Good morning!

Lakehouse (LON:LAKE)

Share price: 43.88p

No. shares: 157.5m

Market cap: £69.1m

(at the time of writing, I hold a long position in this share)

I reported yesterday on Board changes at this support services group, with the CEO stepping down, and the Chairman, Stuart Black, becoming the new CEO.

EGM Requisition - another announcement today states that the founder (and still 15.5% shareholder, Stuart Rawlings), supported by respected fund manager Slater Investments (holding 6.0% of the company) has served a notice to the company requisitioning a general meeting. Under the Companies Act 2006, and shareholder or group of shareholders holding at least 5% of the shares in issue, can requisition a meeting of shareholders.

The purpose of the meeting is as follows;

The Requisition proposes resolutions that the three current Non-executive Directors of the Company be removed from the Board of Directors of the Company, to be replaced by Steve Rawlings, Ric Piper and Robert Legget. In addition, a further resolution is proposed to remove from office any person appointed by the Directors of the Company as an additional director pursuant to the Company's Articles of Association between the date of the Requisition and the conclusion of the requisitioned general meeting. As a consequence, if such resolutions are passed, all of the Company's Non-executive Directors will have been proposed by the Requisitionists.

This is quite a strange situation. Since Non-Execs don't have any real power, they're normally just asked to resign, and they comply. I can't recall seeing EGM requisitions before to oust Non-Execs. It's normally the case that someone wants to take control of the Board by ousting the Execs, but that's not the case here.

My opinion - this suggests to me some sort of disagreement between major shareholders, and the new CEO (former Chairman), so shareholders are flexing their muscles here by the looks of it. Clearly the two major shareholders concerned, who together own 21.5% of the company, don't rate the current Non-Execs, and want them out.

I put a call in to the CEO this morning, but got no answer, so instead spoke to an adviser. I was advised that the company will put out an announcement commenting on the EGM requisition, so we should keep our eyes peeled for that, which should hopefully explain the situation.

Personally I think that the founder, and 15.5% shareholder, wanting to come back as a Non-Exec can only be a positive thing. Also I would always back the judgement of Slater Investments, as they know what they're doing. So it seems to me that the most sensible course of action would be for the company to comply with the demands in the requisition straight away, and not bother calling a general meeting.

I remain of the view that this share looks an interesting recovery situation. Peel Hunt's revised forecasts mean that the PER is amazingly low, at about 4. PH are one of the best brokers for research in my view, so I always sit up & take notice of their reports (they called DEB and BOO absolutely spot-on in the autumn, for example - saying that both looked set to perform well over Xmas, and they did).

We should get more clarity in the next few days anyway.

Software Radio Technology (LON:SRT)

Share price: 24.5p (up 32% today)

No. shares: 127.5m

Market cap: £31.2m

(at the time of writing, I hold a long position in this share)

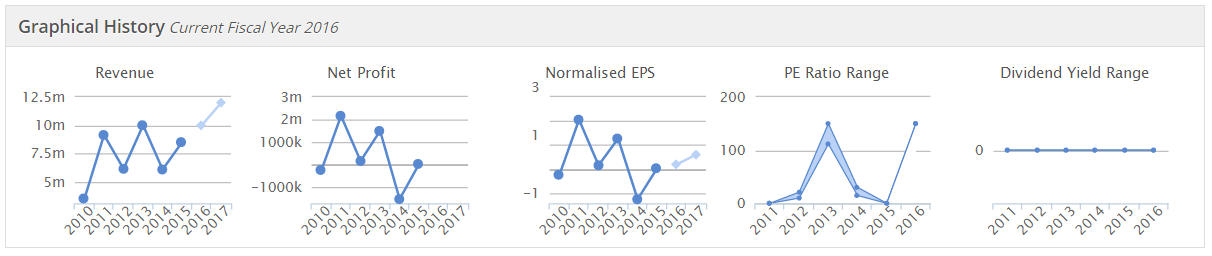

Supply agreement - it looks as if patience is finally paying off for SRT shareholders, who've endured erratic performance from the company - with seemingly good years and bad years alternating, as you can see from the useful Stockopedia graphic below:

In the context of historic numbers, the deal announced today looks huge;

SRT, the global provider of maritime tracking technologies, products and turn-key system solutions, is pleased to announce that it has entered into a major agreement (the "Agreement") for the supply of a significant maritime domain management system ("MDM system" or the "System") for a large country in Asia. Under the Agreement, SRT will play an integral role in the development and implementation of a national integrated maritime system which is expected to generate revenues of up to €90 million (approximately US$100 million) for SRT over three years, depending on final specification.Given that in the past, the company has struggled to get turnover over £10m p.a., then a $100m boost over 3 years looks transformative in scale (and hopefully profits too).

