Good morning. It's not a small cap, but I have to mention the Q1 trading update from WM Morrison Supermarkets (LON:MRW) this morning, which is shocking - it reports LFL sales down by 7.1% (excl. fuel, which if it's included worsens that to down 8.2%). I don't recall ever seeing such a steep decline in a supermarket's sales, and this surely makes their shares uninvestable now, and for the first time raises the prospect that a major UK supermarket might eventually end up going bust, if that trend continues? Morrisons confirms guidance of £325-375m profit this year. That doesn't look a lot in comparison with £2.8bn of net debt. Discounters are forcing the major supermarkets to reduce prices, so I'm wary of going near any of them as an investor - will dividends be sustained?

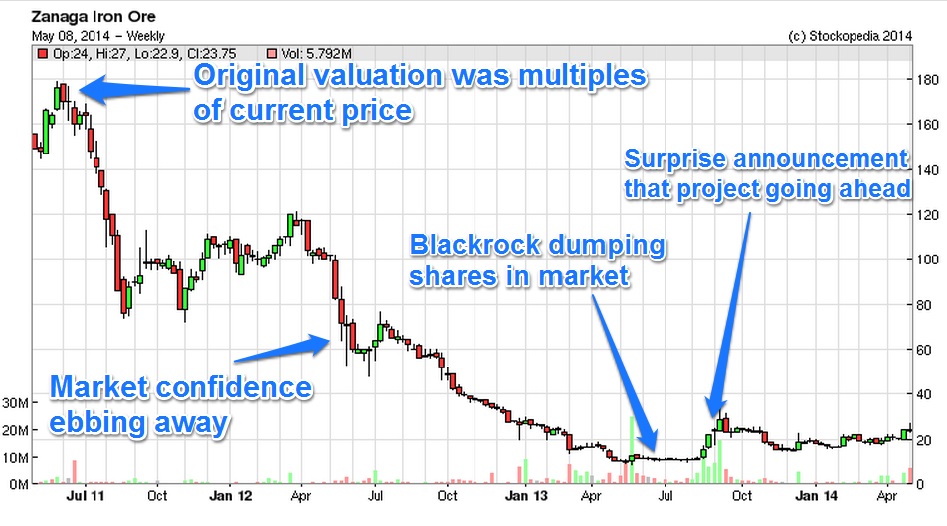

Zanaga Iron Ore (LON:ZIOC)

Regulars might remember that this is my one incursion into the resources sector, which is an area that I normally steer clear of, as it needs specialist knowledge to make money here. Also it's like searching for a needle in a haystack, with the majority of smaller Listed resource companies just burning cash & going nowhere.

However in the case of Zanaga, a number of special factors convinced me that this one was worth backing. It has net cash, and the cash burn for the feasbility study on this vast iron ore project in West Africa has been almost entirely financed by mining giant Glencore, the 50% (less one share) JV partner to Zanaga.

Much to everyone's amazement, Glencore seem to be pressing ahead with this project, whereas the market had assumed the project was dead once Glencore took over Xstrata (whose project this was originally), and over $300m has been invested already by Xstrata/Glencore just on the Feasibility Study, release of which has been announced today, along with the applications having been submitted to the Government of the Republic of Congo (which is the smaller, more stable of the two countries called Congo).

Key features of this project are that the capex requirement has been reduced from an original $7.5bn, to $2.2bn for stage one, with a further $2.5bn capex required for stage two, but self-funding. Also it is premium quality iron ore, and in the bottom quartile for cost - so although the selling price of iron ore has come down, and there are concerns of a wall of supply hitting the market, this particular project should remain economic even if there are further falls in the price of iron ore.

China is key to financing this project, who are known to be keen to break the stranglehold that existing producers have on prices and supply. It is believed that a lot of the capex could be financed through loans, although some dilution will inevitably occur to ZIOC, possibly from bringing in a new equity partner to finance the remaining capex for stage one - which is the one remaining major uncertainty.

