Good morning! I note the very large movement in the Euro against sterling this year, so am having a think about how this might affect the companies in my portfolio (chart courtesy of IG).

The impact of a weaker Euro on UK shares seems to mainly be a case of profits from European subsidiaries translating into a lower sterling profit. Also it makes life more difficult for UK exporters into Europe, as either their selling price in Euros has to go up, or the profit margin has to shrink (or a bit of both).

UK importers however will be able to buy cheaper products from Europe - so that maybe will help supermarkets' margins? If readers can think of any other particular beneficiaries or victims of recent, large currency fluctuations, then do please add your comments in the comments below.

AGA Rangemaster (LON:AGA)

Share price: 103.5p

No. shares: 69.3m

Market Cap: £71.7m

Full year results for calendar 2014.

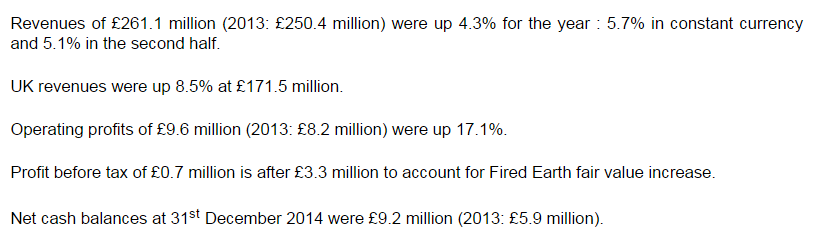

The highlight bullet points look encouraging;

However, none of that really matters a great deal, because AGA is really a giant pension fund, with a small business struggling to service it.

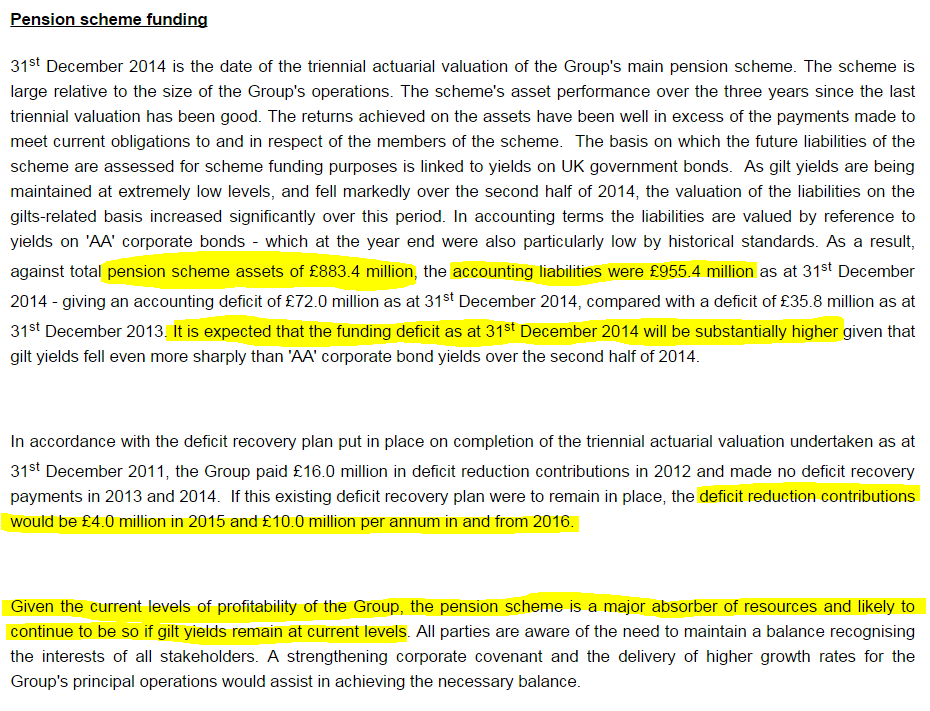

Pension deficit - here is the whole section of today's report on AGA's pension fund issue. Note the sheer size of the pension fund, which dwarfs the company. Plus note that the existing recovery payments will likely consume ALL the company's profits from 2016 onwards:

Remember that the accounting valuation of pension deficits produces much lower deficits than the actuarial method of valuation, so it's a tricky area for investors - the deficit showing on the company's balance sheet can just be the tip of a much larger iceberg.

Dividends - can't be paid, without the agreement of the pension fund trustees. Therefore that means there is no realistic prospect of shareholders receiving any divis for the foreseeable future.

My opinion - given the enormity of the pension scheme problem, and the knock-on impact of that meaning no divis are likely, then it makes me wonder what value (if any?) to put on the shares in this company? As things stand at the moment, the equity is worth very little I would say. So the only value is if you start making assumptions for what might happen when interest rates rise, and the pension deficit should then greatly reduce, or even swing into a surplus, who knows?

