Good morning! Vianet (LON:VNET) has issued a trading update this morning, and it will be interesting to see how the market reacts to this. Technically, it's a mild profit warning, since they indicate that pre-exceptional operating profit will be c.£3m, about 10% down on last year, for the current year ending 31 Mar 2014. However, in the circumstances, with a major threat to their core business from the Government's proposed Statutory Code, that's actually not a bad result in my opinion. We already knew this was likely to be a poor year, with all the extra costs associated with defending the company against this legal threat, and disruption from management time being diverted from the business, plus the inevitable standstill on making new sales of the beer flow monitoring equipment until this issue was resolved. So anyone expecting a good year this year just hadn't done their research!

Pub closures has meant that the installed base has fallen to 17,000 Pubs, where it was expected to stay at 17,500, so that's disappointing, if not altogether unsurprising in the circumstances. The group's other divisions have improved, with the vending division now profitable, the USA making "positive progress", and fuel division is now close to breakeven.

The bit I like best is that the recurring revenues are emphasised (mostly on five year contracts), which has allowed continued strong cashflow, and the interim & final dividends are being maintained, which is excellent news. That means the 7.6% dividend yield is safe, for the time being. Now all they need is for the regulatory threat to fall away, as it's very likely to in due course, and in my view we'll be heading back to a quid a share, and maybe more once some decent vending contracts come through.

I am expecting the shares to open down modestly today, and if they continue dropping, I will be using that as a buying opportunity. The valuation here is pretty attractive if you think, as I do, that the regulatory threat is not likely to have any teeth. Anyway, let's see what happens!

There's a solid trading statement from Thorntons (LON:THT) this morning, for their Q1, being the 14 weeks to 5 Oct 2013. I'm not quite sure why they measure a quarter as 14 weeks, when it's actually 13 weeks? Total sales were up 2.1%, although this masks an excellent +11.0% performance from their commercial division (called FMCG by them). The retail division saw sales down by 5.7%, although that's not as bad as it looks, as this was mainly driven by store closures. Like-for-like sales in retail was only down 0.4% (this measure strips out the impact of store closures).

In terms of outlook, the key bits are these;

We have an exciting Christmas offer across the business and are encouraged by the strong order book within our FMCG division. This puts us in a good position ahead of the key Christmas trading period.

Our current outlook for the financial year remains in line with market expectations.

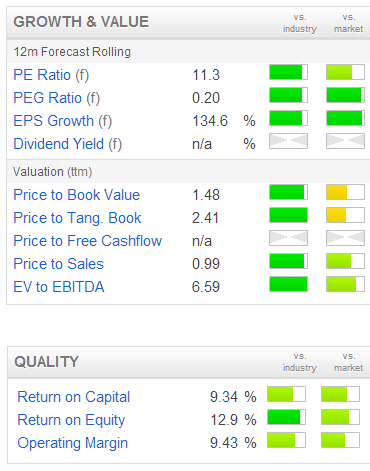

So that looks pretty sound. In terms of valuation numbers, Stockopedia shows the broker forecast consensus as being for 7.8p EPS this year, so at 91.5p per share at the time of writing, that makes a current year PER of 11.7, which looks about right. However, that's not taking into account the substantial net debt, and pension deficit, which I last calculated as 40p per share, and 36p per share respectively.

So if you ignore the Balance Sheet altogether, then the shares look reasonably priced. However, if you factor in the weak Balance Sheet, and lack of dividend (although it looks like divis are being resumed this year, at a low level), then the shares don't look cheap at all.

It's also a low margin operation overall, so I remain of the view that shareholders had a very lucky escape here thanks to a friendly Bank Manager that supported the business when it was teetering on the edge a while back. Yes it's recovering now, but I think shareholders were very lucky rather than skilful here. You only have to look at Albemarle & Bond Holdings (LON:ABM) to see what can happen at highly geared companies.

This is the final call for Mello Central tonight - the excellent quarterly investor evening held in London at FinnCap's offices in 60 New Broad Street. There are three interesting companies doing presentations, and a record attendance of about 70 investors (a mixture of PIs, HNWs, and City folk) is expected. See you there! Start time is 5pm for arrival/drinks, and 5:30pm presentations begin. Then drinks, food & networking afterwards.

