Good morning! Here we go again, another week of reports. It's quiet for news today, so a leisurely start to the week.

New audiocast - for anyone interested, who hasn't already come across it, I published a new audiocast yesterday, interviewing renowned investor Richard Crow (@RebelHQ on Twitter). Richard (rightly) has a large following in the private investor community, and he gave us some fascinating insights into his investing approach - based on common sense, turnaround situations, some contrarian thinking, and charts signaling to him when sentiment is improving. Lots of thought-provoking comments, so well worth a listen - click here.

Mello Bloomberg - another event from David Stredder! He's teamed up with Bloomberg, who are kindly hosting a one-off event at their London HQ, which I am told is a pretty funky & exciting place to visit. The hospitality is excellent too, I am reliably informed. Speakers for the tech-themed evening include Mark Slater, and Ben Rogoff of Polar Capital. Networking over drinks and a buffet, will follow.

This unique event will be held on Thu 12 Mar 2015, from 5pm-approx. 9:30pm. No doubt we will spill out into a nearby pub at the end. To book your ticket, please use this link. NB! We have a special Stockopedia discount code, so if you enter DISCSTOCK you will get £14 knocked off the ticket price (reduced from £49 to £35). Hope to see some of you there!

Quarto Inc (LON:QRT)

Share price: 156p

No. shares: 19.7m

Market Cap: £30.7m

Refinancing - this book publisher has entered into a new four-year syndicated bank facility with four banks. It's a mixture of overdraft and term loan, but no financial details are given.

I wonder how much the banks stung them for, in arrangement fees? I bet it was a hefty amount.

My opinion - it's good to see the banks being supportive, but what if they hadn't been? The company could have sunk under the weight of its excessive debt.

As covered in my report of 2 Feb 2015, the debt situation here is clearly excessive (which the company tacitly admits, with frequent comments in its announcements about the need to reduce debt). It is strange that the company continues paying generous dividends, whilst having a weak balance sheet with far too much debt. That seems reckless to me.

The EBITDA figure is meaningless, as the company capitalises so much onto its balance sheet, within current assets as "pre-production costs". If you more conservatively write off such costs, then the balance sheet looks extremely thin, in my view.

Overall, risk has clearly reduced with new bank facilities now in place, and the company is trading well. So perhaps my worries are overdone, but personally I don't compromise on weak balance sheets - why take on extra risk when you don't have to? There are plenty of good companies out there with ungeared balance sheets.

So this share remains something I wouldn't be interested in. It's on a low PER for good reasons.

Flowgroup (LON:FLOW)

Share price: 34.4p

No. shares: 239.5m

Market Cap: £82.4m

Launch marketing - today's RNS gives information about the marketing campaign for the launch of the company's new type of domestic boiler. It generates electricity, as well as conventional heating of radiators. This electricity is fed back into the grid, and the feed in tariff is used to finance the capital cost of the boiler.

My opinion - the installation cost (over and above the price of the boiler itself) seems rather high, and looks to be not far off the cost of a conventional boiler (fitted). So I'm not convinced that the economics of this product are sufficiently compelling to drive rapid adoption.

It sounds intriguing, but I've decided to sit this one out, on the sidelines, and wait for clearer evidence as to whether this new type of boiler is being adopted by customers in sufficient volume to make the shares attractive at the fairly hefty market cap of £82.4m.

It's very difficult to dislodge tried & tested conventional technology with something new, so I would need to see firmer evidence of commercial success before wanting to risk my money again on this share.

HSS Hire Shops

HSS Hire Shops joins the main market today.

The shares seem to have opened at a discount to the offer price of 210p, being 197.5p at the time of writing. I'll have a quick read of the admission document when time permits.

Most IPOs are over-priced in my view, and it's usually an opportunity for an existing backer to bank their gains & move on. But the odd one does well.

Plastics Capital (LON:PLA)

Share price: 105p

No. shares: 35.3m

Market Cap: £37.1m

Trading update - this small, niche plastics group, says that trading is in line with expectations (Q3 is Oct-Dec 2014, as the company's year end is 31 Mar 2015).

