Good morning!

Chinese tourists

Amazing statistic for the day - Chinese tourists spent $215bn on outbound travel last year, up a remarkable 53%. Let's hope the UK authorities have ditched the expensive & bureaucratic visa requirements previously in place. We need to get a decent slice of that tourist revenue, even though it will make it easier for spies to visit us alongside the tourists.

So the outlook for London hotels is probably good.

Holiday

Talking of overseas travel, I am off to Abu Dhabi tomorrow morning, for a week of sunshine, swimming, good food, reading, and partially-relaxing. These reports will continue as usual. As it happens, the time difference is ideal - 3 hours ahead of the UK, so I'll be able to get up at 10am AD time, which will be 7am UK time. So these reports might even improve whilst I'm away! I'm really not a morning person, and my brain is usually only fully operational by about 10-11am.

Yesterday's report

I reviewed a few more companies yesterday evening, being:

Best Of Best (LON:BOTB)

Robinson (LON:RBN)

Costain (LON:COST)

So if you wish to see my thoughts on those, here is the link to yesterday's full report.

I also briefly looked at the acquisition made by Portmeirion (LON:PMP) but didn't write anything about it. The deal seems entirely sensible to me, as expected from sensible management. I'm regretting having sold my shares at around 1100p, and might buy them back on any dips in future.

ISA millionaire - new eBook

Probably the best article ever written on Stockopedia was from my friend Leon Boros, explaining how he had built up his ISA to over £1m.

Leon has now published an eBook through Stockopedia, updating everything. I haven't read it yet, but it's on my reading list for next week, on the beach. Here is the link to download Leon's new ebook.

There are lots of commentators on shares, but the best ones to listen to are people who have actually made a lot of money over the long term.

Not much news today, but let's look at what there is:

T Clarke (LON:CTO)

Share price: 87.25p (up 3.3% today)

No. shares: 41.8m

Market cap: £36.5m

(at the time of writing, I hold a long position in this share)

AGM trading update - this building services group has a 31 Dec 2016 year end, so today it updates on the first 4 months of this year, as follows:

Trading for the year to date is in line with the Board's expectations, with our revenues to the 30th April 2016 standing at £78 million (30th April 2015 £72 million).

So turnover is up 8.3% so far this year. This compares favourably with broker consensus of a 3.1% increase in turnover (to £250m) for the whole of 2016.

The order book is also up, having risen by 10% to a record £330m. Good stuff.

This year's revenues look to be mostly in the bag:

The Board believes that our expectations for the Group's annual revenues will be met for the current year. The majority of the Group's businesses have secured revenues in excess of 85% of their targets. Looking forward, 45% of forecast revenues have been secured for 2017 and a further £38 million for 2018 and beyond.

We remain confident about the progress we are making. We are seeing margin improvements across the Group and we will continue to target opportunities to match our planned capacity and resources with a focus on projects which will further improve the margin profile of the business.

This is important, because the margins are very low for this type of business. Hence the bull case for the shares relies on margins improving. You only have to see the number of cranes all over London, to confirm that there's something of a building boom going on - good news for specialist contractors like CTO.

Outlook - despite some negative commentary in the press recently about the prospects for commercial property building, things sound fine here:

Overall the trading environment continues to improve and the Board remains confident for future prospects.

My opinion - normally I'm not keen on low margin businesses. However, as I've mentioned before, I think CTO is in the sweet spot of the cycle at the moment, which may continue for several years, who knows?

This should power considerable increases in earnings, and that in turn should pull up the share price, providing nothing goes wrong. Although with this type of business, there's always the potential for a contract to go wrong. Having said that, I visited a London site which CTO was working on earlier this year. Everything is so well organised, and working to a detailed plan, so for the particular work which CTO undertakes (a lot of which is electrical/IT work), the risks should be fairly manageable.

