Good morning!

Indigovision (LON:IND)

Share price: 357p

No. shares: 7.6m

Market Cap: £27.1m

Trading update - Scottish CCTV company IndigoVision has issued an update this morning for the extended 17-month period to 31 Dec 2014. Sensibly, the year end has been changed from a totally illogical 31 Jul to 31 Dec, a move which was planned well in advance (so not suspicious in any way). The 31 Jul year end was a nightmare, since the company was trying to close deals when its customers were on holiday! Whereas most companies wind down for a 31 Dec year-end, so now IndigoVision has joined them.

I'm pleased with the speed of the announcement today, which indicates good financial controls are in place.

Sales growth - this was last reported (for the 15m to 31 Oct 2014) at +9% to £43.4m. Today the company updates that sales were +10% for the 17m to 31 Dec 2014, so that's moved in the right direction, slightly. The company is now (as previously announced) reporting in US dollars, so sales were $82.5m for the 17-months.

Translated into sterling at today's date, that is £54.1m, which is £0.1m ahead of the original broker forecast for this year (before the profit warning on 11 Nov 2014). Although recent dollar strength has helped push the sterling number up.

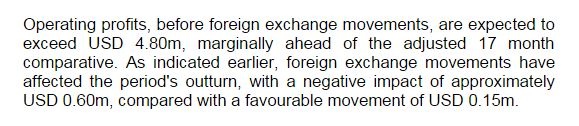

Profitability - the company had already warned that this period's profits would fall short, but didn't quantify that in the trading update of 11 Nov 2014.

Today the company says;

My initial reaction was pleasantly surprised by this. Given that the company had warned on profits a few weeks ago, reporting today that they are slightly ahead of the prior period is not a bad outcome at all. It's not a barn-storming success either, but in the context of a market cap of only £27.1m, these numbers are reasonable.

$4.8m profit for the 17 months works out at £3.15m profit (using exchange rate today of £1=$1.524). That compares with £2.71m reported (also at constant currency) for the 12m ended 31 Jul 2014. So there's been a slowdown in profits in the 5-months to 31 Dec 2014, which looks to have been profitable by about £0.44m - not very good, but not a disaster.

Regional differences - having had a quick chat with the company today, they are frustrated that a sudden & sharp downturn in business in S.America (not helped by the World Cup shutdown), and Asia this autumn turned what would have been an excellent period into a reasonable but not madly inspiring period.

Gross margins - margins are not mentioned in today's update, but there hasn't been an issue here in the past - it fluctuates between 50-60%, depending on the sales mix. The company reported a 57.6% gross profit margin for the year to 31 Jul 2014, so it's an operationally geared business - high gross margins, combined with large, lumpy sales contracts, is a recipe for volatile profits I'm afraid, that's just the nature of the beast.

My opinion - I've checked whether IND has much exposure to the oil & gas sector (which has hit competitor Synectics (LON:SNX) very hard), and the answer is that they don't have over-reliance on it, it's just one sector of several that the company serves.

Overheads - the company is taking a cautious approach to any further increases in overheads.

Sales lumpiness - the company is pushing its mid-market product range, which should help sales become more predictable (i.e. more frequent but lower value sales, hence more predictable). Large one-off projects are now seen as the icing on the cake, rather than being vital to achieving or missing forecasts, as has happened in the past.

Overall - the company is trading well in N.America, and Europe/M.East/Africa. Sales growth of 30% and 19% respectively for the 17m period to 31 Dec 2014 are impressive. That was diluted by weaker performances in Asia towards the end of the year (but still up 11% overall for the 17m). However, it was a 20% drop in Latin American sales which put the dampener on the results for 2014.

The company is pushing hard on lots of fronts, with new products, better sales teams, improved product quality, better marketing, etc. Management sound upbeat, the company's profitable, and has a bullet-proof Balance Sheet, so things could be a lot worse. They also pay nice divis!

