Good morning!

Greece yet again dominates the agenda, with the surprise "No" vote in their referendum yesterday. The Futures were indicating a 2% sell-off today in the UK, but as it's turned out, the FTSE 100 is currently down only 50 points, less than 1%, which is well within the range of normal daily movements.

The Greek finance minister seems to have been pushed out this morning, and I've read soothing comments from Germany, saying they won't leave Greece in the lurch, so from what I can gather, those two things seem to have calmed the stock market. Although there are only small volumes traded in the small caps which I monitor, suggesting that most investors have discounted the Greek situation already, and are not inclined to panic sell on bad news any more.

So perhaps Greece is now subject to the law of diminishing returns, in terms of its impact on UK shares? I do hope so anyway, as the whole thing is now beyond ridiculous, having dragged on for what, seven years now?

The market crash in China doesn't seem to be bothering anyone here either, probably because it's a fairly self-contained & over-valued market, which went on a speculative bubble of its own, that is now unwinding with a crash.

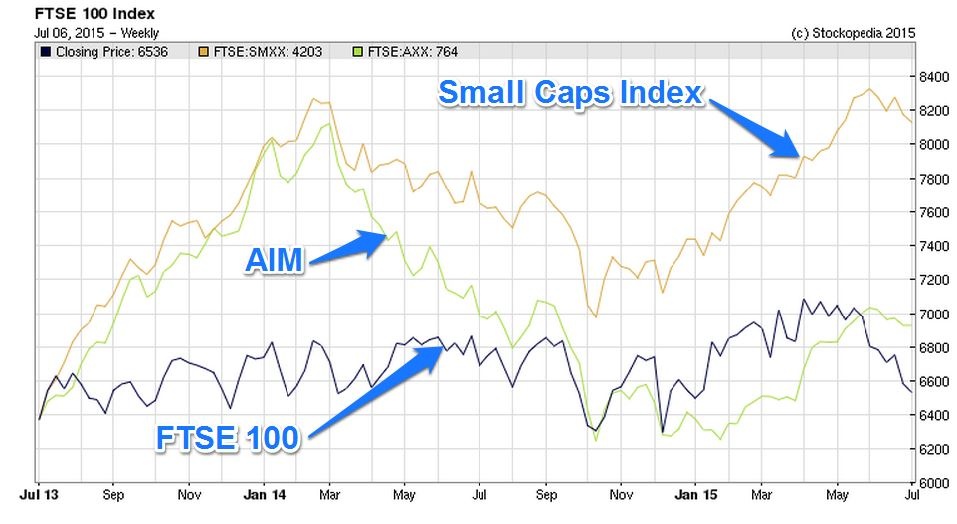

So against all this kerfuffle, our market seems to be holding up pretty well. Although the FTSE 100 looks weak, the small and mid cap indices are actually quite strong at the moment - as you can see from the two year chart below - so certainly in 2015, small caps have been the right place to be, after a poor 2014:

Trakm8 Holdings (LON:TRAK)

Share price: 179.5p (up 2.3% today)

No. shares: 28.9m

Market cap: £51.9m

Final results y/e 31 Mar 2015 - I'm really impressed with these figures, from this small telematics group. Turnover has risen 94% to £17.9m, although it's worth noting that some of this increase is due to an acquisition in Oct 2013 (called BOX) contributing a full year's figures to the latest results, whereas it only contributed half a year in the prior year group results.

The narrative points out that organic revenue growth was 73%, which is extremely impressive. The gross margin has fallen considerably though, from 57.2% to 45.2%, which they say is due to the greater contribution from BOX, which achieves lower margins than the rest of the group. Also it's worth noting the management comments about competitive pricing pressure, so it seems to me this is very much a sector where companies have to run to stand still, and constantly innovate with new, improved products, if they want to survive and prosper.

On the other hand, once customers are signed up, then TrakM8 receives a reliable stream of recurring revenue, so quite a nice, predictable business model.

It's good to see that the group also has some overseas sales, although these are very small, with UK being 93.5% of turnover.

Profitability - operating profit before exceptional costs rose from £863k last year, to £1,760k this year, a rise of 104% - very impressive! There are no exceptional costs this year, but £433k for last year, so comparisons below this point on the P&L cease to be meaningful for this reason.

Valuation - diluted EPS rose from 1.9p to 5.48p, so a huge % increase. At 179.5p the shares are rated at 32.8 times, which obviously is a rich rating, but given the very strong organic growth, a high rating looks justified - providing strong growth is likely to continue of course, as valuing companies is all about predicting the future.

The company flags adjusted EPS of 6.24p in the highlights section, with the main adjustment being share based payments. This is a personal judgment, but in my view share based payment is remuneration, so should not be adjusted out.

