Good morning!

I'm feeling bright-eyed and bushy-tailed this morning, so I thought I'd get a head-start and kick off the report.

Character (LON:CCT)

- Share price: 485p (pre-open)

- No. of shares: 20.9 million

- Market cap: £102 million

Character Group adds Pokémon to its portfolio

I like the sound of this.

Character is a toy designer and distributor, which describes itself as "the UK's leading independent toy company".

It manages third-party brands under licence. Typically, this means managing relationships with manufacturers in China and the distribution of product to their end markets. Peppa Pig has been particularly important, though it also picked up Teletubbies in the last couple of years. There is a modest level of diversification among different brands.

Today's announcement improves that diversification by adding Pokémon to the mix, from summer 2018. Character's operating subsidiary will be the master toy distributor in the UK & Ireland, thanks to an agreement with Wicked Toys, the global licensee.

Comments the joint MD:

"We are thrilled to be adding such an iconic and powerhouse property as Pokémon to Character's product line up. Toys are a major part of the Pokémon brand and bring a tangible dimension to fun for kids.

"The partnership with Wicked Cool Toys spells exciting times ahead and gives Character a tremendous opportunity to add further breadth and depth to our product range; we cannot wait to get started."

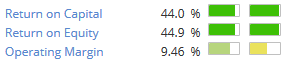

My opinion: Character has had consistently excellent Quality metrics, e.g.:

Despite this, and its strong track record, the market has been reluctant to give it a lofty valuation. The PE ratio is currently less than 9x (based on last night's close).

I had justified this scepticism on the grounds that the customer list is somewhat concentrated, and Character ultimately does not own the intellectual property underpinning the products it sells.

However, I am increasingly of the view that the scepticism is overblown, and that a PE ratio more akin to a normal "quality" company might now be fair. Furthermore, while earnings growth has slowed down here over the past couple of years, perhaps with the help of this latest deal, they might now be due to enjoy their next leg up?

Additional comment from Paul: Thanks Graham. I hold some CCT personally, and have been buying recently (avg 490p). It does look strikingly cheap on a PER basis, has a decent balance sheet, and pays reasonable divis. So it's certainly worth a look, in my view. Although I've found it tricky to buy & sell, as the shares are very illiquid. It's quite odd having one's finances tied to the popularity of the Teletubbies, and Peppa Pig - the latter looks to me like a pink hairdryer! (no doubt very popular at EGS).

As regards Pokemon, my only knowledge of it was when my sister-in-law leapt up from the dining table in Corfu last summer, shouting, "There's one over there!!!", and ran off into the middle distance, clutching her smartphone.

Somero Enterprises Inc (LON:SOM)

- Share price: 298.5p (+1%)

- No. of shares: 56.2 million

- Market cap: £168 million

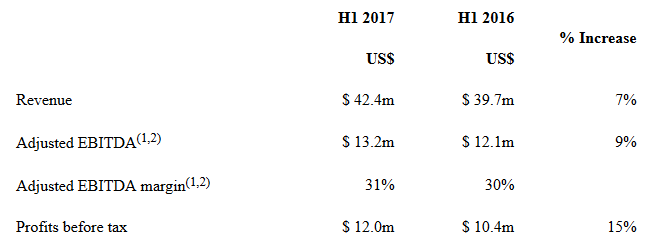

Somero's results to June are in line with expectations. For new readers, this is a US-based company in the concrete-levelling business!

The interim dividend rises 10%.

Trading in Europe and Latin America are confirmed to have led the growth, after some weakness in the important North America region, allegedly due to weather.

The statement is keen to point out that North America is due for a rebound, as heavy rains have subsided. Presumably the recent tragic hurricane activity won't put a dent in performance:

H1 2017 trading in North America ended with June at the highest levels of the year with market indicators pointing to solid H2 2017 trading.

Outlook sounds fine:

With the solid H1 2017 performance and healthy momentum carrying over into H2, the Board expects Somero to deliver another successful year of growth in line with current market expectations.

Net cash improved to USD $18.3 million.

