Good morning!

"Mad Mike" Ashley, the 59.3% owner of Sports Direct (LON:SPD) - in which I hold a long position - put on a great show yesterday, in front of MPs. It even made the top slot in the main evening TV news.

Overall, I reckon he handled it quite well - in particular admitting mistakes, and agreeing that certain details of how warehouse staff were treated were unfair. Owning up to mistakes, and putting them right, is always the right approach in life generally. It's also pretty effective at neutralising criticism.

So whilst he comes across as an extremely forceful character (which some might characterise as a bully), and clearly has an ego the size of a small planet, he's also a talented retailer. SPD is a fundamentally very sound business, which generates pots of cash, and is likely to continue to do so. Maybe he'll take it private at some point?

Although JD Sports Fashion (LON:JD.) is clearly eating Sports Direct's lunch on the sale of expensive, branded trainers, SPD remains dominant in low to middle-priced sports clothing. To my mind, all the stuff about Mike Ashley is largely background noise. I don't see it having much impact on the fundamental value of the business, other than tarnishing the brand name a bit in the short term. Consumers have very short memories, and quickly forget issues like this.

That leaves a very good business, with some fixable issues, on a relatively modest valuation. So I continue to like, and hold, SPD shares.

EDIT: My apologies, but due to a technical glitch, a lot of my section on BOO has vanished. I'll try to get it back from backup.

Boohoo.Com (LON:BOO)

Share price: 56.1p

No. shares: 1,123.3m

Market cap: £630.2m

(At the time of writing, I hold a long position in this share)

Q1 trading update - covering the 3 months to 31 May 2016. This is a strong update, with excellent (all organic) growth in all regions. Here are the highlights, highlighted:

(picture removed, as seemed to corrupt article)

Forex - is expected to become helpful as the year progresses, helping margins, but it sounds as if this benefit will be recycled into lower prices for customers.

Cost efficiencies - longer term, there is scope to improve the net margin, by automating the warehouse. It sounds as if, right now, the company is focused mainly on sales growth.

Valuation - this is the tricky bit! Obviously this share has risen considerably, and on any conventional metric, it looks expensive. However, I find with rapid organic growth stocks, it doesn't pay to obsess over what the PER is. Remember that ASOS (LON:ASC) was on a crazily expensive rating for years, and still is - it's rated at 63 times current year forecast earnings - which doesn't make sense to me - ASC looks significantly over-valued.

However, Institutions want these stocks, and are prepared to pay up for them. In my view, BOO shares are a far better proposition than Asos. BOO makes a much higher net profit margin, and probably has better growth potential from here (as it's smaller). I'm concerned that Asos may have grown so big that management might not be fully in control.

As I've been saying for a while, BOO is expensive now. However, today's update shows us why. Where else can you find this type of very strong organic growth, on high gross margins?

PrettyLittleThing.com - there could be upside from BOO exercising its £5m Call Option, bringing this other family business into the fold. I feel that BOO will have to exercise this option, and remove a major conflict of interest for the family shareholders.

An announcement that PLT is coming into the group could trigger a vertical move upwards in the share price, in my view. So the family shareholders will benefit from this too. Therefore I'm very keen to see this happen. PLT is performing very well, per press reports, and online stats.

What this also shows though, is that BOO could become a multi-brand online retailer. It has key expertise on sourcing, and has also shown itself to be great at marketing, and pretty good at logistics too. In fact, I think BOO is demonstrating that it's good at everything! (contrary to a ridiculous research note from Panmures a while back).

Therefore I think there is additional upside on BOO shares from this developing into a potentially giant group longer-term, operating multiple websites and brands. Management are extremely ambitious. There's loads of international growth to go for too.

My opinion - I'm increasingly of the view that this share could just keep going up, much in the way that Asos did during its rapid growth phase. So, although it conflicts with every fibre of my being, I'm trying to look through the expensive rating that the shares are currently on. Although 40 times earnings this year, and 32 times next year, is not into bonkers valuation territory at all. It's probably about right for now, but I think the rating could even go higher potentially, who knows?

Another key point is that this share is under-owned by institutions. If they want to own it, and clearly with this type of performance underway they will do, then the only choice is to pay up.

Overall then, I'm very happy with today's update, and can't see any reason at all to sell. Mind you, looking at the chart, it's going to have to pause for breath, or retrace somewhat, at some point. I've no idea when though.

I keep reminding myself, "Run your winners", as the saying goes!

DX (Group) (LON:DX.)

Share price: 17.75p (up 4.4% today)

No. shares: 200.5m

Market cap: £35.6m

Trading update - this sounds encouraging:

Trading to date in the second half of the financial year has been in line with management expectations, with customer renewals at the DX Exchange operations at anticipated levels. The Company therefore remains on course to meet management expectations for the financial year.

Although to put that into context, the DX Exchange service is the big profit generator at this group, and it's basically in terminal decline. Solicitors are using it less & less. That leaves a large fixed cost base (hundreds of local offices), and a declining revenue stream. It's difficult to see a good outcome for this business.

That then leaves a low margin, parcels service, in a highly competitive market.

The company is "reviewing its options" with regard to its expensive new midlands hub, which failed the planning permission hurdle.