So any analysis that talks about the PER, and future EPS etc., is meaningless without considering what is likely to happen with the pension deficit. IF the deficit disappears over the next couple of years, then you could start to value the shares on a conventional basis.

Personally, I'm not an expert on pension deficits, so it would be little more than guesswork for me to forecast what's going to happen here. The shares are reasonable value if you totally ignore the pension deficit. So 9.4p adjusted EPS for 2014 puts the shares on a PER of 11.0 times. Trouble is, all the earnings are required to plug the gap in the pension fund.

What happens if interest rates don't rise? What if we end up in a Japan-type scenario where interest rates stay low for 20 years? In that scenario Aga shares would effectively be worth nothing. I can't see the point in taking that risk, when you don't have to. Put it on a PER of say 4, and that might better reflect the current risk/reward re the pension fund - so I'd start to get interested if the shares fell to about 38p. At 103.5p the share price seems nowhere near to a sensible risk/reward level, in my opinion.

Cambria Automobiles (LON:CAMB)

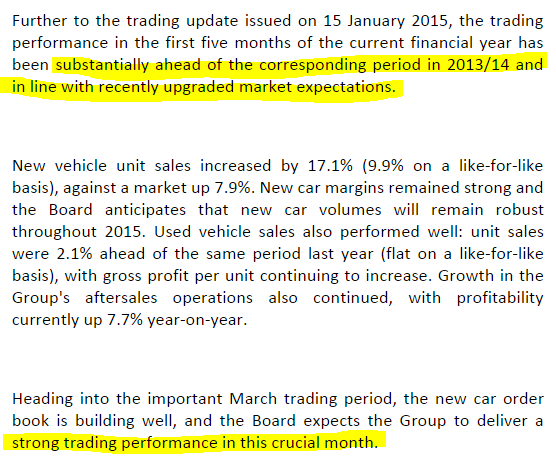

Trading update - things are going well for this growing chain of car dealerships;

Thinking about exchange rates, the considerable weakening of the Euro versus sterling should be good for car dealerships which import European cars, as they should be getting cheaper, thus allowing car dealerships to pass on price drops, and improve special offers to entice customers.

Dealerships also benefit from after-sales servicing, and warranty work, since most buyers of new cars tend to have the vehicle serviced by the original dealer for the first 3-5 years of ownership.

My opinion - so why aren't shares in CAMB and other dealers going through the roof? Possibly because they are enjoying such favourable conditions, due to ultra-low interest rates, and now cheaper imports too, that some shareholders think they must be at or near the top of the cycle for earnings. For that reason I think it probably makes sense not to get too carried away with valuations in this sector. A PER of sub-10 makes sense if earnings growth is likely to be very difficult to achieve in future.

On the positive side, most people I talk to feel that management at CAMB is strong, and that the company can grow earnings through acquisitions. It also has a nice balance sheet, with lots of freeholds, which over time should give a competitive advantage & upside from properties rising in value.

CAMB seems to be on a forward PER of about 10, which taking into account the favourable cyclicality at the moment, is probably about right. The divi isn't much, at only 1.3% yield.

Athelney Trust Closed Fund (LON:ATY)

Final results - as usual this tiny investment trust's results statement is of interest and amusement purely for the outspoken views of its Chairman, Mr Hugo Deschampsneufs.

He is, as ever, clearly relishing his six-monthly soapbox moment, to ramble on about politics, short selling conspiracy theories, Tescos, and assorted other matters that have rattled his cage in 2014.

Still, all great fun! The fund seems to make steady returns from boring, value shares. Nothing wrong with boring of course, I use that word as a compliment when it comes to shares, as it usually means cheap! Although a lot of the shares he mentions this year are cheap for a reason.

Snoozebox Holdings (LON:ZZZ)

(at the time of writing I hold a long position in this share)

Update - a couple of interesting snippets in today's update from Snoozebox. It has been selected by Ealing Council to create some modular housing, in conjunction with Mears (LON:MER). That's quite interesting - maybe there is potential for JVs to help create affordable housing? ZZZ has lots of experience in this area, having pioneered portable accommodation for several years now. Semi-permanent sites appeal in that they are steady revenue earners, as opposed to events, which only generate a few days' income. Although the daily room rate on semi-permanent sites is very low compared with events.

Got to dash, yet another lunch in the City beckons (that's 4 this week!). I could get used to this - working in the morning, then lunching in the afternoons!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ZZZ, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.