The reporting style is a little bit too glass half full for my liking, pointing out that three of six geographical segments grew, as did three of six product categories, versus H1 2016!

Nonetheless, it is undeniable that the overall trajectory remains positive here for now.

Europe sales more than doubled, from a low base. Sounds like it has potential to wrap up the market here just as it wrapped up the North American market.

China sales declined and I remain sceptical of the potential for that market to be penetrated in a material way.

The company continues to talk up its internal product development. Having gone through the accounts for a couple of years, I came to the conclusion that Somero could have invested quite a bit more than it actually did, to expand the product set. But even with the modest amounts which it has allocated, it continues to pump out a couple of new products every year.

My opinion

No fundamental change in the story here. Maybe the most significant snippet of news is the European expansion, across a variety of large European economies, with the potential for a lot more to come from this region.

It remains a high-margin, high-quality, conservatively-financed company.

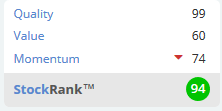

StockRank is 94.

Fulham Shore (LON:FUL)

- Share price: 13.375p (-22%)

- No. of shares: 571.4 million

- Market cap: £76 million

AGM statement and trading update

This restaurant roll-out issues a profit warning. Bad luck to current holders.

Paul has covered it in significant detail, most recently in July (link).

In total, 11 new restaurants have been added to the portfolio so far in the current financial year (ending March 2018), bringing the total to 56. This includes a franchise restaurant in Italy. The plan remains for 15 in the current financial year despite some delays.

The delay is for a good reason: re-opening negotiations with landlords of new sites as a result of an increased overall supply of sites. So it shouldn't form part of the disappointment today.

In terms of their location, "many" of the recently opened sites are outside London. In July, Paul expressed his opinion as follows:

I think the very high margins being achieved in London may not be replicated as the chain expands outside of London. So it's probably prudent to assume that the operating margin may gradually fall over time, due to this factor, and cost pressures.

Interestingly, when it comes to the profit warning section of today's statement, it is actually to do with the London suburbs:

Despite hitting our Group targets for the first quarter of this financial year, during the holiday season in July and August the Group has seen a slowdown in trade, primarily from our restaurants in London suburbs. We believe this is a sector-wide trading pattern and not unique to our brands.

We are further informed that there is a "higher fixed cost element" to support the increased operations, particularly in The Real Greek division. So Headline EBITDA will increase versus the prior yet and yet "is likely to be less than current market expectations".

My opinion: I've said before here that I'm not a big fan of the restaurant sector, so it's just not for me. It's hard to build a sustainable competitive advantage without a super-strong brand name, the fixed costs are very large, including huge rental expenses, and operational gearing is hard to achieve.

Most players end up competing on price against each other while having to balance against the unpredictable, partially regulated costs of food ingredients and staff wages.

Honestly, I don't know what the investment case is for Fulham Shore (LON:FUL). Maybe if I made an on-site visit, I could be convinced that it was differentiated and would therefore plough through the competition. Franco Manca Brixton has a 4.5 rating on TripAdvisor, so let's give credit where credit is due.

I'd look at it again if it was on a dirt-cheap rating, but for now I'd leave it alone.

Additional comment from Paul - we dodged a bullet here. As mentioned before, in my view this is a smashing company, but a profit warning seemed likely - indeed, was almost hinted at in the last statement which I reported on here. As Graham mentions above, hospitality is a horrible sector at the moment - with fixed costs meeting over-capacity, and declining demand. Plus the competition is price discounting, to drive volume.

The company says today;

...we have decided to review our opening pipeline and to seek to improve terms with landlords of new sites we had already identified. This may delay some of our openings to later in this financial year.

That sounds very sensible to me. However, I worry that the implication might be that they've possibly overpaid on rents for recently opened sites?

How to quantify the profit warning today? It says;

...As a result of these two factors, the Board expects that, while Headline EBITDA (as defined in the Company's accounts) for FY18 will be significantly higher than that achieved in FY17, it is likely to be less than current market expectations.

