Good morning and welcome back!

Eckoh (LON:ECK)

Share price:44p (+8%)

No. shares: 244.3m

Market cap: £107m

There is some great coverage by Paul in the archives, if you want to read back through the recent history of this company, which provides call centre solutions and secure payment technologies for businesses.

In summary: it was highly rated, but had a problem in a non-core division, which set back expected growth for the year ending March 2017.

Since then (last September), it has been on a gradual recovery track, and today's update has further soothed investor worries:

The Board of the Company confirms that trading for the year ended 31 March 2017 was comfortably in line with market expectations, with revenue and margin growing by over 20% for the fourth year in succession. The Company continues to make good progress in the UK, and the Group's operations in the United States have produced a record year in terms of revenues and order book; as a consequence US-derived revenues will again represent a growing proportion of total Group revenues.

"Comfortably in line" presumably means at the upper end of the range of expectations (otherwise wouldn't it just be "in line"?)

Net cash is ahead of expectations.

In a further piece of news, the non-Exec Chairman is stepping down, in what appears to be an orderly transition.

My opinion

The Stockopedia Risk Rating is "Adventurous", which sounds about right.

On the one hand, you have a good history of profitability, you have a balance sheet moving back into net cash, and a company which owns its IP and seems to have plenty of expertise in its sector.

But there are some companies which are better suited for minority, external investors than others and this looks like one of those where perhaps the position of employees is a bit stronger than the position of external shareholders. I say that since it appears that a good deal of Eckoh's services rely to a greater or lesser extent on the skills of its own expert consultants.

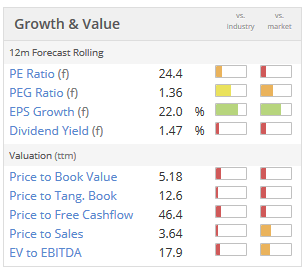

So as always it's a balancing act. The stock does pay a dividend and business is growing. So do your own research and make up your own mind, it might be worth a look:

Alfa Financial Software (New flotation)

This company is seeking to list on the Main Market of the LSE, and I mention it in passing for two reasons.

Firstly, if you're interested in the sector, it sounds worthwhile: the company provides a platform ("Alfa Systems") which automates and improves processes for asset finance companies. Sample clients mentioned in this announcement are Bank of America, Barclays, Mercedes-Benz and Nordea.

The key argument for its future potential might be as follows:

The Directors believe this market is underserved due to a lack of purpose built modern solutions, with many asset finance companies currently relying on legacy systems or non-specialist ERP systems.

In the proposed IPO, the Chairman and CEO will be selling shares and targeting an initial 25% free float, and have a 365-day lock-up on remaining holdings. That is a reasonable length to me.

If you check the financial summary, it looks rather unusual as revenues increased 36% in 2016, but PBT actually fell slightly due to a very large item called "pre-IPO share based payments". Assuming that share based payments on this scale will not be be repeated (which I don't know for sure), the underlying growth trend is excellent, as adjusted EBIT rose from £22.5 million in 2015 up to £32.8 million.

So it looks like an interesting IPO but the second reason I mention it is just to offer a note of caution in relation to the market generally. Obviously we've been enjoying all-time highs in the major Indexes but in a global setting we've also seen a lot of companies coming to the market this year.

This article from March has evidence that "the number of flotations worldwide has surged to levels not seen since before the credit crunch".

While the London IPO market might not be surging to the same extent as New York, it nearly always says something to me about valuations when I see companies listing in their droves. A lot of it is sector-specific. For example, at the moment, software companies seem to be very enthusiastic about coming to market (e.g. $SNAP). This of course has implications for the software companies which are already listed too.

Premier Foods (LON:PFD)

Share price:43.75p (+1.7%)

No. shares: 832.4m

Market cap: £364m

Premier Foods Renews Relationship with Mondelez

Good news at Premier:

Premier Foods today announces it has signed 'Heads of Terms' for a strategic global partnership with Mondel?z International to renew the Company's long-standing licence to produce and market Cadbury branded cake and ambient dessert products. Once finalised, the new licence will run until 2022, with an option for the Company to extend this to 2025, subject to meeting certain performance criteria.

Under the proposals, Premier will possibly be able to make cakes under any Cadbury brand (Flake, Crunchie, etc).

It's good news and Premier shares are up nearly 10% since I last covered them in January.

News has been light since then. The only thing I'd mention is that agreed payments to the pension schemes were reduced out to 2023 (see here), in an update which reminded us that the present value of future payments to these schemes is £300 million - £320 million.

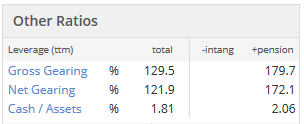

Net financial debt was last reported at c. £550 million, while the value of the Group pension deficit is the difference between two large numbers (assets and liabilities) each in excess of £5 billion.

So I doubt very much that today's update, positive though it may be, is important enough to change the overall outlook here.

I think the road back to a reasonable balance sheet will be a long one, so it's not something that would fit into my investment strategy. But it's not currently distressed and could eventually prove to be a huge winner, if it navigates through these challenges.

Numis (LON:NUM)

Share price: 278.5p (unch.)

No. shares: 113.3m

Market cap: £316m

Relevant to some of my prior comments in this article, Numis reports seeing "a scarcity of primary equity issuance in the UK market as a whole", in the six months to March 2017.

For the market as a whole, the value of secondary trading on the London Stock Exchange has shown an improvement on the comparable six month period. However, equity issuance across the market has not experienced any appreciable upturn, with equity funds raised on AIM and the Main Market combined totalling £13.6bn, down 1% versus the comparable prior period.

Despite these uninspiring macro conditions, and a 38% fall in its first-half PBT to £10.5 million, Numis reckons that it delivered a "creditable performance", considering that the comparable period was a record for the firm.

It goes to show that all-time highs in the stock market don't always translate to easy money for the brokers.

Outlook

The co-Chief Executives have "confidence that the business will have a satisfactory outcome for the full year":

Our second half has started very well with the completion of 10 fund raises generating fees of over £10m. Equities revenues continue to run at the high levels seen in the first half.

So it doesn't sound as if shareholders have any particular reason to panic.

In December, I suggested that this stock probably deserved a higher rating despite the lack of visibility in this industry. It has indeed risen since then, despite the weaker six months just recorded.

Profits are always going to be volatile, so investors need to try not to over-react to news every six months.

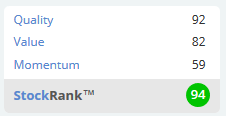

The StockRank is still excellent and I still consider this to be a good, investable company:

That’s it from me today. Paul is scheduled to be back tomorrow.

Thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.