Operating margins are benefiting from lower raw materials prices (presumably linked to the lower price of oil), and cost reduction initiatives. It says that the acquisiton of Flexipol has gone well.

Somewhat confusingly, the last sentence seems to slightly backtrack from the positive narrative preceding, saying that H2 will be "broadly in line with market expectations". As we all know, that means slightly below, so it sounds like a very slight profit warning for Q4, but nobody seems to have noticed, and the share price is up 1p today!

My opinion - I tend to blow hot & cold on this share. It looks quite good value, if you believe the adjusted profit figures. Also the dividend yield is now appealing at about 4%. I'll firm up a view on it, when the full year accounts come out, which should be at the end of June.

Webinar tomorrow

I see Ed's doing a webinar on the StockRanks tomorrow at 12:30 - see the banner at the top of the main menu for a sign up link. Should be interesting, I'll be listening in.

I think many of us have seen enough of the StockRank system here on Stockopedia to get increasingly comfortable that it's a pretty good initial filter for sound stock ideas. We still need to do our own research too, but I am increasingly liking it, as it generally rates sound companies highly in my view.

Probably like most people here, I'm inherently suspicious of automated systems for stock-picking, since they can overlook glaring negatives that should be obvious to a human (e.g. the inherent dodginess of Chinese stocks!). But combine a good human common sense filter, with the StockRank system to provide a shortlist, and I reckon that's a very good combination for finding a basket of stocks that is likely to out-perform over time.

Euro / Greece

Following the news over the weekend, it seems that the Euro is yet again facing another potential crisis. It's not just about whether Greece is going to exit the Euro (looking increasingly inevitable, surely?). Worries are building over how other, larger, heavily indebted countries such as Spain, and Italy, might react. If Greece manages to exit the Euro and write off its debts, then that is likely to trigger political turmoil in those countries, with the populace demanding equally radical solutions there too?

Who knows what impact this is likely to have on equity markets? It's starting to make me feel nervous anyway, and I'm reluctant to take on any new positions with another Euro crisis rumbling away, and the undertainty of a UK election imminent (not that it makes very much difference, as whoever ends up running the country after May will face the same imperative to keep trying to restrain public spending, or at least limit the increases anyway).

Acal (LON:ACL)

Share price: 258p

No. shares: 63.0m

Market Cap: £162.5m

Trading update - today's update reads positively. The key paragraph confirms they are in line with expectations;

Group sales are up 30% (40% at constant currency) in H2 to date (from 1 Oct 2014 to date). It's a 31 Mar 2015 year end, so the year is close to finishing. Some growth has come from acquisitions though.

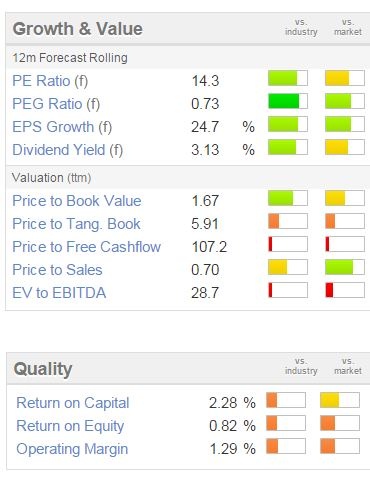

Valuation - see below the usual Stockopedia graphics. Note that the quality scores are low, as this is a very low margin company. As such, I would say the PER and yield look about right, maybe slightly too expensive for this type of business?

My opinion - it's not a company I'm familiar with, so don't really have a particular view on this one. I generally try to avoid very low margin businesses like this, but if there is scope for margins to rise, then profit can shoot up.

It would be interesting to see if they are benefiting from a trend towards on-shoring of production back to Europe? For the time being, the share price looks up with events to me, at about 17 times this year's earnings, and 14 times next year's. It's difficult to see much upside from that valuation, unless the company out-performs against forecasts.

Hardide (LON:HDD)

Mkt cap £15m at 1.48p/share

Trading update - the company says that trading from Oct 2014 to Jan 2015 is "slightly ahead of budget".

A note of caution is sounded about the potential impact of the lower oil price.

This company looks vulnerable to a potential profit warning later this year, in my view, so I'll give it a miss.

All done for today! See you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.