Good morning! Graham has passed the controls to me today, it's Paul here!

To get you started today, here are some late comments from yesterday, on SCS (LON:SCS) and T Clarke (LON:CTO) . I put them in yesterday's report at about midnight last night, so most readers won't have seen them. Hence copied below;

SCS (LON:SCS)

Share price: 228p (down 2.6% yesterday, at market close)

No. shares: 40.0m

Market cap: £91.2m

ScS, one of the UK's largest retailers of upholstered furniture and floorings, today issues the following trading update ahead of announcing its interim results for the 26 weeks ended 26 January 2019 on 19 March 2019.

Overall, trading has been OK;

The Group has traded in line with the Board's expectations in the first half of the financial year. Whilst we are mindful of the risk from the impending Brexit outcome, we believe the Group's increasing resilience puts the business in a strong position to manage the continued economic uncertainty and take advantage of opportunities.

LFL order intake - growth is still positive for H1, but has slowed down somewhat.

When I last reported on ScS, here on 25 Oct 2018, LFL order intake growth for the first 12 weeks of FY 07/2019 was up 4.5%

Today, the company is saying that LFL order intake growth for the first 26 weeks is up 1.5%. Thi suggests that the later 14 week period must have had flat, to slightly negative LFLs, to have brought down the overall 26 week average from +4.5% to +1.5%. Even so, it's still not a shabby performance, given macro headwinds & deteriorating consumer confidence.

House of Fraser concessions - have now all ceased trading, so we can forget about that issue.

Valuation - remains attractively low, as I've mentioned several times recently.

Low PER, high dividend yield, and a strong balance sheet stuffed with (customers') cash - is a very attractive combination.

My opinion - this sofa retailer has remained resilient in tough market conditions. The share looks attractive, providing we don't see a meltdown in consumer confidence.

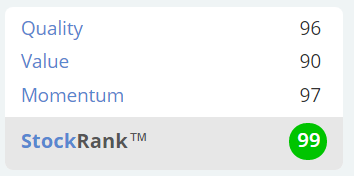

StockRank remains exceptionally good;

UPDATE 1 Feb 2019 - a brief RNS today says that SCS is no longer proceeding with an acquisition;

ScS, one of the UK's largest retailers of upholstered furniture and floorings, provides an update on the recent press speculation regarding the potential acquisition of Sofa.com Limited.

The Group confirms that ScS Group plc is no longer in discussions regarding a potential acquisition of the business and assets of Sofa.com Limited.

BBC news is reporting that Mike Ashley has bought Sofa.com for a nominal sum.

T Clarke (LON:CTO)

Share price: 97p (flat yesterday)

No. shares: 42.9m

Market cap: £41.6m

TClarke plc ("TClarke" or the "Group"), the Building Services Group, announces a year end trading update for the financial year ended 31st December 2018.

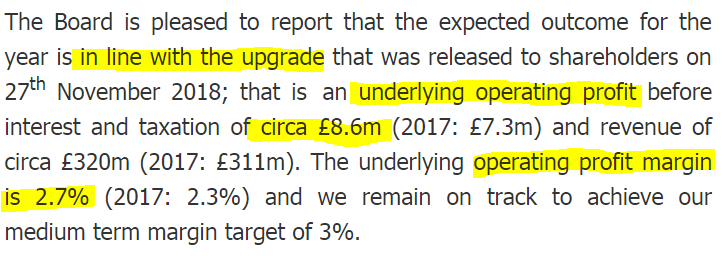

It's an in line update;

Year end cash is £12.4m

Order book - is up decently, standing at £411m (up 22% Y-on-Y)

My opinion - it's good to see the company trading well, and having a good outlook.

I looked into this group quite closely a few years ago, and in the end decided it's not the sort of sector I would want to invest in going forwards. The margins are too low, and these are often large, complex contracts. So the risk of something going wrong, on low margin contracts, would worry me too much to want to hold this share.

On to today's news. I'll start with the biggest % faller, so must be a profit warning.

