Good morning! Tracsis (LON:TRCS) is a growth company that has been mentioned here quite a few times. It offers a range of specialised products to the rail sector, including scheduling software and remote monitoring equipment (to identify faults and wear on things like overhead gantries & points, before they fail). I have previously felt that the valuation got a bit ahead of itself last year, but it is now looking as if the company is growing nicely into the valuation.

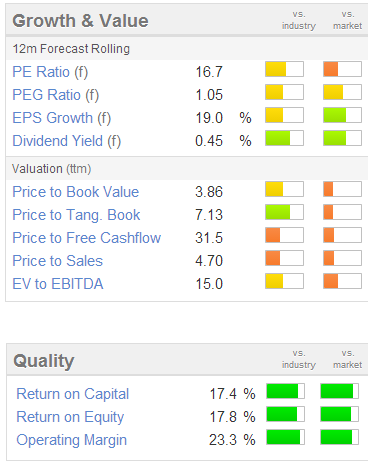

The latest share price of 198p (market cap of £51m) represents a forward PER of 16.7 times, using Stockopedia's usual blend of forecasts, which eliminates differences in year-end dates, making all companies comparable. That's not cheap, but the market likes growth stocks, and tends to put them on higher ratings, and Tracsis has had a very good track record of growth and sensible acquisitions in recent years.

It also has a solid Balance Sheet with net cash. So I like the company, and rate management highly. I also like the way management are very accessible to shareholders, which is important for smaller Listed companies in my view.

Note the strong return on capital & equity bars on right (green is good, red is bad). Being a growth company, the dividend is small.

That said, it's still a small company, with the inherent risk of lumpiness in contracts on the hardware side of the business. Combined with quite a high valuation that makes it a little too high risk for my personal investing taste, but each to their own, and I can certainly see the attraction to more risk tolerant investors than me.

Today brings good news of a significant £2.2m order from an existing client, for remote monitoring equipment. This is an initial order in a five-year framework agreement, so that augurs well for the future. The key sentences say;

An order of this magnitude provides the Group with additional confidence in meeting current market expectations...

Given the magnitude of this order, we believe Tracsis is well placed to win further contracts of this nature both within the UK and overseas.

That sounds pretty bullish to me, so I wouldn't be surprised to see these shares take another leg up.

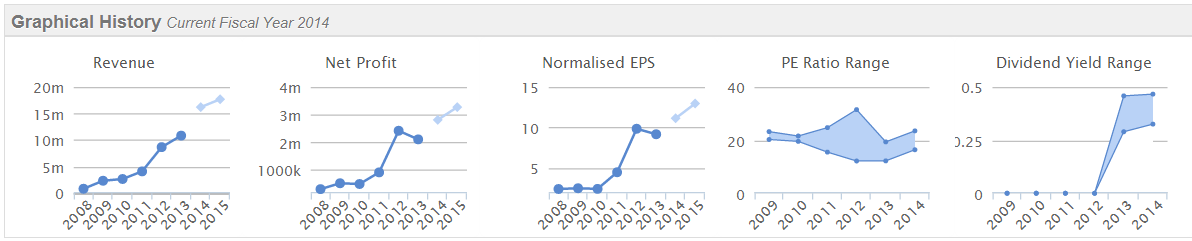

The good track record of Tracsis is demonstrated well by the Stockopedia graphical history below (I'm a big fan of these graphs, as so much can be gleaned in just a few seconds, thinking about what they tell you):

There's a profit beat from Thalassa Hldg (LON:THAL) this morning. These shares have been a remarkable performer, rising almost 6-fold in the last year, from about 50p to 288p. It offers services to the oil & gas sector, which seems to be things like doing seismic surveys, etc.

Their trading update covering the year ended 31 Dec 2013 says that turnover will be in line, operating profit will be 10% ahead, and EPS will be more than 20% ahead of market expectations. I like the way they have quantified their profit beat, which is very good practice, and allows investors to make better informed decisions. Whereas if they had just said "significantly exceed market expectations", then the market might have gone crazy and assumed profits might beat forecasts by say 50%. Communication is so important, and the golden rule is the more specific, the better. So this statement passes the clarity test with flying colours.

Here is Thalassa's spectacular two year share price chart:

The market likes this announcement from Thalassa, as you would expect, with the price up about 10% to 315p at the time of writing. With just under 24m shares in issue (net of shares held in Treasury) that equates to a market cap of £75.6m. That looks pretty racy on the historic figures, but it's all about growth. So looking at forecasts, and remember to convert their reported US$ figures into sterling, the calendar 2013 EPS broker consensus forecast is shown as about 11.5p, so they are 20% ahead, which means they'e achieved about 13.8p in 2013.