Before getting too carried away, shareholders should note that the agreement is back-end loaded in revenue terms;

...Consequently revenues attributable to the Agreement will be spread across three phases with heavy weighting to Phase 3

The Directorspeak emphasises the long-term nature of achieving deals like this, and also notes that this is one of the largest in the pipeline, i.e. not the largest. So that tantalising suggests there could be other big contracts in the pipeline.

Simon Tucker, SRT CEO said: "This Agreement marks the conversion of a further project, and one of the largest, in our validated sales opportunity pipeline. This is a substantial maritime domain awareness project involving many stakeholders and we have been working towards this for several years. SRT's many years of investment has resulted in our MDM system with its proven performance, unique functionality, such as ABSEA and GeoVS Data management and display functionality. This, coupled with SRT's expertise in the area of large scale national maritime monitoring systems, made us the natural choice. We look forward to working closely with our customer to deliver this significant project in the coming months and years."

My opinion - you can't help but like SRT's CEO, he's so enthusiastic, and open with shareholders, even when the company disappoints. So it's very pleasing to see things seemingly coming together, for a considerable expansion of the business.

Manufacturing is out-sourced, so the company should be able to scale up production for the phase 3 roll-out of this contract in due course.

I'm not entirely sure how you value the shares, but making a stab at forecast earnings say 2-3 years out is probably the best way. If all goes to plan, the company should be delivering very much larger turnover & profit figures by then, so this announcement looks excellent to me. I'm actually quite surprised that the share price has only risen by 32% today, given how large this contract win is.

Personally I bought some stock in the company a while back, at 31.5p, so am not feeling quite so daft now, after today's announcement has stemmed my losses somewhat.

Penna Consulting (LON:PNA)

Recommended cash bid at 365p - well done to shareholders in Penna. This looks a done deal, with 68% acceptances already secured.

I flagged up this share in my report here on 24 Sep 2015, concluding that, "Today's update says YTD profits are up "more than 25%" versus a strong equivalent period last year. Valuation seems reasonable, and StockRank is high, at 96. Worth a deeper look methinks! - See more at: http://www.stockopedia.com/content/small-cap-value..."

Sadly, I never got round to taking a deeper look! Pity, as the shares were 225p then, so by today a 62% gain would have been enjoyed by anyone who followed up on the idea. Hopefully some readers have done well on it.

Tribal (LON:TRB)

Share price: 46p (down 7.5% today)

No. shares: 94.8m

Market cap: £43.6m

There are 2 updates today;

FD stepping down - this looks an orderly departure, with him staying on for now, until a successor is found. We never really know in these situations if someone has been pushed, or if they are leaving voluntarily. He's been in the job over 6 years, and as I know myself, things do get boring after that length of time running a company's finances - having the same conversations over & over with the same colleagues, suppliers & customers, etc.

It's an odd time to be leaving though, when a Rights Issue is being sorted out. Maybe Instis wanted a change after very disappointing recent performance from the company? (although that's hardly the FD's fault).

Update on trading - various points are mentioned today, none of which look particularly earth-shattering;

Australian contract - the company previously indicated that this contract might defer into 2016, and confirm that is the case today, with the impact being £2m in both revenue and profit.

Impairment of intangibles - doesn't really matter, as non-cash. £8m in product development costs, and £38.8m in goodwill are being written off.

Rights issue - confirms that it will be up to £21m, a reduced amount due to the previously announced disposal of a non-core subsidiary.

My opinion - there's not really anything of particular substance in today's update. So shareholders now await the terms of the Rights Issue.

I think there might be scope for these shares to recover further, but personally I've banked my profit and moved on, from an original falling knife purchase at c.29p, which was a nice little trade (reported here at the time), although not timed particularly well on my part - it's very difficult to time the exact low point. But as long as risk:reward is fundamentally in your favour, then personally I don't mind a short term running loss - if it's very likely that loss will disappear once sentiment improves.

Falling knives can be very lucrative, if you pick the right ones, and avoid the disasters. I'm still working on that, but am getting better at it as time goes on. I think the trick is to wait until all the bad news is out, and the shares really beaten down to a point where everybody hates it. Providing that coincides with a reasonable expectation for a trading recovery, and reasonably sound finances, then there can be an opportunity.

The key thing with TRB is that they had an underwritten Rights Issue already agreed. This meant that the refinancing would definitely happen, and vitally that existing holders would not be diluted (if Rights taken up). This factor made it a good falling knife to catch. The non-core disposal was a bit of luck, so icing on the cake there.