Development spending - as has been noted before, TRAK capitalises a hefty chunk of development spending. The cashflow statement shows that £862k was capitalised in 2014/15, which is material to these results. The amortisation charge (which I assume only relates to development spend) was £517k, so the net boost to profit in 2014/15 from this accounting treatment (as opposed to expensing all development spend) was £345k - not massively material, so that's fine I reckon.

Taxation - note that corporation tax appears to be minimal at this group. This could be because they utilise R&D tax credits, but I'd like to get additional comfort on this - as a minimal tax charge is an amber flag that profits may not be real. There was a £75k negative tax charge in 2013/14, and only a £13k tax charge in 2014/15.

I can understand that the tax charge might be a lower rate, due to R&D tax credits, but to eliminate tax altogether seems surprising.

EDIT: I spoke to management about this issue today, and they explained it was due to b/fwd tax losses being utilised, particularly at BOX. Also, they submitted a substantial R&D tax credit last year, as I suspected. So mystery solved!

Balance sheet - this looks OK overall. Net tangible assets comes out at £3.4m.

The current ratio is fine, at 1.61.

Note that there is £2.8m of bank debt, but at the year end date this was more than offset by £3.4m of cash. Presumably the cash is at a seasonal high on the balance sheet date, as otherwise they would have paid off the bank debt, because running cash balances and bank debt at the same time is obviously inefficient in terms of interest cost, unless there's an interest offsetting arrangement.

Tha bank facilities are new, with HSBC, for a 5-year term loan of £3m, and an (unused) three year revolving credit facility of £1m. A further £2m bank facility seems to have been agreed post year end, for selective acquisitions.

I'd say the balance sheet has probably been geared up enough now, and that TRAK should look to raise some fresh equity for any further acquisitions - which makes sense too given that the share price is so buoyant.

DCS Systems - was acquired for £3.3m post year end. TRAK mentions a fragmented market, and that it is a consolidator.

Broker forecast - new forecasts out this morning from FinnCap pencil in 11.0p adj EPS this year, and 15.4p next year. If accurate, then this would put the shares on a PER of only 11.7 times next year's earnings, which seems a modest rating for a growth company.

My opinion - this is a quality company, with good management, in my view. So longer term, I suspect it is likely to be one of the winners in this sector, due to innovative products.

The price looks up with events for now, in my view. However, if future progress continues to be as impressive as now, and broker estimates are achieved or beaten, then the shares could keep rising, as profits grow rapidly. The Directorspeak today sounds positive, with talk of a strong pipeline, numerous customer trials, etc.

The big danger with a highly rated growth share, is that if something serious goes wrong, causing growth to stall, then it's a long way down, as the rating is adjusted from a PER in the thirties, to one in the low teens, if a bad profit warning were to occur. Although that risk doesn't seem likely here, it's always important to bear in mind as a potential risk.

As things stand though, I could see further upside on this share. So if I held (which I don't), I'd probably be tempted to sit back and enjoy the ride, rather than cashing out at this point. FinnCap's target share price of 220p looks achievable, in my opinion.

ATTRAQT (LON:ATQT)

Share price: 58.5p

No. shares: 20.6m

Market cap: £12.1m

Trading update - this is an interesting, tiny company (too small to be listed really). I visited the company and saw a product demo for its online merchandising software last year, and was very impressed. There's no doubt it has an excellent, niche product, which helps online retailers improve their sales by better display of product online, and searching. The client list is impressive, so the product undoubtedly works, and generates predictable monthly recurring revenues.

The company today reports good growth, and that it is "on track to deliver results for 2015 in-line with market expectations".

Forecasts are currently for a £0.9m loss this year, and a £0.3m loss next year, so it's still a little away from being commercially viable.

My opinion - I like the potential here, in particular as I think management are capable of running a much bigger business. So this could be one to watch for the future. Although the market cap of £12.1m is perhaps a tad too high for where things are right now?

Funnily enough, it reminds me a bit of TRAK - where I had a call with management a couple of years ago (when the shares were only 19p), and I remember being very impressed, thinking that they seemed high calibre people who could & should be running a much bigger business. Sadly I wasn't able to buy any stock in TRAK at 19p, as it was totally illiquid, but it's nearly 10-bagged since then.

So spotting good management when companies are too small to be on the radar, is an interesting angle on micro cap investing.

Monitise (LON:MONI)

Share price: 10.6p

No. shares: 2,163.6m

Market cap: £229.3m

Trading update - this stock has been a disaster for investors. It's the usual story - a blue sky, cash-burning business model, followed by a gradual loss of investor confidence, as profitability looked too far off, or even impossible to achieve.

However, reality seems to be dawning on the company, and the new CEO (from Mar 2015, Elizabeth Buse), costs are being reduced. Today's update says that H2 costs will be "materially lower" than H1 (note that it has a 30 Jun year end).