So at 315p per share, the PER is a lofty 22.8. You would need to feel pretty confident that more strong growth was in the pipeline to be comfortable with that valuation. There's no dividend either. Although there does seem to be plenty of cash, especially after an £18.1m Placing in Oct 2013. So that could well be the key to the valuation - i.e. investors are factoring in the cash balance, and the upside from it being invested in growth. That makes sense, as the Placing proceeds would not have made much (if any) impact on the 2013 results, but if invested wisely should generate higher earnings in 2014 and beyond.

A little while ago I reported on how John Lee, the FT writer and believed to be Britain's first ISA millionaire, gave a fantastic talk at a Mello investor evening late last year. John's talk was absolutely full of investing wisdom, and I bought a copy of his book, "How to make a million - slowly" at that event, although must confess I've been so busy that haven't started reading it yet.

With that in mind, I spotted an article here on Stockopedia, written by a friend of mine, Boros10 who it turms out is also an ISA millionaire. He's not only a very shrewd investor, but also one of the nicest people I know, and he has explained in meticulous detail how he actually built up his ISA to over £1m in this article.

It's an absolute must-read, with some very important conclusions drawn. In particular he dodged the credit crunch completely by going into cash in March 2008, and his portfolio actually went up that year! This confirms my inkling that the most successful investors I know are people who see trouble ahead and cash-out before the proverbial hits the fan. Not just with the market as a whole, but with individual companies too (a point also covered in this article). Other conclusions are that great progress can be made from compounding, and from keeping losers small, but letting the winners run. Anyway don't let me ruin it for you, as the article from Boros10 explains his approach & his lessons learned far better. It really is essential reading in my view.

There's a profit warning from Mothercare (LON:MTC) this morning. Can't say I'm surprised, as its UK business has been struggling for some time, and the growth from overseas was holding it up. However, my view is that if a business can't make money in its home market, then something is badly wrong.

Their shares have crashed by about 30% this morning to 295p, which values it at about £261m, down from last night's £373m market cap. The 12 weeks to 4 Jan 2014 saw deteriorating trends across the board, with UK LFL sales worsening to -4%. For the full 40 weeks of the year to date, UK LFL sales were -2.3%. That's really bad news, as the problem is that costs are rising, and mainly fixed, so if your sales are falling (and usually that goes in conjunction with lower margins as prices are dropped to clear slow-moving stock), then the operational gearing which we discussed yesterday goes into reverse, and can decimate profits.

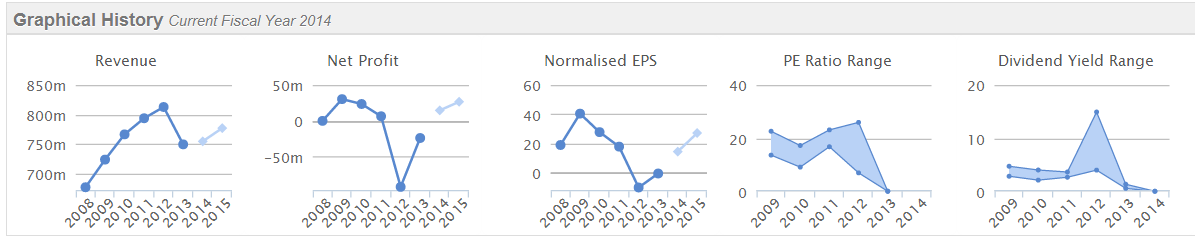

The problem here is that there weren't really any profits to start with, and the market cap was hanging on hopes for a recovery which isn't now happening. Therefore in my view things are not looking good for Mothercare. It only made £8.3m underlying profit on £749.4m sales last year (to 30 Mar 2013), so will certainly be loss-making this year, possibly quite badly.

The balance sheet is weak, with negative net tangible assets of £7.7m, since it has net debt and a pension deficit, hence in my view it's difficult to see any reason at all to hold these shares at the current valuation, even after this morning's fall. It could even make a candidate for a short position?

Today's statement concludes;

As a result of lower UK sales and margin and the International currency impact, full year profits are likely to be below the current range of market expectations. We continue to focus on delivering a turnaround in the UK and exploiting the global growth opportunities for Mothercare.

I am surprised they are still talking about profit, as looking at the last 2 sets of results (interims & prelims) it's difficult not to conclude that this year will actually be loss-making, not profitable. I don't see how they could turn a profit this year, given that they were only just above breakeven last year, and LFL sales are down again this year.

International has been impacted by adverse currency movements, and deteriorating underlying sales, but is still growing. Overall, not good, and personally I would definitely not be long of Mothercare.

If I'm right that they are now loss-making, then the light blue forecasts on the charts below could lurch down into losses, and create a very ugly trend:

The bullish view on Mothercare is that their heavy losses in the UK will gradually be sorted out, as they close loss-making stores, which is what a lot of the exceptional costs were last year. That's a fair point, but it can be very expensive to get out of loss-making shops (French Connection are facing the same issue). Meanwhile Mothercare's international operations are pretty successful, making good profits. So it's not dissimilar situation to FCCN, where parts of the business are decently profitable, but there is then a large negative value to the problem parts of the business. With International growth now also slowing, then the bull story is much weaker at MTC than it was.

