whereas Koovs has taken, in my view a potentially disastrous approach of trying to run before they can walk. The result is large, ongoing cash burn, and a requirement for more fundraising in future. Note this comment today;

Koovs continues with its phased capital raising to support the Company's three-year business growth plan.

I reckon they came close to failure with the last fundraising, it looked knife-edge stuff. Who's to say investors will be happy to continue pouring in more money? Existing shareholders are in a very risky position, facing continued, unknown extent dilution. I would never invest in anything like that, as it usually goes wrong.

Overall - if you like punting on blue sky stuff, then every now and then you might win big. However, in the vast majority of cases, the losses will be 90-100%.

Maybe Koovs will work out, who knows? All I'm saying is that, to date, there is no evidence to suggest this is going to become a viable business any time soon. It needs further cash to continue its high cash burn in the meantime, so people are really taking a big risk here.

I hope it works out for holders, but it's far too risky & over-valued for me. I'd rather stick with profitable, growth companies in this sector, which have already proven they are viable, and have no further funding requirement - e.g. Boohoo.Com (LON:BOO) and MySale (LON:MYSL) , both of which I currently hold long positions in.

A few quickies to round off with;

Belvoir Lettings (LON:BLV) -

I've reported reasonably positively about this franchised property lettings business. It's expanding by buying up smaller competitors. Interim results to 30 Jun 2016 are out today.

The figures look alright, but it's difficult to tell when a company is making acquisitions. So I look out for the crucial comments on performance versus expectations, which sound fine here;

"Belvoir is on track to meet its objectives for the year as we continue to make good progress against our multi-brand strategic plan."

That seems to be saying in line with expectations, just using different wording.

Broker consensus is for 9.1p in 2016, and 10.2p in 2017. At 133.5p per share, that works out at a PER of 14.7 and 13.1, which looks about right to me.

However, anyone considering a purchase should look at the balance sheet. It's really not good. As I mentioned here in my report of 7 Jun 2016, the latest acquisition was financed mainly using debt. So there is now a total of £14.4m in debt and deferred consideration combined. That looks a hefty amount for a business which seems to be paying out the bulk of its earnings in dividends.

So I worry that management may be trying to stretch cashflow too far - a cut in the dividend looks necessary to meet the cash outflows required in future years to pay down debt, and meet deferred consideration payments too.

Overall therefore, it's not for me.

Redstoneconnect (LON:REDS) - this company is basically the decent bits previously within the dog's breakfast of companies that used to be called COMS. It has new management, who I met fairly recently on a visit to their London office.

I was impressed with their strategy, and there seems to be good potential in a number of new software & services products, on a theme of "smart buildings". This covers many aspects of the building, from aircon, IT, access controls, management of hot-desking, booking of meeting rooms, you name it.

The company has existing outsourcing contracts with some seriously big clients, so the door is already ajar for it to sell new services into major clients. The contracts are typically long-term too, so revenue/profit should be decently predictable.

Today it says that trading for H1, to 31 Jul 2016 is in line with expectations.

I'm not sure how to value it, as the broker consensus shown on the StockReport looks a bit odd, with a PER of only 2.32. I'll see if I dig out some recent broker research, and will update if I manage to get hold of anything useful.

OK, all done for today! See you in the morning.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.