Good morning! If you're not interested in my macro musings, then ignore this next bit.

Revisiting a topic from last week, I'm still trying to get my head around the possible implications of the now knife-edge Scottish independence vote. To stress again, it's the economic/markets impact that matters as regards this column, not the political side of things, which is best discussed elsewhere.

Sterling vs dollar - Looking at currencies first, commentators this morning are gushing about how the pound is weakening (a 1% move down against the dollar, to £1 = $1.617 this morning alone).

As you can see from the chart on the right (courtesy of IG Index) covering just over a year, sterling's move down against the dollar in the last two months has indeed been significant.

However, that's been reversing the previous trend of strengthening sterling, so we're now back to where we were in autumn of 2013. This is probably a good thing for investors, as numerous companies have been citing the strength of sterling against the dollar as a reason for disappointing earnings in the last few months.

So as long as the move doesn't turn into a rout, then I see the weakening pound against the dollar as a mostly good thing for my shareholdings. To recap, a weaker pound makes UK exports more competitive, makes UK manufacturers more competitive in the domestic market against overseas competition, and means that dollar denominated earnings translate into higher sterling earnings (e.g. with mainly dollar earnings, 4imprint (LON:FOUR) should benefit from the recent exchange rate movements).

Sterling vs Euro - As everyone seems to be attributing recent sterling weakness against the dollar to the Scottish independence vote, I assumed that sterling must also be plunging against the Euro?

However, that is not the case at all. In fact, sterling has moved very little against the Euro recently, as you can see from the sterling:Euro chart on the left.

The Euro has got its own ongoing problems of course, but if the forex markets were really scared about the Scottish independence vote, then sterling would have sold off heavily against the Euro too, which is hasn't.

So it looks as if the only factor we need to consider (so far) as investors is the impact on our portfolios of the sharp move of sterling against the dollar.

UK stocks - Maybe investors will become more wary of buying or holding shares in companies with Scottish exposure, but personally I won't be making any adjustments to my portfolio. I like investing in companies in Northern England, and Scotland, as you tend to have more grounded management, who are less greedy, and more committed to the companies they run.

I have two Scottish companies in my portfolio Indigovision (LON:IND) and Spaceandpeople (LON:SAL). I cannot see any significant impact on either from Scottish independence. It will just be business as usual, in my opinion. So there's no reason to make any adjustments to my portfolio. In fact IND will be gaining from the recent dollar strength vs sterling.

Portfolio insurance - since the Scottish vote is very soon, on 18 Sep 2014, and Sep 2014 FTSE Put Options expire on 19 Sep 2014, then it seems to me they make a good insurance policy against the market having a panic sell-off, if an upset looks likely. So I bought some FTSE 100 Puts last week, which is looking a good move so far, as they have almost doubled in value already.

At the very least, I think a Yes vote could push Scotland, and maybe even the whole UK into another Recession, as the substantial uncertainty is likely to curtail business investment. How can businesses invest, if they don't even know what currency they will be using, what interest rates will be, etc?

The timing of this whole thing is insane. Surely it could have been delayed until the economy was stable, and growing sustainably? I seem to be far more worried about this than most other people, so perhaps I'm fretting unnecessarily? It does strike me as a big issue though, in terms of potential risks to the market, hence why I'm nervous.

Seeing Machines (LON:SEE)

Share price: 7.5p

No. shares: 822.2m

Market Cap: £61.7m

There's been excellent newsflow recently from this small Australian developer of eye-tracking software & equipment. Although it's worth bearing in mind that the company is likely to be loss-making for a couple more years. However, we're still in a bull market, and investors are prepared to pay up-front for exciting technology such as this.

The company already has a relationship with Caterpillar, selling its equipment for large trucks deployed in mines. The second market is road transport, with a couple of deals already announced there. Today sees a third strand added to SEE's activities, namely a "memorandum of understanding" with Samsung. No financial details are given, so one shouldn't get too excited about this, however it does look encouraging, with the two companies formalising a joint R&D effort.

I particularly like the endorsement of SEE's technology from Samsung;

Mr Sunkyu Lee, VP of Product Planning at SEMCo said: "SEMCo has been working with Seeing Machines for some time now and recognises their eye tracking algorithms as industry best. I believe that our joint development and commercialisation of these technologies will radically enhance the user experience and ultimately change the way that people use their electronic devices to interact with their online and offline environments. "

I know that the most cynical of you will disregard such quotes, but it doesn't do any harm getting high quality third party confirmation that SEE are indeed the leaders in their field.

