Morning folks,

There is a lot of trivial news today, but sorting through it, I think I can find a few interesting stories. Let's see!

Cheers,

Graham

Codemasters Holding (LON:CDM)

- Share price: 200p (placing price)

- No. of shares: 140 million

- Market cap: £280 million

Admission to AIM and First Day of Dealings

Codemasters is a video game developer and publisher, specialising in racing games. The company announced it would float today in a placing announcement earlier this week.

It has been around for 30 years and has 500 full-time employees across 3 UK locations and an art production facility in Kuala Lumpur. Its main franchises are "DiRT", "GRID" and "F1". It owns the rights for DiRT and GRID, while Formula 1 is owned by Liberty Media.

Most of the IPO proceeds are going to its majority shareholder, an Indian conglomerate, through that conglomerate's Singaporean subsidiary. The selling shareholder is selling 60% of the company to raise £170 million (gross), more than ten times the IPO proceeds to be received by the company itself.

As mentioned recently, I tend to prefer IPOs which are more focused on raising money for the company than on letting the existing shareholders exit. But that's just a general rule, and we can always look into the specifics of any situation.

Admission Document

I've pulled out the Codemasters admission document from its website - the key information source for any new stock.

According to this, the company has been producing Micro Machines for many years. This is a fun racing game I played when I was a bit younger - it was an extremely good title.

The document also reveals that GRID and DiRT are successors of Toca Touring Cars and Colin McRae Rally - while I didn't play them so much, I do remember that they were huge titles at the times. I haven't owned a games console in something like ten years, so it's no surprise that I don't recognise their names any more.

Anyway, the admission document has 145 pages, so in a situation like this where I am under some time pressure, I need some shortcuts.

I want to understand the relationship with Liberty Media a bit better. Using the search function, I find:

the loss of the F1 licence could materially adversely affect the business of the Group and its trading performance

- this is no big surprise, but is helpful to see it in black and white.

We also have confirmation that performance is reliant on its three big brands, including F1:

The Group’s ‘‘DiRT’’, ‘‘GRID’’ and ‘‘F1’’ franchises contribute a significant proportion of the Group’st otal revenue and any downturn in the popularity and subsequent sales of one of these franchises may adversely affect the Group’s financial condition.

Scrolling down to the historic financial performance of the group, and the Going Concern statement, I see that it has been reorganised prior to IPO:

As set out in Note 34 (Post reporting date events), the Group undertook a group reorganisation and debt restructuring whereby all but US$5 million of the principal of the loans payable to Reliance were converted to equity and the accrued interest on the loans was waived.

That's great - it looks to me like the balance sheet should be back to normal now, rather than drowning in shareholder loans, as it was before.

The company has suffered huge outflows in interest over the past couple of years. Leaving that to one side, the performance looks quite good:

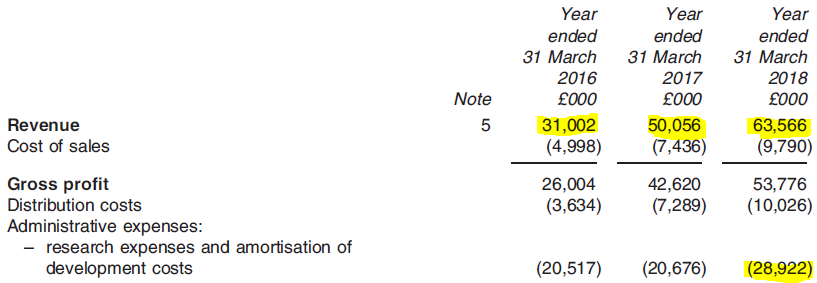

Revenues have risen very well over the past few years and gross margins are excellent, as you would hope to see from a video games publisher. Most of the expense is in research and the amortisation of development spending, e.g. £29 million in FY 2018.

Operating profit was £8.1 million in FY 2018 (FY 2017: £14.3 million). The fall in operating profit in FY 2018 was largely due to the increase in research and development costs that you can see in the table above.

I'd be interested to know:

- the breakdown of revenue between DiRT, GRID and F1.

- to what extent the revenues are a function of specific games titles being released each year, i.e. vulnerability to future years which might be quiet in terms of the release cycle.

Dignity (LON:DTY)

- Share price: 1048p (-14%)

- No. of shares: 50 million

- Market cap: £524 million

CMA Investigates Funerals Sector

The Competition and Markets Authority announces an investigation into the £2 billion funerals market.

