Good morning!

We seem to be in the midst of a very strong rebound in the main indices, driven by a recovery in the resources sector, but with plenty of other things rising nicely too. Long may it last!

I've not heard this John Templeton quote before, but spotted it on Twitter this morning, and thought it worth repeating here;

"You never get a bargain except where most investors are trying to sell"

(I've not been able to verify this quote, so bear in mind it came from Twitter, hence may not be 100% accurate!)

Home Retail (LON:HOME)

Share price: 147.5p

No. shares: 813.4m

Market cap: £1,199.8m

Not a small cap, but interesting nonetheless - I've bought some shares in Home Retail (LON:HOME) this week, after an absence of several years - it's a company I know quite well, and met management at their AGM a few years ago.

This share looks potentially cheap, given its tremendously strong balance sheet - not only with net cash, but also it owns the customer credit operation outright too, and has no gearing. Although there is a pension deficit.

What has really got me excited, is their plans to offer same day delivery for £3.95. Four delivery slots are available, and if you order by 6pm, you should get it by 10pm, the same day. I think this could be transformational - since Argos might morph into a hybrid between a retailer, and a distribution company for other businesses. This is one step ahead of Amazon, amazingly - demonstrating that, far from being a stale old economy business, Argos is actually leading the charge on modernising its operations. That could lead to a re-rating of the shares, maybe?

I have tested out the same day delivery service, and so far it has miserably failed! Both orders were not delivered, and no emails or other explanation given. They haven't taken any money though, so clearly they are having teething problems, on what is a very ambitious project. Although they wouldn't be attempting it, unless it was feasible, so I can live with teething trouble.

XP Power (LON:XPP)

Share price: 1575p (down 4.5% today)

No. shares: 19.0m

Market cap: £299.3m

Trading update - this company has been on my watch list for a while, as I liked the company when doing a review of its interim results here on 27 Jul 2015.

The company seems to be based in Singapore, but it has a UK full market listing (not the dreaded overseas company on AIM - which is an automatic bargepole for me), and it has sound finances, a good track record, and consistently pays divis. So it looks worthy of consideration.

The company describes its activities clearly, which always helps, on the rare occasions that you find it, as "a world leading developer and manufacturer of critical power control sub-assemblies for the electronics industry".

Today we are given a Q3 update (it's a 31 Dec year end), with the key part saying;

The Group traded in line with the Board’s expectations during the third quarter of the year. Revenues for the nine months ended 30 September 2015 were strong, increasing by 9% to £81.7 million, compared with £74.8 million in the prior year. In constant currency the increase in revenues was 4%.

Other points made, I will summarise as follows;

- European markets strong, weaker order intake in N.America in Q3 (surprising, as this is the opposite to what other companies are saying)

- Order intake decreased 3% in constant currency, up 2% reported currency, for YTD

- Favourable margin impact from high factory utilisation

- Net cash £1.2m at 30 Sep 2015 (£1.3m at 31 Dec 2014)

- Q3 dividend of 15p, total divis YTD 42p (up 8% y-on-y)

Outlook - there looks to be a slight wobble in N.America, but doesn't sound serious. No comment is made on full year expectations, so I assume in line? Seems odd that they didn't confirm full year, which introduces some doubt.

Despite the challenging macroeconomic backdrop our European business has performed well and we expect this to continue into the fourth quarter. Conversely, order intake in North America has not continued at the same rate we saw in the first half of 2015, which will have a marginal impact on revenue in the fourth quarter.

We remain encouraged by new design wins and believe the Group is continuing to take market share as our portfolio of industry-leading power technology products is designed-in to new equipment by our target customers. These design wins will translate to orders as our customers move to production.