The market cap of SEE is getting rather on the warm side again, but given the strength of the newsflow, personally I'm not inclined to sell my existing holding.

Character (LON:CCT)

Share price: 214p

No. shares: 21.3m

Market Cap: £45.5m

There's a positive trading statement from the company today, saying;

...the Group anticipates it will report that the financial year ended 31 August 2014 has performed in line with management forecasts and therefore expects to deliver results in line with market expectations.

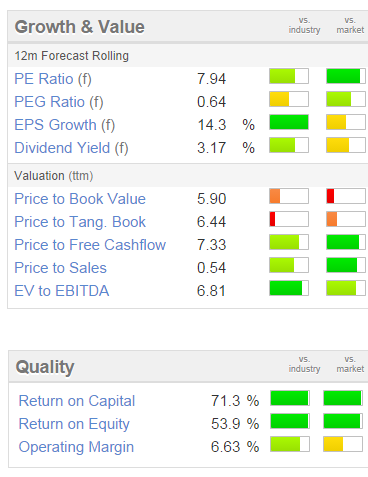

The shares look cheap to me;

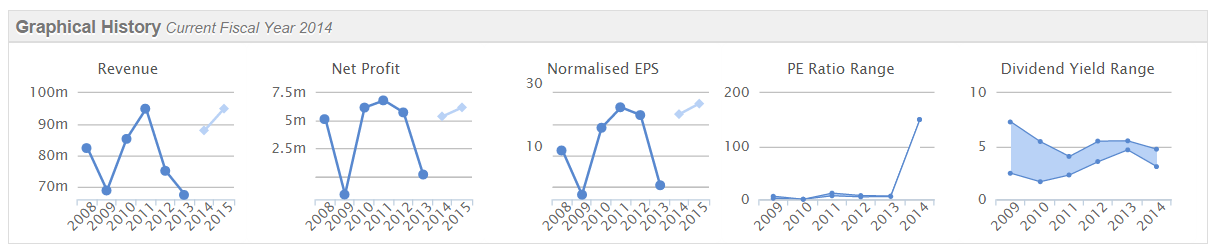

Although in the past the company has been subject to the vagaries of demand for toys, with the occasional bad year thrown in, as you can see from the Stockopedia graphical history below;

The only reason I don't currently hold any of these shares in my portfolio is because the bid/offer spread has been too wide, and the shares are horribly illiquid, which puts me off. Having said that, it's probably a mistake, based on the current valuation I should probably hold this share, but don't. Might pick up a few on the next market wobble.

BREAKING NEWS! - In a separate announcement, CCT announces that is has signed the Teletubbies!!!

Getech (LON:GTC)

Share price: 64.5p

No. shares: 30.3m

Market Cap: £19.6m

Shareholders at this oil services company (they do seismic mapping & data for oil exploration cos) have endured something of a rollercoaster this year, with a rather odd series of negative, then positive announcements in rapid succession.

This morning's headline from the company is striking;

Largest ever new contract - $5 million

The customer is the Angolan national oil co, Sonangol. More detail about the contract is given, the most important bit being this;

The work is due to start immediately and the Company anticipates that most of the income will be recognised in the current financial year. This is an excellent start to the year and gives confidence that the Company will meet the current year market forecasts.

So before getting to carried away, it's worth noting that they are only talking about meeting, not beating market forecasts. That said, given the debacle earlier this year, it makes sense to play it safe. Also, as the company has a 31 July year end, they are only just over one month into the current year, so it would be a bit mad to suggest outperformance this early on, especially as the company has lumpy revenues, and they don't know how the rest of the year will pan out.

The shares are up 19% today to 66.5p, which given the inherent uncertainty about performance, looks high enough for the time being, in my opinion. This translates into a PER of 10.8 times broker consensus forecast of 6.13p EPS this year.

A 2.1p divi is forecast for this year, giving a useful yield of 3.4%.

As you can see from the two year chart, shareholders need to be prepared for volatility here. Also I feel it's important not to let the valuation get too stretched, otherwise you're the wrong side of risk:reward if something else goes wrong, as inevitably it will at some point - since small companies like this are heavily dependent on a small number of key clients & contracts.

Pennant International (LON:PEN)

Share price: 86p

No. shares: 26.3m

Market Cap: £22.6m

Next I'm having a quick skim through the interim results to 30 Jun 2014. Pennant is a small group of companies that seems to mainly operate in the flight simulator area, and similar.