CML Microsystems (LON:CML)

Share price: 342p (down 21% today, at 09:35)

No. shares: 17.1m

Market cap: £58.5m

Trading update (profit warning)

CML Microsystems Plc (the "Company" or "Group"), which designs, manufactures and markets semiconductors, primarily for global communication and solid state storage markets, today issues the following trading update:

(the company's year end is 31 Mar 2019)

Weaker H2 performance - trading has been below expectations;

With only two months of the financial year remaining, the Company now expects second half revenues to be below those achieved during the first 6 months and full year revenues to be approximately 12% lower than the prior 12-month period.

Given the expected sales performance, the Company therefore expects revenues and profit before tax to be materially below current market expectations.

Gross margin has continued to track above last year due to product mix and the cost base has remained stable.

What's gone wrong?

- Softer Chinese economy

- Ongoing geopolitical issues

- Customers de-stocking, hence lower new orders

- As previously mentioned in Nov 2018 - weaker automotive sector & longer lead times for raw materials

As a general aside, it's interesting to note that companies often blame under-performance on a multitude of external factors. However, hardly any companies ever say that they're losing sales to competitors, who have better & cheaper products (which is often the real reason). I'm not saying that's the case here, it's just a general observation.

Outlook - the company seems to be saying this is just a bit of a glitch -

Whilst this is disappointing to report, the Board believes that medium to long term growth drivers for our products remain particularly strong and we are focussed on driving the business over this period and our strategy remains unchanged.

We are maintaining levels of investment in product R&D on the back of many consecutive years of profitability.

The growing product portfolio and our expanded global sales coverage is driving the value of our sales opportunity pipeline significantly higher.

Despite the challenges associated with current market dynamics, we believe that the Company remains very well placed to benefit as these external situations normalise.

I like the sound of all that, but don't know how much we can rely on it? After all, companies almost always talk up their prospects, which doesn't always translate into actual good results.

Valuation - broker consensus for FY 03/2019 was 24.7p EPS, before the profit warning today.

This has been revised sharply down, to just 15.0p. At 342p, the PER is 22.8 - that's a high rating, and factors in some degree of earnings recovery in future. If that doesn't happen, then the share could take another tumble.

Cashflow - I note from forecasts that the company is capitalising a large amount into intangibles each year, more than the amortisation charge.

Balance sheet - is strong, with decent net cash. I think there might be some freehold property here too, I seem to remember that from a while back. That's worth checking, if the share interests you.

My opinion - I don't have the sector knowledge to predict whether this is a temporary glitch, or not. Therefore it's not possible for me to give a view on whether the shares look good value or not. So it's one for sector specialists to look at.

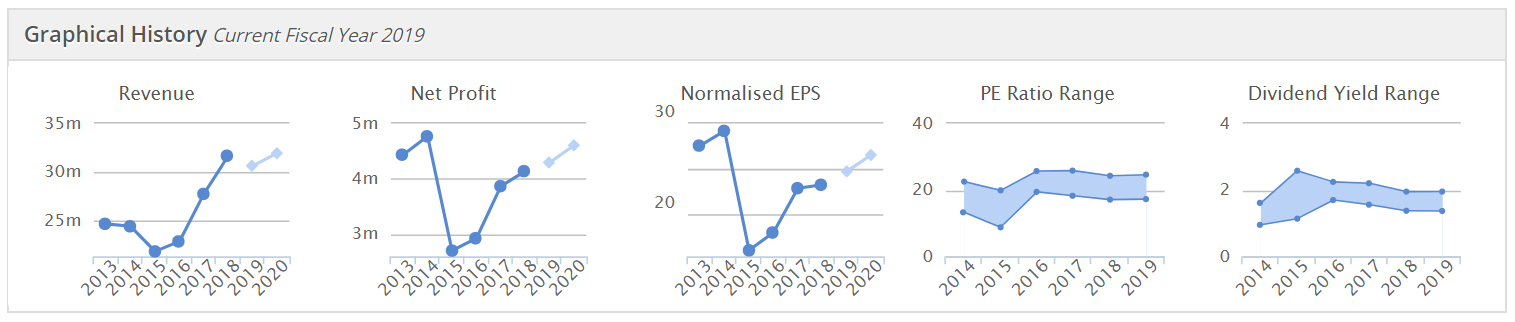

The long term performance looks solidly profitable, but not very exciting in terms of growth, to date. Bear in mind that the lighter blue blobs are forecasts, which will reduce significantly after today's profit warning. Therefore it's going to look ex-growth once these graphs update for today's RNS, and broker forecast reductions. Does that justify a PER of 22? Only if you think profits are likely to grow decently in future.

