Good morning! Attention is likely to be focused on the big supermarkets, several of which are reporting this morning. You can read about them in numerous places, so there's likely to be less attention paid to small caps this morning, so let's have a rummage around there and try to find some bargains!

Anpario (LON:ANP) has issued a one sentence trading statement, saying;

Anpario plc is pleased to announce that it continues to trade in line with expectations, and will put out a pre-close trading statement in early February.

I really like the brevity - that is classy. The share price has been very volatile of late, having a big run up from Sep 2013 until a few days ago, when it suddenly dropped from 335p to 250p for no apparent reason. I think it was just a case of the share price getting overheated perhaps?

I really like the brevity - that is classy. The share price has been very volatile of late, having a big run up from Sep 2013 until a few days ago, when it suddenly dropped from 335p to 250p for no apparent reason. I think it was just a case of the share price getting overheated perhaps?

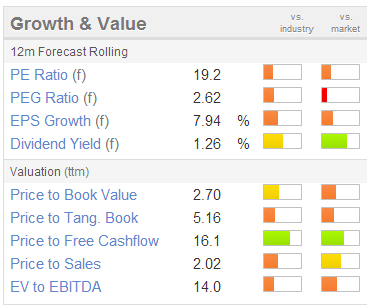

Certainly it doesn't look good value even now, after the sharp fall. As you can see from the Stockopedia growth & value graphic on the right, the forward PER is 19.2, and the dividend yield only 1.26%.

Growth rates have been nothing to write home about in the recent past either, but of course the market looks forwards and anticipates what it thinks will happen in the future. I don't know anything about the company, so do not have a view on how things might progress. My approach is to just search for value and GARP, and then do more detailed research when I find something that looks attractively valued at first glance, which this doesn't.

Interactive gambling company NetPlay TV (LON:NPT) has issued a positive trading statement. They finished the year with a strong Q4, with revenue up 33% year-on-year. Full year EBITDA is expected at the top end of market expectations.

In normal circumstances I would rush out and buy some shares, as Stockopedia is showing a mass of green apart from PBV (which doesn't really matter in this case, as it's not an asset-backed business). However, the reason this stock is cheap is because of investor worries about a looming change in taxation of online gambling companies. This could have a material impact on their results next year I think (from memory the changes kick in from early 2015 - perhaps any reader who is aware of the detail on this could add their comments below).

Also there has been very heavy Director selling in the past 18 months, which also makes me uneasy. So personally I'll be steering clear of this one, for the reasons given. Even though I suspect that the shares will probably go up in the short term, as people unaware of the taxation changes buy the stock on value grounds. However, there is then the risk of a precipitous fall later in 2014 if the taxation issue looks likely to be costly. I don't think it has been quantified yet. The company spoke about "mitigation" action to reduce the impact of tax changes, but in my opinion it would be better to be completely open, and just spell out chapter & verse on how it will affect the figures. An informed market is able to correctly value a share.

Deltex Medical (LON:DEMG) makes surgical probes which help improve outcomes from certain types of hospital operations apparently. I've followed the company for a while, and can never quite make up my mind on it. They are achieving sales, but effectively flat-lining around the £6m p.a. level, which isn't enough to break into profit. The interesting thing is that the probes are high margin, so if sales do beging to take off, then operational gearing could have a dramatically positive impact on the bottom line, and of course the valuation.

Selling into health services is notoriously difficult, as the decision-making process is so lengthy & bureaucratic. I can't help feeling that with Deltex it has dragged on too long now to be convincing as a rapid growth company, but that's only a hunch. Also investors tire of stories after a while, and this one has been around for years, so that limits the number of investors who will be prepared to have a punt on it.

That said, there are some pretty good sales growth figures reported today. Probe sales have grown from £4.5m in 2012 to £5.5m in 2013, so that's up 22%. The cash position is £1.5m, and the company has the option of cutting overheads if needs be to run at cashflow breakeven.

The outlook statement sounds fairly generically optimistic, but not exciting;

Deltex Medical made substantial progress in 2013 and enters 2014 with momentum in key markets. This momentum is underpinned both by the investment we have already made in establishing ODM as an important new medical modality and by the strong market positions we have built as platforms for growth.

There's not enough there to tempt me back in at a market cap of £24m (at 13.75p per share).

On the other hand the chart seems to show it apparently finding a floor around the 14p level, and better growth reported this morning should underpin that possibly? It's lagged small caps generally by a lot in the last two years, as the comparative line on the chart below shows (being the Small Caps Index). So if some really positive news comes out, it could move a lot perhaps. Although care is needed when looking at the share price of a company that issues lots of new shares - Stockopedia shows the average number of shares rising in all of the past seven years. It would be good if the market cap could be overlaid onto the share price chart, as that would show the relationship between share price and number of shares in issue.

The market likes an announcement from Ilika (LON:IKA), with the shares up a remarkable 86% to 41p at the time of writing. I have no idea how to interpret this announcement about their battery technology, but it sounds potentially interesting. It's not a value situation, but a blue sky growth stock. Do any readers have any views on this one, I would appreciate a heads-up on it from any reader who understands the technology & the market opportunity!

I've been pondering strategy recently, and as has been demonstrated recently by Topps Tiles (LON:TPT), the opportunities now are to find companies that are operationally geared, and are trading well ahead of expectations. In an economic recovery, brokers tend to be too pessimistic, lagging behind improvement in trading at companies they report on. So this provides us with an opportunity to find companies which are likely to beat forecasts.

For this reason, I've been to narrowly focussed on the forward PER, as this is based on broker forecasts. So if those broker forecasts are far too low, then the real PER will turn out to be a lot lower than we currently think it might be. So time to think more outside the box, although covering 500 stocks superficially means that I don't have the time or mental bandwidth to do a great deal of in-depth research, other than on stocks I really like & intend holding for the long term.

That said, often the best thing is to do nothing - i.e. just hold existing stocks. My original Blog (which I started in June 2012, because stocks were so cheap then I saw bargains galore) showed an average 63% gain between Jun-Dec 2012 - that was on the whole portfolio of all stocks reported on, not just a selection. So this morning I wondered how those same stocks had got on in 2013, updated my spreadsheet and was staggered to discover that my portfolio of stock picks from 2012 was now up 190%!

The reason I mention this is to emphasise the point that several very shrewd investors have made recently, including John Lee, and Boros10 (both are ISA millionaires), that picking the right stocks is only half the battle, the trick is then to just sit back and run the position long term. So to a certain extent all my fiddling around in 2013 was a waste of time, as I would have performed better by doing literally nothing, and just holding onto my 2012 stock picks! Food for thought isn't it?

The thing I love about this game is that you never stop learning! That's what makes it so interesting & stimulating.

Finally, McBride (LON:MCB) has issued a trading update. Their shares have dipped 2p to 100p, and look to be at a 12-month low, valuing the company at about £180m. Although it also has high levels of debt, which they state will be around £85m when reported for the half-year ended 31 Dec 2013 (it has a 30 Jun year end date).

This company makes own label household & personal care products. Revenue for H1 was down 3% on a constant currency basis (so presumably down more when translated into sterling). They expect H1 operating profit to be around £ 10 m, and expect an improvement in H2 - ah yes the old H2-weighted year hope thing, that so often doesn't actually happen!

I'm not tempted by this one, due to the debt, and lacklustre performance.

Right, I have to dash for a train into London, so see you from 8 a.m. tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in IKA, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.