Good morning!

Today I intend reporting on;

- BooHoo (BOO) - positive trading update

- Quarto (QRT) interim results to 30 Jun 2016 + CEO audio interview

- STM (STM) - trading & strategy update

- SCS Group (SCS) - trading update & refinancing

- Hargreaves Services (HSP) - results y/e 31 May 2016

I note that sterling has been very weak lately (currently £1 = $1.298) - another leg down seems to have been triggered by the bizarre policy mistake by the Bank of England last week, to cut interest rates again to 0.25%. This looked like a panic measure, and I think was counter-productive.

Policymakers need to understand that sometimes doing nothing is the best thing to do. Businesses constantly adapt to whatever the circumstances are - but above all, simply want stability - then they can plan & invest with confidence. Tinkering around with policy, whether it be fiscal or monetary, can be harmful in my view.

Weaker sterling is GOOD for:

- UK producers (more competitive against imports) and especially UK exporters

- UK listed companies with overseas subsidiaries - their earnings translate into a higher sterling amount

- UK inward tourism - which has already risen in response to cheaper sterling

Weaker sterling is BAD for:

- Importers - e.g. non-food retailers - who will have to raise prices next year, probably hurting their profits.

- More expensive imported goods increases inflation (which should trigger higher interest rates)

- Higher inflation squeezes household disposable incomes, hurting discretionary spending (such as restaurants, pubs, etc.)

- Foreign holidays become more expensive for UK people

The above isn't meant to be exhaustive, it's just what I could think of, off the top of my head. If I've missed anything important, drop it into the comments section below, and I'll add to the list.

Clearly the above is important to bear in mind when selecting which shares to buy or hold.

Boohoo.Com (LON:BOO)

Share price: 79.5p (up 6.7% today)

No. shares: 1,123.3m

Market cap: £893.0m

(at the time of writing, I hold a long position in this share)

Trading update - regulars will know that this has been one of my favourite shares since the overdone sell-off after a profit warning in Jan 2015. Look at the chart since - who says don't catch falling knives?!

Now obviously, charts like that will correct, and then consolidate, at some point, but the big question is - when? The shares haven't been zooming up for no reason, it turns out that the business is trading more strongly than expected. It says today;

The Company has performed well during the first five months of the year and the start to August has been encouraging.

Demand has been robust and sales momentum in the first quarter has continued into the second quarter.

Sell through of seasonal stock has been strong through the Spring and Summer season.

BooHoo's "test & repeat" business model gives it a massive advantage over High Street retailers. A decent-sized High Street retailer would have to buy, say 30,000 units (3 colours, 10,000 units of each) of a particular garment out to 500 shops, with no idea if that style is going to sell or not. It would also need replenishment stock to be held in a warehouse for topping up when required. A lot of ranges don't sell, so have to be marked down to half price, to shift the stock. That badly impacts gross margin, and all the while a shop is holding slow-moving stock, the overheads (rents, rates, and staffing mainly) are clocking up.

BooHoo does things differently. It constantly introduces new styles onto its website (daily, up to 100 new styles per day), in small quantities only (a few hundred units). If they sell rapidly, then a repeat order is immediately placed, and thanks to focusing on suppliers which can deliver rapidly, the repeat order is then back on the website, in much greater quantity - because the company already knows it will sell well. High sales, and high margins.

This has a terrific beneficial impact on margins. Also, without all the costs of a huge branch network, BOO has lower overheads.

However, online doesn't have it all their own way. The downside of online fashion is that the customer returns rate is high - typically 30% (compared with 3-10% on the High Street), although I believe BOO is lower than 30%. So returned stock is a drag on margins, as it often has to be disposed of at a low price.

Also, online selling requires a massive, ongoing marketing spend. There's no barrier to entry, but there are huge barriers to achieving scale. BOO is now big enough to out-spend most rivals on marketing, which is something of a moat (to use Buffett-speak). They've got to keep getting the product right though - marketing spend is wasted money if your product is no good.

Guidance for the full year (ending 31 Jan 2017) is raised by the company;

Consequently, the board now anticipates that the results for the current year will be above expectations with increased sales growth of between 28% and 33% (against previous guidance of 25% to 30%).

As a result of operating leverage in the business, the board currently anticipates improved EBITDA margins for the financial year and further guidance will be given at the interim results in September. The board continues to be positive about the trading environment for boohoo.com.

That's really good news, especially that the EBITDA margin is improving too.