As a general point, prompted by Mothercare, it's worth bearing in mind that because we are currently in an optimistic market that is pricing-in improvements in trading from growth for most companies, then the slightest disappointment will lead to big markdowns in share price. So rather than getting carried away with the excitement of a bull market, I see this as a market that is increasingly becoming littered with banana skins - take one false step and you're flat on your back! Also remember that the mathematics of it mean that a 30% loss on a share requires a 43% gain to recoup your loss. That rapidly becomes more extreme, so a 50% loss requires a 100% gain to get back to even money.

So to my mind, it's a case of being very wary about paying up for a richly valued stock - one really does need to do the research thoroughly, and be as sure as possible that you've got it right. It's only a matter of time before some of the really bonkers valuations out there take a big tumble, so chasing the momentum on wildly over-priced stocks is a very dangerous game to play, as shareholders in Perform (LON:PER) recently discovered.

Intercede (LON:IGP) has issued a bullish-sounding trading update, saying that revenues for the first nine months (it's a 31 Mar year end) have exceeded those achieved last year. So last year they did £6.7m turnover, and made a small loss. So they're on track to do say £9m turnover this year. The market cap is about £75m! Blimey, that's one helluva big valuation, so the market is pricing in a lot of growth & future profits.

There's a good trading update from dotDigital (LON:DOTD), the email marketing software company. I saw management present last year, when the shares were about 15p, and thought it looked interesting, but couldn't quite get comfortable enough to buy. Pity, as they've doubled in price since then, and now sit at just over 30p, so a market cap of about £85m. That might look expensive, but they are growing strongly, and are forecast to make 1.05p EPS this year (ending 30 Jun 2014) and 1.6p the following year, so PERs of about 29 and 18.7 respectively. That's too rich for me, despite the in line with expectations statement today.

I've had a quick skim over the results for the year ended 31 Oct 2013 from Idox (LON:IDOX), and have to say they're not as bad as I expected. Profit before tax (on continuing operations) was slightly down at £7.5m, although they also highlight adjusted profit tax which is much higher at £13.3m (down 10% on the prior year).

The main adjustment is £5.4m in relation to amortisation of intangibles, so this is usually a way of stuffing costs onto the Balance Sheet, as lots of software companies do. However, on closer inspection of the cashflow statement, they only capitalised £1.7m of development costs in the year, so I would be comfortable with adding back amortisation and deducting capitalised development spending, to arrive at £11.2m which is a reasonably conservative way of looking at adjusted profit after expensing all development spend in the year.

The main problem with Idox is its Balance Sheet, which fails my tests. So I would not normally consider this share investable, as it has negative net assets of £24.8m, and too much debt for my liking. That makes it too high risk for me personally. I am tempted to ignore my own rules sometimes, as a lot of highly indebted companies with weak Balance Sheets have made excellent speculations/investments in the last year. On balance though I like to be able to sleep at night, knowing that there is no chance of any 100% losses in my portfolio, so will pass on this one. It is quite tempting to have a small punt on it though.

Dialight (LON:DIA) has warned on profits again. This is another example of a formerly trendy growth stock that has hit the buffers, with disastrous consequences for shareholders. Their shares have halved in just four months from the peak in Sep 2013. On 12 Sep 2013 I commented on Dialight;

"I see that Dialight (LON:DIA) has warned on profits, with the shares down 16% to 1150p. They say that contract delays mean that profits are likely to be "broadly in line with the prior year". It did 41.3p EPS last year, so that means the shares are still far from cheap on a PER of 27.8. That's a seriously racy price for a company that is not showing any profit growth against last year - I'm surprised the shares haven't fallen considerably more, so are not of any interest to me."

That has proven correct, with a disappointing update today indicating underlying profit before tax will be not less than £14.5m for calendar 2013. That looks to be well short of the £18.7m forecast that I've found, although you can never be sure that you're comparing apples with apples with profit figures, but usually most broker notes report underlying profit figures too.

So I think that means they're very roughly heading for about 30p EPS in 2013, well down on the 41.3p last year. Not good. On the other hand, the outlook statement sounds quite positive, saying;

With the Industrial Lighting market remaining buoyant and Dialight continuing to hold its market leading positions, the Board remains confident of delivering renewed profitable growth in 2014 and beyond.

So if you think this is just a glitch, then these shares might be coming into range where they're worth considering. Having said that, even down 201p to 641p today (a fall of 24%), they are still on a PER of 21 times my estimate of 2013 earnings. So it's not exactly a bargain even now, in fact it still looks expensive, if my number-crunching is correct.

Bit of a marathon report today, but there was a lot to cover.

See you from 8 a.m. tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.