The company reiterates its target of achieving EBITDA breakeven in 2015/16, and proper profitability thereafter.

Gross cash was £88.6m at 30 Jun 2015, but they don't say what net cash is, so that would need checking.

Also I wonder how much of the remaining cash will be left by the time (if!) they achieve breakeven. Probably not much, as cash burn has been prodigious in the past.

My opinion - overall it looks very high risk still, but maybe there are the first signs that something viable might be created here in the long run, who knows?

Vislink (LON:VLK)

Shareholder action group - it seems that the shocking greed of Vislink Directors, in trying to get through an incentive scheme which would give them about 15% of the upside from a modest hurdle of the market cap, has already backfired spectacularly.

Shareholders are up in arms about this hare-brained plan. One of the ShareSoc Directors, David Stredder, has set up a page where Vislink shareholders can register their view, and I know he is keen to tackle the company with this, once support has built. So far there is a 100% No vote, against the plan.

Excessive Director remuneration is a big problem with corporate Britain, and elsewhere, yet they keep pushing pay packages up & up, on an endless ratchet. Tame Non Execs, and consultants paid handsomely to rubber-stamp remuneration packages, are just facilitators for pure greed, in my view.

The scheme proposed by Vislink Directors is one of the worst I've ever seen. It should be rejected by shareholders, and I would go further and kick out the Executive Chairman too, who has a history of lining his own pockets at the expense of companies he works at.

He only works part-time at Vislink too, yet takes an excessive remuneration package, and now wants even more, potentially substantially more, under this new scheme.

David has also spotted that in the last Annual Report, on page 52, that the Chairman apparently not being paid a bonus in the table of remuneration is misleading, as the notes then go on to say that he received £304k which was paid direct to HMRC for an outstanding tax liability. So to my mind, that should have been shown in the remuneration table, and would have taken his package from £438k to an astonishing £742k.

It's a disgrace in my view, so if you are a Vislink shareholder and you agree with me, then the link for the action group is here.

Revolution Bars (LON:RBG)

Share price: 205p

No. shares: 50.0m

Market cap: £102.5m

Trading update - for the year ended 30 Jun 2015.

LFL sales rose 3.0%, with total sales of £111.8m. Profits are expected to be in line with expectations. The Directorspeak mentions new sites being opened later this year.

Valuation - Stockopedia shows that broker EPS estimate for the year just finished is 12.7p, rising to 14.4p for 2015/16. That translates into a PER of 16.1 and 14.2 for the relevant years.

My opinion - I can't really comment properly, as I've not seen the balance sheet, so you can't value a company sensibly without knowing what its net cash or net debt position is. Although generally speaking I would consider a bars business to be poor quality - they tend to require heavy ongoing capex, there's lots of competition, lots of leakage of cash & stock, lease terms can be onerous, and bar groups often go bust.

Add to that the fact that this is a recent IPO, coming to market in Mar 2015, so it would be interesting to find out how much cash the previous owners took out, and why they sold. I very much dislike recent floats, as there's usually something wrong with them - over-priced, and/or something wrong with the outlook which drove the previous owners to seek an exit.

Billington Holdings (LON:BILN)

Share price: 256p (up 16% today)

No. shares: 12.9m

Market cap: £33.0m

Trading update - a smashing update from this structural steel company today, saying that H1 will be "significantly ahead of current market expectations".

I note that broker consensus EPS forecasts for 2015 have steadily risen from 13p to 15.5p in recent months, and it sounds like they'll be well ahead of that - maybe 20p could even be on the cards, at a guess?

The company seems to have net cash too, so an ungeared balance sheet.

I tried to buy some stock in this company last year, but the free float is so small that I found it totally illiquid. Pity, as it looks a nice little company, that is performing well. I do wish companies would ensure that they at least have some liquidity in the market, otherwise there's not a lot of point having a listing!

Velocys (LON:VLS)

Suspension of CEO - quite an intriguing announcement today, which I wondered might present a buying opportunity? The shares are down 16.5% to 96p today, on news that the CEO has been suspended pending an investigation into allegations of serious misconduct. Sounds ominous.

However, the company then says that, "the allegations do not involve any element of fraud or financial impropriety".

So that probably only leaves bullying of staff, violence, or sex. I wonder which it is? Maybe he's done a Jeremy Clarkson, and hit someone who didn't serve up steaks at the appropriate time?

The company seems to be a jam tomorrow type of company - heavily loss-making, so it wouldn't interest me anyway, as I always lose money on this type of share when I get sucked in by a good story. Still, it was worth checking.

I suppose if you like the company, and think the CEO is readily replaceable, then it might be a buying opportunity?

That's it for today!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only, and should never be misconstrued as investment advice).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.