Dignity has revenues of c. £300 million from providing funeral services so, naturally enough, this sounds like bad news.

The Competition and Markets Authority's (CMA) market study will examine whether the information provided by funeral directors on prices and services is clear enough for people to be able to choose the best option for them.

It will also look at how prices have changed over time and the factors that affect them.

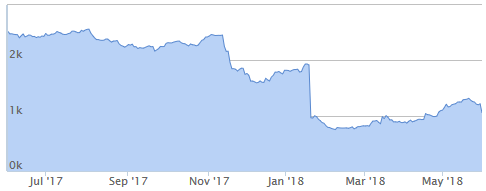

Recall what happened last year - Dignity's share price collapsed after it admitted that its pricing was unsustainable:

This was as predicted by a short-seller who operates a funeral price comparison site and posted his thoughts here on Stockopedia (link).

According to the bear, Dignity had increased its prices by 81% from 2005-2016, squeezing its customers as much as possible, and this had been the main driver of its financial returns.

In January it announced price freezes for traditional funerals and 25% cuts in simple funerals, to stem its losses in market share.

What will the CMA think? They mention today that low-income individuals might spend up to one third of their annual income on a funeral.

It's a sensitive issue. Personally, I would have thought that this was the sort of thing that the welfare system (or life insurance, for those who can afford it) was supposed to deal with. After all, there aren't really any barriers to entry to being an undertaker, are there?

HM Treasury is also getting involved in the issue of pre-paid funerals:

In parallel to the CMA's market study, HM Treasury is launching a separate Call for Evidence on regulation in the pre-paid funerals sector. The CMA therefore does not intend to examine the pre-paid sector within its market study.

Personally, I wouldn't have marked down Dignity shares by much on this news. In my own view, regulation tends to help, not to hurt, the competitive position of an industry's largest companies (because of their economies of scale - it's harder for smaller companies to pay the fixed costs of dealing with regulation).

The company responds favourably to the announcement:

As one of the UK's largest providers of funeral and crematoria services, Dignity has led calls for greater regulation of both at need and pre-paid funeral sectors while continuing to set the standard for what constitutes best practice in the industry.

So if I was already thinking about buying some Dignity shares, I would be strongly considering doing so today.

I think this could be a decent investment at the current level, but personally I would wait for cheaper entry, considering that it has £565 million in debt outstanding in mortgage-type debt instruments (to be repaid by 2049). So it's not really as cheap as it appears at first glance.

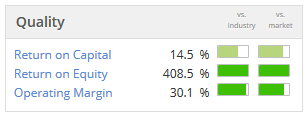

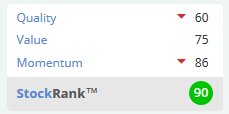

The Stocko algorithms aren't overly excited by it either. They do give it an above-average quality rank:

One warning about this is that you do need to watch out when you see a massive Return on Equity (ROE), compared to Return on Capital. This implies a lot of debt capital is being used. Return on capital is a safer metric in that sense, and is a moderate 14.5% in the case of Dignity.

PCF (LON:PCF)

- Share price: 42.5p (-1%)

- No. of shares: 212 million

- Market cap: £90 million

(Please note that I currently own shares in PCF.)

Reader requests have prodded me into saying a few words about this online bank and vehicle finance provider.

Those of you who attended Mello in Derby will have had the opportunity to meet Scott Maybury (CEO) and David Bull (FD), and to listen to a detailed presentation they made, explaining the business. I'm hoping to do an interview with Scott in the next little while, which will hopefully give us all even more insights into the company's long-term plans.

I bought into PCF last December at 27.5p, eagerly anticipating that the company's return on equity would start to climb again towards 12.5%. I don't expect turbo-charged returns from financial stocks like lenders and insurance companies: I expect to earn something similar to their return on equity, adjusted for any dividends they might pay.

What really excited me about PCF was that it had already done all of the hard work in terms of building the infrastructure to operate as a bank. Looking ahead, the plan was simple: build retail deposits, gradually replace the wholesale funding sources, and grow the lending portfolio responsibly.

As things turned out, I got a much faster return than I expected, gaining over 50% in six months. What has happened, I think, is that others have cottoned on to the fact that PCF's lending portfolio is probably going to grow very fast, that it is set to become a much bigger company, and management have continued to execute very well.

I do expect a few bumps on the road but if that all-important ROE number can continue to grow, with impairments remaining under control, then I think investors will do well.