As promised, here are some late updates:

Portmeirion (LON:PMP)

Share price: 1127p (up 4.4% today)

No. shares: 10.8m

Market cap: £ 121.7m

Results y/e 31 Dec 2015 - this share traded sideways throughout 2015, at around 900-950p per share, but has put on a nice spurt recently. Personally I've taken profits on the recent surge, so am sitting on the sidelines, but looking to buy back on any dips.

Today's results look excellent - broker forecast was for 61.8p EPS, but the company seems to have come in well ahead, at 66.02p. These are clean numbers too - Portmeirion is conservatively run, with no funny business in its accounts - very refreshing.

Good results have been delivered despite a slowdown in one of its 3 key markets - South Korea.

Valuation - the historic PER is now up to 17.1, which seems reasonable to me, but perhaps not quite the same bargain it was a while back, when you could buy it on a PER of 12-14. Given the brand value, strong balance sheet, and dependable performance, I'd say it's certainly not over-priced, just priced about right. I think there is potential upside on a takeover approach, as it's the type of company that could well attract an overseas bidder.

Outlook - the Chairman today says;

Trading in the first two months of the current year is ahead of the comparative period in 2015. The outlook for 2016 is positive

The new kiln is now in production, so the company has increased capacity, to respond to increases in demand.

Balance sheet - is absolutely wonderful! Working capital has been particularly well controlled, with both debtors and inventories down against a year ago, despite the rise in sales. This is also reflected in a very healthy £11.1m net cash balance, nearly 10% of the market cap.

Although the narrative points out that this is a seasonal high, and there can be a £9m cash "swing" during the year, making the cash position comfortable rather than excessive.

Pension deficit - required a £0.9m over-payment in 2015.

Dividends - 30p in total for the year, yielding 2.7%. Not bad, but not madly exciting either. Divis are rising, but of course the re-rating of the shares means that the yield has actually come down. Still worth having though.

My opinion - even though I don't currently hold this share, it remains a firm, long-term favourite of mine. The company is probably benefiting from cheaper energy. Also, I think it should benefit from weaker sterling at the moment, depending on what arrangements have been made for currency hedging.

It's an absolutely lovely company - conservatively managed, with a bulletproof balance sheet, and a terrific track record of growing sales & profits. That said, I don't see enormous upside on the shares in the short term, unless a takeover bid happens, which is always possible.

If however I was running a buy & forget type of long-term portfolio, then I would definitely have this share in it.

4imprint (LON:FOUR)

Share price: 1249p (up 0.6% today)

No. shares: 28.0m

Market cap: 349.7m

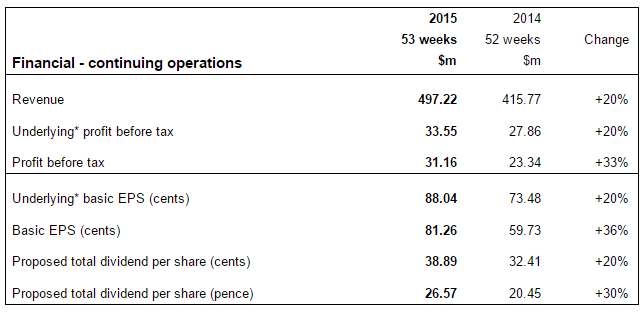

Results, 53 wks ending 2 Jan 2016 - the first thing to note is that this is a 53 week period, so might benefit from the additional week's sales. Actually, I've just answered my own question, as it seems the extra week has been negative for profits;

2015 was a 53 week accounting period for the Group, compared to the usual 52 week period. The effect of this extra week on Group revenue was an increase of around $4m, contributing roughly one percentage point of the 20 percentage points of revenue growth over 2014. The effect of the additional week on underlying operating profit was negative due to a full week of payroll and overheads outweighing the gross margin arising from a quiet week of revenue during the holiday season.

What a terrific performance, here's the highlights section - and remember this growth is all organic too (i.e. not bolted on through acquisitions);

As 96% of group revenue is from North America, it reports accounts in US dollars.

Note that the balance sheet is amazingly efficient - because there are hardly any inventories. So each delivery must be made to order by subcontract manufacturers. This makes the business strongly cash generative.

Valuation - basic EPS of 81.26c is the better measure in my view, as the "underlying" EPS fo 88.04c strips out things that I think should remain in as costs - such as share based payments (bonuses to staff basically), and pension fund costs.

Using today's exchange rate of £1 = $1.422, basic EPS turns into 57.1p. So at 1249p the shares are rated on a 2015 PER of 21.9 times - a pretty punchy rating, although well-deserved given excellent performance.

Pension deficit - a one-off payment of £10m is being made to mitigate the deficit. This looks a manageable issue, and is not a deal-breaker, when compared with the market cap of the business.