The other point which springs to mind, is that there was a semi profit warning in Nov 2018. This could be seen as a good example of when it's best to sell on the first sniff of trouble. Especially at times of macro deterioration - hopes of catching up on reduced performance, are far less likely to actually happen right now, than if the global economy were booming.

M&C Saatchi (LON:SAA)

Share price: 328p (up 15% today, at 11:13)

No. shares: 88.9m

Market cap: £291.6m

This is a famous advertising & marketing group.

Calendar 2018 trading -

M&C Saatchi anticipates that the results will be in line with the Board's expectations. The Board expects the Group to make further good progress in the year ahead.

The Group has seen organic revenue growth in 2018 continue to outrun sector averages.

Current trading is also sound;

... We have made a good start to 2019 with trading in line with expectations. "

That's all nice, but not enough to justify a 15% share price rise. So I've checked to see if there are any other announcements from the group today. Yes, here we go;

Disposal - the group has bagged £25m in cash (equivalent to 8.6% of its market cap), from the sale of its 24.9% minority stake in Walker Media.

This looks a favourable deal, as it was accounted for as an associate, producing £1.6m income into Saatchi's 2017 accounts. Its balance sheet value was £10.7m, so this will produce a nice profit on disposal, as well as strengthening SAA's balance sheet by turning an associate asset into cash of almost 2.35 times as much.

My opinion - I'm not really interested in PR companies, as investments.

However, Saatchi is certainly a very famous brand, and the forward PER looks quite good value, combined with a reasonably good dividend yield.

Cyclicality is the big worry. IF the world economy is rolling over into recession (it may not be, who knows?) then PR businesses are one of the worst places to invest - as for the clients, it's discretionary spending, and often the first thing to be cut when times become difficult.

Here's the long-term chart;

As a final point on Saatchi, today was a good example of why it's always important to check the company page (StockReport on Stockopedia) to make sure there are not any other announcements made on results day. I've been caught out before, failing to do this, and misinterpreting the results statement, because I hadn't been aware that there was another price-sensitive announcement which had also been announced on the same day.

This is why using an email alert system, or other watchlist, is a good idea for companies of interest.

Comptoir (LON:COM)

Share price: 10.5p (up 5% today, at 12:51)

No. shares: 122.7m

Market cap: £12.9m

Comptoir Group Plc (AIM: COM), the owner and/or operator of Lebanese and Eastern Mediterranean restaurants, is pleased to today announce a pre-close trading update for the 52-week period ending 31st December 2018.

Given the mess that the hospitality sector is in (chronic over-supply, basically), this sounds alright;

The Directors are pleased to report that trading for the 52 weeks to 31st December 2018 was in line with market expectation with the expected strong finish to the second half of the year.

New sites - 2 ordinary, and 1 franchise opened in 2018

Balance sheet - company says it's strong. I'll be the judge of that, let's have a look! (as claiming to have a strong balance sheet is an amber flag for me). Looking at its most recent (interims) balance sheet, it looks OK to me. The company did an equity fundraising in 2017, and still has net cash from that.

My opinion - this small restaurant group seems to be holding its own, in a very tough marketplace.

The problem is that it's only really trading around breakeven, and is facing rising costs - especially labour, as are its competitors. Therefore, it's difficult to see why the trajectory of future profits would be anything other than downwards. London sites could well also be taking a hit on the business rates.

The reasonable balance sheet means that it's probably going to survive. Although that depends on individual site performance, and how long they're locked in to property leases.

Overall, there isn't enough information available to make a meaningful judgement on it. My pick in this sector is Fulham Shore (LON:FUL) (in which I have a long position).

COM shares are horribly illiquid, so almost impossible to trade in any decent size. So why get involved? There's a de-listing risk here too, as it's difficult to see the point of maintaining a listing.

That's me done for today.

Have a lovely weekend!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.