I know it is frustrating for people who live outside London, to keep hearing about all these London events, but the information shared with attendees then tends to ripple out onto bulletin boards after the event, so indirectly you also get to hear about it too.

I like the trading update from Zytronic (LON:ZYT) today. This is a small UK company that designs & manufactures specialised touch screens for things like vending machines, cashpoints, etc. So they make bespoke designs, and in relatively small batches, therefore it's not competing with the high volume commoditised end of the market.

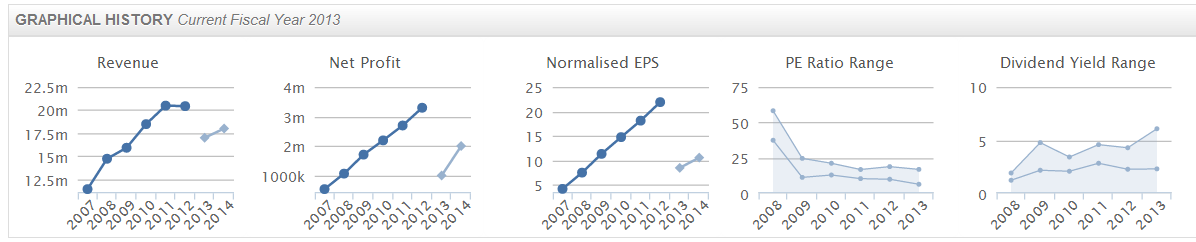

They had an absolutely superb track record of steadily rising sales & profits (see historic graphs below) until May of this year, when a nasty profit warning halved the share price, which had already been drifting down to around 300p, to bottom out in July at around 144p. This was a narrow escape for me, as I liked the company and management, following a meeting in late 2012, but decided that it was fully priced at over 300p, with not enough upside to make risk/reward attractive enough for me to invest.

So I've been looking for an opportunity to get back into Zytronic, as I believed management's assurances that the difficulties they experienced in early 2013 were not a symptom of decline, but were due to gaps in the order books. However, I also wanted some firm evidence in terms of an improved trading update, and this morning we got it.

They say that H2 for the year ended 30 Sep 2013 saw "an improved trading performance", and that results for the year should be ahead of market expectations. Pre-audit estimates are for £17.2m turnover, and £1.9m profit before tax. That's well ahead of arguably ultra-cautious broker estimates for £1.0m profit on £17.0m turnover.

As you would expect, the shares have bounced nicely this morning, up 21p to 184p at the time of writing. My assessment is that this now lifts a cloud from the company, and should mean that investors can stop worrying about the downside, and concentrate more on the upside - which is interesting, as they have some innovative very large touch screens, including curved ones, in the pipeline.

EPS should drop out around 10p for the year just finished, so the shares are not cheap against those figures, at a PER of 18.4, but as you know it's all about looking forwards, not backwards in valuing shares. So with a bad year behind them, we should be able to look for say 12-15p EPS this year, so the PER is probably somewhere in the 12-15 range, which looks reasonably good value to me, for a tech company with interesting technology.

The dividend yield and strong Balance Sheet have definitely helped support the share price, and with a 9.1p payout expected for this year, the divi yield is very good, at almost 5%. Although it should be noted that the dividend cover is only just over 1 time - i.e. the company will be paying out almost all its earnings in divis for the year just gone. That's only OK as long as they expect EPS to rise strongly from here.

Overall then I'm encouraged by this statement, and think the shares could return to being an interesting growth company, but they can't afford to slip up again, or the rating will get trashed.

Risk/Reward & Profit Warnings

As a general aside, you've always got to consider what the impact of a profit warning would be, as any company can hit a bump in the road. Especially smaller companies, which tend to be more reliant on a small number of key products and clients. So that means there is typically 20-50% downside risk to the share price on a profits warning (depending on its severity), therefore one has to see much more upside from the current price in a good scenario, to make the reward outweigh the risk.