H1 Highlights

PBT climbed 20% in H1 to £2.1 million, but this number matters very little to me, to be honest. The point about building a banking infrastructure is that you build something which can handle much larger payloads. It's very similar to a fund management business. You build a platform which can handle many multiples of its existing assets. That is what PCF is setting out to do.

So even though the 20% increase in net income is to be welcomed, what I really want to see is an increase in ROE: this means that profitability is improving relative to the equity capital deployed by the company.

We don't have much evidence that this is happening yet. H1 return on equity (for the period ending March 2018) is 8.7% - not bad, but much lower than the long-term target. There are growing pains as the company develops into its new business model, i.e. the initial set-up costs and the increased overhead to manage banking infrastructure.

Consider how the overall structure has changed: it has £108 million in new customer deposits as a bank, but it had new business originations of just £69 million. It could be absolutely going for broke with its lending portfolio, but it's not. Unsurprisingly, therefore, the portfolio "continues to perform well and in line with our expectations".

One of the ways in which the company is being conservative with its portfolio is that it's improving the average credit profile of its customers. The CEO was very specific in correcting me when I referred to the existing portfolio as "sub-prime" - he refers to is a "near-prime", and is keen to compete for the lower-yielding but very safe prime segment of the marketplace, now that it can afford to (you need to have cheap funding to be able to lend to the lowest-risk customers profitably).

Big Picture

The big question mark for me is not so much about the 2020 targets, which I am optimistic that the company will achieve (it doesn't matter to me if it doesn't meet them exactly on time).

Instead, the big question mark for me is about what happens between 2020 and 2022, when the company's strategic objective is to shoot for a £750 million portfolio. Some sort of acquisition plan will be required, and great care will be needed to ensure that it is executed properly.

If it goes well, then with the benefit of operational leverage through the banking model, the company will be targeting a significant further increase in ROE, to 17.5%.

Of course, others may also have economic concerns in relation to general conditions in the credit and consumers markets - I am willing to accept these risks, on the basis that PCF is well-capitalised, has a great track record in impairments, and is serving an increasingly strong set of customers. When you're investing in equities, there is often no alternative but to accept that you are taking some economic risk!

Valuation

Net assets finished H1 at £40 million, so the shares are now clearly on the expensive side in terms of price/book value (about 2.25x).

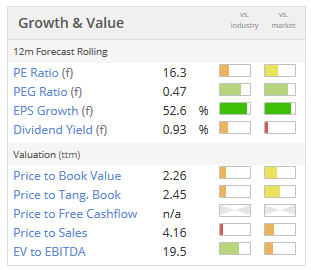

The Stocko value metrics sum it up. The shares are:

- expensive relative to earnings

- cheap relative to earnings growth

- expensive relative to dividend yield (I don't care about this, I want the company to reinvest earnings for growth)

- expensive relative to book value

- expensive relative to sales (irrelevant since it doesn't have "sales" in the conventional sense - it's a bank)

In the end, for me it comes down to two simple questions:

- How much conviction do we have that ROE will improve? (I could be wrong, but I am willing to bet that it will improve toward management targets)

- How many multiples of book value are we willing to pay for a company which will hopefully achieve ROE of 12.5% in the next few years, and perhaps as much as 17.5% in the long run?

These are complicated questions. For what it's worth, I'm happy to hold on to my PCF shares at the current level.

Haynes Publishing (LON:HYNS)

- Share price: 241p (+4%)

- No. of shares: 15.1 million

- Market cap: £36 million

A quick word on this publisher of technical manuals. It has been a great little turnaround story over the past couple of years (and I'm embarrassed to admit that I've been watching it, off and on, all the way up!)

(Be careful - there are two share classes, which can cause havoc with some software programs. I think the Stockopedia calculation is correct.)

This is the opposite of a profit warning:

The Group on target to report adjusted profit before tax (excluding adjusting items and acquired intangible amortisation) up c. 10% from the prior year and ahead of current market forecasts by c. 7% for the year ended 31 May 2018.

I can see a consensus forecast for 2018 PBT of £2.7 million (although I don't know to what extent this estimate has been adjusted for intangibles, etc). Perhaps we can now assume it will be 7% higher, at £2.9 million?

Well done to those who have been staying with this for the last few years. What looked like a very old-fashioned company has found a new lease of life with new management and a fresh approach.

The Stocko algorithms reckon there is still plenty to shoot for: it's classified as a Super Stock.

Ok, I'm out of time for today as I need to attend a couple of weddings. Have a fine weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.