Good morning,

Hopefully I don’t experience any technical problems today!

Yesterday’s report eventually featured Gocompare.Com (LON:GOCO), Foxtons (LON:FOXT) and Proactis Holdings (LON:PHD), and is at this link.

Duke Royalty (LON:DUKE)

(Please note that I have a long position in DUKE.)

Duke Royalty (LON:DUKE) - for those of you who are interested in Duke Royalty, my interview with CEO Neil Johnson has been published at Cube.Investments and should also be available through whatever podcast app you use. And it’s on YouTube at this link.

For the background to this interview, please check the archives. There were a couple of points where I was seeking clarity after two big deals were recently executed by Duke.

The key insights I took away from the interview were:

- The higher yield at Capital Step's investments could be seen as a function of their smaller size (Capital Step is the royalty company acquired by Duke for £10 million, plus the assumption of Capital Step's debt facility). Smaller investments tend to carry a higher yield. Neil Johnson confirmed that the features of the CS investments were very similar with Duke's.

- The 12% equity stake in Miriad products was a "sweetener" that wasn't explicitly paid for. Duke is earning the full yield on the entire £10 million investment it made in this company.

- Equity holdings are likely to be held until the investee goes through an MBO/private equity deal. While Duke as a minority shareholder would not be in control of the sale process, it would be open to the possibility of selling its equity holdings at agreeable prices.

- Further to that point, there is no reason why Duke needs to hold its royalty agreements for 30 years or in perpetuity: there is always the option for management or someone else to offer to buy them out of their agreements.

- Finally, the dividend payout ratio might fall to c. 60%. The range for royalty companies is 60%-80%, with the payout ratio tending to fall as they grow. (I am in favour of a reduction in the payout ratio because I want the company to compound investor returns quickly and my attitude is that "every little helps" when it comes to retained earnings!)

It was a super interview (even if I say so myself!) and I'm very thankful to Neil Johnson for taking the time to give such detailed answers to my questions.

Revolution Bars (LON:RBG)

- Share price: 67.8p (-15%)

- No. of shares: 50 million

- Market cap: £34 million

I'm expecting that Paul might have something to say about this. In anticipation of his comments, here is a summary of the results to 29 December 2018:

- like-for-like sales -4%.

- adjusted operating profit £3.3 million

- operating loss £3.1 million

- no dividend

"Under-investment in the brand's proposition, exacerbated by management instability and the hot summer" are blamed for negative LfLs.A brand review has been completed and£1.5 million of p.a. cost savings identified.

Looking forward, cash will be allocated to refurbishing the existing estate and reducing borrowings.

New sites are said to be doing well, but Q3 has got off to a rough start with LfLs of minus 7.3% in the first 8 weeks.

Creative excuses

Revolution is always good for excuses. Bad LfLs up to mid-February are blamed on "closure of three Revolution sites for refurbishment, Valentine's Day not coinciding with Wednesday student events, and later half term holiday weeks".

Revolution blamed a bad H2 last year on the weather being too hot and too cold. It feels like the company will only perform well if it is put in a petri dish and kept in a laboratory at the perfect temperature.

It also needs the student calendar to match up perfectly with nights out, and none of its sites must ever need to be refurbished again. If all of those conditions are met, then we will finally get to see what the company can do.

The growth story is dead at least for now, as the site opening programme has been halted. With no new sites planned and the cancelled dividend, it is giving itself a chance to keep its debt under control.

Cash and debt profile

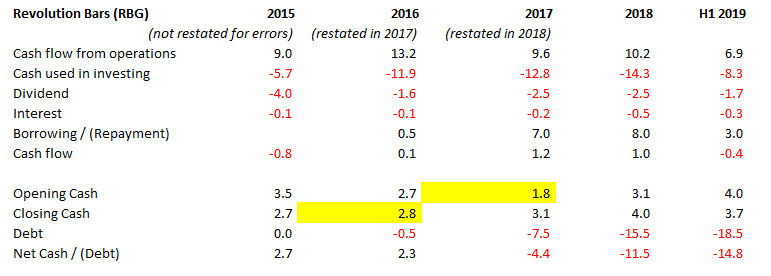

I've reviewed the historic cash flow at Revolution:

There were restatements in both 2017 and 2018, but the restatements did not go back and fix all of the errors for historic 2015 and 2016 numbers. I think this is why there is a mismatch between closing cash in 2016 and opening cash in 2017. £1 million disappeared.

What the numbers do tell us is that around £12.5 million of dividends have been paid out during a period in which the company has borrowed some £18.5 million. Its facility only stretches to £25 million, so without a new facility, it is running out of road as far as the lenders are concerned.

In the absence of dividends, Revolution could have funded a good deal of its expansion with its own cash flow, though it would still have needed to borrow around £6 million.

The analysis could benefit from a breakdown of cash flow from investing into "maintenance capex" versus "growth capex", so that we could see how the company is doing on a static basis. The portfolio has grown from 57 to 79 sites during the period shown in the table above..

During this period, a whopping £53 million has been spent on capex. And yet the company says that it has suffered from a lack of capital investment!

This sort of capital intensity is what keeps me away from this sector, as it strikes me as a very difficult place in which to build a sustainable, profitable business with attractive free cash flow characteristics.

Rightmove (LON:RMV)

- Share price: 455.9p (-5%)

- No. of shares: 893 million

- Market cap: £4,070 million

(Please note that I have a long position in RMV.)

Let's say a few words on this big-cap where I've been a shareholder for a few months.

Results to Dec 2018:

- revenue +10% (£268 million)

- underlying operating profit +10% (£203 million)

Check out that operating margin!

Cash conversion is close to perfect with £200 million of cash generated from operating activities, or £167 million after taxes.

Capex was negligible, enabling Rightmove to return about £170 million to shareholders via dividends (£55 million) and buybacks (£113.5 million).

Operationally, things are steady with 4% growth in traffic, 5% growth in time spent by users on the site and 9% growth in ARPA (revenue per advertiser).

Outlook

The transition online isn't finished yet, according to Rightmove, as customer spend continues to transition online. There is also a reassuring note that RMV is not materially affected by the property market cycle except in the most extreme circumstances.

With ARPA continuing to grow, and our commitment to further innovation, the Board remains confident of making further progress in 2019.

My view

I'm greatly encouraged to see that market share of traffic has bounced back up to 76% (last year: 73%). In mobile, market share of traffic is flat at 79%.

Since RMV is already so much bigger than its competitors, and has grown its market share in a growing market, the 2018 increase in minutes spent on its site has massively outstripped the increase at its competitors. The increase in time spent on Rightmove is 8x larger than the increase in time spent at any of its competitors.

The market may have been disappointed that the number of Agency branch customers fell by 2%, as some agents show resistance to Rightmove's pricing power and look for alternatives such as Onthemarket (LON:OTMP).

The total number of customers has increased again, though, as more New Homes vendors signed up.

The reduction in the number of agents is a slight disappointment but it's not enough to wipe out my overall positive view of these results. Higher prices and higher revenues can occassionally mean slightly fewer customers. Other companies I own sometimes maximise profitability at the expense of the total size of their customer base, e.g. Gocompare.Com (LON:GOCO) and IG Group (LON:IGG).

It's a bit different for Rightmove (LON:RMV) whose market share underpins its pricing power, and so I wouldn't mind if it slowed down ARPA increases to make absolutely certain that its market share remains extremely high. Over time, it has done an extremely good job of managing this trade-off.

That's it from me for the week. Thanks for the comments and feedback as always.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.