Good morning!

It's a public holiday in the USA today apparently, so their market will not open. This is likely to mean a quieter day here in the UK.

Brady (LON:BRY)

Share price: 98.5p

No. shares: 83.3m

Market cap: £82.1m

Interim results to 30 Jun 2015 - this software company has a tendency to give an upbeat commentary with poor figures, and that's certainly the case today. Really upbeat narrative, but the figures are not very good at all.

Revenue fell nearly 10% in H1 to £14.1m, and recorded a pre-tax loss of £389k (vs. £1.4m profit in H1 of 2014). The company blames reduced turnover on forex movements, and "the timing of licence sales".

The narrative says that these results are "in line with market expectations for the full year", which will require a dramatically better H2 performance, since the market is expecting a full year profit of £4.7m, meaning that H2 will need to deliver over £5m in profit, which looks a tall order to me. Although the company says;

Anticipated strong performance for H2 2015 with visibility on 80% of revenues for the full year.

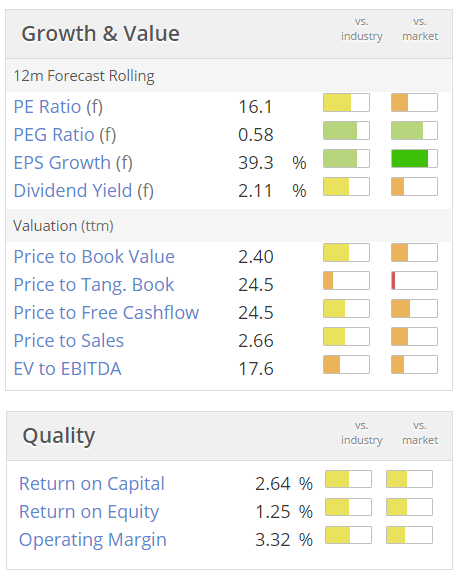

Valuation - the StockRank is 76 - so upper medium.

It's looking fully valued on most metrics below;

Balance sheet - reasonably good. The net cash of £6.2m is mostly money received up-front from customers, as is often the case with software companies.

Note there is a pension deficit of £2.4m, which has risen from £0.9m a year earlier.

My opinion - there's lots of positive-sounding stuff in the narrative, about new contracts, etc., but the H1 figures look disappointing. So personally I would be very cautious about wanting to buy shares at an £82.1m market cap, when it has just reported a loss for H1.

Companies which need to strongly out-perform in H2 to hit their full year forecasts very often struggle to do so. Therefore I suspect there is an elevated risk of a profit warning here if they don't manage to deliver the anticipated strong H2.I'll check out the full year figures when they are published in the Spring of 2016, but for me anyway, risk:reward doesn't look attractive right now.

Another issue to consider is that Brady has a strong focus on energy & commodity markets. So they could at some point possibly suffer fall-out from the chaos in that sector. Maybe that is the underlying reason for poor H1 numbers?

Acquisition - in a separate RNS today, Brady says it has acquired a product called "ScrapRunner", which is software for the recycling sector.

Whilst small, this looks a cracking deal. The price being paid is $2m, and ScrapRunner has (unaudited) 2014 figures of $2m revenue, and $694k profit before tax. 62% of revenues are recurring. So bolting on this cheap acquisition should be nicely earnings enhancing for Brady, assuming that this level of profit is sustainable.

Avation (LON:AVAP)

Share price: 120p

No. shares: 55.2m

Market cap: £66.2m

(at the time of writing, I hold a long position in this share)

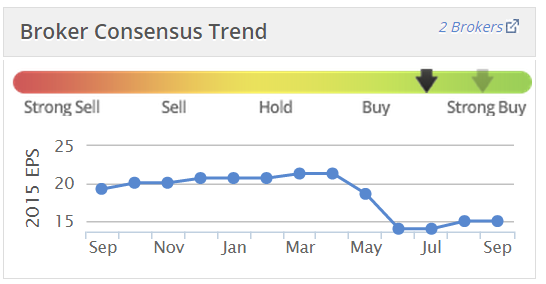

Results y/e 30 Jun 2015 - I can't fathom why it is that the stock market doesn't seem to like this aircraft leasing company. Although Stockopedia's neat little graphic on broker consensus shows that earnings forecasts were marked down significantly in May & Jun 2015:

