Good morning!

I had a second wind last night, and added sections on the trading updates from Latchways (LTC) and Filtronic (FTC) into yesterday's report, so here is the link if you wish to see that.

A quick recap on a couple of stocks I didn't like yesterday. One has plummeted, and one has gone through the roof, as follows;

Quindell (LON:QPP)

This share has come back from suspension today, following the barrage of negative newsflow yesterday, culminating in the announcement at 14:51 yesterday afternoon that the Serious Fraud Office is investigating "past business and accounting practices at the company". That's not exactly ideal news to come less than a couple of market trading hours before the shares returned from suspension this morning.

At the time of writing, QPP shares seem to have settled around 89p, with nearly 11m shares traded (I'm writing this at 09:18), which is a discount to the mooted 100p cash return to shareholders. That seems a reasonable price to me, given all the uncertainty. Will the cash return be approved by the Court, given the seriousness of regulatory investigations, and potential claims against the company? Who knows? Ask a lawyer!

Furthermore, sentiment will play a big part here. Who would want to hold a share where serious accounting irregularities & misstatements have not just been alleged, but have been admitted now? I can only think of two types of shareholder - firstly, the irrational PI fanatics who will blindly support the company whatever it does, and secondly, special situation investors, who have worked out the various scenarios and taken a punt based on what they believe to be the most likely risk-weighted outcome.

So the main issue is if, and when the cash return to shareholders might take place, and how much it is likely to be. My guess is that the amount of shareholder return might be scaled back from 100p to a lower figure, so that new management have plenty of cash headroom to deal with whatever else comes out of the woodwork, not to mention the likely considerable ongoing legal & accounting costs.

Tern (LON:TERN)

This micro cap's shares were 13.7p when I pointed out that its main investment was a dormant company when its last accounts were filed in Sep 2014. They are now 22.5p, up 64% in less than 24 hours!

So clearly in the short term, fundamentals don't actually matter with micro caps, since we're in a market where speculative forces can swish a share up to pretty much any price - especially since AIM shares have no minimum free float, so it's a doddle to "corner" a share price, as happened with GATE, which rose to an insane valuation, before being suspended.

AIM really needs to do something about this, as shares with minimal free floats can quite easily be manipulated to literally any price that the manipulator wishes to achieve, if they have deep enough pockets.

It remains to be seen whether Tern has anything of value. I can't see that they have, but in the meantime it's been a nice little speculation for people who took a punt on it. Anyway, that's gambling, not investing, so I shouldn't really have even mentioned this share in a value & GARP-focused report. So from now on, I won't mention this company again, as I don't think it's a serious investment at this stage, just a speculation.

Portmeirion (LON:PMP)

Share price: 935p (up 2.7% today)

No. shares: 10.7m

Market cap: £100.0m

I feel unclean after writing about those two companies above, so let's cleanse ourselves by looking at a profitable, dividend-paying company with a decent balance sheet!

Interim results to 30 Jun 2015 - these results look solid to me.

Revenue up 14% to £27.9m for the six months

Profit before tax up 45% to £1.8m

Strong order book for H2.

The last point is the most important, as Portmeirion has a heavy H2 weighting to its trading, since its pottery products are gift-orientated, especially its rather jolly "Christmas Tree" range which sells regular as clockwork in the USA.

The new kiln, which will enable them to increase production, is expected to be commissioned in Q4 of 2015, so that should facilitate further growth in 2016 and beyond. Hopefully there won't be any teething problems. I imagine it will also be more efficient, in terms of energy consumption.

Outlook - as usual with this company, it all sounds solid;

As ever, our second half year remains key to our full year performance; we are ready. Our brands, quality standards, people, production facilities, logistics, designs and finances are all in good order.

Balance sheet - very strong, no issues here, other than a small £3.7m pension deficit, which is annoying, but as we saw with AGA recently, even a humungous pension scheme won't stop a determined acquirer from buying the business. Note that Portmeirion's pension deficit, whilst small, is consuming £800k p.a. in overpayments, so about 10% of cashflow, therefore it shouldn't be disregarded altogether in valuing the company.

Valuation - is probably about right, on a PER of about 15 and a dividend yield of 3.1%.