Looking back, headline EBITDA was £7.1m in FY2017. So if this year is going to be "significantly higher", then it's hardly a disaster. Although of course, EBITDA should be higher, given that loads of new sites have been opened.

My opinion (Paul) - I'm tempted to start nibbling at this share, but on balance will probably sit on the sidelines and see where the share price eventually settles. It's difficult to see a catalyst for the share to increase, in the short term anyway.

I'm taking a break now, and might add something else later if it catches my eye.

Cheers!

Graham

Additional sections from here are written by Paul.

LoopUp (LON:LOOP)

Share price: 227p (up 15.5% today)

No. shares: 41.0m

Market cap: £93.1m

Interim results- for the 6 months ended 30 Jun 2017.

This company provides innovative conference call software/telephony. The product is excellent, and is particularly popular with lawyers & accountants, and other clients who like its security (you can control & see exactly who is on the call) and ease of use.

The attraction of the share is that it's growing strongly & consistently, and is building up a recurring revenue stream at high margins. So profitability should flow strongly through in future.

- H1 revenues rose 44.2% to £8.65m

- Gross margin is excellent, at 76.8%

- Operating profit was only £0.5m - not much for a company valued at £93.1m!

Outlook sounds positive, which the company helpfully suggests with the title "Positive Outlook"!

We continue to see strong demand for our product from our target market of mid-to-large enterprise and professional services firms.

Since the end of the reported period, we've had some major new customer wins set to roll out in the second half, including a major multinational consulting organisation, a premier investment banking advisory firm, and a leading UK building society.

Pipelines are healthy and we remain confident in our ability to deliver further growth.

Balance sheet - looks fine to me. No issues there.

Cashflow - isn't good. This is an issue that sceptics keep flagging up. The company capitalised £1.85m into intangibles in H1, which seems a huge amount relative to the P&L numbers.

Also, note that overheads on the P&L rose considerably - so the operational gearing isn't really delivering much profit growth - the company is spending its additional gross profit on increased costs.

My opinion - I like the product very much, having road tested it myself. Also the company has a lot of things going for it - a young, energetic team, etc. However, I cannot get anywhere near to the £93m market cap, when calculating what the company might be worth.

I ditched my shares (sadly!) when Amazon launched its Chime product. My fears look misplaced, as Chime doesn't seem to have affected LoopUp at all.

We're in a roaring bull market for growth stocks right now, so maybe LOOP shares might continue to do well? I'd be very wary about the valuation though, which looks too rich for me, even allowing for the excellent performance & positive outlook reported today.

Trakm8 Holdings (LON:TRAK)

Share price: 89.1p (up 1.8% today)

No. shares: 35.7m

Market cap: £31.8m

(at the time of writing, I hold a long position in this share)

AGM trading update - this is a telematics company, providing equipment which allows monitoring of vehicle fleets, and insurance black boxes for new drivers.

The company has had a chequered history, with the shares originally doing well, but then running into trouble with a big profit miss, which caused the share price to halve in Nov 2016.

Of late, newsflow seems to be improving, but I think it will take time for the market to trust the company & management again.

This sounds reassuring;

"Trakm8 is pleased to report that trading in the first five months of the current financial year commencing 1 April 2017 has been satisfactory and ahead of the same period last year, and is consistent with its expectations for the year as a whole...

Details of contract wins are given.

Outlook comments sound good to me;

We are confident that our pipeline of opportunities will deliver further new contract wins and extensions over the coming months.

We remain on track to report improved cash generation this financial year in line with market expectations.

The Board's outlook for the year of a much improved financial performance is unchanged. The Group will report its half year results as usual in late November."

The comment about cash generation is interesting because vocal (obsessive!) bears on this stock have repeatedly criticised the company for its historic failure to generate meaningful cashflow. It's not unusual for growth companies to lack cash generation whilst they are growing fast. However, in this case the lack of cash generation is in stark contrast to competitor Quartix Holdings (LON:QTX) which is a cash machine! So I think the onus is very much on TRAK to demonstrate improved cashflows in future.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.