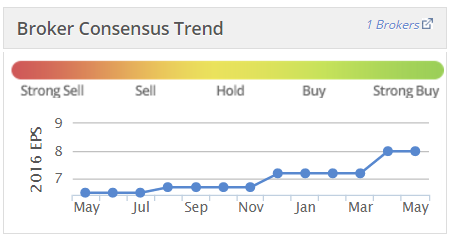

Note how broker forecasts have been edging up in the last year. My hope is that this could continue, and the update today suggests there's a good chance of that happening perhaps.

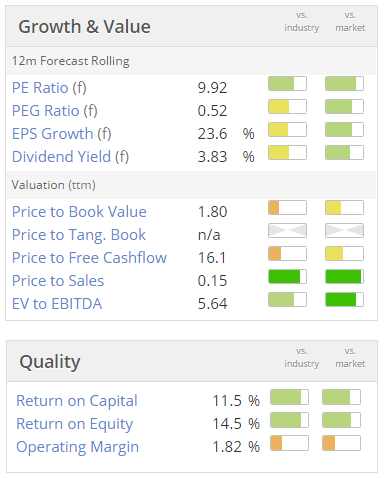

The valuation on existing forecasts appears reasonable, and note the useful dividend yield - it's always enjoyable to be paid, whilst waiting for a future possible capital gain.

Overall then, I don't see anything to worry about in terms of the outlook, for the time being. So this group should hopefully continue to see improved trading, mainly from margins increasing.

Interserve (LON:IRV)

Share price: 313p (down 20.6% today)

No. shares: 145.7m

Market cap: £456.0m

Trading update (profit warning) - this follows on neatly from above, where I mentioned the risk of big contracts going wrong. This share has been clobbered today with a shocking update saying that a big contract has gone very badly wrong:

However, our expectations for the UK construction division as a whole have been significantly adversely impacted by a further deterioration in our Glasgow energy from waste contract. The issues relate to the design, procurement and installation of the gasification plant, together with continuing challenges with the supply chain that will result in further cost overruns and delays. As a result the Board anticipates a £70m exceptional contract provision to be taken in the first half of 2016, resulting in a similar level of cash outflow spread across 2016 and 2017. We will be pursuing every opportunity to mitigate this situation.

£70m!!! Wow, that is a cock-up of epic proportions - that's just over 15% of the current (lower) market cap. How on earth did such a disaster happen? To me, that makes this share totally uninvestable, as it suggests that management are not in control of the business.

I did consider shorting this share first thing, but given that the problems are ring-fenced, and fixable, then it's probably not a good idea.

Other parts of the business are however trading alright.

Balance sheet - management today say this:

Our balance sheet remains robust. However, taking full account of the cash impact of the contract provision noted above, net debt is expected to be around £35m higher than previously guided at both the half year and the year end.

Memo to Interserve's Board of Directors - your balance sheet is most certainly NOT robust! The business is entirely dependent on a high level of bank debt. Here are the figures:

Writing off goodwill & other intangibles, the balance sheet is actually negative, at -£7.6m NTAV.

Pension scheme - the surplus of £17.2m shown in the accounts actually hides an actuarial deficit of £64m, requiring cash injections of £12m p.a., due to be reviewed in 2018.

Net debt of £308.8m at end 2015 looks dangerously high to me. This business is in effect financed entirely by bank borrowings, not a prudent way to do things at all.

For this reason, I feel the very high dividend yield is a trap. Heavily indebted companies should not be paying out big divis. They should be retaining cash to strengthen their balance sheet. It's very easy for divis to be slashed, or cancelled altogether, if trading deteriorates.

There is talk of the disposal of one division, to raise cash, but that would of course also reduce profits.

My opinion - I don't like the look of this one bit. Although with the problems looking ring-fenced, rather than being due to overall trading problems, then hopefully things should be fixable.

Personally though, I wouldn't have any confidence in management who have allowed such a disaster to happen on their watch.

That's it for today. I have an investor lunch to go to now. Then I'll be going to New Broadcasting House, to record some comments on BHS - the BBC read my report on it, and have asked me to drop in, re a Radio 4 show which will be discussing the issue.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.