My opinion - I really like this company, but don't currently hold because I felt there were better opportunities elsewhere. However, as a long term, tuck away and forget share, this one ticks a lot of my boxes, so it's something I'll probably add back into my portfolio at some point in the future, maybe on a market correction.

Proactis Holdings (LON:PHD)

Share price: 91.2p (up 0.2% today)

No. shares: 39.4m

Market cap: £35.9m

(at the time of writing, I hold a long position in this share)

Trading update - for the year ended 31 Jul 2015. I mentioned this share in Monday's report (3 Aug 2015), as it appeared in the Midas column of ThisIsMoney, so for some reason the company/advisers decided to alert some investors a few days in advance that it was doing well. I don't really agree with that - news should not be pre-released via PR and the press. The rules are supposed to be that everyone gets news at the same time through the RNS.

Anyway, the news reads positively, with the key section of today's announcement saying;

The Group confirms that results are expected to be in line with expectations, with revenues increasing by c.69% to approximately £17.2m (2014: £10.2m) and adjusted1 EBITDA increasing by c.130% to approximately £4.6m (2014: £2.0m). The Group signed 39 new name deals during the year (2014: 38) and, as with the prior six months, initial contract values, upgrade business, order book and pipeline for further new deals remain very encouraging.

What a pity the company followed the horrible current trend for software companies to focus on EBITDA - a meaningless, inflated version of profit. Although Midas refer to £2.9m proper profit this year being forecast, and I've confirmed that figure elsewhere too.

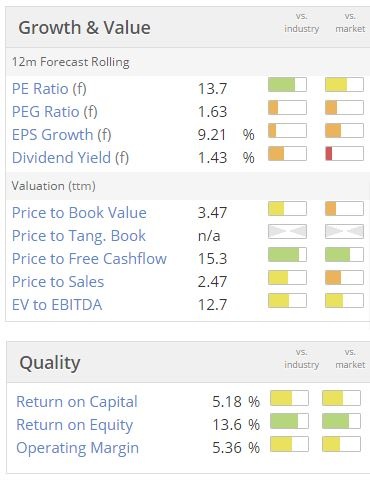

Valuation - if you regard this is a sexy growth company, which I think it is possibly becoming, then the valuation looks good value, on a fairly modest PER;

Note the "n/a" next to "Price to Tang. Book" - this is a quick way to check if any company has a Balance Sheet with positive net tangible asset value. If there's a "n/a" here, then it means NTAV is negative - which is technically a fail of one of my key balance sheet tests (although I break my own rules if the company impresses sufficiently in other areas).

Note also there is a smallish dividend yield.

My opinion - I bought into this company after ditching my Tungsten (LON:TUNG) shares a while ago, and trawling the market for something operating in the same area, but cheaper & less cash burning.

So imagine my surprise when I found Proactis were developing a very similar early payment system for suppliers on its own e-invoicing & spend control platform, and whilst smaller than Tungsten it actually already makes a profit! Plus it's reasonably priced on current forecasts, and is putting out positive trading updates. So what's not to like (apart from the balance sheet)?!

This share won't appeal to everyone, but I think it looks potentially interesting, as a GARP candidate. Things I dislike are the weak balance sheet, and the lack of market liquidity in the shares - so it can have a nasty bid/offer spread.

Also the historic performance doesn't really look that great, it's more about the outlook for the invoicing & payment network that they are building - that's the exciting bit. Also, I am impressed by their clients, shown on their website - it seems to have quite a big public sector focus at the moment, but not exclusively by any means, as you can see from the "some of our customers" logos which I've copied from their website - presumably these organisations have given their consent for their logos to be used on Proactis's website?

(although someone probably ought to give Proactis a nudge to remove Afren's logo)

Any views on this company? Please add your comments below - as usual I like to hear both bullish and bearish comments.

Trakm8 Holdings (LON:TRAK)

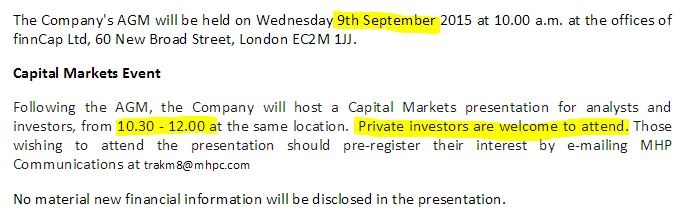

Investor presentation - this is worth a mention, because it's great to see companies which seek to engage with investors of all types - not just institutions, but private investors too. I firmly believe that small caps need a balanced mix of institutional investors, and a healthy private investor base too - after all, it's private investors who create market liquidity in small caps, narrow the bid/offer spread, and set the share price. So it's amazing how many companies and advisers completely ignore this vital section of small cap market participants, or only seek to engage when they have an ulterior motive (such as wanting to create some temporary buying interest).