On quality and selling price, note that the company says today;

The Zanaga pellet feed product is expected to receive a significant price premium relative to the 62% Fe IODEX reference price. This will be supported by its superior iron grade, low level of impurities, and its product sizing being suitable for direct feed to pellet plants.

Construction is expected to take place in 2016-2018, with first mining in Q4 2018, and first shipments in Q1 of 2019. Although I believe there will be some smaller scale production from the surface deposits prior to that.

The size of this project is pretty breath-taking - Measured resource is 2,330 Mt, so bearing in mind the selling price is currently around $100 per tonne, that means this project has something like $233bn worth of iron ore in it! Production is expected to ramp up to 30Mt p.a., so at $100 per tonne that's turnover of around $3bn p.a., and if we assume a profit margin of about 50% (based on the $50/t operating profit estimate in today's statement), then it should be making around $1.5bn p.a. profit once it's running at full capacity. What value might you put on that? Probably somewhere around $10bn? At the moment Zanaga owns half of the project, so its market cap of £67m (at 24p per share) clearly has some potentially large upside on it.

However before we get too excited, the project has to be financed first. This will inevitably lead to Zanaga being diluted, but maybe not as much as people think. If say 80% of the capex can be financed through Chinese debt, then that would only leave $440m to be financed through equity. If the project was valued at say $1bn, and a new equity partner injected all the $440m capex, then Zanaga would end up owning 34.7% of the project. A couple of years down the line, with production starting, then the project might be valued at say $3bn, so Zanaga's share would then be worth $1,042m, or £616m, which equates to just over 9 times the current market cap.

Obviously it would be amazing if we do get a 9-bagger out of this share, and something might go wrong to scupper that outcome, but it's tantalising potential upside. Also if you look at the valuation Zanaga had when intially floated, it was in that sort of area, of around 9 times the current share price. So with the project economics getting back to what was originally planned, it's surprising that the share price has not shown more of a recovery in my view. Although junior resource stocks are very much out of favour still, and perhaps people want to see how the project is to be funded before investing?

With the feasibility study now published, the next step is arranging the financing. So fingers crossed. Obviously having Glencore as your JV partner means that doors open, and the project should go ahead. The only question is what dilution Zanaga will suffer. Bear in mind that they have watertight contract terms with Glencore which prevent Zanaga from being forcibly diluted.

I'm surprised to see such a muted reaction to this morning's publication of the feasibility study. Mind you, the shares have risen strongly in recent weeks, in anticipation. So maybe a question of buying the rumour, sell the news?!

NATURE (LON:NGR)

The market has responded positively to results from NATURE (LON:NGR) today. We were discussing this one recently here, with some very useful points made by a reader in the comments section. It's very helpful & welcome when readers can flesh out the detail, or correct any errors or misunderstandings from me, as I only have time to do a quick review of companies here, as I cover about 500 in total, which is obviously quite a challenge!

First off, I have to say that publishing unaudited results for the year ended 31 Dec 2013 on 8 May 2014, some 129 days later, is far too slow a reporting cycle. They should be publishing results in early to mid February, not in early May!

The figures look quite good though. Turnover is up 52% to £21.8m, and underlying profit before tax is up 172% to £1.3m. Underlying EPS is up 129% to 1.1p, although at the current share price of 30.75p that equates to a PER of 28, obviously far from a bargain. A rating that high indicates that the market believes further substantial increases in profitability are possible.

Two readers commented that they thought it would take the company about two years to get profit margins back up again, with rebuilding their Gibraltar facility after an explosion, and some other issue in Rotterdam. On balance, I think this company has been too accident-prone (literally) for me to want to get involved - I've found that any company that handle hazardous goods can be problematic, especially smaller companies, and the valuation here looks to be already pricing in earnings recovery. Good luck to those of you that do hold though, I hope it works out for you.

Rex Bionics £RXB

Mention must be made of this company which has come to the market in an IPO today. At 180p per share the market cap is £25.7m, and it has raised £8.8m in fresh cash from new equity issued.

