Good morning! A bit of respite for us today, as the US markets bounced strongly yesterday evening.

Gresham Computing (LON:GHT)

Share price: 66p

No. shares: 63.2m

Market Cap: £41.7m

Profit warning - this software company today says;

However, we now expect that a number of new CTC contracts previously anticipated for 2014 will instead fall into 2015 and as a consequence the Board expects total revenue for 2014 to be 10%-15% lower than current market expectations. As a result, earnings for the full year 2014 are expected to be materially below current market expectations.

Timing of contract wins is usually a big problem for software companies, as they have fixed costs, but lumpy revenues, thus making profits unpredictable & volatile. That is the reason many software companies have instead tried to move to a SaaS model, where instead of paying a large up-front licence fee, customers instead pay smaller, but more regular payments, more like a hire charge than a one-off purchase.

My opinion - I've only mentioned this company once in these reports, on 5 Feb 2013, when I commented that the shares looked too expensive. There has always been a lot of hype around this company's shares, but the financial track record looks lacklustre, and undeserving of a premium rating in my view.

Note that its track record on free cashflow generation is very poor, which probably explains why it doesn't pay any divis. Sure enough if you check its cashflow statements, more than all the cashflow generated is spent on intangible assets (i.e. capitalised internal costs). Therefore it doesn't really make any profit at all.

There are lots of software companies which do this - capitalising a load of internal costs, thus reporting profits which aren't real. The lack of a decent dividend is the big tell. Also, the cashflow statement & Balance Sheet show you what is going on. Caveat emptor! I reckon that sooner or later the penny will drop, and a lot of small software companies that don't generate any cash at all will be heavily marked down in price.

I like software companies, but it's real cashflow, evidenced by a decent dividend, that is the litmus test for me.

SkyePharma (LON:SKP)

Share price: 323.5p

No. shares: 104.8m

Market Cap: £339.0m

Normally I don't go near the pharmaceutical sector, as I don't have the expertise to start forming judgments on the products, their chances of success, etc. However, this share caught my eye on 21 Aug 2014, and my report here on that day flagged up that it looked interesting, "...a great combination of modest forward PER, with an excellent growth rate, so very low PEG (very positive). Also note the high quality scores as well - so this could be a rare growth at reasonable price (GARP) stock?".

Anyway, so far so good, as the stock was 249p when I wrote that, and it shot up the next day, and is now 30% higher - not bad in a bear market for small caps!

In the meantime I've been doing more research, and note that the company seems to have products which are taking off in multiple countries. Also its previously weak Balance Sheet has been fixed. On the downside, a lot of the profit seems to be coming from milestone payments, which are unpredictable, and some are one-off in nature, whilst others are based on sales targets. So that would need looking into.

Trading update - an IMS has been issued today. It sounds reassuring;

Overall trading to date has continued to perform in line with the Board's expectations. As anticipated, revenue during the period has benefited from increased flutiform®supply sales, higher royalties from flutiform®and the new GSK inhalation products and a share of higher EXPAREL® net sales.

Outlook - a lot more detail on individual products is given today, but I'm a numbers man, so will not even attempt to interpret the detail on products! So this bit is what interests me;

"We remain confident in the potential for strong growth from the eight new products approved or launched since March 2012, with positive sales momentum continuing since the interim results were announced in August.

"We are focused on delivering the next phase of growth through strategic investment in new products and technologies. In our inhalation business, work has begun on the development of SKP-2075, the lead product in our new anti-inflammatory therapy platform for the treatment of COPD. In our oral business, we are encouraged by the progress we are making in the development of Soctec™, our novel gastro-retentive drug delivery platform.

"The Group remains well-placed to leverage its rejuvenated revenue-generating product base and build a strong platform for future growth."

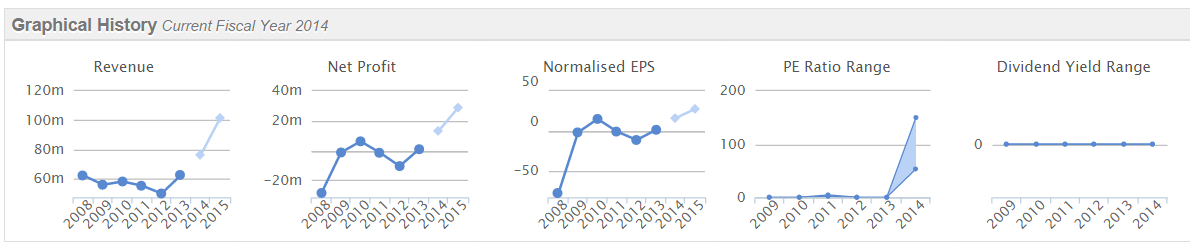

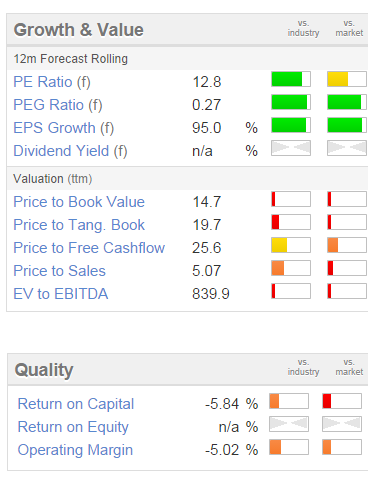

Valuation - The Stockopedia graphical history also shows consensus forecasts too, on the first three graphs - forecasts are shown in lighter blue for 2014 & 2015 in this case (calendar year ends).

This looks rather exciting to me - after five years bumping along around breakeven, with sales fairly static around £60m, it now looks as if things are taking off. The forecasts are credible, as the company is saying they are in line with expectations over three-quarters of the way through this year, so this looks like a growth company starting to take off perhaps? (assuming the growth is maintained).