I try to assist in building relationships between companies/the City, and private investors, so am happy to pass on this invite from TRAK to investors who wish to find out more about the company, and meet management.

It's an excellent company in my view, and wish I'd bought shares in it (tried to buy at 19p a few years ago, but there were no shares available, so that was a 9-bagger that got away!)

Matchtech (LON:MTEC)

Share price: 561p (down 4.1% today)

No. shares: 30.4m

Market cap: £170.5m

Trading update - for the year ended 31 Jul 2015.

No surprises here, with the key sentence saying;

The Group expects profits to be in-line with current market expectations, including a maiden four months of contribution from Networkers International ("Networkers"), which was acquired on 2 April 2015.

The update then presents a sea of figures in tables, covering net fee income, staff numbers, etc. Drawing out a few points;

Net fee income at Matchtech grew at 2% in H1, slowing to 0% in H2, so a negative growth trend there.

Staff numbers (i.e. its own employees) seem to have dropped sharply at Matchtech, reducing from 410 at end H1 to 344 at end of H2. This is due to the closure of its Barclay Meade subsidiary in London (loss of 28 jobs), and the sales headcount being reduced elsewhere by 33, the reason given being;

Investment in headcount at the end of last year and in the first half of this year did not translate into an expected increase in client demand.

So the company has reduced its costs in order to meet profitability expectations for the year, which is a little disappointing, but I suppose there's no point in maintaining an excess selling overhead if the demand isn't there from customers to justify it.

Networkers - this company was separately listed, but was acquired by Matchtech on 2 Apr 2015, so four month's figures will be included in the results for 2014/15, then a full year's results for 2015/16. This is why analyst forecasts show a big jump in EPS for the current year which has just started.

Fee income is reported as being flat year-on-year, and a comment is made that Networkers has traded in line with expectations.

Some positive comments are made about the integration of Networkers;

The integration process has started well and the Board is increasingly confident of achieving its targets for overhead savings by the end of FY 2016. This is expected to entail exceptional integration costs of around £1.0m in FY 2015, and a similar amount anticipated in FY 2016.

In addition, the Board has accelerated its plan to integrate certain sales teams. In particular, with effect from 1 August 2015, the IT businesses of Matchtech and Networkers will have a common leadership and Networkers' engineering business will join Matchtech's equivalent business.

I'm encouraged by this. As I commented at the time, these two businesses seem a very good fit. So it's pleasing that synergies are being achieved. The one-off costs are not important in terms of valuing the business.

Net debt - this has risen to £35.5m, as half of the acquisition price for Networkers was funded by new debt. I reported on the combination of Matchtech & Networkers in detail here.

I read some commentary in a magazine suggesting that the debt taken on is somehow a problem. I think that's a complete red herring. The combined business looks comfortably able to handle this level of debt, and it's not excessive at all compared with some recruitment companies, where bank debt is common to finance the debtor book, often through invoice discounting facilities.

Outlook - it sounds as if H1 of this year is going to be relatively flat, as the company today says;

Looking ahead, the Board's plan is for Group NFI to return to growth in the second half of the 2016 financial year, with further growth over the medium term.

My opinion - I think this is a nice long-term hold - it seems a well-managed, specialist recruitment group. There's nothing madly exciting in today's update, and I can see why the shares have come off a little.

Overall I think it looks priced about right at the moment, but I reckon there's a good chance that the combined businesses could out-perform against forecasts with a bit of patience.

I would say that there's not really a lot of difference between many of the listed recruitment companies, so everyone has their own favourite, but personally I would rather go for a medium-sized one like this, where there's less risk of something going horribly wrong. Some of the very small recruiters look over-priced to me, as they really should be priced at a discount, but often aren't.

That's me done for today, and yay I hit my 1pm email deadline for the first time in ages!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PHD and MTEC, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only. They are NEVER recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.