Share price: 166p (+7.7%)

No. shares: 375.5m

Market cap: £623m

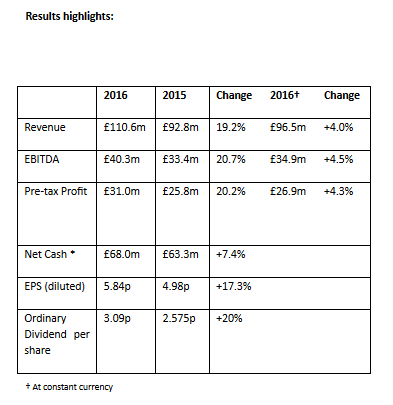

Interim Results (for the six-month period ended 31 October 2016)

Note the huge tailwind from currency movements. UK/ROI revenues are only about one quarter of total revenues (the rest primarily coming from Continental Europe and Japan), so the move in Sterling produced a windfall of additional profits.

Outlook: It is no surprise that the shares are bouncing, given the following outlook statement.

The Group's performance for the first half was ahead of

the Board expectations and the Board therefore now expects the Group's

profits will significantly exceed current market expectations for the

financial period ending 30 April 2017. The Board continues to be

optimistic about the Group's future prospects.

Revenue analysis: The number of vending units increased by 3.4% to nearly 47,000. Photobooths are 60% of the entire estate, and are growing at a slower rate. Instead, the primary growth driver is laundry units, whose numbers increased by 51%.

Profit (at constant currency) is growing at a slightly faster rate than revenue, which is growing at a slightly faster rate than the total number of machines - these are all positive signs to me.

Dividend: Interim dividend is increased by 20% to 3.09p. This suggests a possible yield of 4.2% on the current share price (depending on the movement of the final dividend).

Net cash: £68 million, after making adjustments and deductions from £77 million of gross cash, with a very healthy balance sheet. Indeed, I would have argued that this was probably too much cash for the business to hold, but I note that it has already made three special dividends since 2012. So I can't blame management for not trying to keep the cash balance under control!

My opinion: I have been watching the Finance Director's presentation to Mello earlier this year, and have a very positive overall impression of the business. ROCE has been estimated according to my sources at an average of c. 29% over the past three years, which for me puts it in the category of a super-high-quality business (although it's true that these were all-time high performance levels for the business).

Prior to this morning, brokers were forecasting pre-tax profit for the financial year of c. £42.6. This will need to be revised higher now.

The question was raised at the Mello presentation - given that laundry machines and launderettes already went out of fashion, is it realistic to expect them to be a growth business in the future? A very fair question.

But I'd still happily pay a very high earning multiple for a business which can generate cash and economic returns like this one, even in the absence of rapid growth.

Brainjuicer (LON:BJU)

Brainjuicer (LON:BJU)

Share price: 532.5p (+7%)

No. shares: 12.2m

Market cap: £60.8m

Confident little update:

Trading, since the announcement on 16 September 2016 of

the Group's results for the six months ending 30 June 2016, has

continued to be strong. Despite the partial recovery in the value of

the pound in recent weeks, we are confident that Gross Profit, our main

top line indicator, and Pre-tax Profit (normalised and reported) for the

twelve months to 31 December 2016, will be above current market

forecasts. Our continued strong progress has been underpinned by the

excellent performance of our Advertising Testing and Brand Tracking

services.

The shares are approaching all-time highs.

Earnings: Brokers were forecasting pre-tax profit of £5.5 million for this financial year. Obviously, this is another instance when forecasts will need to be revised higher.

The company's success in the US exposes it to a higher effective tax rate, so for example if it achieved PBT of £6 million for the year, this would probably translate to final net income below £4 million. Taxation rates are of course subject to change, something else to consider in your calculations!

Cash: Cash in June was £5.2 million. It's a shareholder-friendly company, paying out a chunky special dividend in October, but even after that, it looks to me as if year-end net cash should be well in excess of £6.0 million, possibly in excess of £6.5 million.

My opinion: I'm a big fan of this company. Most of the profits now arise from their quantitative services, which are cheap to deliver and result in fantastic profit margins. These services enable companies to scientifically test and manage their brands. Of course Brainjuicer is not the only company which provides these services, but it is certainly one of the most successful smaller ones.

It has been careful to manage expectations. In September, it reminded investors that "the majority of our business is still Ad Hoc, with little revenue visibility". Reliable, repeat business is hard to achieve in this industry.