My opinion - have I fallen in love with this stock? Damn right I have! The valuation is high, on conventional measures. However, when you find something really special like this, then it's usually a mistake to sell because the valuation has become stretched.

The valuation is actually low relative to £ASC (in which I hold a short position) , and it's a better business than Asos in my view - because it's growing faster, with much better margins.

The other interesting angle, is that there are early signs that BOO might be cracking the USA market. See this article, and also if you look at the web stats, a lot of traffic to BooHoo.com is coming from the USA.

Quarto Inc (LON:QRT)

Share price: 261.5p (unchanged today)

No. shares: 19.7m

Market cap: £51.5m

Interim results to 30 Jun 2016 - I interviewed the CEO & CFO of Quarto this morning, and have published the audio of our phone call - please click here to listen to what I hope was an interesting chat, and I also managed to ask the excellent questions submitted by 7 readers - thank you very much to them.

Quarto is mainly an illustrated book publisher, so it has a huge profit weighting to H2, for Christmas & Thanksgiving present giving. Therefore there is little to be gleaned from the interim numbers.

For example, in 2015 it made an H1 loss before tax of $1.6m, but for the full year it made a profit of $12.9m.

This year's H1 loss is slightly worse, once you strip out last year's exceptional items.

The balance sheet remains highly geared, but net debt is on a downward trend - but still too high in my view, at $72.5m.

Although management emailed me on this point, as follows;

Please bear in mind on the debt that June 30 is our peak outflow for the year. Analyst guidance is for c.$53m for year end 2016 which would represent c.$6m reduction in the year or $28m in four years.

There is off balance sheet value, from the back catalogue being written down to nil after 3 years, but continuing to contribute to profits.

Outlook - management sound confident;

By the end of this year there will have been elections or constitutional upheaval in all of our main markets - the US, Australia, UK and Europe. We are increasingly second-half weighted and with good visibility over the majority of our second half revenues, we remain confident of both reducing debt and delivering growth for a fourth successive year.

Dividends - the interim divi has been maintained, and from my chat with management it sounds as if there's no intention to reduce divis in future. The yield is decent, at about 4.4%.

My opinion - I'm warming to this share, although for me the net debt is still too high. However, that is reflected in the low PER. Also, having mostly dollar earnings, then profits are rising on conversion to sterling.

Management seem straightforward, and are happy to respond openly to difficult questions. It seems an interesting buy & build also, with acquired companies being restructured to make them more profitable, remove duplicated overheads, etc.

Overall then it looks potentially interesting, although personally I shall probably wait until debt has come down to levels I'd be more comfortable with.

STM (LON:STM)

Share price: 40.5p (up 26.2% today)

No. shares: 58.9m

Market cap: £23.9m

(at the time of writing, I hold a long position in this share)

Pensions trading and pricing strategy update- I last reported on this administrator of QROPS pensions here on 13 Jul 2016, when it issued a mild profit warning. So that's the background, which I won't repeat today.

The company decided to waive initial fees, in order to drive new business acquisition. This makes sense, as new business will then tend to generate many years of decent recurring revenues.

The update today seems to indicate that this revised strategy is showing signs of working, with a pick up in new business;

By way of a further update on the development of this initiative, management is pleased to announce that the July new business numbers for QROPS saw a 28% increase over those of June, which was in turn a 15% increase over those of May.

New business applications in July 2016 represent the highest month of applications over the last twelve months and a 75% uplift on the average number of applications received in the first four months of the year.

Various other details are given, which I won't go into here.

The interim CEO comments;

"The above, in conjunction with other on-going initiatives referred to in the 13 July 2016 update, is expected to help build a robust recurring revenue stream and deliver long term shareholder value."

My opinion - recurring revenues is what this share is all about. Waiving the initial setup fee is bound to cause a drag on short term profitability, but will build a larger & sticky recurring revenue stream. The churn rate of customers is exceptionally low, at about 2% p.a., so once they're signed up, STM should enjoy many years of profitable business.

I cannot shrug off a gut feeling that something just isn't quite right about this share. Hence why I'm keeping my long position size small. However, the figures do look quite compelling - it has around £9m in cash too.

Anyway, the market loved the update today, with this share up about 26% today.

SCS (LON:SCS)

Share price: 158.4p

No. shares: 40.0m

Market cap: £63.4m

Trading update & refinancing - this covers the 53 weeks to 30 Jul 2016.

