Good morning! Lots of interesting things going on today;

Boohoo.Com (LON:BOO)

Share price 23.1p (down 39% today)

No. shares: 1,123.1m

Market Cap: £259.4m

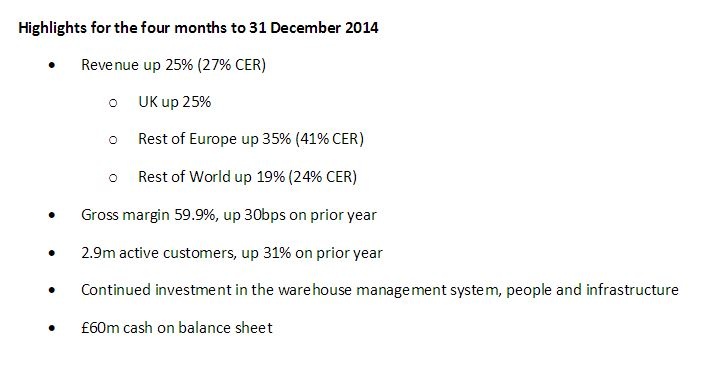

Profit warning - this online fashion retailer has issued a trading update for the four months to 31 Dec 2014. Looking at these highlights in isolation, they look fantastic;

So why have the shares dropped 39% this morning? It's because share prices are set by investor expectations, and in this case BooHoo had been growing very strongly indeed - but, an even stronger result was expected.

Therefore the shares are rebasing this morning for lower growth expectations. So are they good value now?

Valuation - I find it easiest to work on normalised EPS figures. Stockopedia shows that broker consensus for the current year (which is almost finished, as BooHoo has a 28 Feb 2015 year end) is for 1.19p EPS, rising to 1.63p EPS next year.

One broker says the profit shortfall is likely to be c.30% to 0.83p EPS this year. Another broker has revised down to 0.8p EPS this year. So that puts the shares on a PER of about 29 times the current year earnings. Still expensive, some might say. However, it's still a fast-growing company.

As this year only has about 8 weeks left to run, we should really be valuing the company on 2015/16 earnings. Forecasts this morning have been revised down by about 35%, so we're looking at ballpark 1.0p to 1.2p, so if we estimate that consensus might drop out at say 1.1p for the y/e 28 Feb 2016, then that puts it on a PER of 21 times.

Balance Sheet - the company mentioned £60m in cash today, which is just under a quarter of the market cap, although note that this will be at a seasonal high after buoyant Xmas sales.

My opinion - it is rare to find a highly profitable, cash generative online retailer. BooHoo stands out as being far more profitable (as a percentage of sales) than Asos, or indeed any other UK online retailer that I can think of. It makes an operating margin of nearly 10%, and that's during the fast growth phase, when such companies are usually consuming cash, not generating it.

This tells me they have a considerable competitive advantage - namely that these guys are experienced rag traders - BooHoo grew out of a Manchester-based clothing wholesaler called Pinstripe (and a sister company, Jogo), which source product for retail chains. So they have extensive contacts & experience for direct sourcing from the Far East in particular, at rock bottom prices. They also know what styles work, and are hence likely to make fewer buying mistakes than other new entrants to online retailing.

In my view a PER of 21 times (more realistic earnings forecasts) is an attractive price for a high quality growth company. Things are likely to be bumpy in terms of share price, as disappointment means no doubt some early investors will want to ditch their shares & walk away. However, I see this as an excellent buying opportunity, for a quality, Growth At Reasonable Price (GARP) stock.

Although note that online retailers are up against considerable competition from conventional retailers too, note this comment today from BOO;

So I think the glory days of online retailers being valued on crazy PERs (40+) should be over. However, one can now value BOO on a sensible basis as a growth company, and in my view it is now attractively priced, given the growth & international expansion.

There's always the chance of another profit warning in 2015 of course, if growth slows further. However, most company Directors could only dream of achieving the 25% organic growth that BOO has just reported.

In my view the new broker forecasts out today are realistic, probably for the first time, since they are based on the sales growth that the company is actually achieving, rather than very aggressive forecast growth rates.

As you can see from the chart below, the shares are now only about a quarter of the peak price spike immediately after the IPO last year (the IPO price was 50p). So on reflection the company was over-hyped originally, and the forecasts were too aggressive. However, that doesn't alter the fact that it's a very good growth company, and now it's reasonably priced too, in my opinion. DYOR as usual. I'm probably sounding too enthusiastic about this stock, but that's my opinion - I like it a lot at this price, so have been a buyer today.

Majestic Wine (LON:MJW)

Share price: 330p (down 17% today)

No. shares: 65.6m

Market Cap: £216.5m

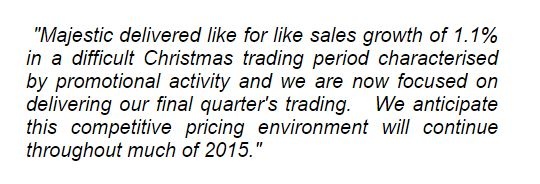

Trading update - the market has responded negatively to the latest trading figures today from this wine retailer. The key figures are that like-for-like sales growth was 1.1% over the 10 weeks to 5 Jan 2015. Total sales growth was 3.7%, which would include some new stores.