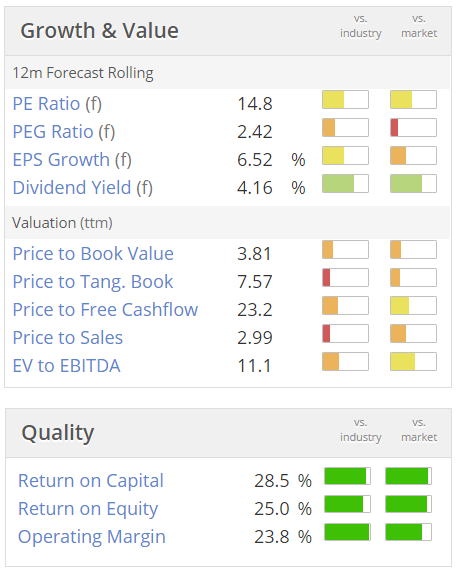

My opinion - I don't hold it currently, but based on the figures, I like this share. It looks like a quality company (i.e. high quality scores, see below) at a reasonable price ("QARP"). Note that Stockopedia's algorithms agree, as it has a StockRank of 94.

The key thing with high margins, is whether they are sustainable? That would need some research. My role here is to flag up interesting companies for people to research further, so if anyone has time, please go ahead & report back in the comments section below, I'd be interested to hear what you think.

Adgorithms (LON:ADGO)

Share price: 52p (down 58.7% today)

No. shares: 61.7m

Market cap: £32.1m

Profit warning - yet another recent IPO disaster - this Israeli company listed on AIM just 4 months ago, and it's dropped nearly 60% today on a profit warning! Liberum is broker & NOMAD, and brought it to the market (Admission document here) - so massive amounts of egg on faces there, as things like this do a lot of reputational damage.

Although I think all IPOs have to be treated with great suspicion. By floating rubbish that then collapses in price, brokers are just killing off the IPO market - chasing short term fees, and fleecing investors, instead of thinking about building up their own firms' reputations long term. That's what happens when you pay people big bonuses to chase short term results. It's a systemic problem with the financial system, as we all know.

Today's profit warning is serious, not just for this company, but for all companies which rely on income from online advertising;

The Company today announces a trading update for the third quarter of 2015. In recent weeks, the online advertising market has experienced severe disruption, resulting in a loss of supply for major online advertising exchanges and a drop in demand from major media buyers.

This has had a significant effect on indirect revenue generation for the Company and is expected to continue to do so for the near term. Consequently, Adgorithms expects its earnings for the full year to be materially below market expectations.

Ad-blocking - although it's not specifically stated in today's announcement, I reckon the underlying problem is probably ad-blocking software. This is becoming increasingly widely used by people, indeed I use a simple add-oin to Google Chrome, called "AdBlock" which eliminates virtually all ads from web pages which I view.

Knowing this, it stands to reason that online advertising will suffer a large crunch - if advertisers realise that their ads are invisible, they won't continue paying for them.

Balance sheet - bear in mind that this company raised fresh cash of £22m (before expenses) at its IPO, so a lot of the market cap may now be supported by cash (if they haven't spent it yet). Therefore, it could be a potentially interesting special situation, worth doing some research on? I won't have time today, but am just throwing the idea over to readers.

My opinion - I already avoid this sector completely - because too many flaky-looking companies (like this one) were floated in rapid succession. What does that tell you? It told me that the good times were probably coming to an end, and the people who owned companies like this wanted to line up an exit route at a favourable price.

Therefore I suggest to readers it would be a good idea to review your portfolio for all companies which rely on online advertising, directly or indirectly, for their revenues, and consider ditching their shares. Surely it's only a matter of time before they all warn on profits, if the whole sector is in turmoil, as suggested by ADGO today?

It usually pays to sell first, and ask questions later, when some sort of sector-wide earthquake happens, in my view.

I've run out of time today, as am heading into London for various meetings.

Other things of note, quickly;

Blinkx (LON:BLNX) - H1 update says in line with expectations, for a $7m EBITDA loss on $90m turnover. So the real loss will be worse. Positively, it has cash of at least $82m. The company says it hopes to return to profitability in the next 6-12 months (at EBITDA level, or real profits? Not stated).

My view is unchanged - the business model broke, and they're still trying to fix it. Why pay a premium to cash, for a loss-making business, that hopes to get back into profit?

Gotta dash, have a great weekend!

Regards, Paul.

(usual disclaimers apply. I hold a long position in HOME, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.