So as always, it's a balancing act. An enterprising, shareholder-friendly company, but does the valuation compensate for likely future earnings volatility? I'd be inclined to say that it does, though I'd be reluctant to allocate a very large percentage of my portfolio.

Ab Dynamics (LON:ABDP)

Share price: 498p

No. shares: 18.9m (after Placing)

Market cap: £94m

Proposed Placing and Offer for Subscription (Tuesday)

Result of Placing (Tuesday)

Some readers asked me to comment on this, so I thought I should briefly discuss (thank you for the suggestions).

This vehicle testing company has witnessed stunning growth over the past six years. Demand for its products and services has grown to such an extent that it has seen fit to build a major new facility, scheduled for completion in Q3 2017.

While it has stated that existing cash resources are sufficient to build this facility, it came to the market on Tuesday looking for fresh funds "to support and further advance the future growth and development of the Group".

A four-pronged rationale is given: new equipment, spending on its international centres, a new simulator factory, and general working capital.

So far, so good.

The fundraising looks reasonable in every respect. Firstly, the gross proceeds sought (£5.4 million from the Placing and up to an additional £1.0 from the Open Offer), are considerably larger than aggregate dividend payments made in recent years. So the company is not wasting time and resources reclaiming funds which it could have had access to with a more prudent dividend policy.

Secondly, while the founder/Chairman sold a chunk of shares as part of the deal, it was a very small percentage of his overall holding.

Thirdly, it was a hugely oversubscribed deal (3.5x), indicating firm shareholder support. Perhaps the Offer will also see a very positive reaction from shareholders.

Brokers are forecasting PBT of c. £5.6 million this year. Given the growth trajectory, and the company's well-supported expansion plans, it makes sense that this should be a highly rated stock.

Share price: 84p (+3%)

No. shares: 30.8m

Market cap: £26m

AGM Statement and Trading Update

This engineering/environmental consultancy held its AGM this morning, appointing a new NED (a long-time CBRE executive, you can read that RNS here).

Before all of that, we had a trading statement:

"During the first four months of the current financial year to 31st

October 2016, the Group's overall performance was in line with the

Board's expectations, with revenue slightly above the prior year period,

in part due to beneficial exchange rates. Cash collection has remained

strong, supporting the Board's aspiration to maintain a progressive

dividend policy increasing the level of dividends payable to

shareholders over time.

Updates are provided on a range of new commissions, including those related to the MoD's Army Basing Programme, the Brent Cross shopping centre and the Priority Schools Building Programme (a government plan to rebuild and refurbish the schools in the worst condition).

Brokers were previously forecasting that PBT would be flat this year at £3.6 million; today's statement suggests to me that the risk is more likely to be on the upside!

The range of services it provides gives it an element of diversification, but it is still very much subject to economic winds.

Share price: 20.5p (-61%)

No. shares: 46.7m

Market cap: £9.6m

Late afternoon profit warning from Fairpoint.

My previous comments on this company have been completely wrong. Most recently, in September, I expressed a tentatively bullish point of view that the company would probably pull through its various difficulties.

This warning signals to us the opposite: the company is performing poorly and with potentially serious financial consequences.

In a nutshell, the legal services division has been performing below plan and the closure of the debt management division is taking longer than expected to result in reduced overheads.

Consequently:

As a result of the factors noted above, the full year results for the

Group for the year ended 31 December 2016 are likely to be materially

below market expectations. The Board is formulating plans to mitigate

the potential impact on the trading performance and financial position

of the Group going forward, including the suspension of future

dividends.

I previously suggested that the company would be better off if it tackled its debt rather than continuing dividend payments, but I don't take any pleasure in seeing it now forced into taking this action!

At June, the company had a net debt position of £15.6 million.

At that time, Fairpoint said that it had "£8.6 million in cash and undrawn lending facility." Based on the cash on the balance sheet at the time, I estimate (and I could be wrong) that the company had used up c. £20.5 million of its £25 million total bank facility.

That doesn't leave much margin for error, especially if things are not going according to plan. Today's statement leaves investors in the dark as to how serious the situation might be, but I'd agree that it's now prudent to price in a rescue rights issue. That would make it yet another debt-fuelled acquisition spree which ended badly for shareholders.

Thanks for bearing with me while I learned the ropes here this week.

Paul is having a lot of fun at the moment and so you might be stuck with me for a little bit longer.

Anyway, have a great weekend everyone!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.