My opinion - an absolutely lovely company, but the price is well above the level where I would be interested in taking a position. You have to remember this is a cyclical business, and discretionary marketing spend such as this company's products are one of the first things to be cut by customers in a slowing economy.

In the last big recession, 2007-8 this share dropped by three-quarters, so it's important not to get too excited during the good years. That said, it seems a very well managed company, and operates in a fragmented market, so there's a lot to like. Valuation is not one of the things I like though - the shares are already discounting several more years' growth.

ATTRAQT (LON:ATQT)

Share price: 44.5p (down 2.2% today)

No. shares: 26.9m

Market cap: £12.0m

Results y/e 31 Dec 2015 - this is a tiny software company, too small to be separately listed really. I visited the company last year, having a product demo & discussion with its CEO, who I rate highly - he should be running a much bigger company in my view.

The product is great - it's an add-on for online retailers, which provides greatly enhanced "merchandising" - i.e. sophisticated search & display capability, which has a proven positive impact on conversion rates - i.e. it helps clients sell more from their websites basically.

Revenues are sticky, on monthly recurring contracts. The company is growing. Trouble is, it's still too small, and still loss-making - turnover rose 40% to £2.9m, and the loss before tax reduced from £1.5m in 2014, to £732k in 2015. That's really not good enough, we're looking probably at 1-2 years just to get to breakeven.

Growth looks good, but it's adding one client at a time, which takes time & effort, to recruit them & set them up. So it's not the type of company where exponential growth could happen, in my view.

Cash - I was sharply critical of the company in early 2015, due to its stretched cash position. I don't think it's wise to float a tiny, loss-making company, with inadequate cash reserves.

So it's pleasing to see the company did a Placing in Nov 2015, to raise £3.3m in fresh cash, and also to reduce a founder shareholder's stake (the colourful Dan Wagner) by £2.6m. The placing was at 52p.

The only drawback with a previously cash-strapped company suddenly having a new cash pile, is that the padlocks on the cash tin can be forgotten, and before you know it, costs are increasing, often in areas where the company has previously made do, but really needed to spend more.

My opinion - I'd like to see this company make the most of its listing by acquiring some complementary businesses, and get to a scale where it's worthwhile having a listing. I think the CEO is up to the job, and definitely one to back, if he finds the right acquisition to build a bigger, and profitable group.

As things stand at the moment, the company is too small, and I don't see rapid enough growth to get excited enough to make me want to buy shares at a £12m valuation. Maybe at half that price, or lower, I might consider having a punt on good management.

The other thing to consider, is that there is quite a lot of risk running an add-on for major online retailers. If your systems go down, and bring down the client's website, which can happen, then you can suddenly be in the firing line for a large claim for lost business from your customers.

Tandem (LON:TND)

Share price: 130p (down 26.8% today)

No. shares: 4.7m

Market cap: £6.1m

Profit warning - there's nothing individually terrible in this announcement, but lots of individual points which sound a bit worrying;

Sales in 2015 were up 5% on a LFL basis, and up 10% after a small acquisition.

"Group operating profit before non-underlying items is expected to be marginally behind the prior year."

OK, not too bad so far. The company made about £1.4m profit in 2014.

Finance costs shows big swings (and are material compared with profits) due to forex movements.

Outlook - it seems more the outlook comments that have spooked the market today;

We have produced a strong range of cycles for the 2016 year, particularly the new range of MTB and junior models. However, we consider the mid-tier independent cycle market to be saturated and highly competitive.

In addition, we do not have a large cycle promotional contract in 2016 and therefore we expect the bicycles and mobility division to have a challenging year.

Comments on the toys division are more upbeat.

The company is developing a direct to consumer website offering, which seems a sensible strategy, given that it's operating in such a competitive market - i.e. cut out the middlemen, and sell direct to the public. Trouble is, that requires marketing spend, and lots of it, to get your website known & busy.

A dispute seems to have arisen with HMRC over import codes used, with potential liabilities there. Sounds a bit worrying.

Exchange rates have moved against them (as an importer, the stronger dollar will increase the cost of imported product);

The recent strengthening of the US dollar is a significant risk. Although we continue to mitigate this risk where possible by the use of various foreign exchange derivative contracts, should the dollar remain at current rates it has the potential to have a negative impact on the second half of the year.

My opinion - it's difficult to see any attraction to this share. Distribution businesses are usually pretty horrible things to invest in - they're always up against suppliers, customers & competitors trying to squeeze out their profit margin. So the danger is, they end up box-shifting for a negligible return.

This share has never appealed to me, and today's can of worms announcement further repels me. Why is it listed on the stock market at all?

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.