You might expect a stratospheric valuation on the company, but it looks quite reasonable on a forward PER basis in particular;

A forward PER 12.8 for this kind of earnings growth looks remarkably good value, if forecast for next year is achieved. Although bear in mind that the PER for 2014 f/c earnings is 19.7, so it's the 2015 f/c earnings (a 71% increase in 2015 over 2014 is forecast) that the valuation really hinges on. If for any reason the 2015 earnings do not rise a lot, then the cheap valuation shown above would stop being cheap!

The quality measures above all look poor, but that's based on historic data. Once the 2014 figures come through in 2015 then the quality measures should dramatically improve as stronger profitability feeds through.

My opinion - Overall then, a potentially very interesting situation in my view - well worth a look, for people who understand the sector and can make sense of the products, etc, hence me flagging up the idea here.

Vianet (LON:VNET)

Share price: 89p

No. shares: 28.3m

Market Cap: £25.2m

This company has a 31 Mar 2015 year end, so gives an update today for H1.

Trading update - sounds OK actually;

Trading for the first half of the current financial year was ahead of the same period last year and, as anticipated, is in line with the Board's growth expectations. The strength of the Group's recurring income and prospects for the second half of the current financial year provides the Board with the confidence to propose maintaining the interim dividend at 1.7 pence.

Various additional detail is given.

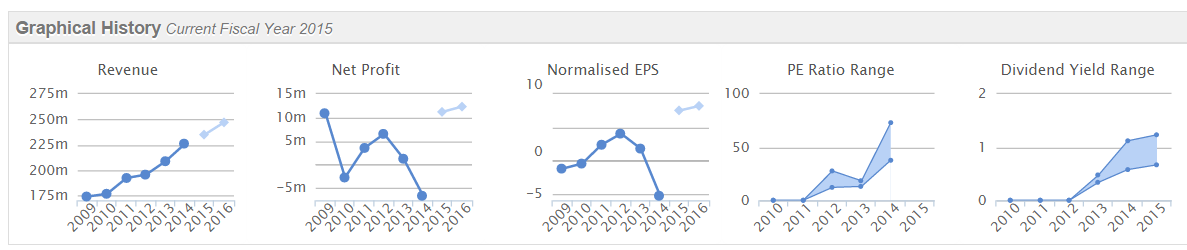

Dividends - one of the key attractions of this stock, but may not be sustainable as the company is stretched to the limit paying the current dividend, in my opinion. The forecast yield is almost 7%, reinforcing that it may not be sustainable (anything above about 5-6% is usually questionable).

My opinion - the company is at last making some progress with its vending telemetry business, and things seem to be stabilising with their beer flow monitoring business, Brulines. The valuation is low here, but the company seems to be permanently up against big headwinds with its various activities, so for that reason I no longer hold any shares in this.

That said, things seem to be looking more positive now than they have for a couple of years. The significant worry of the pubs statutory code is now resolved. Some orders for iDraught have been received in recent months, the company says today, which is also good news.

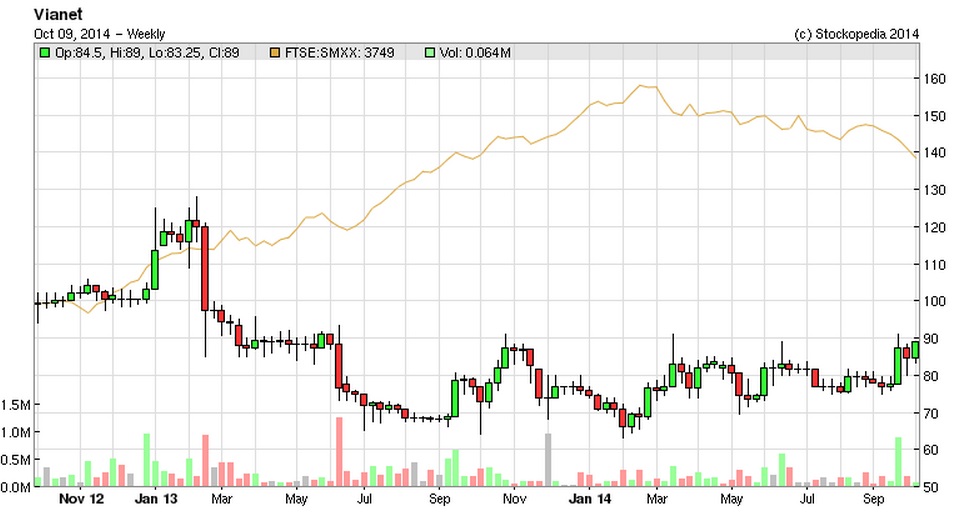

So shareholders could be over the worst, and indeed the chart looks as if there might be some more upside as well;

If you add in significant dividends received over this period, the overall shareholder return has been better than the chart alone suggests.

Scapa (LON:SCPA) - a positive trading update has been published, for the six months ended 30 Sep 2014;

Group revenue and trading profits* have seen good growth over the same period last year, despite currency headwinds, which have reduced since our trading update on 22 July. The trading profit* margin continues to improve and the Group delivered strong operating cash flow, contributing to a healthy balance sheet.

Scapa is well positioned to make further good progress this year and the Board remains confident about the Group's outlook.

That all sounds positive, but they haven't commented directly about performance relative to market expectations, so I assume they must be in line.

The valuation looks about right, with a PER of about 16-17. The dividend is poor, at only about 1% yield.

It would be interesting to look into what factors caused the poor profits in the last two years, and this year's forecast rebound?

That's it for today.

More carnage in the morning no doubt, after a wobbly session in the USA last night.

Regards, Paul.

(of the companies mentioned today. Paul has a long position in SKP, and no short positions

a fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.