The company reports in US$, so it has today announced basic EPS of 24.1c, or 26.3c if you only look at continuing operations (which is the figure I prefer to use for valuation). Converting into sterling at $1.526, that equates to 17.2p EPS from continuing ops. That means the PER is only 7.0, which looks strikingly good value. Although at a time of near-zero base rates, I would expect leasing companies to be doing well, so a low PER is probably justified. Maybe not this low though?

It looks like a beat against expectations, as Stockopedia has 23c as the current broker consensus for y/e 30 Jun 2015. I'm surprised that the share price has dropped slightly this morning, given that it looks like an earnings beat.

Loss on disposal of aircraft - last year benefited from a $3.3m profit on disposal of aircraft (a good sign, as it implies that the depreciation policy is conservative), which became a $0.7m loss this time. So a $4m negative impact there, which explains why operating profit was similar to last year ($33.6m this time, versus $33.9m last time).

Interest cost - being a leasing company, there's obviously a lot of debt, hence a big net interest charge of $18.1m (up from $16.6m last year). A couple of points on this. Firstly, the net interest charge is almost twice covered by operating profit. That looks good to me - it says that the company is making a decent profit margin over its cost of funds.

The weighted average cost of funds is 5.1%, so this implies that the interest cost would have to rise to almost 10% before profits were wiped out. If you check the last Annual Report, the company locks in interest rates for periods that match the aircraft leases, which should de-risk things considerably, and seems an intelligent strategy.

Secondly, there has been a bit of a drag on interest costs this time because Avation raised $100m in a bond issue in May 2015. Those funds have not yet been deployed, so there's a short term impact from costs not having any related revenue yet. That isn't a worry, as it will be fixed once new aircraft are bought & leased out to airlines.

Taxation - note that the tax rate is low because the company is based in Singapore, so enjoys a 10% tax rate, from memory.

Dividends - there's a chunky increase in the payout, up 49% to 3c for the year, so about 2p, for a yield of 1.7%. Not madly exciting, but at least the trajectory is sharply upwards. Avation is growing rapidly, so I wouldn't expect big divis at this stage, hopefully that will come a few years down the line when growth tails off.

Balance sheet - net assets are $128.2m, with only $2.4m of goodwill to write off, so net tangible assets drops out at $125.8m, or £82.4m. Note that the market cap is less than NTAV, at £66.2m, which seems a harsh valuation. I would have thought the shares should be valued at least at NTAV, of 149p per share, with possibly a premium justified, given that the company is decently profitable?

As you would expect, the balance sheet is dominated by enormous fixed assets (the planes), and enormous debt. Avation makes its money by charging airlines more than its own cost of funds. Providing the depreciation policy is correct, and book values of the planes are realistic compared with disposal value, then everything should be fine.

My opinion - airline leasing companies get into trouble in recessions, when their customers can go bust, and planes bounce back onto the leasing company, which then can't find a new lessee. If that happens at the same time as the bank pulling in their loans, then it's curtains.

From several chats with the CFO of Avation (who turns up at nearly all investor events!), management are experienced in the sector, seem to have anticipated and structured the company to manage the sector risks, and the Chairman in particular has a large personal shareholding of 18.5%.

So I'm a little baffled as to why the stock market has rated this company well below NTAV, and on a PER of only 7. I would have thought there's good upside on this price. You do wonder though if the market knows something we don't? Could there be problems lurking, or maybe there are some particularly lucrative leases which won't be renewed? (I do recall mention being made of some Australian leases of old planes, which were very profitable, but may be coming to an end because of the commodities situation).

Management have to manage risk as their primary objective here. So far anyway, they seem to be doing a good job of that. So I quite like this share at the current 120p share price, and see some upside on that potentially.

The company is expanding quite rapidly, with 10 more planes coming on stream in the current financial year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.