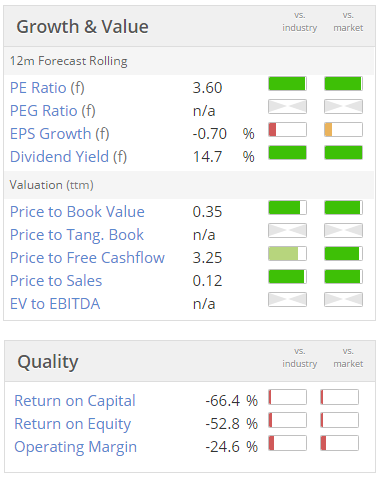

Valuation - when you see a stock on a PER of under 6, that is itself a red flag. It means something is wrong - either excessive debt, or a business that is in structural decline. We'll see more of this in the coming years, as so many sectors are being hugely disrupted by new technology.

The forward PER of 3.6 is crazy. That tells me that the market believes profits are unsustainable, indeed are likely to collapse further. Same with a 14.7% dividend yield. The divis here are clearly not sustainable, so the yield means nothing really.

On the plus side, 2 Directors spent in total £750k buying stock at 17p, 3 months ago. That's a pretty serious commitment. Although I've seen plenty of instances where management make a bold gesture, only to regret it later. On balance though, £750k is a serious purchase, and at the least suggests there is no imminent catastrophe looming.

My opinion - I think this stock could be a nice one for traders - you often find big & rapid movements in price for this type of stock. For me though, I've lost money on it before, trying to catch the falling knife, and hence it's not a stock where my judgement has been good. Therefore it's best just to move on, and forget about it.

The market doesn't seem interested in the company at all. Note that today's relatively upbeat statement had negligible effect on the share price - suggesting that there's probably still an overhang of sellers who want to get out. It's difficult to see any catalyst for a sustained rise in price. Hence why it's not of any interest to me.

Shoe Zone (LON:SHOE)

Share price: 200p (down 2.4% today)

No. shares: 50.0m

Market cap: £100.0m

Interim results, 6m to 2 Apr 2016 - the figures look reasonably alright to me. You have to remember that this company has heavy seasonality towards H2, so the interims last year only made up about one fifth of the full year profits.

You could be forgiven for thinking that ShoeZone is a downmarket, stale business. However, there are a couple of factors which make it a little more interesting.

Firstly, it makes very high gross margins, of 61.1%. That's key to making a decent profit in the High Street these days.

Secondly, it very actively manages its store portfolio, more so than most retailers. So the company opens/closes/relocates stores frequently, and at low cost - I suppose the fit-out costs for downmarket shoe shops are very low compared with other retail uses.

One figure in particular really jumped out at me from the narrative

Rent on renewals fell on average by 29.9% representing a £222k cost saving

Rent as a % of turnover is now 14% (2015: 14.7%)

ShoeZone seems to trade from non-prime sites, and its rent roll is falling significantly on renewal. That's good for profits. Rent at 14% of turnover is a very healthy position when you make a gross margin of 61.1%. The other big costs are business rates, and staff wages. Then there are a load of other, smaller costs, but that should still leave a pretty decent store contribution (i.e. profit at store level, before central costs).

So I see quite a solid business model here actually. There's also quite a good transactional website, which I've used successfully to buy cheap work shoes (I scuff them badly riding Boris Bikes around London, hence why cheap shoes are fine to buy & then throw away every 6 months).

Outlook - sounds fine:

"The Group has traded in line with management's expectations since the period end and the Board continues to look to the future with confidence."

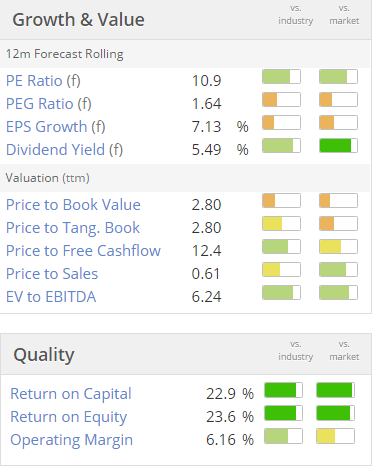

Valuation - this all looks reasonable. Note the good divi yield, and quite high quality scores:

Although I should also point out that a lot of larger, higher quality retailers are on a similar PER at the moment. So personally I would rather buy Next (LON:NXT) (in which I hold a long position) than move down the size & liquidity scale into something like this.

Balance sheet - looks fine. Note the smallish pension deficit though.

It's soundly financed overall, and has net cash. So no problems there.

My opinion - I'd like to meet management here at some point. They are clearly entrepreneurial, and have built an OK business. There's probably not massive growth potential, although some bigger units are to be opened.

My local store (Brighton) is so horrible though. Really unappealing in every way - ugly shop, with rows & rows of dreary-looking, cheap shoes. It's just depressing. I would have thought Primark would be a big competitive threat. They seem to make cheap clothing & footwear somehow seem not quite so bad.

Overall then, I recognise that SHOE has some positive things going for it. I'm not tempted at the current price. It's the type of stock I would however buy on a profit warning, at say 30% lower than the current price. Sooner or later something will probably go wrong, and that would then be the time to pick up some cheap stock I think.

BOTB - very interesting little company (I hold). If they can crack the online marketing side of things to drive faster growth, could get exciting. I'm meeting mgt later this month.

AO. - not looked at its results yet. I don't rate this share. Low margin box shifter. Needs to spend big on marketing to get anywhere.

KOOV - Placing done. I've not looked at details yet. Ultra-speculative, as the company has made very little progress to date, for heavy cash burn.

CRE - to look at later.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.