I didn't spot an excellent update from the company on 9 Jun 2016 - here - which detailed a steadily rising trend in LFL sales growth. Importantly it was a rising trend for year-to-date sales growth - which of course means that the most recent figures were even better than the reported figures, since they pulled up the average for the whole year. Here are the figures;

| No. weeks trading | Ending | LFL sales growth |

| 25 | 16 Jan 2016 | +8.8% |

| 37 | 9 Apr 2016 | +12.0% |

| 45 | 4 Jun 2016 | +14.6% |

| 53 | 30 Jul 2016 | +14.8% |

An impressive table above for sales growth. Most retailers would kill to achieve LFL sales growth of that level. Look how the trend has steadily improved throughout the year too - suggesting to me these are not one-off factors, but something structurally positive is happening here perhaps.

Mind you, nothing is said about gross margins. Sales are for vanity, but profit is sanity. So I'd like to see the full year results first before getting too excited. That will ascertain whether SCS has managed to hold or improve its margins, or whether it has just been discounting in order to ram through more sales volume.

In terms of profit, they're in line;

As a result, the Group expects to report profits in line with current market expectations.

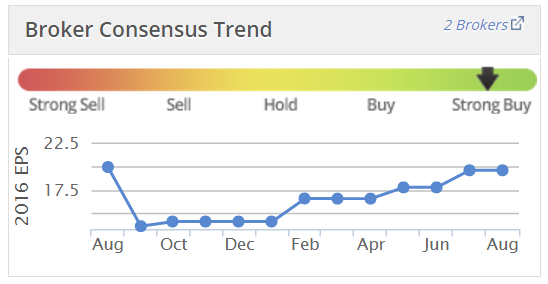

Note that market expectations have increased considerably in the last 12 months;

Broker consensus looks to have been 20p EPS this time last year, then that was reduced sharply to 13.6p by Sep 2015, but has been gradually increased to 19.65p now - almost back to where it started.

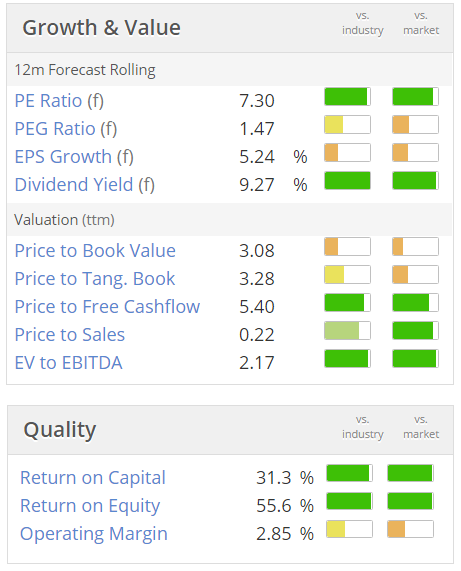

Valuation - this share now looks very attractive on a PER & divi yield basis;

Also note that the StockRank is 98.

Bank facilities - sounds like the Bank Manager is happy too - he's extended SCS's debt facilities through to Oct 2018, at a lower interest rate margin too.

Brexit/outlook - SCS laughs in the face of Brexit uncertainty;

"We are delighted that trading was strong throughout the EU referendum campaign and has continued since the vote with progress on a like for like basis in all retail categories...

My opinion - it looks superficially interesting, but bear in mind that this is a very low net margin business. So profits can vanish extremely rapidly, and turn into heavy losses, in an economic downturn.

I remember buying shares in this in 2007, as the metrics looked very similar to those above. It went bust shortly afterwards when the GFC hit hard in mid-2008.

So I would say that, providing consumer sentiment remains reasonably OK, and credit is in free supply, then everything should be fine. However, at the first sign of any new recession or credit crunch, I would drop this like a hot potato.

Also, an important issue is where the product is sourced from? If it's imported, then prices will be going up next year, due to forex changes recently. That could put a dampener on growth.

Hargreaves Services (LON:HSP) - I've had a quick look through these numbers, and can't really discern much from them.

The traditional coal distribution business now seems to be dead in the water. Overall operating profit has collapsed, from £38.1m to just £5.2m, for y/e 31 May 2016.

I don't know how to value it. Really, this is a special situation, based on what value can be realised from the property assets, and various other bits & pieces.

The CEO has a big personal stake, and seems shrewd, so he'll squeeze maximum value from it, I'm sure. I've no idea what it's worth now.

I'll sign off now. See you in the morning!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.