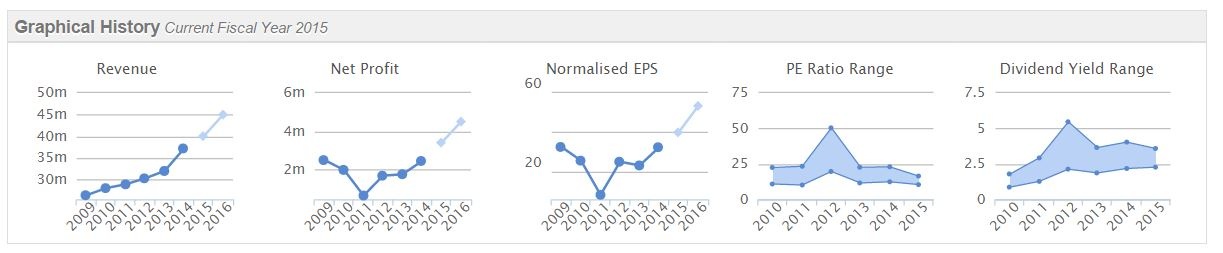

If you look at the historic track record, it's actually been quite good. However people perceive IND as a serial disappointer, because it tends to repeatedly look like it's taking off strongly, only to slip back again. Yet these graphs below from Stockopedia are far from shabby for a £27m market cap company (although I would need to double-check the lighter blue, forecast blobs);

The shares are likely to remain a bit of a rollercoaster, as sales growth ebbs & flows. However, people who had the foresight to buy the dips when everyone else is feeling gloomy, and sell when everyone else is feeling excited, would have done very well out of this share.

I would say we're probably a lot nearer to a buying point, than a selling point, looking at this chart, and taking into account the fundamentals;

Churchill China (LON:CHH)

Share price: 595p

No. shares: 10.9m

Market Cap: £64.9m

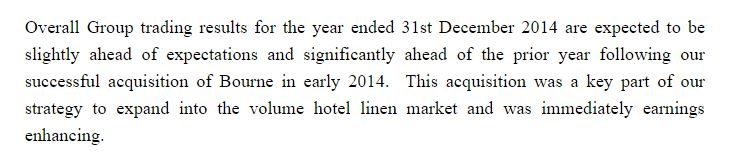

Trading update - an impressive trading update has come out today from this British manufacturer of ceramic crockery, mainly for the hospitality sector. The key bit says;

Valuation - let's try to quantify this. The company did 25.0p normalised EPS in 2013. Current broker consensus is for 27.9p this year. So they say "ahead" of 27.9p, and "significantly ahead" of 25.0p. Hmmmm, I'm thinking 30-32p perhaps for 2014 EPS then?

That equates to a PER range of 18.6 to 19.8 times, based on the current share price of 595p. Not exactly a bargain.

I mentioned in my report of 27 Aug 2014 that the broker forecast for 2014 looked too conservative, and that I was expecting to see a modest upward revision to about 30p. Pity I didn't buy any shares, as they have risen 29% since then!

My opinion - nice company, and it's trading well, with that likely to continue. It scores a high 95 on Stockopedia's StockRank system. The Balance Sheet is strong too, and there's a reasonable divi yield. I don't see obvious value at the current price, it looks priced about right, or maybe a touch expensive.

Trouble is, I always say that, and it keeps going up even more! I'm not going to chase it at this valuation, but well done to people who held. Maybe it's better sometimes to just pay a bit more than you're comfortable with initially, and then hold long term as the company grows into the valuation?

Johnson Service (LON:JSG)

Share price: 63.8p

No. shares: 300.0m

Market Cap: £191.4

Trading & strategy update - this textiles hire & dry cleaning group today updates positively;

We already knew that results would be significantly ahead of last year, due to the acquisition, so that can be disregarded. So the new news is that they're "slightly ahead of expectations" for calendar 2014.

Valuation - broker consensus is 5.16p EPS, so slightly ahead probably means 5.2 to 5.3p I would guess. At 63.8p that puts the shares on a PER in the range 12.0 to 12.3 - reasonably good value, although there is some net debt too, reported at £29.0m today, so that's 15.2% of the market cap, or 9.7p per share in net debt. When you adjust the PER to a cash/debt neutral level, then it's going to be c.13-14, which is probably about right for a business of this nature.

Strategy - I like this. They are set to close about a third of their shops (on lease expiry), and instead are opening collection/drop-off points in Waitrose & doing more collections from customers, and offices. That should increase margins, and make the business more flexible to economic downturns.

My opinion - it looks a reasonable business, on a sensible valuation, with a good stratregy. It's not cheap in my view, but I could see these shares continuing to be a steady performer over the next few years - the sort of share that could go up maybe 10-20% each of the next 2-3 years perhaps, and pay a 2.5% divi on top, which isn't bad going.

Note from the chart below, how this share has shrugged off the small cap malaise, and has continued gently rising this year.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in IND, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.