Also clearly one has to consider the probability of each outcome. So if the downside risk looks very slight (e.g. if a company has recurring revenues on long term contracts), then I would be prepared to invest if I could see say 50% upside on the current share price. Because in that case, a 50% gain is the likely outcome (the reward), and a profit warning (risk) is very low.

However, in a business that does project-based sales, and has high fixed costs, then the risk of a profits warning is very high, so I would want substantially more upside on the share price (100% or more) to make the shares look attractive on a risk/reward basis.

Therefore I often like buying shares after they have warned on profits, but only if it's a fundamentally sound business that has just hit a temporary bump in the road. May Gurney was a good example of that last year, where I bought near the bottom at about 130p, and the shares recovered to about 300p in a year (I sold far too early sadly, but still made a good profit on them).

As Anthony Bolton said, the best buy decisions with shares are often the most uncomfortable - i.e. when sentiment is extremely negative on a company, because they have performed badly in the short term.

On the other hand, catching falling knives can be a diastrous strategy, if you are not able to sort the what from the chaff, in terms of finding decent companies that have just had a temporary setback. I find it's usually best to wait for at least a few weeks after a profit warning for the dust to settle, but the timing depends on what type of market you're in. In a bull market the recovery time can start quite soon, in a bear market it can be 6 months+.

I think that in the current bull market, many investors are over-paying for growth, and are intoxicated with the strong momentum in their favourite stocks, imagining that they will keep going up forever. This is a recipe for disaster in my opinion. The higher the rating, the harder & faster it will fall, if & when the company disappoints in any way. So a PER of say 20 leaves absolutely no room for results that are not up to scratch. Good is not good enough, results have to be sparkling to justify that sort of price.

Whereas with value stocks, they tend to largely shrug off mild profits warnings, as Vianet (LON:VNET) did this morning. A brief blip down, as a few nervous nellies run for cover, then the value buyers come in & it's now only down 2p on the day. That's because sentiment is already so bombed out, that more bad news doesn't really do that much damage. So risk/reward is actually positive, despite (or because of!) sentiment around the share being so bad.

Back to individual companies. Quindell Portfolio (LON:QPP) has issued a positive-sounding update, trumpeting "organic growth of £300m+ per annum". Must admit, I am getting slightly tempted to buy some, as it does seem to have some remarkable momentum behind it in terms of contract wins. Although as has been set out many times before here, the figures don't convince me at all, nor the sustainability of the business model. Given that the market cap is now over £600m, so it's more of a mid-cap, it's not really within the remit of this report any more, so I'll probably drop coverage of it. Although I will report on their published results only from now on, just as follow-up from previous comments, but I won't report on any other sundry statements from them.

This is turning into "War & Peace", so I'll wrap things up fairly soon.

Newriver Retail (LON:NRR) has issued a positive-sounding portfolio update. I like the company & management, and think it's an excellent long term property & dividend play. However, I sold my own shares a little while ago, as they were in my shorter term portfolio, and I wanted the money for something else that seemed to have more immediate percentage upside. I might look at picking up some more NRR if a buying opportunity arises in future, for my long-term portfolio.

A trading update from Optos (LON:OPTS) looks quite interesting - talking of "excellent progress" and reduced net debt. Might be worth a look, as the valuation graphics on Stockopedia show a lot of green (i.e. good!)

Similarly with Accumuli (LON:ACM) - it has issued an in line with expectations trading update today, and the Stockopedia graphics are nice and green, which is a good green light to do some more research, which is one of the ways this site makes researching many companies so quick & efficient - you can rapidly eliminate things that don't fit your basic criteria, freeing up more time to home in on the good ideas with deeper research.

Hopefully my reports here also help people with limited time home in on some of the better ideas from the morning's announcements. That's the idea anyway, although it's always important to remember, these reports are just one person's opinion, written "on the fly", so always essential to Do Your Own Research ("DYOR")!

Signing off for the day, and see many of you at Mello Central tonight.

Best Wishes, Paul.

(of the companies mentioned today, Paul has a long position in VNET.

A Small Caps Fund to which Paul provides research services has a long position in ZYT)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.