Cumulative like-for-like sales growth was 2.0% for the year to date, i.e. 40 weeks to 5 Jan 2015. Therefore the sales trend has slightly deteriorated over the busy Xmas period.

On margins, the company says that they reduced by 50 basis points, which for anyone not familiar with that terminology, an example would be the margin dropping from say 55.0% to 54.5%, which is a drop of 50 basis points. Again, that's not a massive drop by any means.

Overall then, I'm wondering why the market has marked the shares down so sharply today, which looks something of an over-reaction to me.

Valuation - unfortunately the company doesn't say anything in today's statement about profit expectations for this year (ending 31 Mar 2015), which is a glaring omission.

I suppose the market is interpreting the slightly disappointing Xmas trade as meaning that the company might miss current profit forecasts? Consensus is now for 27.3p, so perhaps the company might come in a bit shy of that figure, at say 25p? If that's right, then the PER works out at 13.2 - which is probably about right.

My opinion - I got some flak after my report on 17 Nov 2014, where I suggested that Majestic looked as if it is struggling somewhat against stiff competition from supermarkets, discounters, etc, but today's update rather confirms that I was correct.

The comments today from their CEO reiterates that they are in a very competitive, price-driven market, and that's not likely to change any time soon;

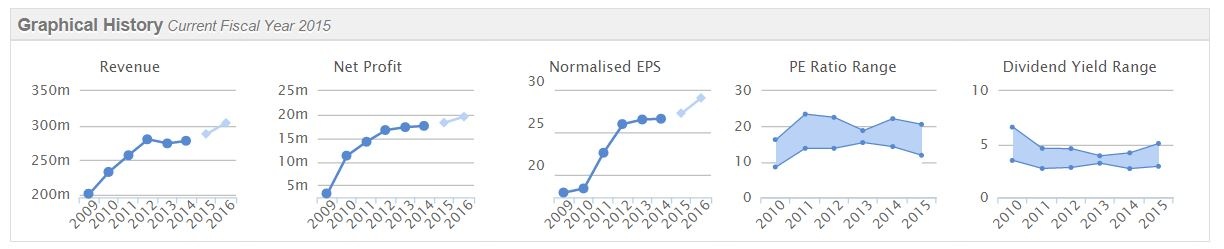

It's Balance Sheet is OK, but has no surplus cash on it, indeed there was small net debt of £4.8m. The Stockopedia graphics below reinforce that this is a mature business, and I think it's struggling to stand still in terms of profitability, such are the competitive pressures it's up against. It's therefore not a stock that is of any interest to me at this price.

I think Conviviality Retail (LON:CVR) looks more keenly priced, if you insist on investing in this sector, and has a cleaner, franchise operating model.

Escher Group (LON:ESCH)

Share price: 200p (down 17.5% today)

No. shares: 18.7m

Market Cap: £37.4m

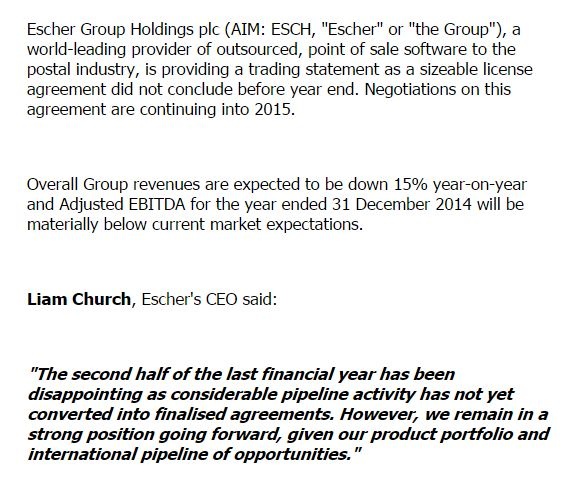

Profit warning - the shares of this software company for postal services, are down sharply today on a trading update. This is self-explanatory, see below;

My opinion - I'm sceptical about this company's business model, as explained here in my report of 8 Sep 2014 on the last interim results. Nothing's changed really, except that my reservations about lumpy contract revenues have proven correct.

Also, as I reported here on 10 Mar 2014 it didn't actually generate any real cashflow at all, since development spending is capitalised, therefore the company's focus on EBITDA overstates what I regard as real profits.

In my view this company has some strategic value to an acquirer, so I wouldn't be surprised if it is take over. However, it really doesn't stack us as a standalone investment in my view.

Topps Tiles (LON:TPT)

Share price: 113.5p

No. shares: 193.6m

Market Cap: £219.7m

Trading update - there's another strong update from Topps. The company achieved +6.0% like-for-like revenues in the 13 weeks to 27 Dec 2014, and excellent performance.

The CEO sounds upbeat too;

My opinion - broker forecast consensus for this year (ending 27 Sep 2015) is 7.89p, so that's a PER of 14.4. Remember it has some debt too, so it's not terribly cheap once you add that in to the valuation. There might be scope for forecast upgrades, if strong trading continues.

I can see some potential upside on these shares from here, if they continue trading well.

All done. See you in the morning.

Regards, Paul.

(of the companies mentioned, Paul has a long position in BOO, and no short positions.

A fund management company with which Paul is associated may hold positions in companies)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.