It is a New Zealand based company that has spent ten years developing artificial legs. Oh, I've just remembered that I've already mentioned it here a few days ago on 2 May 2014. It's very much a hearts & minds thing - you want it to succeed, even if the shares do badly.

It's a bit too early stage for me as an investment, but I shall be following the company's progress with great interest, as it was certainly the most memorable company presentation I've ever been to, since they had a disabled lady Sophie Morgan, demonstrate the product. Hearing her reaction to how it is transformative for her life, was absolutely inspiring. There is a fascinating video of her & the Rex product here, which I highly recommend you have a look at.

Idox (LON:IDOX)

Looking back at my notes here, in my report of 8 Jan 2014 I noted that Idox results were not too bad, and that I was quite tempted to have a punt on it. After pondering it further, I decided that the weak Balance Sheet and high debt were too off-putting. Pity, as the shares have risen about 24% since then, and now sit at 41.4p. The 6% rise today has been driven by an upbeat-sounding trading statement covering the six months to 30 Apr 2014.

The key part says;

The Company is pleased to report a very satisfactory trading performance in the first half of the year, with Group revenues from continuing operations up 12% and earnings substantially ahead of the first half of 2013. Strong cash generation in the period has also enabled a significant reduction in net debt, from £19.8m at the year end 31 October 2013, to £8.7m on 30 April 2014.

That net debt reduction is excellent, and removes my concerns there. Although the Balance Sheet will still be weak, as it last reported negative net tangible assets of £24.8m at 31 Oct 2013, so that's likely to still be negative. Not ideal, but it looks as if any risks over solvency are melting away now due to strong trading. So that puts it back on the table as a potential investment for me.

Today's outlook statement sounds positive;

...We expect the changes made in the first half of the year to deliver a lower cost base in the second half and further trading improvements in 2015. The Board remains confident that market expectations for the full year will be achieved.

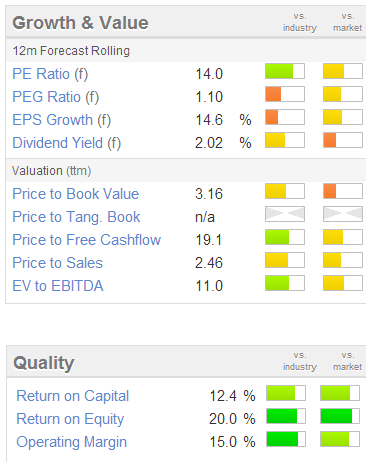

That sounds to me like they might well exceed market expectations if things continue doing well, so I'm now very tempted to have a nibble here. The usual Stockopedia valuation graphics below don't look especially good value, but given that the company could well be set up to beat broker forecasts, then the PER might actually turn out to be lower than 14. Also note that it pays a dividend, expected to yield 2%, which is helpful. What do readers think? I'm hovering over the buy button, but not quite sure yet.

Flowgroup (LON:FLOW)

A quick mention of results from this developer of innovative boilers. The figures look absolutely dreadful! £13.8m turnover, and a gross profit of only £1.8m, then £9.5m of admin costs, leading to an operating loss of £7.7m for the year ended 31 Dec 2013.

I know it's a growth company, but the market cap is £81m, yet it's not proven that it's commercially viable yet. Not by a long shot. It had about £15.4m in net cash at end Dec 2013, although presumably they're burning their way through that.

So this one looks like something that needs to be approached with extreme caution. They capitalised £3.6m of costs in 2013 too, so the cash burn looks even higher than the operating loss.

It looks to me as if this company might need to raise more cash, which means the market cap could well come under pressure. Based on the figures alone, I'd be more inclined to short this, than go long. However, it could have amazing technology, so that would need looking into.

Too high risk for me.

Got to dash, as I'm off into London for meetings, the main one being the ShareSoc growth company seminar from 4pm at FinnCap's offices.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ZIOC, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.