The interim results are roughly flat against last year. EPS rose slightly to 3.47p. There was no H1:H2 seasonality last year, so assuming the same this year and doubling H1 EPS gives us just under 7p full year EPS. So that puts the shares on a PER of about 12.3. That looks about right to me.

The Balance Sheet look solid, although debtors look slightly on the high side, but similar to 6m and 12m ago, so no change there. Net cash has grown to almost £1.9m, which I like.

The outlook statement says;

The pipeline is active and there has been significant on-going dialogue with a broad spread of potential customers on a number of significant opportunities particularly in the defence and rail sectors. While the timing of these opportunities is generally outside our control, the Group's good relationships with its customers and its strong balance sheet provide a firm position from which to build and realise the opportunities as they arise.

So that's completely vague really.

Overall, it looks priced about right I reckon. The 5p fall today doesn't look like a buying opportunity in my opinion, as there's nothing to go on about future potential. So if the company executes well, then the shares will go up, if it executes badly, the shares will go down. I've no idea which it will be, time will tell!

Escher Group (LON:ESCH)

Share price: 280p

No. shares: 18.7m

Market Cap: £52.2m

Interim results to 30 Jun 2014 from this software provider to many postal services globally, look poor to me.

Revenue fell 14% to $11.1m (note the company reports in US dollars), and operating profit fell almost 50% to only $692k. That doesn't look much good in the context of a £52.2m market cap (stated after today's 8% fall in share price).

I'm not keen on this company - whilst it has won impressive contracts with major customers globally, it doesn't really make much profit relative to the market cap, and the profit trend seems to be downwards. The business model relies far too heavily on unpredictable licence fees, in my view. There are no dividends either.

The company might have some strategic value, to an acquirer that is keen to gain access to a critical software provider to many large postal services. However, I can't see much value in it as a standalone company.

The outlook statement sounds mixed;

As the point-of-service automation supplier of choice for postal organisations across the globe, the Group will continue its drive to penetrate this market. Although lead times are long, the Group has been in contact with several postal organisations for some time and is confident that new customers will be signed during the next 12 months.

The recent move to a subscription based revenue model changes the profile of our revenue recognition and while positive in the long run will have a materially negative impact on the Group's revenue for 2014 and associated adjusted EBITDA.

The Board's expectation, adjusted for a subscription based model, for the financial outcome for the full year remains dependent on a license sale and the rollout by a major customer of its integrated Riposte solution. When this has been rolled out to a certain number of workstations, Escher will recognise significant license revenues. Progress with rollout is continuing and the expectation is that rollout will complete in 2014.

The new digital services and interactive retail markets are developing well and the pipeline of opportunities has expanded over the last 12 months. The South Africa Post Office RiposteTrEx contract win in December 2013 is the start of the commercialisation of this opportunity and proof of the emerging demand for these services.

Escher's Interactive Services have also developed a range of technologies including NFC to loyalty and couponing on mobile phones, which has led to an increase in the number of opportunities in the market.

Given the quality of the Group's pipeline and current technology set, Escher remains confident about the prospects for 2014 and beyond.

My opinion - the shares are difficult to value, and in my view there are too many uncertainties to make me want to pay a premium valuation for uncertain performance.

Lunch beckons, so a couple of quickies;

Murgitroyd (LON:MUR) - I've been saying for a while that shares in this European patent attorney are too expensive, and that is very much confirmed by disappointing results for the year ended 31 May 2014 published today.

Turnover rose 6.7% to £38.4m, but profit before tax fell 9% to £4.1m. Basic EPS fell from 38.2p last time to 33.2p this time. That puts the shares on a historic PER of 15.2 (based on current share price of 505p). That valuation only stacks up if you expect profit to recover. Although in fairness, broker consensus was slightly lower at 32.4p, so the company has slightly beaten expectations.

Net debt has been almost eliminated, and is now only £0.4m.

Reflecting the mature nature of the business, management say a more aggressive dividend policy is being adopted.

It doesn't appeal to me. I'd be looking to pay a PER of 10-12 tops, to attract me into these shares.

Cambria Automobiles (LON:CAMB) - There's a nice trading update today;

...the Board is pleased to report that the Group has continued to perform well and that the results for the year ended 31 August 2014 are expected to be ahead of current market forecasts.

Current trading sounds good too;

Heading into the important September trading period, the Group's new car order book is ahead of the same point last year, reflecting the continuing strength of the new car market. The Board continues to view prospects for the new financial year with confidence.

The shares look pretty good value to me, but as always please be sure to DYOR.

Phew bit of a mammoth report today, I might need a lie down on the sofa after lunch!

See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long positions in SEE, IND & SAL, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.